Atlas Travel Insurance Review: Is it Worth it For You?

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

In this Atlas Travel Insurance review, we’ll explore what plans they offer, what they cover, and whether the plans are worth it for you. Enjoy!

If you’re getting ready for a trip, you know it can involve a fair bit of planning. From finding affordable vacation ideas to choosing the ideal flights, there are a lot of decisions to make.

One decision you’d probably rather not deal with is choosing a travel insurance plan. Unlike scouting for the best flight and hotel deals, there’s nothing fun about thinking about the worst-case scenario. It’s tempting to skip it altogether – but don’t.

Anything could happen, and it’s better to be safe than sorry. The best travel insurance companies offer comprehensive coverage that protect your financial investment and your health.

Today I’ll review two types of insurance offered by Tokio Marine HCC-MIS Group, otherwise known as Atlas.

Atlas at a Glance

- Started in 1998 in Indianapolis, IN

- One of the first to make insurance products and services available on the internet

- Sells three comprehensive trip cancellation insurance plans

- Offers a multi-trip travel medical plan

- Offers two customizable single-trip travel medical plans

Atlas Travel Insurance Products

Atlas provides a suite of travel insurance options to meet the diverse needs of today’s traveler. Let’s take a look.

Trip Cancellation Insurance

Atlas trip cancellation insurance plans protect the non-refundable deposits you make when you book your trip. They’re considered comprehensive plans because they also offer emergency medical coverage. There are three tiers available:

- Atlas Excursion

- Atlas Expedition

- Atlas Enterprise

Atlas MultiTrip

The Atlas MultiTrip plan covers frequent travelers for all trips up to 30 or 45 days in a 364-day period. It’s primarily a travel medical plan, although it also includes trip interruption, trip delay, and baggage loss coverage. It does not include trip cancellation, so you’ll either have to use a travel rewards credit card that includes it, or purchase that separately for each trip.

Travel Medical Insurance

Atlas offers two customizable travel medical insurance plans that provide single-trip coverage for trips lasting 5 to 364 days. These plans also include trip interruption, travel delay, and lost baggage:

- Atlas Travel

- Atlas Premium

In this review, I’ll focus on the trip cancellation insurance and MultiTrip plans. If you want to learn more, you can compare Atlas travel medical insurance plans here .

Atlas Travel Insurance: What’s Included?

Atlas trip cancellation insurance plans protect you from financial loss if you cancel your trip or return home suddenly (for a covered reason). There are 3 plans to choose from – Excursion, Expedition, and Enterprise.

As an example, the basic Atlas Excursion plan includes:

- Trip Cancellation

- Trip Interruption

- Baggage Delay

- Emergency Medical and Dental Expense

- Emergency Medical Evacuation and Repatriation of Remains

- Common Carrier AD&D

Of course, the higher-tiered Expedition and Enterprise plans offer more coverage per category and offer extras like Cancel for Any Reason coverage and a Pre-existing Medical Conditions Waiver.

One note about these plans – they are not easy to find on their website. In fact, you have to get a quote (and therefore, already know your plans or have made reservations) to even get access to coverage amounts. We’d love to see coverage amounts front-and-center like they do for their MultiTrip and travel medical plans – without having to put in specific information first. Anyone should be able to see up-front how much insurance is provided.

Atlas’ MultiTrip plan is a travel medical plan that covers all trips lasting up to 30 or 45 days in a 364-day period. It’s an attractive solution for frequent travelers . Their MultiTrip plans include:

- Emergency Medical Evacuation: $1,000,000 lifetime maximum

- Repatriation of Remains: Up to the overall maximum limit

- Emergency Dental: $300

- Accidental Death and Dismemberment: Lifetime max up to $25,000 depending on age

- Common Carrier Accidental Death: up to $50,000 depending on age

- Personal Liability: $25,000 lifetime max

- Trip Interruption: $10,000

- Lost Luggage: $1,000

- Travel Delay (12 hours): $100/day for maximum 2 days

- Lost or Stolen Passport/Travel Visa: $100

- Deductible: $250 per covered trip

- For a full list of what’s covered, click here .

Remember that while it includes trip interruption, trip delay, and baggage loss coverage, it does not include trip cancellation insurance. If you want that, you can purchase it separately.

Great Coverage for Your Epic Trip – Protect yourself and your trip from catastrophe. Get started with comprehensive medical and trip insurance from Atlas. Get your free quote here .

Atlas Travel Insurance: How Much?

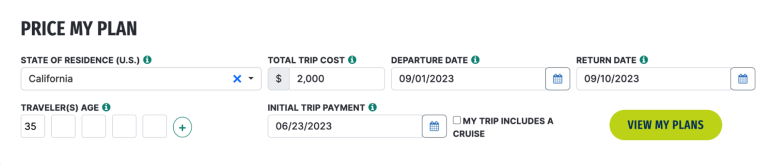

The cost of a travel insurance policy depends on several factors, including your age, the length and cost of your trip, whether you’re traveling solo or with family, and your state of residence. To weigh your options, get an online quote directly from Atlas. That said, these examples help illustrate how the plans compare in terms of price.

Let’s consider a 33-year-old solo traveler heading to Belgium for two weeks in June. He’s from the U.S. state of Georgia, and his trip costs $3,000. Here is what he would pay for each of the Atlas trip cancellation insurance plans:

- Atlas Excursion: $91

- Atlas Expedition: $107

- Atlas Enterprise: $126

Now, let’s shake things up and see what the prices would look like if it were a family vacation. Let’s add his 35-year-old wife and their two kids, ages 7 and 10. With the additional airfare, let’s say the trip costs $5,500:

- Atlas Excursion: $204

- Atlas Expedition: $240

- Atlas Enterprise: $280

In both examples, the jump from Atlas Excursion to Atlas Expedition is pretty small. Considering Atlas Expedition gets you an extra $100,000 in emergency medical coverage and the pre-existing medical conditions waiver, I think it’s worth it.

Note that adding Cancel for Any Reason coverage to the Atlas Enterprise plan would cost an extra $182. The standard trip cancellation coverage includes the most common reasons for canceling a trip, so most people probably wouldn’t add it on.

Atlas MultiTrip: How Much?

When buying the MultiTrip Plan, you can insure trips lasting up to 30 or 45 days. Let’s look at how much it would cost to insure the travelers from the previous example for all trips taken for 364 days.

Our 33-year-old solo traveler would pay:

- $188 for all trips lasting up to 30 days

- $230 for all trips lasting up to 45 days

The family of 4, ages 35, 33, 10, and 7 would pay:

- $282 for all trips lasting up to 30 days

- $345 for all trips lasting up to 45 days

Atlas Travel Insurance: What Isn’t Covered?

The nitty-gritty exclusion details vary by plan and can be found in your plan certificate. Here are a few things worth noting.

Pre-existing Medical Conditions (Certain Circumstances)

The Atlas trip insurance plans define a pre-existing medical condition as one you had in the 60 days preceding your scheduled departure. That 60 days is called the look-back period. Pre-existing conditions are handled differently based on the type of travel insurance you purchase.

The Atlas Excursion plan does not cover pre-existing medical conditions in any circumstance. For some, this is a good reason to buy the Atlas Expedition or Enterprise plans instead.

The Atlas Expedition and Enterprise plans have a pre-existing conditions waiver. That means that if you meet certain criteria, your trip cancellation, interruption, and medical benefits will cover your pre-existing medical conditions. These are the criteria:

- You purchase your travel insurance plan within 21 days of making your initial trip deposit

- You purchase insurance for the full cost of your trip

- You’re medically able to travel on the effective date of your policy

The Atlas MultiTrip plan has a look back period of two years. That means a condition is considered pre-existing if you had it in the two years prior to the beginning of your coverage.

The MultiTrip plan does not cover pre-existing medical conditions except in cases of acute onset. Acute onset means a sudden, unexpected, brief flare-up that requires urgent care (excluding chronic or congenital conditions).

Adventure Sports

There’s a whole list of adventure sports that aren’t covered. That means if you sustain an injury while taking part in one, Atlas won’t pay your claim. Here are a few notable exclusions:

- Parachuting

- Any kind of race

- Base jumping

- Independent scuba diving

- Spelunking or cave diving

- Whitewater rafting

- Big game hunting

If any of these are an important part of your travel plans, you should look elsewhere for your insurance needs. We recommend checking out World Nomads , which is known for its adventure sports coverage.

Lost or Damaged Medical Items

It’s important to note that baggage/personal effects and baggage delay coverage do not cover loss or damage to medical items you may travel with. This includes:

- Eyeglasses, sunglasses, and contacts

- Artificial teeth and dental bridges

- Hearing aids

- Prosthetic devices

- Prescribed medications

- Retainers and orthodontic devices

The best course of action is to keep these items in your carry-on luggage to reduce the chance of loss or damage.

Standard Exclusions

As is the case with most travel insurance providers, Atlas does not cover losses related to:

- Anything self-inflicted

- War, invasion, acts of foreign enemies, civil war, hostilities between nations

- Any non-emergency medical treatment

- Injury or sickness when traveling against the advice of a physician

- Participation in professional sports, piloting, or military training exercises

Again, consult your plan certificate for the full list of exclusions.

Need an all-in-one travel insurance plan? Atlas has your back with several single trip and multi-trip options. Get started today with a free quote.

Atlas Travel Insurance: Who Can be Covered?

Two of the Atlas trip cancellation plans, Atlas Expedition and Atlas Enterprise, cover travelers up to age 99. This is something to consider if you or someone you are traveling with is a senior. Atlas Excursion provides coverage to age 75. Atlas MultiTrip provides coverage to travelers aged 14 days to 75 years.

Atlas Travel Insurance Pros and Cons

Who should buy atlas travel insurance.

Frequent Travelers – If you travel several times a year, Atlas MultiTrip can save you money.

Travelers Who Need an All-In-One Insurance Product – If you need to insure your non-refundable trip deposits but you also want high levels of medical coverage, the Atlas Expedition or Enterprise plans will be a good fit for you. They come with a generous $150,000 or $200,000 in medical coverage.

Travelers Who Need Cancel For Any Reason Coverage – The Atlas Enterprise plan comes with optional Cancel for Any Reason coverage. Although it’s expensive, it will be worth it for some travelers.

Who Should Skip Atlas Travel Insurance?

Seniors Aged 75 and Over – Seniors over age 75 are not eligible for the Atlas Excursion plan or the MultiTrip plan. They can get the Atlas Expedition and Enterprise plan, but they can likely find more options elsewhere.

Adventurous Travelers – Atlas doesn’t offer adventure sports coverage, so if bungee jumping or mountain climbing are in the cards, look elsewhere. I recommend checking out World Nomads .

Frequent Travelers Who Need Trip Cancellation – The Atlas MultiTrip plan is a great option for frequent travelers, except for one thing: it doesn’t include trip cancellation insurance. If you’ll be making expensive deposits several times per year, the MultiTrip plan won’t check all your boxes.

How to Buy Atlas Travel Insurance

The simplest way to buy any of the Atlas plans is online. Start by grabbing a quote and reviewing the coverage. If you like what you see, enter your details and your payment information, and you’re good to go.

The Atlas trip cancellation insurance plans come with a 10-day review period. This means you can request a refund within 10 days of purchasing your plan if you change your mind (as long as your coverage hasn’t started).

With the Atlas MultiTrip plan, you can request a refund any time before coverage begins.

How to Make a Claim

You have 20 days for trip cancellation insurance or 60 days for MultiTrip insurance from the day coverage ends (the last day of the certificate period) to file a claim.

To start a claim, you must contact Tokio Marine HCC-MIS to give notice of your claim. You can do this online or by mail, and you can call to get help. They will advise what forms and information you need to provide.

Atlas Travel Insurance: Should You Buy It?

If you’re looking for a solid, comprehensive travel insurance plan that protects your non-refundable deposits and offers emergency medical coverage, Atlas has you covered.

Their Expedition and Enterprise plans offer robust coverage at a reasonable price. They are the trip insurance plans that will meet most travelers’ needs. In my opinion, the Excursion plan just doesn’t offer enough medical coverage for most situations.

The MultiTrip plan is a good fit for travelers looking to insure multiple trips a year but don’t need trip cancellation coverage.

Whether you chose Atlas or another provider, make sure you protect yourself and your trip by purchasing a travel insurance policy before you go. Thanks for reading and safe travels!

Get International Medical Insurance with Atlas – Are you ready to protect your trip and your health? Hop over to Atlas to get your free quote for your next trip. Grab a free quote here.

Atlas Travel Insurance Review

- Amount of Coverage

- Medical Coverage

- Travel Coverage and Protections

- Affordability

- Covered Activities & Sports

- Availability

Their Expedition and Enterprise plans offer robust coverage at a reasonable price. They are the trip insurance plans that will meet most travelers’ needs. In my opinion, the Excursion plan just doesn’t offer enough medical coverage for most situations. The MultiTrip plan is a good fit for travelers looking to insure multiple trips a year but don’t need trip cancellation coverage.

There is little adventure sports coverage and no annual plans that include trip cancellation insurance.

Sandra Parsons is a professional freelance writer and personal finance expert who writes about all things money. Her work has been featured on sites like MoneyTips, Credit Knocks, Women Who Money, and CreditCards.org. She also adores travel (preferably paid for with credit card rewards) and routinely reviews sightseeing passes and travel insurance solutions. Prior to focusing on her writing career, Sandra spent five years working in banking. She also holds master’s degrees in employment relations and psychology. Learn more about Sandra here.

Similar Posts

Hong Kong Pass Review: Is It a Good Buy?

Is the Hong Kong Pass worth it? Check out our Hong Kong Pass review to learn if this sightseeing card can help you save money on your travel plans!

Personal Capital vs. Quicken: Which is Better for Managing Money?

Looking for a better way to manage your money? We compare Personal Capital vs. Quicken in a showdown that will help decide which program is best for you!

New York Explorer Pass Review 2024: Is It a Good Value?

The New York Explorer Pass is an excellent way to see NYC’s best sights at a fraction of the cost. Our review explains if it is a good fit.

Debitize Review: Earn Points and Miles Without the Debt

Do you love earning credit card rewards but worry about debt? This app may be your solution. Read our Debitize review to learn more!

AllClear Travel Insurance Review: Is It Worth It?

AllClear Travel Insurance offers single and multi-trip medical insurance plans (including pre-existing conditions) for all ages. Learn more in this review.

Is Amazon Prime Worth It?

At $99 a year, Amazon Prime may seem a bit pricey. But, the benefits of Amazon Prime membership can add up quickly. Is it worth it to you? Find out here!

Pin It on Pinterest

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

- Tokio Marine Review

Tokio Marine Atlas Travel Medical Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Tokio Marine rated?

Overall rating: 4.4 / 5 (excellent), tokio marine plans & coverage, coverage - 4.5 / 5, emergency medical coverage details, baggage coverage details, tokio marine financial strength, financial strength - 4.6 / 5, tokio marine price & reputation, price & reputation - 4.6 / 5, tokio marine customer assistance services, extra benefits - 4.1 / 5.

Our Comments Policy | How to Write an Effective Comment

6 Customer Comments & Reviews

Related to travel insurance, top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

WorldTrips Travel Insurance Review — Is It Worth It?

Content Contributor

67 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

89 Published Articles 500 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Stella Shon

News Managing Editor

92 Published Articles 649 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

Who can get worldtrips travel insurance, what does worldtrips travel insurance include, optional add-ons to atlas journey plans, comparison of worldtrips atlas journey travel insurance plans, how much does worldtrips travel insurance cost, how worldtrips travel insurance compares to other options, tips for ensuring a smooth claim process, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Planning trips is fun. Reading about travel insurance for them isn’t. But a little effort to plan for problems during your upcoming vacation can make a big difference.

WorldTrips provides multiple types of travel insurance, ranging from minimalist policies with just medical insurance to full-scale policies that cover anything that might go wrong during your next family vacation. The insurer also offers add-ons that most competitors lack, such as policies for students studying abroad, special provisions for hunting and fishing trips, veterinary emergencies, school activities that force you to delay your vacation, and even coverage for destination weddings when the bride or groom calls it off.

However, you may be surprised that rental car protections are only available as an add-on to WorldTrips plans, and you’ll need the most expensive plan if you want to add coverage for pre-existing medical conditions.

Here’s a look at the various travel insurance plans from WorldTrips and whether the costs are worth it.

Before understanding who can get a plan, it’s essential to understand the different types of travel insurance plans available from WorldTrips.

Atlas Travel plans are available for citizens and residents of numerous countries when traveling internationally. Conversely, Atlas Journey plans are available only to U.S. citizens and residents, covering domestic and international travel. Atlas Journey plans are geared primarily toward trip delay and cancellation benefits, while Atlas Travel plans are focused primarily on medical coverage. However, they share some crossover benefits.

WorldTrips also has travel insurance policies that aren’t focused on typical tourists. StudentSecure plans provide injury and illness coverage for those studying abroad. Atlas MultiTrip plans provide coverage for 364 days, covering trips up to 30 or 45 days each (depending on the plan you choose), and Atlas Group plans can provide up to a 10% discount if you’re traveling in a group of 5 or more people.

Additionally, WorldTrips Atlas Travel plans can provide medical coverage for those doing overseas volunteer or missionary work.

WorldTrips offers multiple types of travel insurance policies. Atlas Travel plans are available only for international trips (open to residents of many countries) and primarily focus on medical coverage. With these plans, you’ll choose your preferred deductible and maximum coverage limit, then provide your age and destination.

U.S.-based travelers have access to Atlas Journey plans. These cover domestic and international trips and are what you likely think of when considering travel insurance. We’ll analyze these in depth in the article and then cover the medical-focused Atlas Travel plans near the end.

WorldTrips Atlas Journey Travel Insurance Coverage Types and Benefits

To know what you’re looking for in a travel insurance policy, you should first understand what the types of coverage are:

- Trip Cancellation Insurance: Covers prepaid, non-refundable expenses when you cancel a trip for covered reasons like sickness, injury, or death of a family member.

- Trip Interruption: Reimburses prepaid, non-refundable expenses if you miss part of a trip or have to end a trip early due to covered reasons like weather, jury duty, or injury.

- Travel Delay: Applies to additional expenses incurred for delays of 5+ hours, covering accommodation, meals, and local transport costs.

- Travel Inconvenience: Applies when one of the following occurs: your return home is delayed and causes you to miss 2 or more days of work, your flight must land 50+ miles from the original destination, there’s a documented security breach causing delays at your departure terminal, you’re a victim of a verified physical assault, your credit/debit card is canceled for reasons beyond your control, or your travel documents are stolen and can’t be replaced locally.

- Emergency Accident and Sickness Medical Expense: Covers losses due to medical and dental emergencies. This is secondary coverage except on the Premier plan.

- Medical Evacuation and Repatriation of Remains: Covers medically necessary transportation and care en route when you’re ill or injured and don’t have access to appropriate care in the immediate area. You also can be covered for repatriation to your home or other U.S. city with appropriate care, requiring prior approval.

- Baggage Damage or Loss: Provides reimbursement for loss, damage, or theft of personal effects in excess of other insurance, such as homeowners’ or airline baggage policies.

- Baggage Delay: Provides reimbursement for covered expenses after 12+ hours of baggage delay at your destination. Covered expenses include necessary clothing, laundry, toiletries, and costs for retrieving your baggage. Coverage ends when your luggage is retrieved or you return home — whichever is first.

- Missed Connection: Can reimburse expenses related to missed cruises, tours, flights, or trip departures due to 3+ hours of delays. Covered delays include weather, carrier problems, strikes, quarantines, and more. Expenses cover costs to catch up with your trip or money lost from missing the trip.

- Airline Cancellation or Reissue Fees: Reimburses costs for changing or canceling tickets after interruptions or canceled flights. This coverage applies to costs after any refunds or vouchers you receive.

- Travel Assistance Services: Provides 24/7 assistance services like security advice, coordination of medical benefits, interpreters, legal referrals, and referrals for needs during emergencies. Note that you may have costs for services you use from these referrals.

It’s also important to note that each section has rules and restrictions about which costs are covered, when coverage applies, and other terms you must follow.

You’ll see options for additional coverage depending on the base plan you select:

- Cancel for Any Reason Coverage (CFAR): This add-on policy covers up to 75% of your losses if you cancel for reasons not covered in other sections of your policy, so long as you purchase within 21 days of your first deposit and cancel 48+ hours before the trip. This add-on isn’t available for Economy plans.

- Interruption for Any Reason: Provides reimbursement for 50% of non-refundable trip costs after a trip is interrupted for non-covered reasons. WorldTrips says, “No questions asked” on this coverage. This add-on is available for Premier plans only.

- Pre-existing Conditions: Requires purchasing a policy within 21 days of the initial deposit and covers pre-existing conditions that have a change in treatment or that make you unable to travel.

- Adventure Sports: Provides coverage for leisure, non-professional sports like bungee jumping, scuba diving, and mountain climbing up to 7,000 meters, as well as safari activities. This add-on is available for all plan levels.

- Rental Car Damage and Theft: Requires a $250 deductible; afterward, provides rental car coverage for collision, theft, and damage beyond your control. You must be authorized to drive at the destination and listed on the rental policy. This add-on is available for all plan levels.

- Pet Care: Provides reimbursement for a trip canceled due to the death or critical illness of your dog or cat within 7 days of trip departure. Provides up to $250 in coverage for boarding fees if your return home is delayed for a covered reason and up to $500 for emergency veterinary care for a pet traveling with you. This add-on is available with all plan types.

- Rental Accommodations Protection: Covers trip interruptions if you can’t access your vacation rental property for 12+ hours or if your property is unsuitable or not as described on arrival. It’s available on all plan levels.

- School Activities: Provides cancellation coverage for trips you must cancel due to school activities like exams or sporting events beyond standard season dates. This coverage also applies to study abroad, volunteer, or philanthropic programs. This add-on is available for all plan levels.

- Hunting and Fishing: Covers canceled and interrupted trips related to changes in government regulations or delays of 24+ hours in receiving your necessary equipment. This coverage also applies to theft, damage, and destruction of your essential equipment and trips where your guide or traveling companion becomes medically unfit to participate. This add-on is available for all plan levels.

- Destination Wedding: Provides reimbursement for lost funds when you plan to attend a wedding and then it’s canceled. Coverage also applies to canceled flights, flights forced to land 50+ miles from the intended airport, and flight delays of 12+ hours. This add-on isn’t available for Economy plans.

- Security/Terrorism: This covers cancellations due to terrorist events at your destination or trip interruption for riots/civil unrest lasting 12+ hours. It also can provide ransom payments or security assistance for kidnapping. However, it doesn’t cover countries like Mali, Afghanistan, Syria, or others excluded from the policy. It’s available on all plan levels.

- Primary Medical Coverage: This paid upgrade to Preferred plans makes the emergency medical and dental benefits primary coverage rather than secondary.

- Primary Baggage Coverage: This makes baggage coverage primary rather than secondary. This is available on all plan levels.

It’s also possible to upgrade your maximum coverage limits on certain benefits. These include baggage loss and upgrading benefits from secondary to primary coverage.

Few companies offer kidnapping ransom, destination wedding, or school activity coverage. If these are concerns for your upcoming trip, WorldTrips can make sense over competitors that lack these protections.

Take note that rental car protection isn’t included in any plans — not even the Premier plan. It’s available for an additional cost, but this reinforces the importance of using a good credit card that provides built-in rental car protections .

Pre-existing Conditions

When purchasing an Atlas Journey plan, this coverage is included if you purchase your plan within 21 days of your initial trip payment.

COVID-19 Coverage

Atlas and StudentSecure plans purchased on or after February 2, 2023, include coverage for medical expenses related to COVID-19.

There are several coverages that are the same across all 3 plans :

- Coverage for Pre-existing Medical Conditions — Included if conditions are met and policy is purchased within 21 days of initial deposit

- 24/7 Travel Assistance Services — Included

- Adventure Sports Medical Coverage — Available add-on service; average cost $44

- Pet Care — Available add-on service; average cost $10

- Rental Car Damage and Theft — Available add-on service; average cost $50

- Rental Accommodation Protection — Available add-on service; average cost $21

- School Activities Protection — Available add-on service; average cost $16

- Hunting and Fishing Protection — Available add-on service; average cost of $20

WorldTrips Travel Insurance Economy Plan

This is the most inexpensive plan but still covers the essentials. You can be reimbursed for canceled, interrupted, and delayed trips and get reimbursed for sicknesses, injuries, and even delayed bags. Numerous add-ons can improve this plan, though the cost will increase.

WorldTrips Travel Insurance Preferred Plan

This intermediate plan offers more coverage and higher cover limits than the Economy plan but costs more. This plan has additional add-on options, and it’s the lowest plan with an option for CFAR coverage.

WorldTrips Travel Insurance Premier Plan

The most expensive plan also offers the most robust coverage — in terms of types and values. It’s the only plan with an option to add coverage for pre-existing conditions, though many options remain add-ons and aren’t included in this plan (such as rental car coverage).

None of the Atlas Journey plans include rental car protections. Those are available as an add-on, however.

Atlas On-The-Go Insurance

WorldTrips provides another travel insurance plan called On-The-Go . It’s only available to U.S. residents and covers non-refundable trip costs, lost or damaged personal items (including luggage), and medical expenses (including COVID-19).

You can be covered for trip interruption, travel delays, missed connections, and emergency medical expenses. However, you won’t be covered for trip cancellation and cannot add coverage for pre-existing conditions or CFAR.

Let’s price some sample plans to see how they cost. This will give you a better idea of whether these plans fit your budget.

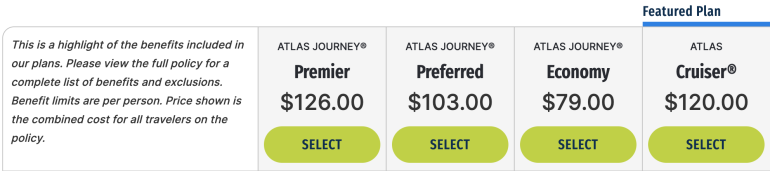

Atlas Journey Plans

These plans are available to U.S. residents and citizens and cover domestic and international trips.

Atlas Travel Plans

These plans are available to residents of numerous countries and only cover international trips.

Notice there is a high additional cost for elderly travelers . Also, your maximum coverage amount is lower for people aged 60 and above.

Since Atlas Travel plans primarily focus on medical coverage, you don’t need to provide your trip cost when getting a quote. These plans can make sense if you’re OK with minimal trip protections while ensuring you’re covered for possible injuries during a trip. You can choose from several options for a maximum coverage amount and deductible payment for your claims.

These plans are focused on medical coverage during international trips. If you aren’t worried about expenses for delays or cancellations, you could potentially save money by purchasing an Atlas Travel plan. These especially make sense for last-minute trips where your odds of cancellations are low.

As these plans have maximum coverage amounts and don’t cover trip cancellation, they’re cheaper. This can be a good option if your trip is unlikely to be canceled and you want protection for your stuff and your health during a vacation. As long as you’re a U.S. resident, plans are available for both international and domestic travel.

WorldTrips Travel Insurance vs. Competitors

Part of shopping for trip insurance is understanding what you get and how much it costs. The other part is understanding how this compares to competitors. What are companies like Generali Global Assistance and Nationwide charging for similar plans? Here’s a comparison of costs.

We priced a 1-week itinerary for 2 travelers (ages 40 and 39) going to Colombia in November 2023. The cost for the trip was estimated at $3,000, and the first trip deposit was made in the last 24 hours. Squaremouth provided these comparison costs.

The WorldTrips plan had the middle cost of the 3 .

All 3 plans included COVID-19 coverage; all 3 provided the same trip cancellation benefits and the same medical evacuation benefits . However, WorldTrips and Nationwide had lower maximums for emergency medical benefits than Generali, and WorldTrips also had the lowest maximum benefit for trip interruption .

WorldTrips has a competitive cost against similar plans from other providers. You’ll see similar coverage types and maximum payouts in some areas. However, you’ll see lower benefits for emergency medical and trip interruption than more expensive options. Consider these numbers and how important they are.

WorldTrips Travel Insurance vs. Credit Card Insurance

You may be surprised that your credit card could provide some of the same travel insurance . This could help you save money by not needing to buy a separate policy.

However, when the coverage goes into effect varies. Some credit cards require you to pay for the entire trip (including round-trip tickets, not one-way) with that card to trigger the protections. Others go into effect by paying just a portion of the trip with that card. It’s important to understand exactly what your card offers and when it’s available to determine if those protections are sufficient.

Here’s a look at how WorldTrips’ Atlas Journey Premier plan compares to coverage with The Platinum Card ® from American Express , Capital One Venture X Rewards Credit Card , Chase Sapphire Preferred ® Card , and Chase Sapphire Reserve ® .

WorldTrips’ Premier plan has lower trip delay, lower lost luggage, and lower accidental death and dismemberment benefit maximums than you may get with premium credit cards. However, WorldTrips’ top plan has better baggage delay protections and offers the best protections for emergency medical and emergency evacuation.

Even before your trip, you should think about “what if something goes wrong” and have a plan. That includes buying your plan within required deadlines (based on initial and final trip payments) and keeping receipts for every expense. Keep receipts for flights, hotels, rental cars, meals during trip delays, and even a toothbrush while waiting for delayed luggage. Keep it all.

You also should read the policy documents before and after buying a plan. These will help you know precisely what is and isn’t covered. For instance, destination wedding coverage can be handy if the wedding gets called off, but the policy’s fine print will tell you you’re not covered if you’re the bride or groom.

Keeping a paper trail and knowing what is (and isn’t) covered will ensure a smoother claim process because you’ll avoid submitting unnecessary claims and will avoid unnecessary delays during the evaluation process. It also helps you know what’s covered before you swipe your card for expenses during a delay.

If you need to submit a claim, WorldTrips has a “How the claims process works” page , and it includes instructions on what to do, what forms you need, and how the claims process varies based on whether your trip was inside or outside the U.S. It also provides information on how medical facilities can direct bill WorldTrips, which can save you the hassle of paying and then waiting for reimbursement.

No one likes to think about emergencies when planning an exciting holiday. However, planning for emergencies can reduce stress and costs should something go wrong. WorldTrips offers several types of travel insurance, covering all your bases or potential medical expenses. The sheer variety of options provides more potential coverage types than many competitors.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is worldtrips legit.

WorldTrips has been around since 1879 and operates in 180 countries. It’s headquartered in Houston, Texas, has excellent financial strength ratings from multiple credit rating organizations.

How do I contact WorldTrips insurance?

In the U.S., you can call 800-605-2282. From outside the U.S., call collect to 317-262-2132.

How do I submit a claim to Worldtrips?

Within the member portal (formerly the Client Zone), you can access the claimant form, fill it out, and then upload all of your documents electronically. It’s also possible to bill WorldTrips directly for medical expenses.

How do I cancel my Worldtrips policy?

Send an email to [email protected] to cancel your travel insurance policy. You must submit your request prior to the policy’s effective date to receive a refund.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance companies of May 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 6:28 a.m. UTC May 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Preferred and Atlas Journey Premier plans get 5 stars in our rating because of the extensive coverage they provide for the price. Both plans come with high limits for important benefits such as emergency medical and evacuation, travel delay and missed connections. WorldTrips travel insurance also offers a pre-existing medical condition exclusion waiver if you buy a plan within 21 days of making your first trip deposit.

Best travel insurance of 2024

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel, WorldTrips has two top-rated travel insurance plans in our rating:

- Atlas Journey Preferred provides $100,000 per person in emergency medical benefits as secondary coverage, with the option to upgrade to primary coverage. Primary coverage means you don’t have to first file a medical claim with your health insurance company. Atlas Journey Preferred is also the best travel insurance for cruises with $1 million in coverage for emergency evacuation.

- Atlas Journey Premier costs more but gives you $150,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier has $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 411 reviews of policies purchased through the travel insurance comparison site since 2008.

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for missed connections

If you’re looking for good travel insurance for missed connections , it’s worth considering TravelSafe. Its Classic plan includes $2,500 in missed connection coverage for each person on the plan. Some travel insurance companies only provide missed connection coverage for cruises and tours, but TravelSafe doesn’t impose that restriction.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Best trip insurance for traveling with a pet

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. It’s also the best trip insurance for pet parents , with an optional Pet Bundle add-on that includes pet medical, pet kennel and pet return benefits.

- Cheapest of our best trip insurance plans.

- Optional pet bundle adds pet medical expense and pet return benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best travel insurance for cruise itinerary changes

Nationwide’s Cruise Choice plan is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Cruise Choice also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “Cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Via TravelInsurance.com’s website

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance quote requests on the Squaremouth website last month, these are the main benefits travelers are looking for in a travel insurance policy.

*Source: Squaremouth.com. Travel insurance quote filter usage from March 24 to April 23, 2024.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Preferred and Atlas Journey Premier — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.