U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

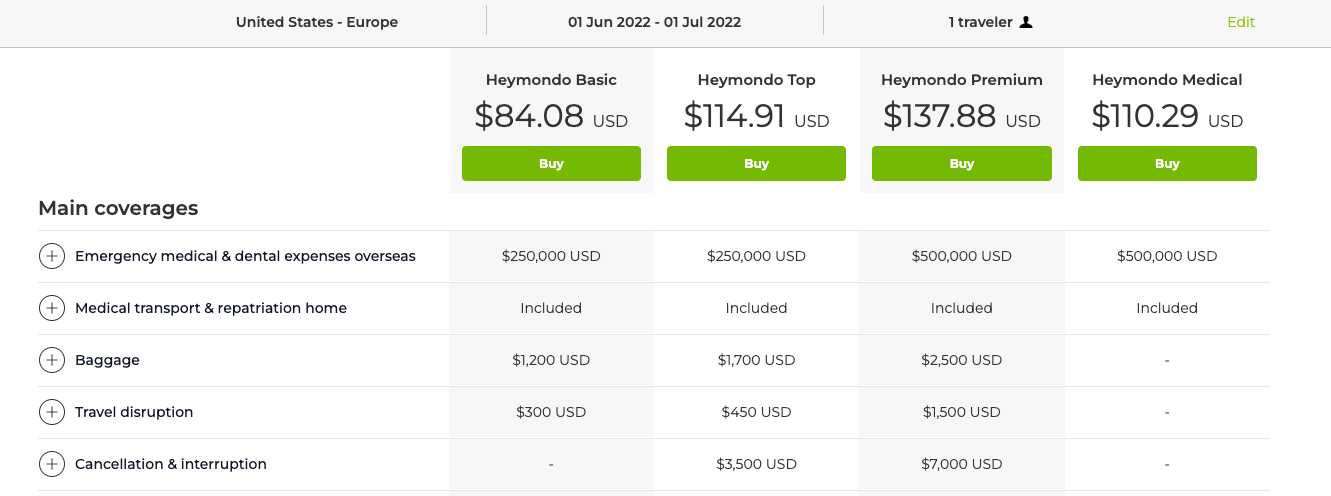

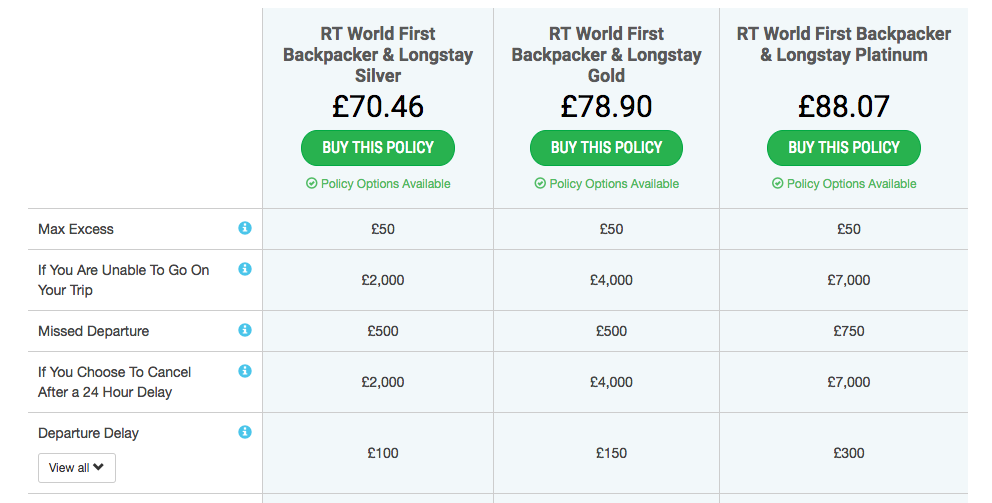

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

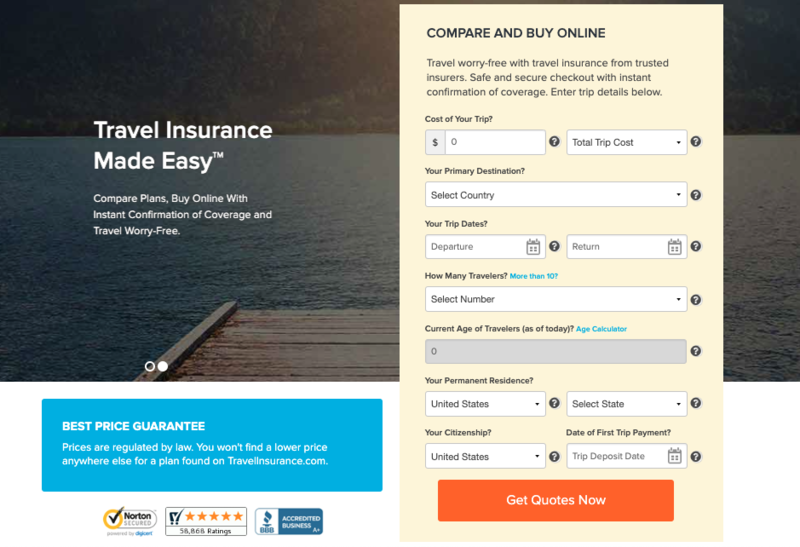

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

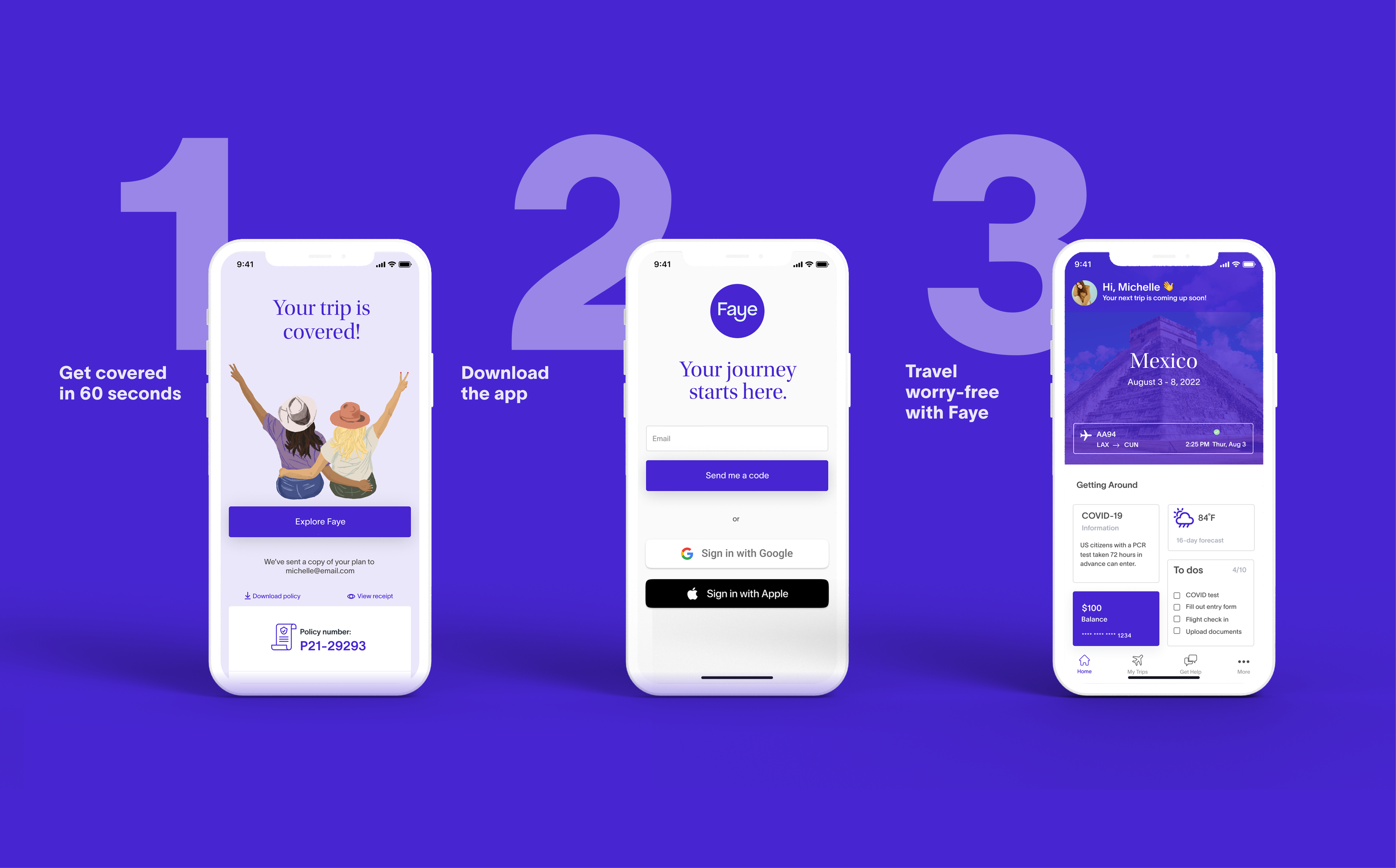

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage Size and Weight Limits by Airline (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

How to Renew Your Passport Online

For the first time since March 2023, online passport renewals are available.

13 Best Carry-on Luggage Pieces 2024 - We Tested Them All

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Best travel insurance companies of August 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 1:56 p.m. UTC Aug. 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Elevate plan gets the top score in our rating because of the extensive coverage it provides for the price. It offers best-in-class emergency medical and evacuation benefits, as well as high limits for baggage insurance.

Best travel insurance of 2024

- WorldTrips : Best travel insurance.

- Travel Insured International : Best for emergency evacuation.

- TravelSafe : Best for missed connections.

- Aegis : Cheapest travel insurance.

- PrimeCover : Best for trip interruption coverage.

- Travelex : Best for families.

- AIG : Best for add-on coverage options.

- Nationwide : Best for cruise itinerary changes.

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,918 coverage details evaluated.

- 588 rates reviewed.

- 5 levels of fact-checking.

Best travel insurance companies

Best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel , WorldTrips’ Atlas Journey Elevate plan gives you $250,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

See our full WorldTrips travel insurance review .

Pros and cons

- $250,000 in primary medical coverage.

- $1 million per person in medical evacuation coverage.

- Primary damage or loss baggage coverage of $500 per item, up to $2,500.

- 5 optional upgrades, including pet care, adventure sports and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 428 reviews of policies purchased through the travel insurance comparison site since 2008.

Heidi’s expert take: “WorldTrips offers primary coverage for emergency medical benefits and for baggage damage or loss. This means the travel insurance company will pay your claim first and then seek recovery from any responsible third party. Plans with secondary coverage may be cheaper, but for the amount of hassle you can save when filing a claim, I recommend looking for a plan with primary coverage.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “The Worldwide Trip Protector plan provides rare non-medical evacuation benefits of up to $150,000. If you’re traveling to an area at risk of a political, security or national disaster, this emergency evacuation coverage could help get you back to safety.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for missed connections

TravelSafe offers good travel insurance for missed connections , with $2,500 in missed connection coverage for each person on the plan.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you want missed connections coverage for any trip, I recommend buying a plan like TravelSafe Classic. It offers up to $2,500 in missed connection coverage and doesn’t restrict this benefit to cruises and tours like many policies do.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Cheapest travel insurance

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. This is based on the average cost of seven international trips of varying lengths and values for travelers of different ages.

See our full Aegis travel insurance review .

- Cheapest of our best trip insurance plans.

- Pet care benefit of $500 under travel delay benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Heidi’s expert take: “If you’re looking for a budget travel insurance policy , Go Ready Choice may fit the bill. It has comparably low coverage limits, but if you have health insurance that will cover you on your trip, its $50,000 in secondary medical coverage may be sufficient.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best for trip interruption coverage

Why it’s the best

If you need to cut your trip short and head home early for a covered reason, PrimeCover Luxe has the best trip interruption coverage of all our top-rated plans. This top-tier travel insurance plan offers trip interruption coverage of up to 200% of your trip cost. You also have the option to add a rare “interruption for any reason” (IFAR) coverage upgrade for even more flexibility with your travel plans.

- Trip interruption coverage of up to 200% of total trip cost.

- Excellent $1 million emergency medical evacuation and $100,000 in non-medical evacuation coverage.

- Pre-existing medical condition waiver available if you buy travel insurance within 21 days of first trip deposit.

- Good primary medical coverage of $250,000.

- Luxe plan is the most expensive of our best-rated travel insurance plans.

There are no reviews online for PrimeCover yet as it is a relatively new product offering.

Heidi’s expert take: “PrimeCover Luxe is on the high end of cost in our rating, but it does offer robust coverage for the price. If you’re concerned about the money you’d lose if you had to end your trip early, it offers an “interruption for any reason” (IFAR) coverage option, which I don’t see very often. With IFAR, you can pull the plug on your trip for any reason and seek up to 60% reimbursement for any prepaid, nonrefundable travel expenses you’ll lose.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

See our full Travelex travel insurance review .

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you’re traveling with kids, I recommend looking for a plan that will cover them for free, like Travelex. The number of children you can add to a Travelex policy is unlimited and they’ll get travel protection at no additional cost.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review .

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Heidi’s expert take: “You can add riders to your AIG travel insurance policy to maximize your coverage. Choose from these bundles: adventure sports, medical, pet, quarantine, security and wedding. You may also want to add “cancel for any reason” coverage and rental vehicle damage coverage.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for cruise itinerary changes

Nationwide’s Choice Cruise is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Choice Cruise also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

See our full Nationwide travel insurance review .

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

Heidi’s expert take: “Nationwide Choice Cruise has protections for cruisers when it comes to prepaid expenses. But its emergency medical coverage is secondary, which means you’d have to file medical claims with your health insurance first. Since your health insurance won’t help you at sea, I recommend cruisers look for cruise travel insurance with primary medical coverage instead.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Compare the best travel insurance plans

Via Compare Coverage’s website

Heidi’s expert take: “Here are my tips on how to buy travel insurance that gets you the most coverage for the lowest price: Buy early . Getting travel insurance within two weeks of making your first trip deposit may qualify you for coverage of pre-existing medical conditions, and it won’t cost you any extra. Look for primary emergency medical coverage . If you buy a plan with secondary coverage, you’ll have to file a claim with your health insurance first, even if you know it will be denied. Don’t overinsure . Calculate the value of only your prepaid, nonrefundable trip expenses that are not already covered by other insurance (like credit card travel insurance or health insurance, if your coverage extends to where you are traveling). Even if this value is $0, you can still buy travel insurance for the travel medical insurance benefits, and you’ll only be paying for the insurance you need. Understand exclusions . If you are planning to go scuba diving, for instance, make sure this adventure activity is not excluded from a policy’s coverage. If so, you may need to pay for a rider or shop for another plan that offers the coverage you need.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical condition exclusion waiver , meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise, travelers have more to lose if their plans are disrupted.

Based on travel insurance quote requests on the Squaremouth website last month, these are the main benefits travelers are looking for in a travel insurance policy.

*Source: Squaremouth.com. Travel insurance quote filter usage from June 22 to July 22, 2024.

Methodology

Our insurance experts reviewed 1,918 coverage details and 588 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

If you’d like to dig in deeper, head over to our travel insurance ratings methodology page.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Explore and Atlas Journey Elevate — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Editor’s note: While our parent company has an interest in PrimeCover, this review was subjected to our team’s standard, rigorous editorial process, which remains independent of any influence from insurance companies, business relationships, affiliates or any other external parties.

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- 'Just a parade of incompetency': Spirit Airlines passengers with 'nightmare' stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

How travel insurance works for baggage

Travel insurance Erica Lamberg

What does travel delay insurance cover?

Travel insurance Mandy Sleight

Travel insurance for UK trips

Travel insurance Amy Fontinelle

What is trip interruption insurance?

10 worst US airports for flight cancellations last week

What are your rights during an airline meltdown?

Hurricanes and travel insurance

Generali Global Assistance travel insurance review 2024

Travel insurance Jennifer Simonson

Travel insurance for vacations to Italy

Travel insurance Timothy Moore

Tricky travel insurance questions answered by experts

Survey: 20% of Americans have had a life-changing experience while traveling

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Cheapest travel insurance of August 2024

- Search Search Please fill out this field.

We independently evaluate all of our recommendations. If you click on links we provide, we may receive compensation.

- Personal Finance

Best Travel Insurance Companies for August 2024

:max_bytes(150000):strip_icc():format(webp)/EricRosenberg-2023-Square-0224d594cbdc4555900b9c356d7b60b9.jpg)

Travel insurance is an important product to consider when booking a trip, especially if it's a pricy one or you believe there's a chance it could be canceled. If you're like the 40% of people who told Nationwide Travel Insurance they plan to travel more in 2024 than in 2023, then travel insurance could be key to making those plans a reality. And if you don't have travel insurance through your credit card, then it's important to get a policy from a travel insurance company.

According to our research, Travelex is the best travel insurance company because its comprehensive coverage comes relatively cheap. We chose the best travel insurers in our list based on an analysis of 31 travel insurance companies across several areas that are most important to travelers, including options available for your coverage, claim and policy limits, what the policy does and doesn't cover, and typical policy costs. We took time to research insurance coverage limits and what the policies covered and rank companies accordingly.

- Best Overall: Travelex

- Runner-Up, Best Overall: Allianz Travel Insurance

- Best Value: InsureMyTrip

- Most Comprehensive Coverage: World Nomads

- Best for Older Adults: HTH Travel Insurance

- Best for Cruises: Nationwide

- Best for Medical Coverage: GeoBlue

- Our Top Picks

Allianz Travel Insurance

InsureMyTrip

World Nomads

HTH Travel Insurance

- See More (4)

The Best Travel Insurance Company: Travelex

- Compare Providers

- What Is Travel Insurance?

Is Travel Insurance Necessary?

What does travel insurance cover.

- How Much Does Travel Insurance Cost?

- What Happens When You Cancel a Trip?

How to Get Travel Insurance in 6 Easy Steps

Best overall : travelex.

- Number of Policy Types: 3

- Coverage Limit: Up to 100% up to $50,000 for cancellations

- Starting Price: $24

Travelex is the best overall travel insurance company because it offers coverage (up to 150% for interruptions) for you or your family members at a competitive price—and kids are included at no extra charge. A relatively low price for the high levels of coverage made it our top choice. Look for the Travel Select plan for the best coverage.

Competitive pricing for comprehensive coverage

Multiple plan options with customizable features

Children younger than 21 covered at no extra cost

Mixed pre-existing medical condition coverage depending on the policy purchase date

No annual plan available

Basic coverage plan features minimal coverage

Travelex Insurance Services is a well-known travel insurance provider based in Omaha, Nebraska. Founded in 1996, Travelex offers several insurance packages depending on the coverage you need for your trip. Policies are underwritten by Berkshire Hathaway Specialty Insurance, which earns an A++ rating from AM Best and AA+ from Standard & Poor’s, which means the company has good financial strength. Coverage is available to customers worldwide.

There are three plans: Travel Basic (the budget-friendly option), Travel Select (good for families), Travel America (coverage for travel in the U.S.).

The Travel Select plan starts at about $36 (that is a one-time payment for your whole trip). It includes trip cancellation insurance, trip interruption, and emergency medical and evacuation, but there also are several ways to customize and upgrade coverage. It also includes protection for kids 17 and under.

Travel is covered up to $50,000 for cancellations. You can receive up to 150% of the trip cost, up to $75,000, for trip interruptions. Emergency medical limits are $50,000, and emergency evacuation coverage is good for up to $500,000.

In addition, Travel Select has a 15-day pre-existing medical condition exclusion waiver. If you purchase your policy within 15 days of paying for your trip and insure the full cost of the trip, your pre-existing injury or illness is likely covered.

Runner-Up , Best Overall : Allianz Travel Insurance

- Number of Policy Types: 10

- Coverage Limit: Varies depending on annual or single-trip plan

- Starting Price: $138

Allianz is the runner-up best overall travel insurance company because it offers coverage for frequent travelers with a low cost per trip. Get the best coverage from the AllTrips Executive Plan. Individual trip coverage is also available.

Annual- or single-trip plans are available

Many policy types fit varying needs

Cover yourself and your household all year even if you’re not traveling together

Does not cover extended travel periods

Some annual plans have per-trip limits while others have annual limits

Limit for emergency medical transportation coverage is only $250,000

Allianz Travel is a subsidiary of Allianz, which traces its history back to 1890 in Germany. Travel policies are underwritten by insurers with AM Best ratings of A to A+ and are available only to legal U.S. residents.

Travelers who want to hit the road many times per year should consider annual travel insurance rather than individual per-trip policies. Allianz Travel offers four different annual plans with varying benefit levels. We particularly like its AllTrips Executive Plan, which has the highest limits and coverage.

The AllTrips Executive Plan provides tiered limits starting at $5,000 for trip cancellation insurance or interruption coverage. It also offers $50,000 for emergency medical and $250,000 for emergency transportation per insured per trip. There is a lengthy list of exclusions, including extreme sports, so make sure to read the fine print before jumping into adventure activities.

Quotes for a single traveler, a couple, and a family of four had a price point of $500 per traveler per year. If you pay for comprehensive coverage at $120 per person per trip and are going to travel at least five times per year, you will break even with this plan. If you’re looking for lower costs, the AllTrips Basic, Premier, and Prime options are also available from Allianz.

Best Value : InsureMyTrip

- Number of Policy Types: Multiple options from over 20 providers

- Coverage Limit: Varies

- Starting Price: $25 to $100

InsureMyTrip is the best valued travel insurance company because it allows you to compare policies from more than 20 different travel insurance providers with one form so you know you’re getting a good deal for the coverage you need. You can find low-cost trip coverage or customize a plan to meet your needs so you don’t overpay for coverage you won’t use.

Search for quotes from multiple reputable insurers

Shop around with one application for multiple trip types

View multiple plans from eligible insurers for your planned trip

Many popular insurers are not included in listings

Initial listing pages don’t show policy limits

Includes some policies with low coverage limits

Founded in 2000, InsureMyTrip is a travel insurance comparison website that searches more than 20 insurers using one intake form. It offers an easy-to-use sign-up tool to compare multiple policies based on your specific needs quickly. Filters can pick policies that cover adventure sports, higher limits, increased medical coverage, and more.

A quote for a family of four taking a 14-day trip that costs $4,000 and includes plane and hotel expenses resulted in three suggested plans with costs of around $100 to around $400 for varying levels of travel protection. Basic features included luggage coverage, travel delay, and medical care. Note that rates will differ based on where customers are originating from and where they are vacationing, as well as other variables.

The insurers you'll find while using InsureMyTrip have earned a variety of industry ratings and are generally considered reputable and financially stable. Still, as with policies bought directly from insurers, it’s a good idea to read the policy details before clicking the buy button. Each underlying insurer has different claims processes, exclusions, and limits. InsureMyTrip makes it easier, however, to be an informed travel insurance buyer.

Most Comprehensive Coverage : World Nomads

- Number of Policy Types: 2

- Coverage Limit: Up to $10,000 for trip cancellation

- Starting Price: $100 to $200

World Nomads is the best comprehensive coverage travel insurance company because adventure travelers and digital nomads will get coverage of up to $100,000 for accidents for some of the most extreme adventures.

Extensive coverage with high limits for medical and emergency evacuation

Protects your bags, computers, and sports equipment when traveling

Explorer plan covers adventure sports

Only single-trip plans are available

Most pre-existing medical conditions are not covered

Not all policies cover adventure sports

World Nomads is a good insurer for those looking for adventure. The Australia-based provider was founded in 2000 and is a solid choice for worldwide travel with few excluded activities. Policies are underwritten by various insurers including the financially strong and well-known Nationwide Mutual Insurance Company, Generali Global, AIG, and Lloyd’s.

Coverage includes terrorist attacks, assault, medical repatriation, equipment and baggage, and overseas medical and dental. The high-end Explorer Plan covers activities including snow sports, water sports, aviation, motorsports, athletics, and high-adventure experiences. It names more than 200 activities, many of which other insurers specifically exclude.

For the Explorer Plan, a solo 35-year-old would pay around $200, depending on inputs like state of origin, for a month in Thailand, which is reasonable for such extensive coverage. The Standard Plan costs around $100 for the same trip, but it makes sense to choose higher coverage levels if you’re worried about something going wrong.

This U.S.-based policy is underwritten by Nationwide (rated A by AM Best) with a $100,000 limit for emergency accidents and illnesses, $500,000 for emergency evacuation, $10,000 for trip cancellation insurance (or interruption), and much more.

Though it doesn’t have the same insurance reputation as some other providers, it works with reputable companies to underwrite policies.

Best for Older Adults : HTH Travel Insurance

- Number of Policy Types: 5

- Coverage Limit: Up to $50,000 for trip cancellation

- Starting Price: Varies

HTH Travel Insurance is the best travel insurance company for older adults because its medical coverage is excellent and you get flexible options while on a budget.

High levels of medical coverage for adults up to 95 years old

Up to a $1,500 allowance for someone to visit you in the hospital

May be expensive depending on your needs

Best plan for older adults requires existing health insurance

Lowest policy has a $50,000 maximum benefit per person

Headquartered in Pennsylvania, HTH Worldwide was founded in 1997, and HTH Travel Insurance offers plans with high levels of medical coverage. That’s a big concern for older adults leaving the country , as they could end up in a doctor’s office or hospital with an expensive bill to follow. HTH Travel Insurance offers up to $1 million in total coverage for medical.

Policies for travelers with existing primary insurance enjoy 100% coverage for typical hospital charges, including surgery, tests, office visits, inpatient hospital stays, and prescription drugs outside of the U.S., among other coverage.

Medical evacuation is available up to $500,000, but trip interruption and baggage coverage are pretty light. Most people will choose this plan for medical rather than travel benefits. This policy is available to applicants who are 95 years old or younger.

Travel insurance is also available for people without existing health coverage. Most older adults in the U.S. are covered by some existing coverage, such as Medicare, but Medicare doesn’t work outside of the United States, leaving people uninsured when abroad. HTH Travel Insurance provides policies for those without existing medical coverage. The age limit is 95, but there is a 180-day pre-existing medical condition exclusion.

Best for Cruises : Nationwide

- Number of Policy Types: 8

- Coverage Limit: Up to $30,000 for trip cancellation

- Starting Price: $100

Nationwide is the best travel insurance for cruises because it offers multiple options to protect your cruise vacation with tailored coverage for common cruise trip issues. Make sure to review the benefit levels so you pick the right coverage for your needs.

Large insurer with a strong reputation

Three different cruise insurance plans to choose from

Coverage for common cruise issues like missed connections and itinerary changes

Some plans have low coverage levels for some incidents

Benefit limits are low for trip interruption for any reason

Pre-existing medical conditions may not be covered

Nationwide has been around since 1925. The Columbus, Ohio-based insurance company offers the most popular types of insurance including auto, home, and life. It also offers a few types of travel insurance coverage for individual trips, multi-trips, and cruises.

For single trip protection, Nationwide offers trip cancellation insurance of up to $10,000 with its Essentials plan and $30,000 with its Prime plan. Travelers may also get an annual travel insurance package for just $59 a year to cover delays, medical expenses, medical evacuation, lost luggage, and travel assistance.

Its custom-tailored plans for cruises, however, are what landed it in this category. The Universal Cruise plan, Choice Cruise plan, and Luxury Cruise plan make it easy to pick the right coverage for your individual needs. The cost for a couple on a 10-day cruise to Mexico, for example, was quoted at around $200 for both the Universal and Choice plans.

Cruise insurance from Nationwide covers what you worry about most with a cruise. Things like broken-down ships and itinerary changes can lead to missed excursions and flights or other costs. For the Universal Cruise plan, emergency medical expenses are covered up to $75,000 with medical evacuation benefits up to $250,000.

Additionally, all plans include coverage for the weather, an extension of school sessions, work emergencies, and terrorism. The luxury plan also covers the Centers for Disease Control and Prevention warnings in effect at your destination.

Travelers in 2024 have concerns over trip cancelations due to unprecedented events. Nationwide's survey showed that 51% are still worried about a resurgence of COVID-19, while 54% worry about weather-related delays or cancellations. Other worries include technology issues (38%), unruly fellow travelers (37%), and employee strikes (25%). Travel insurance can help alleviate some stress about a trip being canceled.

Best for Medical Coverage : GeoBlue

GeoBlue is the best travel insurance company for medical coverage because it offers multiple options to buy travel medical insurance coverage for a lower price than a full travel insurance package. It offers medical coverage on its own if you don’t want or need additional travel coverage.

Up to $1 million in medical coverage

Gives a la carte medical coverage when other trip costs are already covered

Different policies allow you to cover various needs and pre-existing medical conditions

Primarily covers medical costs

Additional primary medical coverage required

GeoBlue, headquartered in Pennsylvania, is part of Worldwide Insurance Services, and policies come with a license from Blue Cross Blue Shield Association. Policies are issued by 4 Ever Life International Limited, a company with a history of more than 60 years and an A rating (Excellent) from AM Best.