June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

How to Buy Travel Insurance for Long Trips

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

4 Best Long-Term Travel Insurance in 2024 (w/ Prices)

Home | Travel | 4 Best Long-Term Travel Insurance in 2024 (w/ Prices)

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Planning on taking an extended trip soon? Long-term travel insurance is the perfect choice for travelers who are embarking on a long-term trip and need medical- and travel-related coverage.

Of course, insurance for long-term travel isn’t necessary for every traveler, particularly if you don’t take trips that are longer than three months. However, long-stay travel insurance is useful for anyone who is studying abroad, working abroad temporarily, taking a gap year, or simply traveling for a long period of time.

When I first moved to the US, I wasn’t sure if I would stay permanently, so I purchased a long-term travel insurance policy from Heymondo , knowing that it would save me money and give me coverage if I experienced any medical emergencies. It was exactly what I needed at the time.

5% OFF your travel insurance

As soon as I decided to live in the US permanently, I switched to insurance with more medical coverage beyond emergency situations since extended-trip travel insurance is not suitable for expats who want routine medical care.

If extended-stay travel insurance is what you need, keep reading, because we have compared the best long-term travel insurance plans (Heymondo, World Nomads, Travelex, and SafetyWing) and can help you choose which of these is best for your trip.

What is long-term travel insurance?

Long-stay travel insurance coverage comparison

- Long-stay travel insurance price comparison

- Best long-term travel insurance companies

Long-term travel insurance is insurance for anyone taking a long-term trip who needs medical expenses and trip-related coverage. Any trip that lasts a minimum of 90 days and a maximum of one or two years (depending on the long stay travel insurance company) is considered a long-term trip.

Like other travel insurance, insurance for long-term travel provides medical- and travel-related coverage for incidents like emergency medical care, trip delays, baggage loss, and repatriation. It is not suitable, however, for anyone who is permanently living abroad, especially because it only covers emergency medical expenses and not routine medical care.

Long-term travel insurance vs. annual, multi-trip travel insurance

So, is long-trip travel insurance the same thing as annual, multi-trip travel insurance ? They might sound similar, but actually, insurance for long-term travel and annual travel insurance is completely different.

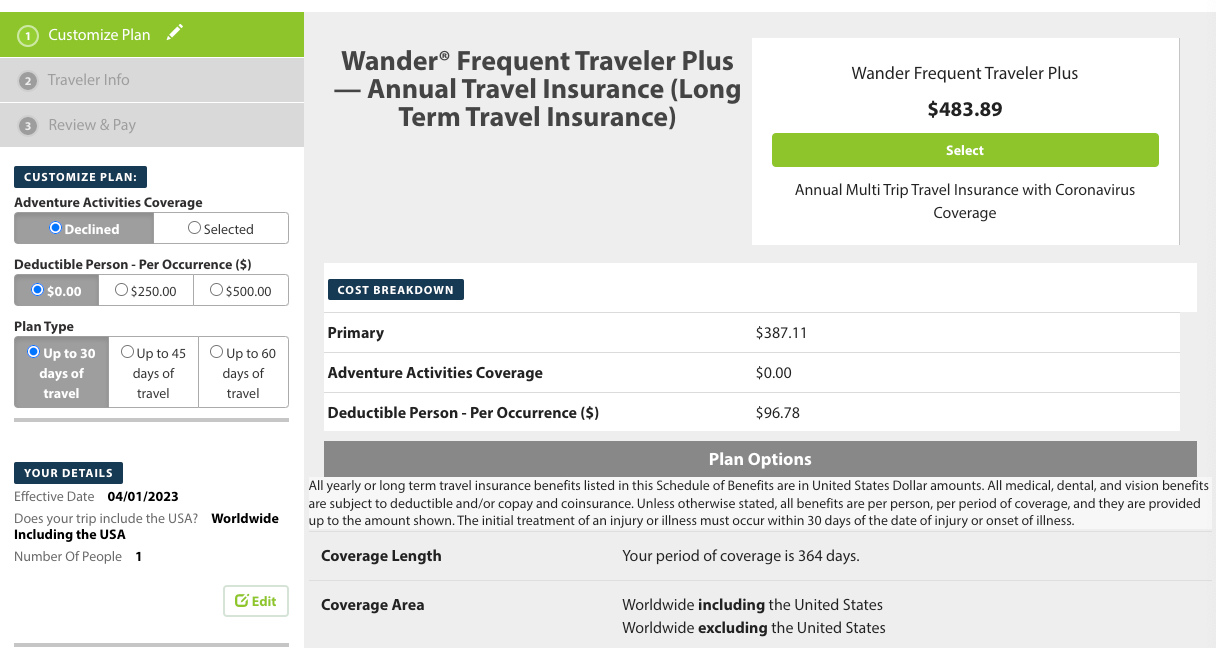

Long-term travel insurance is insurance for long trips that last three months or more, while annual travel insurance covers multiple shorter trips that happen within one year. With annual travel insurance, trips are restricted to 30-90 days, so it’s not a useful option if your trip will last any longer than that. Annual travel insurance is also only helpful if you’ll be taking at least four or more trips a year.

If you are going on a single, long-term trip or are taking multiple trips within a year that will last longer than 90 days, long-stay travel insurance is the best choice for you.

Who is insurance for long-term travel for?

There are several reasons you might need insurance for long-term travel . You might be taking an extended trip, working abroad, embarking on a gap year, or more. Below are the most common and useful reasons for buying travel insurance for long-term travel :

Extended stay travel insurance for long trips

If you’re about to take a long trip that will last at least three months, you will definitely want to have travel insurance coverage, particularly for emergency medical expenses.

Long-term travel insurance will work out to be the most affordable option for your trip, especially if you don’t plan on returning to your home country before 90 days have elapsed. If you plan on going back home before 90 days have passed, then annual, multi-trip travel insurance might be more helpful for you.

Long stay travel insurance for working abroad

Are you about to be working from another country for an extended but temporary period? Having travel insurance for working overseas is a must, as it’s very possible that you’ll need emergency medical care at some point during your time abroad.

Remember to put your country of residence as your home country, not the country you will be working in temporarily. Otherwise, you will not be covered since long-term travel insurance usually does not provide coverage in your designated country of residence.

Travel insurance for expats

Although it may seem like a great idea to use long-term travel insurance as travel insurance when moving abroad , long-stay travel insurance is not intended for expats. Long-stay travel insurance only covers emergency medical expenses, so it’s not suitable for someone who lives abroad permanently and will need routine medical care and check-ups.

On top of that, whatever country you move to will now be your country of residence. Insurance for long-term travel does not generally provide coverage in your designated country of residence, so you may not be eligible for coverage anyway.

Long-stay travel insurance for students

It’s incredibly exciting to study abroad, but accidents and mishaps can and do happen, so avoid paying for emergency medical expenses and replacing stolen valuables with your own money by getting extended-stay travel insurance .

Having long-term travel insurance coverage will be especially useful if you plan on taking weekend trips to other countries that are close to the country where you are studying abroad; you can still receive the same coverage for those smaller trips (just make sure to select worldwide coverage or, if you’ll just be traveling in Europe, Europe/EU coverage).

Round-the-world trip insurance

Taking a long-term trip around the world is many people’s dream. If you are lucky enough to get to live out that dream, it’s easy to make sure your extended-stay travel insurance worldwide will cover you everywhere you want to visit.

Just make sure you select “worldwide” or “around the world” coverage when you purchase your extended-trip travel insurance . That way, you won’t have to buy individual long-term travel insurance policies for each country you visit. Best of all, you’ll be covered for any spontaneous stops you make while traveling the world.

One-way travel insurance, the best gap year travel insurance

If you’re planning on spending a full year traveling the world, travel insurance for long trips abroad is exactly what you need. You’ll benefit from worldwide emergency medical coverage, so you can receive treatment if you get injured or fall ill, as well as travel-related coverage for baggage loss and trip delays.

I recommend purchasing a one-way travel insurance plan from Heymondo or SafetyWing since both companies allow you to renew your plan from month to month. That way, if you end up coming home unexpectedly early, you won’t lose out on any money.

Insurance for digital nomads

ith so many jobs transitioning to working from home right now, it’s easier than ever to work remotely from anywhere in the world. If you have the opportunity to travel the world while working, take it, but make sure you purchase digital nomad travel insurance before you leave.

You’ll want your insurance coverage to include electronics (laptop, tablet, etc.) so that you can easily replace these crucial pieces of technology for working remotely if they get lost or stolen. Additionally, if you’ll be trying to check a lot of places off your travel bucket list, choose worldwide coverage so that you’ll have the freedom and insurance coverage to go wherever you want.

There can be many considerations to keep in mind when purchasing long-term travel insurance , but coverage is certainly the most important aspect to consider when selecting the long-stay travel insurance you want to buy.

Below, you’ll find a long-stay travel insurance comparison that shows you the differences in coverage among the Heymondo, World Nomads, Travelex, and SafetyWing plans.

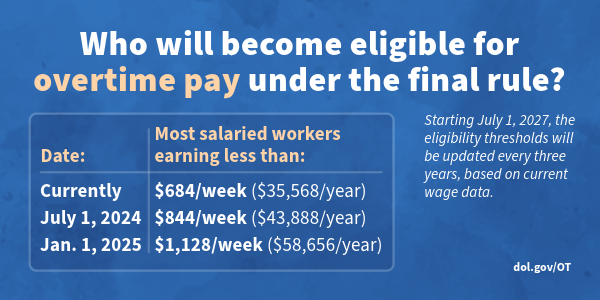

Long-term travel insurance price comparison

If you want a better idea of how much long-term travel insurance costs based on the length of your trip and/or the specific coverage you choose, below is a chart comparing the prices of 1-month, 3-month, 6-month, 8-month, and 1-year long-term travel insurance as well as the prices of long-stay travel insurance, annual multi-trip travel insurance, and cancellation insurance.

The price of long-term travel insurance will be impacted by several different factors, including your age, nationality, and state of residence (if you live in the US).

To give you an idea of how much insurance for long-term travel costs, I’ve used the example of a 30-year-old American citizen who lives in Pennsylvania and needs worldwide coverage to generate quotes for this long-stay travel insurance price comparison .

Best long-term travel insurance

As you can see from the charts above, each of the four long-term travel insurance plans I compared has its merits.

Heymondo offers the highest emergency medical expense coverage, plus it’s the only insurance for long-term travel that pays your medical expenses upfront, so you don’t need to file a claim after your trip to get reimbursed. I will say, however, that it’s not the cheapest long-haul travel insurance and it does have a deductible of $100 for emergency medical expenses. Still, I do think it is the best long-term travel medical insurance if you want ease and convenience.

SafetyWing ’s Nomad Insurance also provides very good coverage, but their deductible for emergency medical expenses is $250. In spite of this slight drawback, SafetyWing stands out as the best insurance for digital nomads since you can sign up for a plan and it will automatically be renewed every four weeks.

Travelex , on the other hand, has the cheapest travel insurance for long-term travel (for trips of six months or more). For shorter trips, there are other, cheaper options. Travelex’s plan has no deductible, but its emergency medical coverage is also very limited, so I would think twice before going on a long-term trip with such a small amount of coverage.

Last but not least, World Nomads offers the best gap year travel insurance. The emergency medical expense coverage is perhaps a little low, but it is at least higher than Travelex’s medical coverage. There is no deductible for medical expenses, but you will need to pay out of pocket and then file a claim to get reimbursed if you receive emergency medical treatment.

As you can see, the best long-stay travel insurance for you will depend on your needs and type of trip, so keep reading to learn more about each plan.

1. Heymondo , the best long-term travel medical insurance

Personally, I consider Heymondo the best long-term travel medical insurance since its Top plan provides the highest amount of emergency medical expenses and evacuation and repatriation coverage. It’s also one of the only types of travel insurance with COVID coverage that covers COVID testing required by a doctor. Moreover, you can easily extend your plan by anything from two weeks to eight months whenever you want to.

Best of all, you won’t have to worry about waiting to get reimbursed for medical expenses since Heymondo pays your medical expenses directly and upfront for you, removing the hassle of the claim-filing process. Heymondo also makes it easy to tailor your insurance for long-term travel to fit your needs since you can add optional electronic and/or adventure sports coverage to your plan.

Heymondo’s Top plan does have its limitations, though. There is a $100 deductible for medical expenses, which means you’ll have to pay $100 towards any medical bills before Heymondo pays the rest for you. This long-stay travel insurance also lacks trip cancellation coverage; you will need to buy that coverage independently here.

If you want cheap long-term travel insurance , Heymondo is ideal; its plans already provide very good value for the money, plus you can save an extra 5% on their insurance with the discount link below.

Heymondo is also the best travel insurance company for single trips. We currently have their travel insurance and have used their assistance app more than once. Heymondo has always been there to help us when things go wrong during our trips.

2. World Nomads , the best gap year travel insurance

If you’re taking a gap year, you’re probably interested in breaking out of your comfort zone and having a real adventure. In that case, World Nomads is the perfect travel insurance for living abroad for a year and trying new things.

Its Standard plan includes adventure sports and activities coverage, so you can try everything from trekking and ice fishing to hockey and horseback riding and still be covered for accidents and injuries. Moreover, you’ll benefit from solid overall coverage for emergency medical expenses, evacuation and repatriation, trip cancellation, trip delay, and baggage loss.

Even better, there’s a $0 deductible for medical expenses, so you won’t have to pay a cent out of pocket toward your medical bills. However, World Nomads’ long-term travel insurance is the most expensive out of all the ones I compared, so if you want to save a lot of money and get similar or better coverage, Heymondo may work better for you.

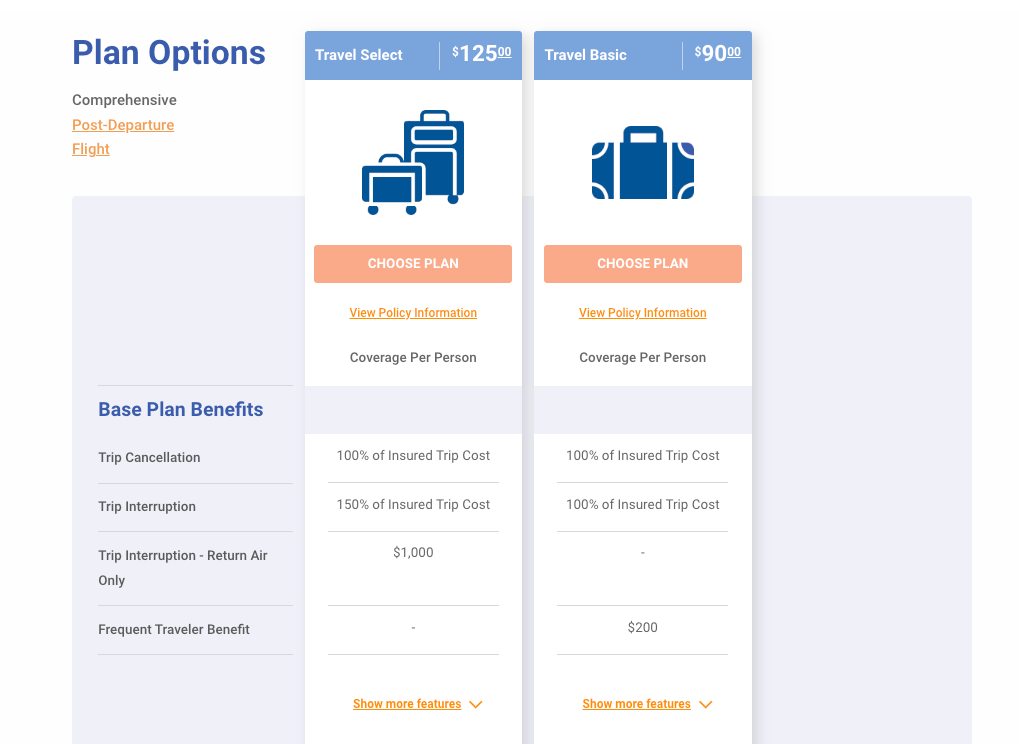

3. Travelex , the best travel insurance for long-term travel

Travelex ’s Travel Select long-trip travel insurance has a lower amount of emergency medical coverage than the other insurance plans I have compared, and I personally wouldn’t feel protected traveling with such a low amount of medical coverage on a long-stay trip. However, Travelex is a viable option if you’re traveling on a budget for more than six months because it’s really cheap (and has a $0 deductible for medical expenses)!

Travel-related coverage is another story since Travelex has the highest amount of trip cancellation and trip delay coverage of all the plans I compared. It’s the best plan to choose if you anticipate experiencing any travel mishaps. You’ll also enjoy great baggage loss and evacuation and repatriation coverage.

If you would rather benefit from more medical coverage for a similar price, Heymondo is the best choice for you.

4. SafetyWing , the best insurance for digital nomads

SafetyWing ’s Nomad Insurance lives up to its name by being the best insurance for digital nomads . Not only is Nomad Insurance a cheap long-stay travel insurance , but it also provides a high amount of medical-related and baggage loss coverage.

On top of that, you can choose to have your insurance renew itself automatically every 28 days. Automatic renewal will save you time and money; ensure you don’t forget to renew so you’re always covered; and provide you with more flexibility if you haven’t decided when to end your trip yet. Just select a start date (but not an end date) when you buy Nomad Insurance and keep renewing until you want to go home, at which time you can select an end date.

Nothing’s perfect, however, and unfortunately, SafetyWing’s Nomad Insurance is no exception. There’s a $250 deductible for medical expenses, which means you’ll have to pay $250 out of pocket for medical treatment before SafetyWing will cover medical expenses for you.

SafetyWing also lacks trip cancellation coverage, which can be very useful if you have to cancel a trip due to weather, illness, injury, or many other reasons. If you want a lower deductible, go with Heymondo instead, and if trip cancellation coverage is important to you, choose World Nomads or Travelex .

What does long-term travel insurance cover?

The best travel insurance for long-term travel will usually include the following types of coverage:

- Emergency medical expenses : This is probably the most important type of coverage as well as the coverage you are most likely to need while traveling. Accidents, injuries, and illnesses can happen at any time, so having emergency medical expense coverage will ensure that you don’t have to pay out of pocket for hospitalization or medical transportation.

- Evacuation and repatriation : Hopefully, you’ll never have to use evacuation and repatriation coverage, but it is useful to have. Insurance for long-term travel with evacuation and repatriation coverage will pay for the transportation costs of taking you from a remote area to the nearest hospital or sending you back to your home country if you fall seriously ill or have an accident.

- Trip delay : Unfortunately, travel does not always go smoothly; your flight could be delayed due to inclement weather or an airline issue. If that does happen, long-stay travel insurance ’s trip delay coverage will cover expenses, such as meals and accommodation, that are incurred because of a several-hour delay.

- Baggage loss : Even when you take precautions to keep your belongings safe, there’s still a chance an airline could lose or damage your bags, or a pickpocket could take your purse. In any case, long-term travel insurance with baggage loss coverage will reimburse you for any valuables that are lost or damaged, so you won’t have to replace them with your own money.

Is long-term travel insurance worth it?

Ultimately, yes, long-term travel insurance is worth it for extended trips, working abroad temporarily, and taking a gap year. It’s also a great alternative for international student insurance . In all of these situations, insurance for long-term travel will ensure that you get the medical- and travel-related coverage you need without having to break the bank.

As you’ve seen in the long-term travel insurance comparison chart above, Heymondo is the best long-stay travel insurance in terms of medical coverage. It offers the highest amount of emergency medical expense and evacuation and repatriation coverage.

Heymondo’s extended-stay travel insurance also provides the convenient flexibility of being able to renew your policy for periods from two weeks to eight months, which is perfect if you haven’t yet decided when you’ll end your trip. To top it all off, you can even get 5% off their insurance just for being a Capture the Atlas reader.

If you’ll be traveling for more than six months and you’re looking for the cheapest long-stay travel insurance, then Travelex may be better for you. Just be aware of their plan’s lower amount of medical coverage.

If you have any questions about long-term travel insurance, feel free to comment below and I will happily help you out!

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

22 replies on “ 4 Best Long-Term Travel Insurance in 2024 (w/ Prices) ”

Hi Ascen, we are US citizens and plan to spend about 6 months of the year in California and 6 months abroad. We have lived in California and in the past had insurance with our jobs which will now be no more. So the question is when we are are in California what is our insurance option so we can visit doctors, dentists etc. Thank you

Hi Sonu, you need standard health insurance for California and travel insurance for traveling out of the States. Travel insurance won’t cover routinary medical appointments.

Let me know if you have any questions, Ascen

Good day. Could I get overlapping coverages to address different issues? Does any of these cover rental car collision insurance during any portion of the stay? If not, what do you recommend for that?

Yes, you can hire different travel insurance to get different coverages. That is no problem.

Hi my husband was diagnosed with mestatic melonma in 2021, Weve been traveling back and forth to Moffitt overvs year now. Weve paid out over $7000 just in lodging. Do you have a plan for this??

I’m sorry about that but there is no insurance that can cover that. That is not an unforeseen issue that occurred during a trip that is mostly what travel insurance cover.

Hi There is an age limit on Heymondo 49+ not included. I am 60. Can you recommend any long stay travel insurance for this age group? Thanks Karan

Hi Karan, I recommend checking our article on senior travel insurance for the best options for you.

Hi! Do you know if you need basic medical coverage from your home country before purchasing any of these insurance plans presented above? My situation is a bit complex. I am a Canadian citizen currently living abroad (non-resident of Canada), therefore I have no basic Canadian health coverage. I am currently covered by the country I reside in (Qatar), however, once I leave, I will no longer have a residency permit and therefore no coverage here either. So when I leave, I won’t have coverage anywhere. I am planning on leaving to travel for a year, so I need long-term travel and medical coverage.

Hi Marisas, please take into account that these long-term travel insurance are travel insurance. That means that they don’t cover routine health checks or chronic diseases. They only cover you under unforeseen problems. For example, if you hire one of these long-term travel insurance and have a car accident during a trip and need surgery, the travel insurance will cover but it won’t cover cancer treatment, for example.

Hi can you recommend a travel insurance for a 7 month European trip for wife and self age 59 CA residents- many thanks

Please check the coverage for the insurance recommended in this article and choose the one that is best for you.

Hi Were planning to travel continuously for one year to Europe, Asia & med cruise. Is there a travel insurance that can cover this? Most insurances will require you to go back to your home country (US) after 60 to 90 days. Thanks

Hi Nate, I don’t believe you need to get back to the US with the Heymondo Long-Term Travel Insurance. Have you checked it out?

Hi Ascen We are a male 57years and female 58 years and we are travelling to south Africa to include Botswana Namibia Mozambique,Angola Zambia and Lesotho, we are shipping our car from Australia into south africa and will be travelling for two years we both hold Australian and UK passports Could you please recommend a medical insurance for this trip , we are not to bothered about trip cancellation baggage etc any help would be appreciated We have used world nomads previously but would consider others as well Thank you ag and rg

Hi Antony, that trip sounds amazing! If you’re doing a long-term trip like that one, I recommend Heymondo since they pay all medical expenses in advance. Just be aware of the 100$ deductible per claim.

Said that their price is very competitive and they have very high coverage.

Looking for long term insurance for cancel for any reason plus Covid coverage.

I recommend purchasing separately a long term travel insurance with Covid Coverage (I recommend this one ), and a cancel for any reason policy.

Interesting that this features Travelex and then notes: “Can get similar or better coverage for a more affordable price” From whom?

As you can see in the different comparison charts (coverage comparison chart and price comparison chart), Travelex is the one with the lower coverage, by far, and it’s only worth checking for 6-month insurance or more.

Let me know if you have any questions,

Hi! Do you know if you need basic medical coverage from your home country before purchasing any of these insurance plans presented above? My situation is a bit complex. I am a Canadian citizen currently living abroad (non-resident of Canada), therefore I have no basic Canadian health coverage. I am currently covered by the country I reside in (Qatar), however, once I leave, I will no longer have a residency permit and therefore no coverage here either. So when I leave, I won’t have coverage anywhere. I am planning on leaving to travel for a year, so I need long-term travel and medical coverage. Thanks!

Hi Melanie, no you don’t need it. You will need just long-term travel insurance and you will be covered wherever you go. Also in your home country as long that you’re traveling there and use the insurance just for emergencies (not regular checks, ongoing problems, chronic diseases, and things like that). In your situation, I think the long-term travel insurance of MONDO is your best bet.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

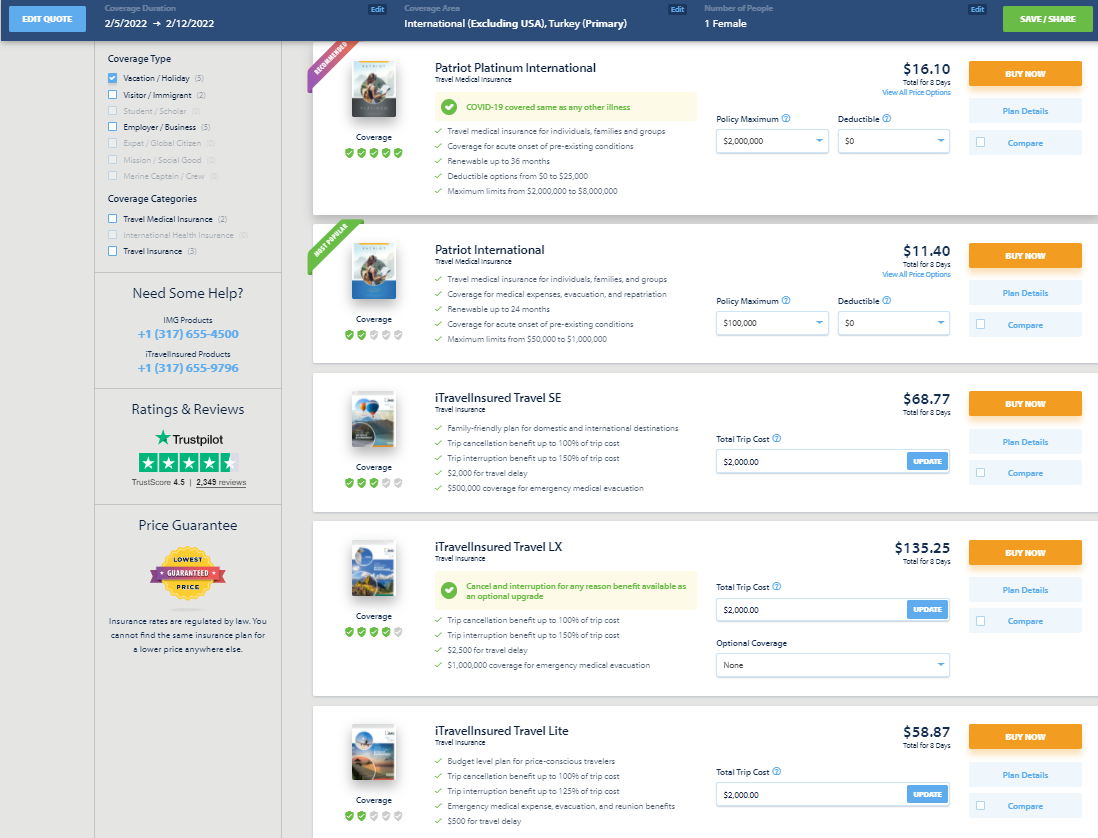

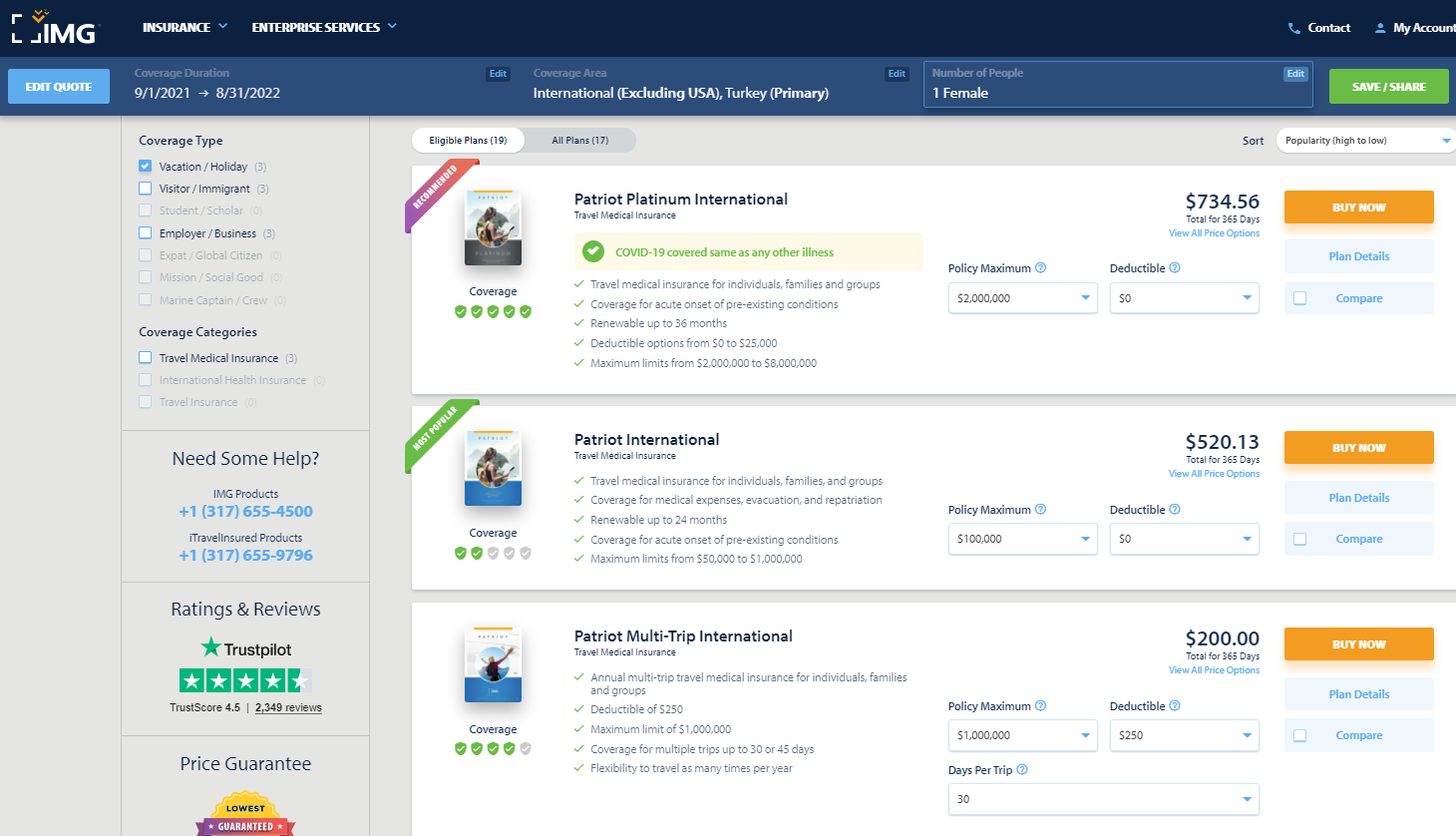

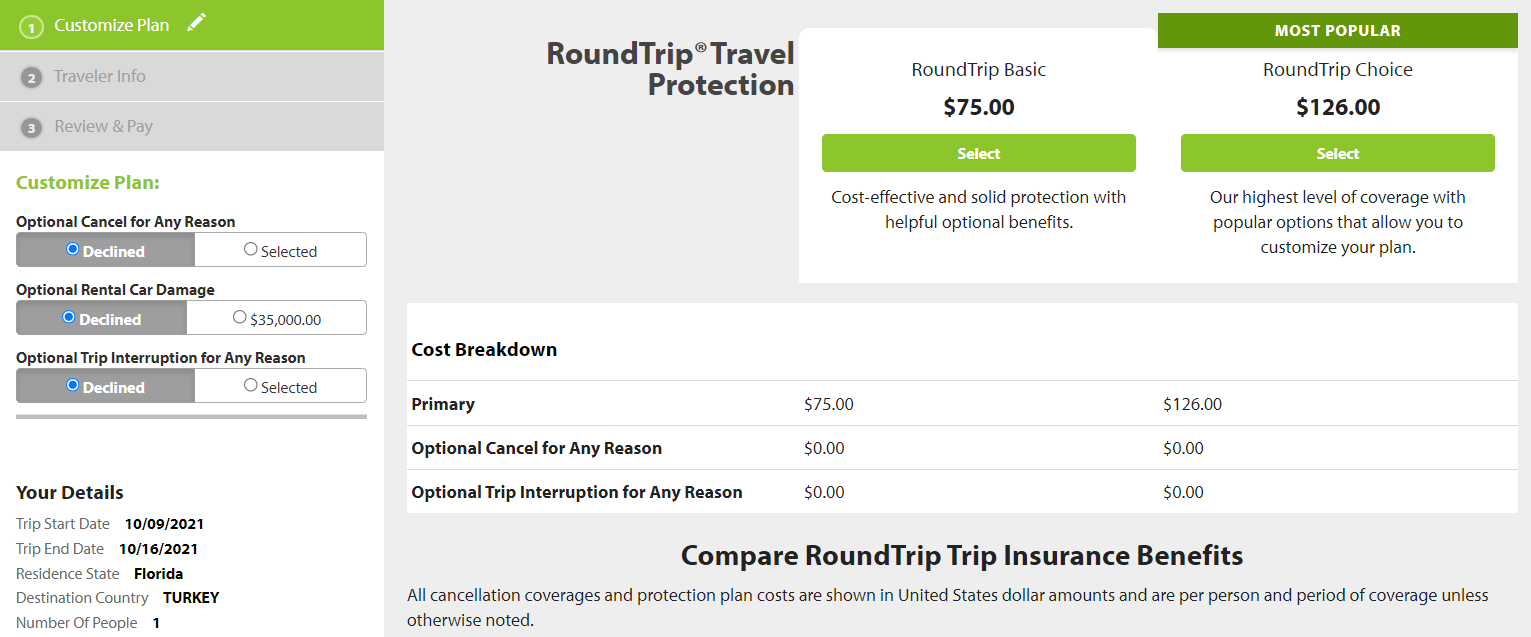

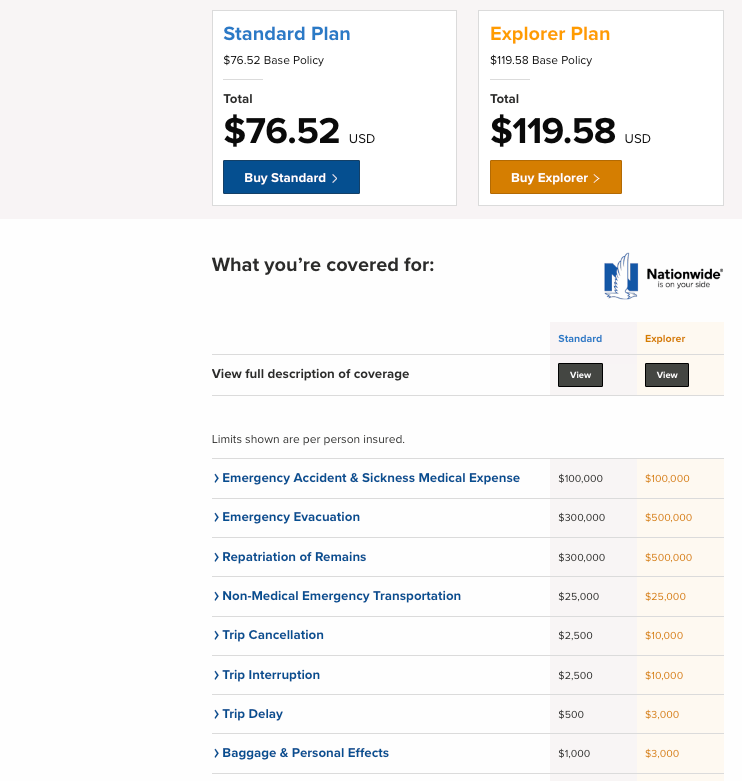

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

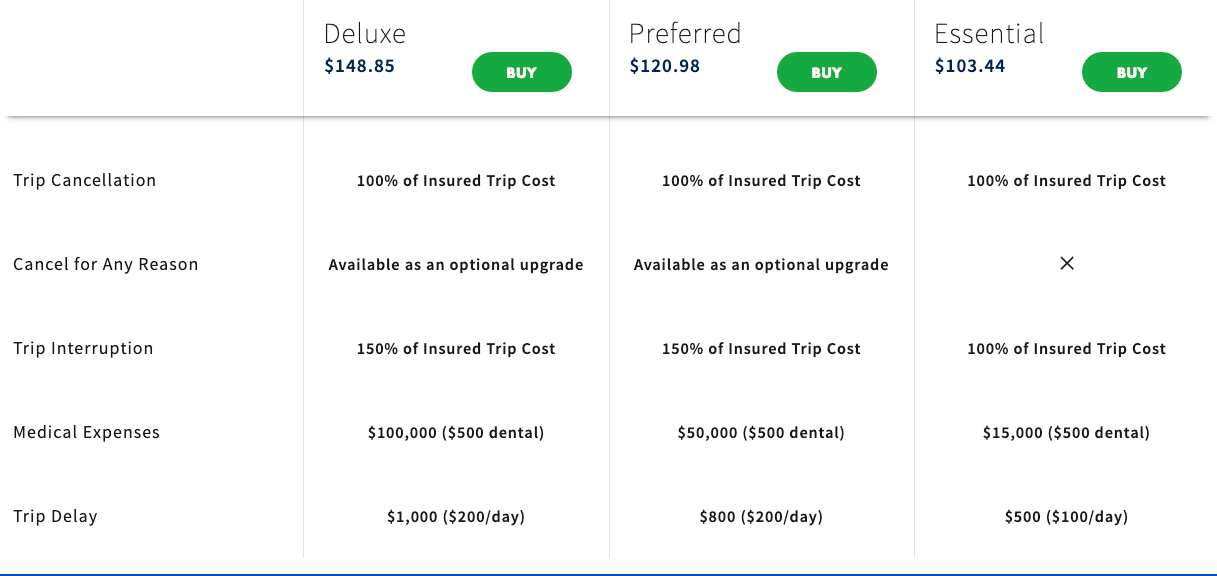

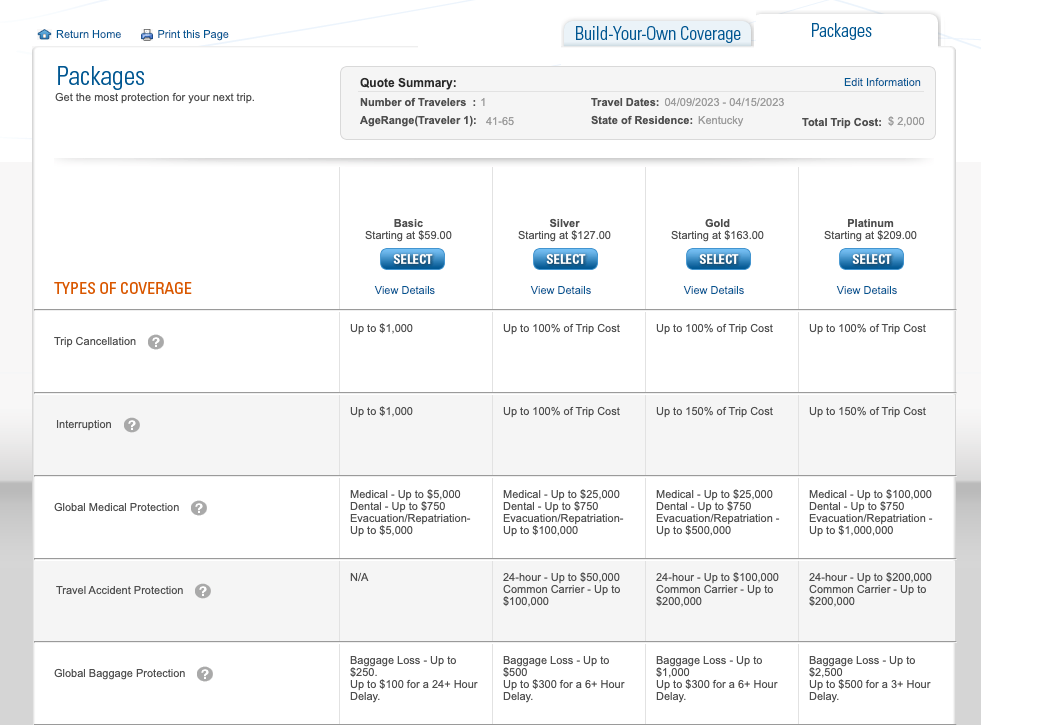

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

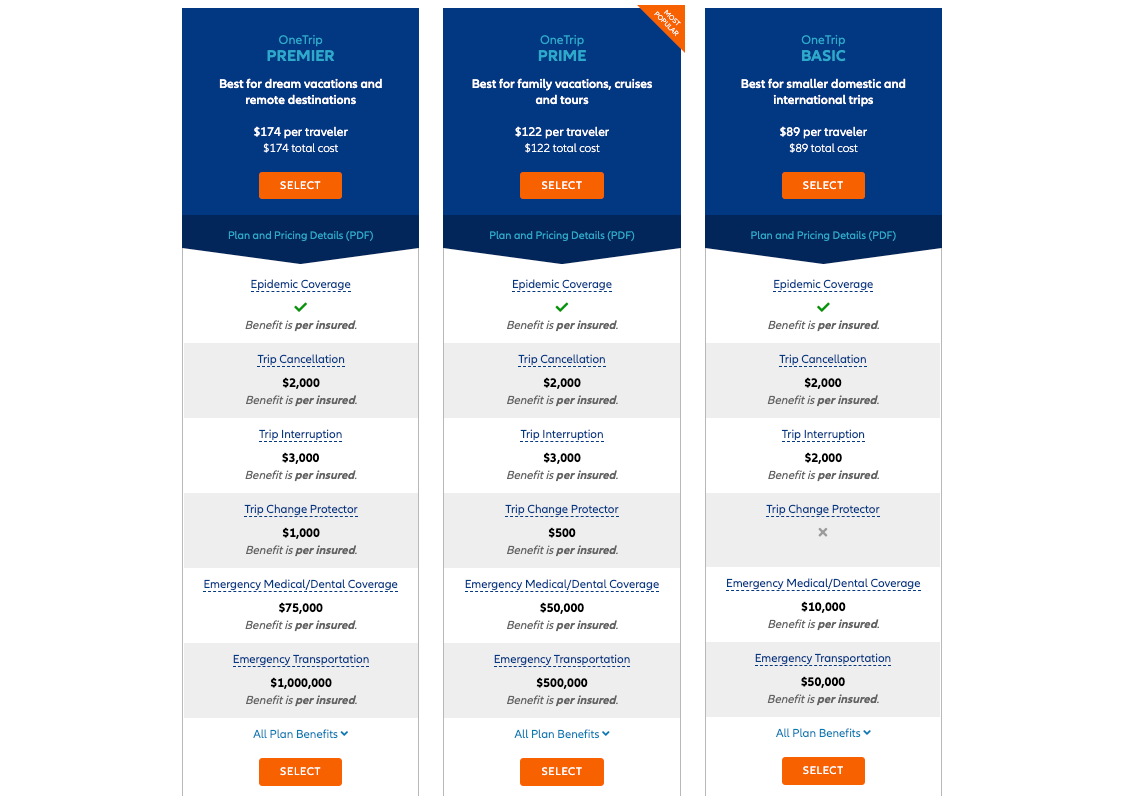

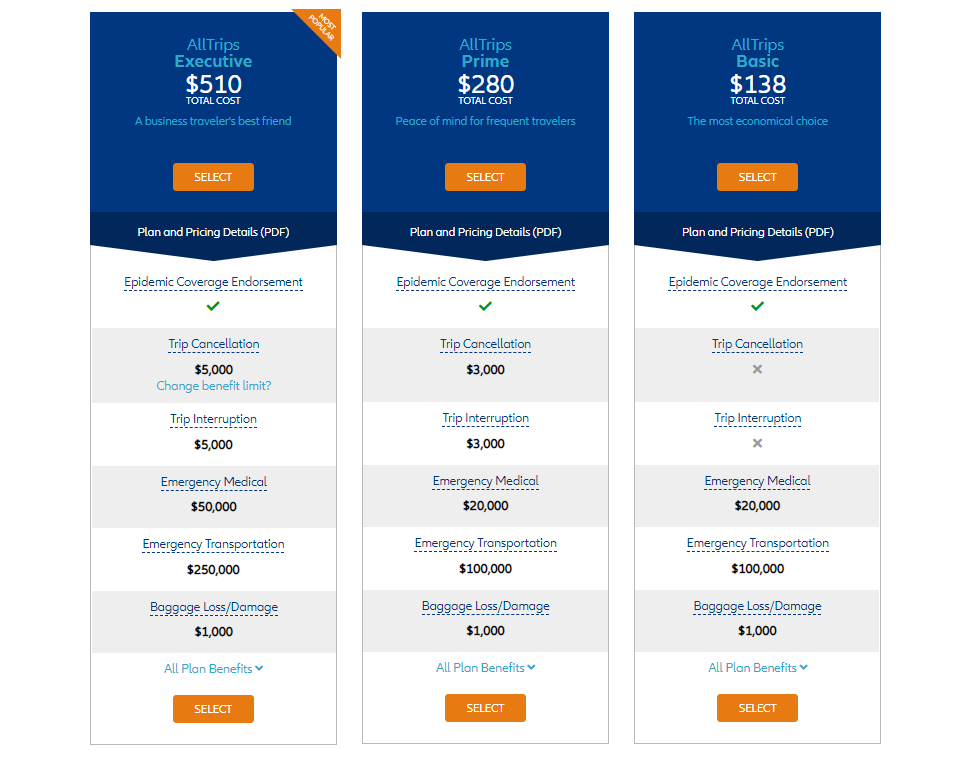

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

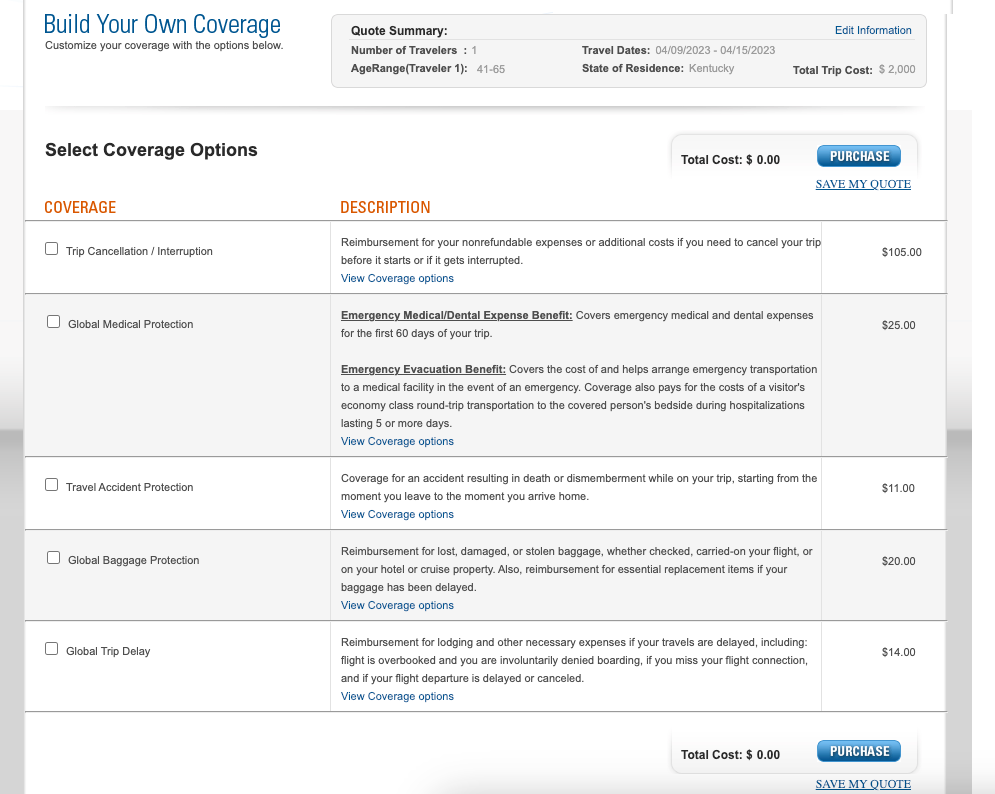

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

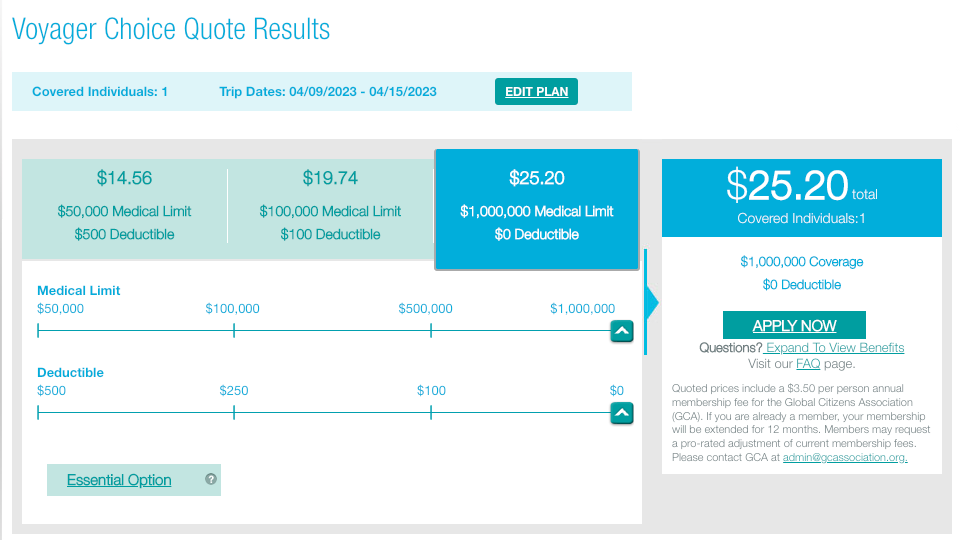

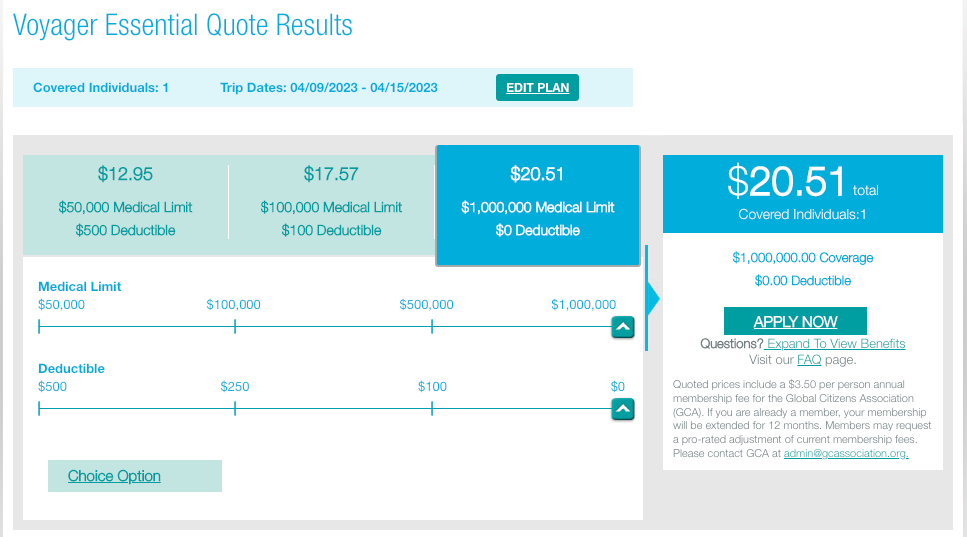

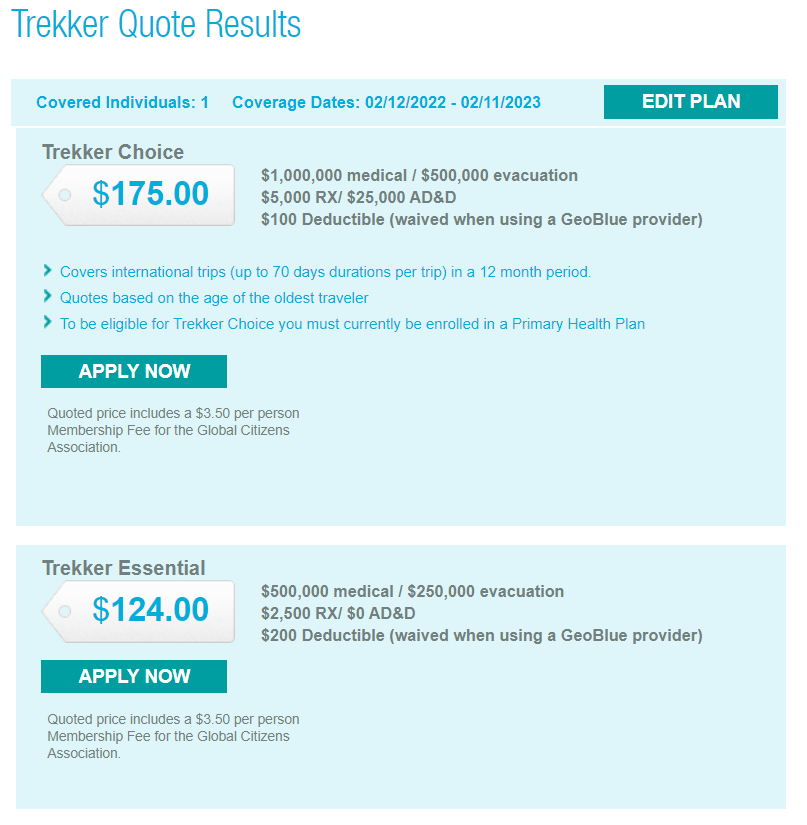

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

Agent Information

Seven corners travel medical annual multi-trip.

International travel insurance with Coronavirus coverage

The world has changed, and travel is different now, so you may be thinking to yourself: “What travel insurance do I need?”

If you travel abroad frequently, you need the convenience of an annual travel insurance plan, or long-term travel insurance, for multiple trips.

You also need high limits of medical protection, including coverage for COVID-19 expenses and other illnesses and injuries that occur when you travel. Seven Corners Travel Medical Annual Multi-Trip meets those needs.

Our annual COVID-19 coverage provides:

Pandemic travel insurance up to $1,000,000.*

Emergency medical evacuation benefit of $1,000,000.

*Coverage is limited for 65 years and older. See Schedule of Benefits below for details.

How does Seven Corners Travel Medical Annual Multi-Trip provide convenience and protection?

- Purchase coverage once a year and then travel as often as you like.

- Customize your coverage by selecting your trip length, choosing from 30-, 45-, and 60-day trip lengths. You’re covered for international trips for the trip length selected.

- You can also choose your deductible.

Is Emergency Medical Evacuation important?

This benefit helps if you become sick or hurt while traveling abroad. If the medical facility where you are located cannot provide the level of care required for your medical condition, our medical team will connect with your attending physician to determine if a medically necessary emergency medical evacuation is needed. If so, we will arrange and pay to transport you to the nearest facility that can provide the care you need.

Annual Coronavirus Travel Insurance Benefits

Plan options.

All benefits listed in this Schedule of Benefits are in United States Dollar amounts. All medical, dental, and vision benefits are subject to deductible and/or copay and coinsurance. Unless otherwise stated, all benefits are per person, per period of coverage, and they are provided up to the amount shown. The initial treatment of an injury or illness must occur within 30 days of the date of injury or onset of illness.

Coverage Length

Your period of coverage is 364 days.

Coverage Area

Worldwide including the United States

Worldwide excluding the United States

Covered Ages

14 days to 75 years

Benefit Period

You have 90 days to receive treatment from the date of an injury or illness. Initial treatment must occur within 30 days.

Medical Maximum Options

Ages 14 days to 64 years old: $1,000,000

65 to 75 years old: $100,000

Deductible Options (You pay)

$0; $250; $500

Coinsurance Inside the United States (The plan pays)

We pay 90% of the first $5,000, then 100% to the medical maximum.

Coinsurance Outside the United States (The plan pays)

We pay 100% to the medical maximum.

Hospital Room and Board, Inpatient Hospital Services, Outpatient Hospital / Clinical Services, Emergency Room Services, Physician Office Visits, Prescription Drugs, Home Health Care

URC* to medical maximum

$15 copay for Physician Office Visits

COVID-19 Treatment

URC up to medical maximum

This includes long-distance or remote (i) health-related services and information, (ii)treatment of injury or illness, or (iii) other live consultations, each of which involves an insured person and a physician or nurse practitioner at different locations using telecommunications technologies including internet, phone, video, audio, and computers.

If you are hospitalized while traveling outside of the United States, we will pay you for each night you spend in the hospital, up to 10 days. This benefit is in addition to other covered expenses, and you may use these incidental funds as you wish.

This covers expenses incurred in your home country (including those following an emergency medical evacuation or repatriation) for conditions first diagnosed and treated outside your home country, if you seek treatment within 90 days of the injury or illness. There is no coverage for pre-existing conditions.

The following expenses must always be pre-certified in the United States:

- Outpatient surgeries or procedures;

- Inpatient surgeries, procedures, or stays including those for rehabilitation;

- Diagnostic procedures including MRI, MRA, CT, and PET Scans;

- Physiotherapy;

- Home infusion therapy; or

- Home Health Care.

To comply with the pre-certification requirements, you must:

- Contact Seven Corners Assist before the expense is incurred;

- Comply with Seven Corners Assist’s instructions;

- Notify all medical providers of the pre-certification requirements and ask them to cooperate with Seven Corners Assist.

Once we pre-certify your expenses, we will review them to determine if they are covered by the plan.

If you do not comply with the pre-certification requirements:

- Covered expenses will be reduced by 25%; and

- The deductible will be subtracted from the remaining 75%; and

- Coinsurance will be applied.

Pre-certification does not guarantee coverage, payment, or reimbursement.

Contact information for Seven Corners Assist is provided on your ID card.

Many travel insurance plans do not cover pre-existing conditions. Travel Medical Annual Multi-Trip covers them through the acute onset of pre-existing conditions benefit. An Acute Onset of Pre-Existing Conditions is the occurrence of a pre-existing condition that meets these criteria:

- It is sudden, unexpected, and occurs without advanced warning;

- It is a medical emergency;

- It occurs during the period of coverage and after the 72-hour (3-day) waiting period;

- You obtained treatment within 24 hours of the occurrence;

- You did not have a change in prescription or treatment related to the underlying pre-existing condition within the last 30 days; and

- Your pre-existing condition is not congenital, a previously diagnosed chronic condition with expected episodes or flare-ups, or a deteriorating condition which cannot be controlled and gradually intensifies over time.

Coverage begins 72 hours after the effective date of coverage and ends when the first of these events occurs:

- The condition no longer being considered acute; or

- Your discharge from the hospital.

This plan can pay the stated amount for each night you are hospitalized in the United States for a heart attack or stroke.

If you are injured as a result of terrorist activity, we will reimburse you for medical expenses if the following conditions are met:

- You have no direct or indirect involvement.

- The terrorist activity is not in a country or location where the U.S. government issued a Level 3 Terrorism, Level 3 Civil Unrest, or any Level 4 Travel Advisory or the authorities of your host country or home country issued similar warnings, any of which were in effect within six months of your arrival.

- You departed the country or location following the date a warning to leave was issued by the U.S. government or appropriate authorities of your host country or home country.

The plan can pay for emergency treatment for the relief of pain to sound natural teeth.

The plan can pay for emergency treatment to repair or replace sound natural teeth damaged because of an accidental injury caused by external contact with a foreign object. You are not covered if you break a tooth while eating or biting into a foreign object.

The plan can pay for an emergency eye exam if required to obtain a prescription for replacement corrective lenses if your prescription lenses are lost or damaged to due a covered accident. There is no coverage for the cost of the lenses or for contact lenses.

If medically necessary, we will arrange and pay for transportation and related medical expenses during transportation to:

- Transport you to the nearest adequate medical facilities.

- Transport you to your home country for treatment or to recover after an emergency medical evacuation.

If your physician recommends it, we will pay and arrange for one person of your choice to travel to the hospital where you are located when an emergency medical evacuation is occurring or has occurred or when an emergency medical repatriation is to occur.

This benefit must be arranged by Seven Corners Assist. Failure to use Seven Corners Assist may result in the denial of benefits.

If you are in a hospital intensive care unit more than three days and do not require an Emergency Medical Evacuation or Repatriation, we will arrange and pay for round-trip economy airfare or ground transportation for one person from your home country to travel to and from your bedside.

If you are traveling alone with children and are hospitalized because of a covered illness or injury, we will arrange and pay for:

- One-way economy airfare to return the children to their home country; and

- Attendant/escort services to ensure the children’s safety.

These benefits must be arranged by Seven Corners Assist. Failure to use Seven Corners Assist may result in the denial of benefits.

We can pay reasonable expenses for embalming, a minimally-necessary container for transportation, shipping costs, and government authorizations to return your remains to your home country if you die while outside your home country. You cannot use this benefit if you use the Local Cremation or Burial benefit.

This benefit can pay reasonable expenses for the preparation and either your local burial or cremation if you die while outside your home country. You cannot use this benefit if you use the Return of Mortal Remains benefit.

If you need an emergency evacuation due to a natural disaster, we will arrange and pay for:

- Your natural disaster evacuation;

- Lodging for five days if you are delayed at the safe location; and

- Your return home by means of one-way economy class airfare. Seven Corners security personnel will determine the need for this evacuation in consultation with local governments and security analysts.

We can reimburse you for replacement accommodations for up to five days if you are displaced from planned, paid accommodations due to an evacuation from a forecasted natural disaster or following a natural disaster. You must provide proof of payment for the accommodations from which you were displaced.

We can arrange and pay for your political evacuation and/or return to your home country via one-way economy airfare if:

- A formal recommendation is made for you to leave your host country; or

- You are expelled or declared persona non-grata by the host country.

This benefit will not apply if you did not follow a Level 3 Terrorism, Level 3 Civil Unrest, or any Level 4 Travel Advisory from the U.S. Department of State or similar warnings from authorities of your host country or home country.

Seven Corners has a 24/7 multilingual team available to help with travel emergencies and general assistance including medical evacuations, escorts for unaccompanied children, medical record transfers and second opinions, and help locating medical care. They can also help provide interpreter referrals, help with passport recovery, hotel and flight re-bookings, and many other services.

This can pay benefits for death, loss of limbs, quadriplegia, paraplegia, hemiplegia, and uniplegia due to an accident occurring while on your trip. If benefits are payable under Common Carrier Accidental Death, this benefit will not be paid.

This can pay benefits for death due to an accident that occurred while riding as a passenger on a common carrier (any public air conveyance operating under a valid license to transport passengers for hire).

This benefit can reimburse you for lost bags and personal items owned by you and checked with a common carrier, if you took reasonable measures to protect, save, and recover the property.

This benefit can reimburse you for the expense of necessary personal items if your checked baggage is delayed or misdirected by a common carrier for at least 24 hours while you are on a covered trip. Coverage does not apply to your final destination or residence.

This benefit can reimburse you for the cost of economy travel to your home if you cannot continue your trip due to the death of a parent, spouse, sibling, child, grandparent, grandchild, or in-laws (parent, son, daughter, brother, and sister), or due to serious damage to your principal residence from fire or natural disaster. See the plan document for the definition of a natural disaster. These benefits must be arranged by Seven Corners Assist. Failure to use Seven Corners Assist may result in the denial of benefits.

This benefit can reimburse you for accommodations, meals, and local transportation if you are delayed by your common carrier more than 12 hours while outside your home country if the delay results in an unplanned overnight stay.

This benefit can reimburse you for fees for replacement of your passport, visas and other travel documents if they are lost, stolen, damaged or destroyed during your covered trip.

We can pay for eligible court-entered judgments or settlements approved by us that are related to the personal liability you incur for acts, omissions, and other occurrences for losses or damages caused by your negligent acts or omissions that result in:

- Injury to a third person;

- Damage or loss to a third person’s personal property;

- Damage or loss to a relative’s personal property.

We will pay for eligible court-entered judgments or settlements approved by Seven Corners that are related to the personal liability you incur for acts, omissions, and other occurrences for losses or damages caused by your negligent acts or omissions that result in:

- damage or loss to a relative's personal property.

We cover typical vacation activities. If you plan to participate in more adventurous activities when you travel, consider buying this optional coverage that includes: bungee jumping; caving; hang gliding; jet skiing; motorcycle, motor scooter or electric scooter riding whether as a passenger or a driver; Parachuting; paragliding; parasailing; scuba diving only to a depth of 30 meters with a breathing apparatus provided that You are SSI, PADI or NAUI certified; sea kayaking; snowmobiling; spelunking; surfing waves up to two feet high; wakeboard riding; water skiing; windsurfing; or zip lining. You must purchase this optional coverage if you wish to be covered while riding a motorcycle, motor scooter, electric scooter, or similar transportation when such transportation is an established and accepted routine means of public transportation for hire in the specific geographic area where you are located in the host country.

Frequently asked questions

How this plan works, what documents do i receive after buying travel insurance from seven corners.

The plan document is the legal document that explains how your coverage works and describes all benefits and exclusions for the plan. We recommend you read it, so you understand how your plan works. Refer to the plan document for applicable exclusions.

Once you complete your purchase, you will immediately receive a receipt, a summary of your benefits, an ID card, and a copy of the plan document.

Who can buy a Seven Corners Travel Medical Annual Multi-Trip plan?

To be covered, you must be at least 14 days old and younger than 76 years. You may buy coverage for yourself, your legal spouse, domestic partner, or civil partner, and unmarried dependent children under the age of 19.

Everyone listed on the plan must maintain continuous medical insurance* that provides coverage in their home country.**

United States citizens, including those with dual citizenship, and Green Card/Permanent Resident cardholders cannot buy this plan for travel to the United States and U.S. territories.

Country Restrictions — We cannot sell to persons who are a resident of Cuba, Democratic People's Republic of Korea (North Korea), Gambia, Ghana, Islamic Republic of Iran, Nigeria, Russian Federation, Sierra Leone, Syrian Arab Republic, Ukraine, and United States Virgin Islands.

Other country restrictions may apply. Our online quick quote tool will help you find eligible plans. You can also contact an agent for the latest information and to find the best plan for you.

*Continuous medical insurance refers to a primary health plan. It is a group health benefit plan, an individual health benefit plan, or a governmental health plan designed to be the first payor of claims in effect before this plan begins and continuing as long as this plan does. Such plans must have coverage limits in excess of $50,000 per incident or per year.

**For all travelers, your home country is where you have your primary residence. For United States citizens, including those with dual citizenship, your home country is also the United States regardless of where you have your primary residence.

How many trips can I take?

You can take as many covered trips as you want. You are covered when traveling outside of your home country on a covered trip for the trip length option you selected.

Trip length options include: 30-day trips, 45-day trips, 60-day trips.

What is a covered trip?

A covered trip is a period of travel outside your home country with defined departure and return dates. It begins when you depart your home country and ends when you return to your home country or the moment you remain outside your home country beyond the covered trip length option you purchased.

Where can I travel?

You are covered when traveling outside of your home country*, which is the country where you have your permanent residence.

We cannot cover trips to Antarctica, Cuba, Democratic People's Republic of Korea (North Korea), Islamic Republic of Iran, Israel, Russian Federation, Ukraine, and Syrian Arab Republic.

*For all travelers, your home country is where you have your primary residence. For United States citizens, including those with dual citizenship, your home country is also the United States regardless of where you have your primary residence.

How long can I be covered by this plan?

Your period of coverage is 364 days. At the end of 364 days, you may buy a new plan to cover you for your next year of travel.

We will email you a reminder to let you know your coverage is coming to an end, so you can buy a new plan.

When does my coverage start?

Your coverage begins on your effective date , which is the later of the following times:

- 12 a.m. the day after we receive your application and correct payment if you apply online; or

- 12 a.m. on the date you request on your application.

The coverage for each covered trip begins when you depart from your home country.

All times above refer to United States Eastern Time.

When does my coverage end?

Your coverage ends on your expiration date , which is the earliest of the following times:

- 11:59 p.m. on the date you reach the maximum period of coverage;

- 11:59 p.m. on the date shown on your ID card;

- 11:59 p.m. on the date that is the end of the period for which you paid; or

- The moment you are no longer eligible for coverage.

Coverage for each covered trip ends the earliest of:

- The certificate end date;

- 11:59 p.m. on the last day of any covered trip;

- The moment you arrive in your home country except as provided by Extension of Benefits in the Home Country; or

Does this plan provide primary coverage or secondary coverage?

It provides secondary coverage. All coverages except Common Carrier Accidental Death & Dismemberment are in excess of all other insurance or similar benefit programs and shall apply only when such benefits thereunder are exhausted. This Plan is secondary coverage to any other insurance. Such other insurance or similar benefit programs may include, but are not limited to, membership benefit; workers’ compensation benefits or programs; government programs; group or blanket coverage; prepayment coverage; union, labor, or employee plans; socialized insurance program or program otherwise required by law or statute; automobile insurance; or third-party liability insurance.

Will Seven Corners give me a refund for this plan if I’m not satisfied?

We will refund your payment if we receive your written request for a refund before your effective date of coverage. We cannot provide a refund after your coverage has begun.

Where can I find what is not covered by this plan?

You can find situations and items not covered by this plan in the exclusions section of the plan document.

Who provides the coverage for this plan?

UNDERWRITER

Insurance benefits are underwritten by Certain Underwriters at Lloyd’s, London 1 an established organization with an AM Best rating of A (Excellent). Your coverage will be there when you need it.

ABOUT SEVEN CORNERS

Seven Corners has been helping travelers for 30 years with travel insurance options and travel assistance services. We’ll take care of your plan needs from start to finish — we don't outsource any of our services! Seven Corners will guide you through your purchase, provide coverage information, answer your questions, and process your claims.

1 In specific scenarios, coverage is provided by Tramont Insurance Company Limited. For details regarding Tramont, visit tramontinsurance.com .

Medical Benefits and Coverage

How do i find a medical provider when i'm traveling.

Find medical providers using our online tools or contact Seven Corners Assist .

Inside the United States — We offer an extensive network of providers with special network pricing and potential savings for you.

Through Seven Corners’ relationship with UnitedHealthcare, you have access to one of the largest networks in the United States.

- 1.4M physicians

- 6,500 hospitals

- 45,000 clinics

- 67,000 pharmacies

- 1,800 convenience clinics

Outside of the United States - Seven Corners has a large international directory of providers, and many of them will bill Seven Corners direct for treatment they provide. We recommend you contact us for a referral, but you may seek treatment at any facility.

Utilizing the network does not guarantee benefits or that the treating facility will bill Seven Corners direct. We do not guarantee payment to a facility or individual until we determine the expense is covered by the plan.