- Global Citizen

- Money Works

- Global Issues

- Getting Around

- WU Partners

- Regional News

- Europe & CIS

- Middle East & Africa

- Asia & Pacific

Everything you need to know about travelers checks

Are you planning to splurge on experiences, gifts, and food while you are abroad on your next international vacation? Leave your cash at home and bring a traveler’s check instead. While debit and credit cards have made traveler’s checks largely obsolete, it may be a viable option for your next trip. Learn about traveler’s checks, how to use them, and whether you should bring them on your next vacation.

What is a traveler’s check?

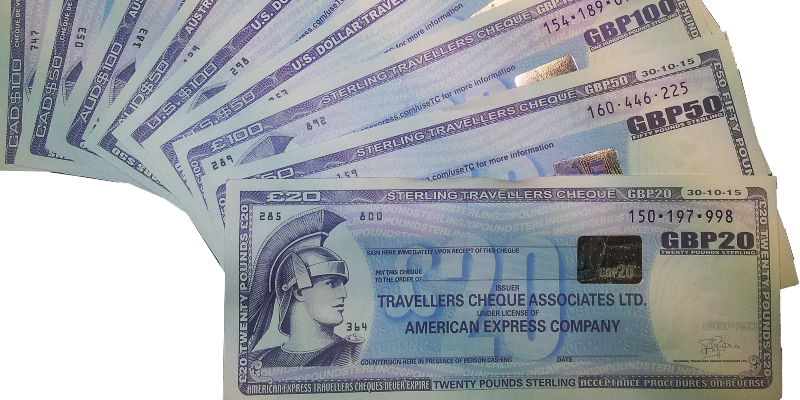

A traveler’s check contains a fixed amount of money and operates like cash. Bring a traveler’s check to a merchant to buy goods or services while traveling abroad. You can get traveler’s checks from financial institutions like banks and credit unions.

Traveler’s checks can come in a variety of currencies, so you can designate the appropriate currency for the country you’re planning to travel to. Traveler’s checks are great protective measures against both fluctuating exchange rates and personal theft. They come in fixed denominations that aren’t as volatile as normal exchange rates and they don’t expire. To protect you against theft, you must sign them when you purchase and cash them, so criminals will have a harder time duplicating your signature when attempting to use your traveler’s checks.

Alternatively, you can also convert your traveler’s checks into cash, which can then be deposited into your bank. Hotels may also cash traveler’s check with no charge. If you end up not using the full amount on your traveler’s check, you can conveniently return the funds to your bank account.

Download the Western Union app

If you need a convenient way to transfer money abroad, do it from your fingertips with the Western Union app. It allows for fast and secure transfers from USD to the currency of your choice.

Download the app now

Should you use a traveler’s check?

Traveler’s checks were primarily used before the popularization of credit cards and prepaid debit cards. Even so, traveler’s checks are still a worthwhile option for your next trip.

Benefits of traveler’s checks

Some benefits of traveler’s checks are:

- Replaceability: If a traveler’s check is lost or stolen, you can replace it. Each traveler’s check comes with a unique serial number. Call the check issuer to report it lost or stolen. They will likely require you to provide evidence of your purchased check through its serial number and your proof of identity.

- Convenience : Traveler’s checks operate like cash and are easy to use for purchases. You just need to load the amount you need, and you can use them around the world.

- No expiration : You don’t have to worry about traveler’s checks expiring. You can buy them when you want to and use them whenever you need them.

Cons of traveler’s checks

Some cons of using traveler’s checks are:

- Outdated: With the popularization of prepaid debit cards and credit cards, traveler’s checks are outdated. You can use credit cards and prepaid debit cards similarly to traveler’s checks.

- Fees: When you buy a traveler’s check, there is an additional fee. You can avoid this by using a debit or credit card instead.

- Limited issuers: Traveler’s checks aren’t available at all financial institutions. Unless your bank offers them nationwide, it can be hard to find them.

Send money with Western Union

If your friend or family member is traveling internationally, you can send them money with Western Union. Help them avoid fees from traveler’s checks by visiting our website or downloading the Western Union app . If you prefer to send money in person, you can visit one of our agent locations .

Send money today

Similar Blogs

What is the currency in china currency and payment, how to track a wire transfer, how are currency exchange rates determined, what causes exchange rates to change.

- Customer Care

- Intellectual Property

- Terms & Conditions

Cookie Settings

How to Cash Old Travelers Checks

Leftover traveler's checks will never depreciate in value nor expire , so there's no reason to hold onto them until your next trip. Cashing your unused checks gives you access to the money right away.

Convert to Cash

Use the traveler's checks to make a purchase at any store where they are accepted and you will receive your change in cash . Most retail establishments accept traveler's checks. Alternatively, most banks will cash traveler's checks, however, you may be required to pay a service charge. Fees may vary per bank.

Advertisement

Video of the Day

Deposit Without Fees

Avoid service fees by depositing the traveler's checks into your checking or savings account. Make the check payable to yourself and countersign the check in the presence of a teller. Most banks will post the deposit to your account by midnight of the same day; posting date will vary per financial institution.

Report an Issue

Screenshot loading...

Travellers Cheques FAQ

Travellers cheques frequently asked questions, passport and credit/debit card replacement assistance, quick links, about travelex, useful information, customer support, travelex foreign coin services limited.

Can You Cash American Express Travelers Checks

Sharing is caring!

As a frequent traveler, I always make sure to have enough cash and cards for my trips. However, there are times when these options may not be available or convenient. That’s where travelers checks come in handy.

In this article, we’ll discuss American Express travelers checks and answer the question: can you cash them?

First and foremost, it’s important to understand what travelers checks are. They’re essentially prepaid checks that you can use as a form of payment while traveling. Unlike cash or credit cards, they offer added security as they can be replaced if lost or stolen.

American Express is one of the most popular issuers of travelers checks, but not all places accept them for payment. So let’s dive into the details of how to cash American Express travelers checks and what fees and exchange rates to consider before doing so.

Table of Contents

Understand the Basics of Travelers Checks

Learning the fundamentals of using travelers checks involves grasping their basic concepts and functions. Travelers checks are pre-printed, fixed-amount checks that can be used to make purchases or get cash while traveling abroad. They were designed to provide a safe and convenient alternative to carrying large amounts of cash.

Travelers checks are available in various denominations and currencies, making them an ideal option for people who need to travel internationally. To use travelers checks, you simply sign each check in front of the person accepting it as payment or when cashing it at a bank or currency exchange office. Once signed, the check becomes valid and can be redeemed for its face value.

Travelers checks provide peace of mind because they can be replaced if lost or stolen. American Express is one company that offers travelers checks which can be exchanged for local currency at banks, hotels and other locations around the world. Knowing where to cash American Express travelers checks is essential when planning your trip abroad.

There are many places where you can cash these checks such as banks, currency exchange offices, hotels and airports. However, some locations may charge fees or have restrictions on how many travelers checks they will accept per transaction. It’s important to research ahead of time so you know where to go without any problems during your travels.

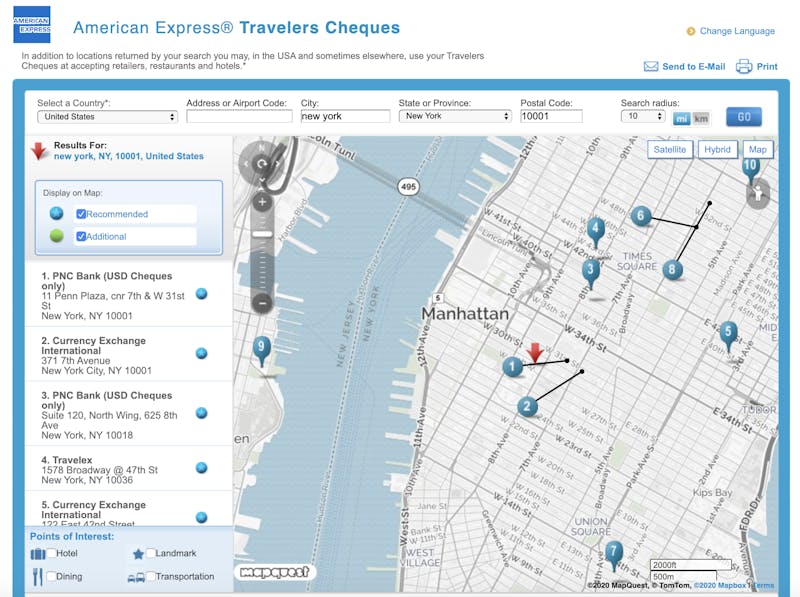

Know Where to Cash American Express Travelers Checks

This section’s all about where to convert those little slips of paper into cold, hard cash and boy oh boy, you’re in for a treat! American Express Travelers Checks can be cashed at many locations around the world.

The first place to check is with your hotel or resort. Most hotels will allow their guests to exchange travelers checks for cash, but be sure to ask if they charge any fees.

Additionally, banks are also a great option for exchanging travelers checks. Many banks won’t charge fees if you have an account with them.

If you’re traveling internationally, it’s important to note that some countries may not accept American Express Travelers Checks as readily as others. In this case, it might be a good idea to research ahead of time which places will accept them.

Another thing to consider is the exchange rate and any associated fees when converting your travelers checks into local currency. We’ll dive deeper into these considerations in the next section about ‘consider the fees and exchange rates’.

Consider the Fees and Exchange Rates

When it comes to cashing American Express travelers checks, it’s important to consider the fees and exchange rates involved. Service fees and commissions can vary depending on where you go, as can conversion fees for exchanging the checks into local currency.

It’s also worth comparing these costs with other payment methods to ensure you’re getting the best deal possible.

Service Fees and Commissions

Don’t miss out on important information about service fees and commissions when using Amex traveler’s checks. While American Express travelers checks are widely accepted around the world, it’s important to note that there may be service fees and commissions associated with cashing them. These fees can vary depending on where you are traveling and which bank or exchange office you use.

It’s always a good idea to research the fees and commissions beforehand so that you know what to expect. Some banks or exchange offices may charge a flat fee, while others may charge a percentage of the total amount being exchanged. By knowing these details in advance, you can better plan your budget for your travels.

Keep in mind that some places may also have minimum or maximum cashing limits, so it’s best to check with the specific institution before attempting to cash your travelers checks. With this knowledge in hand, you’ll be able to make informed decisions about how and where to cash your Amex travelers checks without any surprises along the way.

As we move into discussing exchange rates and conversion fees, it’s important to keep in mind how service fees and commissions may impact those costs as well.

Exchange Rates and Conversion Fees

As we delve into the topic of exchange rates and conversion fees, it’s worth considering how these factors can affect your overall expenses while using Amex’s popular alternative to cash. When you cash an American Express traveler’s check, you’ll receive the local currency at a rate that may differ from the current exchange rate. This difference is known as the exchange rate margin, which is essentially a fee charged by Amex for converting your funds.

In addition to the exchange rate margin, there may also be other conversion fees associated with cashing your traveler’s checks. For example, some banks or money changers may charge an additional commission fee for processing the transaction. It’s important to research and compare these fees before deciding where to cash your traveler’s checks in order to minimize any unnecessary expenses.

With this in mind, let’s take a closer look at how Amex traveler’s checks stack up against other payment methods.

Comparison with Other Payment Methods

If you’re looking for a payment method that won’t break the bank, it’s worth comparing Amex traveler’s checks to other options available.

While traveler’s checks are still accepted in many places around the world, they may not be as convenient or cost-effective as other payment methods.

For example, using a credit card with no foreign transaction fees can often be a better option for making purchases abroad, especially if you plan on traveling frequently or for an extended period of time.

Another alternative to traveler’s checks is using cash withdrawal from ATMs. While there may be fees associated with ATM withdrawals, they are often lower than the conversion and transaction fees charged by banks for traveler’s check transactions.

Plus, withdrawing cash at an ATM allows you to get local currency at a competitive exchange rate without having to worry about carrying large amounts of cash around with you.

Ultimately, your choice of payment method will depend on your individual needs and preferences when traveling abroad. However, it’s important to follow the proper procedure when using any form of payment overseas to ensure security and avoid unnecessary expenses.

Follow the Proper Procedure

So, now that I’ve considered the fees and exchange rates, it’s time to talk about following the proper procedure for cashing my American Express Travelers Checks.

The first step is to sign each check as soon as they’re received and keep them in a safe place until ready to use.

Then, when presenting the checks to a cashier or teller, be sure to bring identification and any additional information requested by the establishment.

It’s important to follow these procedures carefully in order to ensure a smooth and secure transaction.

Sign the Checks and Keep Them Safe

Don’t forget to sign and secure your precious travel funds. When you receive your American Express traveler’s checks, it is vital that you immediately sign them on the designated line. Your signature acts as a verification of ownership and authorizes you to use them.

Remember that these checks are like cash, so if they fall into the wrong hands unsigned, anyone can use them without any authorization. Therefore, always keep them in a secure location such as a hotel safe or a locked luggage compartment.

In addition to signing and securing your traveler’s checks, it’s essential to keep track of each check’s serial number. This information may help you in case of loss or theft since it identifies every single check uniquely.

Also, when presenting them for payment at an exchange office or bank, make sure not to detach any part of the check until after the transaction is complete. Doing so invalidates it and makes it unusable for future transactions.

Now that your traveler’s checks are signed and secured, let’s move on to how you can present them to the cashier or teller at the foreign exchange office or bank.

Present Them to the Cashier or Teller

Now that you’ve signed your American Express travelers checks and stored them safely, it’s time to present them for cashing. It’s important to note that not all merchants or financial institutions accept traveler’s checks anymore, so it’s best to check beforehand if they are accepted.

When you’re ready to cash the traveler’s checks, head over to a bank or other financial institution that accepts them. Present the signed checks to the cashier or teller and provide any additional information they require such as your ID and where you obtained the checks from. Once everything is verified, the teller will give you cash for the amount of the traveler’s check.

It is crucial to remember that presenting proper identification is necessary when cashing in traveler’s checks. In addition, some places may require additional information such as proof of purchase or an explanation for why you are cashing a large number of checks at once. By providing this information upfront, you can save yourself time and potential headaches during the cashing process.

Show Your ID and Provide Additional Information

When presenting your identification and providing additional information at the bank or financial institution, it’s important to have all necessary documents ready to avoid any delays or frustrations.

The teller will typically ask for a government-issued ID, such as a driver’s license or passport, to verify your identity. In addition, they may ask for additional information such as your home address and phone number.

It’s also important to note that the process of cashing travelers checks may take longer than a typical transaction due to the added security measures in place. Therefore, it’s best to plan ahead and be prepared with all necessary documents and information beforehand.

This can help expedite the process and prevent any unnecessary delays or frustrations.

Plan Ahead and Be Prepared

When preparing for a trip, it’s important to plan ahead and be prepared when it comes to using travelers checks.

First, I order my travelers checks in advance to ensure I have them before leaving.

Next, I check the acceptance and availability of the checks at my destination to avoid any issues with using them.

Finally, I always carry some cash and other payment methods just in case the travelers checks are not accepted or if there are any unexpected situations that arise during my travels.

Order Travelers Checks in Advance

Plan ahead and order your currency in the form of travelers checks before your trip. This ensures that you have enough time to receive them and check them for accuracy.

You also have the option to choose the denominations that fit your needs, making it easier to stay within your budget while traveling. Ordering travelers checks in advance also gives you peace of mind knowing that you have a safe and secure way to carry money during your travels.

Instead of worrying about losing cash or having your credit card information stolen, travelers checks provide a more reliable alternative. However, it’s important to check the acceptance and availability of travelers checks at your destination before relying solely on them as a source of payment.

Check the Acceptance and Availability

Make sure to check if the places you plan to visit accept and have availability for using travelers checks as payment, giving you peace of mind during your travels.

Not all businesses or establishments accept American Express travelers checks, so it’s crucial to do some research beforehand. You can contact your hotel or travel agency for information on where these checks are accepted, or you can browse through the American Express website for a list of participating merchants.

In addition to checking acceptance and availability, it’s also wise to carry some cash and other payment methods. While travelers checks are convenient and safer than cash, they may not be accepted everywhere or may take longer to process.

Carrying some local currency in small denominations is useful for buying small items like snacks or souvenirs. It’s also helpful to have a credit card readily available in case of emergencies or unexpected expenses that may arise during your trip.

Carry Some Cash and Other Payment Methods

It’s wise to also have alternative payment methods, such as local currency and credit cards, as not all establishments accept travelers checks. While American Express Travelers Checks are widely accepted around the world, some merchants may not be familiar with them or may simply prefer other forms of payment. In addition, there is always a risk of losing or misplacing your travelers checks while on the go.

Carrying some cash in the local currency is always a good idea, especially for small transactions or in areas where credit card usage is limited. It’s important to check exchange rates before you travel and to withdraw cash from ATMs at reputable locations to avoid any potential scams.

Credit cards are also convenient and widely accepted but make sure to notify your bank of your travel plans beforehand to avoid any issues with fraud alerts or blocked transactions.

By having multiple payment options available, you can enjoy your travels without worrying about how to pay for your expenses.

In conclusion, cashing American Express travelers checks can be a bit of a hassle but it’s definitely doable. Understanding the basics of travelers checks and knowing where to go to cash them are key factors in making the process smoother. However, one must also consider the fees and exchange rates that come with cashing these checks.

Following the proper procedure is also crucial in ensuring a successful transaction. It’s important to plan ahead and bring all necessary identification and paperwork. While it may seem like a lot of effort, it’s always better to be prepared than stranded without any means of payment while traveling.

So if you’re planning on using American Express travelers checks for your next trip, make sure to do your research and follow these tips for a seamless experience. Don’t let unexpected fees or lack of preparation ruin your vacation – take charge and enjoy yourself worry-free!

Meet Audrey and Carl Thompson. This dynamic married couple not only shares a passion for each other but also a deep love for exploring the world. Through their captivating writing, Audrey and Carl offer a unique perspective on traveling as a couple. They delve into their personal experiences, shedding light on the challenges and joys of navigating the globe hand in hand. Their insightful articles address the questions and concerns many travelers face, helping you forge a stronger bond with your partner on your own incredible adventures.

Related Posts

What Kind Of Travelers Checks Don’t Work In France

Can You Cash Travelers Checks At A Bank

We'll Be Right Back!

American Express Travelers Cheques Review: Is it safe? How does it work? What are the rates?

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Traveling or spending money overseas? Discover American Express Travelers Cheques for a safe and secure way to get currency to spend abroad. You'll learn how to save money and how to get the best rate for your next holidays abroad.

American Express Travelers Cheques - All you need to know

American Express (AMEX) Travelers Cheques were first issued more than a hundred years ago, in 1891. Although the traditional travelers cheque has been overtaken by more modern currency exchange options, they’re still used by some as a safe and secure way to spend money overseas. We’ll explore how American Express Travelers Cheques work, what they offer, the fees you’ll need to pay and various other aspects of their services.

*We’re using the same spelling for travelers cheques as AMEX uses on their website, which means no apostrophe and “cheque” instead of “check” — just so you know.

Where to buy AMEX Travelers Cheques

Travelers cheques are available from AMEX service centers, some AAA locations, certain banks and some currency exchange shops. Options to buy travelers cheques outside of major cities like New York, London, Toronto or other big metropolitan areas are limited. Places you may be able to purchase travelers cheques in the US include PNC bank branches and Travelex.

You should contact the location before you visit to check fees, limits, payment methods, restrictions, exchange rates and availability. AMEX recommends you keep your original purchase receipt as proof of purchase.

Where to redeem AMEX Travelers Checks

You can redeem, or “cash” your travelers cheques at thousands of locations around the world. Several currency exchange services, bureaux de change and banks will accept and redeem travelers cheques. Some merchants may even accept travelers cheques directly as payment for goods and services. If you want to make payment, redeem or cash in your travelers cheques, confirm this with the relevant business ahead of time.

When you redeem your travelers cheques, the person you are redeeming them with will need to watch you countersign the cheques, and you may need to present photographic ID and have your original purchase receipt.

In some circumstances, AMEX will allow you to redeem travelers cheques directly with them. They say, “Redemption of your Travelers Cheques directly with American Express may take longer than 30 days, depending on the circumstances of the request. There may be restrictions on the currency and method of redemption and the value of Travelers Cheques that can be directly redeemed.”

Travelers cheques do not expire, so you can either choose to redeem unused ones, or save them for future trips.

Safety and security of AMEX Travelers Cheques

If you’ve purchased travelers cheques, and they’re lost or stolen, AMEX will refund the cheques to you. Travelers cheques are not linked to your bank account either, which means you’re less likely to suffer from identity theft if the cheques are stolen from you.

What Monito Likes About AMEX Travelers Cheques

- A safe and secure way to get currency to spend abroad

- Backed by American Express, a trusted brand and financial services provider

- Refunds available if travelers cheques are lost or stolen

What Monito Dislikes About AMEX Travelers Cheques

- Can be difficult to find locations to buy travelers cheques

- Can be difficult to find locations to redeem or cash in travelers cheques

- Not as widely accepted as they once were

- High commission fees and poor exchange rates can make travelers cheques expensive to use

Alternatives to American Express Travelers Cheques

- Trust & Credibility 10

- Service & Quality 8.7

- Fees & Exchange Rates 10

- Customer Satisfaction 9.4

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

How American Express Travelers Cheques works

1. Buy your travelers cheques from certain banks, currency exchange services and various other locations

2. Travelers cheques are available in a variety of denominations, depending on the currency

3. When you buy the travelers cheques, you will normally need to present your ID and sign the travelers cheques in the top left-hand corner

4. Write down the serial numbers of your travelers cheques as you may need these if they are lost or stolen

5. Once you have purchased your travelers cheques, you can travel to a foreign country and redeem them when you need to

6. Take your travelers cheques to a location that will cash them, sign in the bottom left-hand corner and present your identification

7. The place where you are exchanging your travelers cheques will provide local currency at their prevailing exchange rate

8. You can then spend the local currency as normal

AMEX Travelers Cheques fees & exchange rate

The fees and exchange rates for using travelers cheques can vary widely.

American Express Travelers Cheques fees

AMEX, banks and other issuers may charge a fee when issuing travelers cheques in the first place. This fee is typically between one and three percent of the total value of travelers cheques that you’re buying. AMEX will waive this fee if you’re an American Express cardholder.

Some currency exchange services, banks and other merchants may also charge a commission when you buy or redeem your cheques. You should contact them ahead of time to check what those fees are likely to be.

American Express Travelers Cheques exchange rates

The amount of foreign currency that you receive when redeeming travelers cheques depends on the exchange rates offered by the currency exchange service you’re using. Local bureaux de change and currency exchange services typically have fairly poor exchange rates, so you’ll end up paying more in hidden exchange rate fees.

For example, as we explain in our guide to exchanging currency in London , “this bureau de change is around 2.8 percent more expensive than the base exchange rate for exchanging between dollars and pounds. The base exchange rate was £0.81 for every dollar, but this currency exchange offers £0.79 for each dollar.”

Customer support

If your amex travelers cheques are lost or stolen.

You should safeguard your cheques as you would cash, but if they are lost or stolen, here’s what you need to do:

- Identify the serial numbers of any cheques that have been lost or stolen

- Call American Express as soon as possible to report the missing or stolen cheques and make a claim

- You will need to provide identification and proof of purchase

- AMEX will review your claim, and issue a refund if the claim is valid

When to consider using AMEX Travelers Cheques

Although they’re no longer widely issued or accepted, it does make sense to use travelers cheques in some circumstances:

- If you don’t have a credit or debit card, travelers cheques can be a good alternative

- If you’re concerned about money being lost or stolen, travelers cheques can provide extra security and are not linked to your bank accounts

- If you want to avoid foreign transactions fees (typically up to three percent) when you spend on your credit or debit card overseas, although commission or exchange rate fees on cheques may make this irrelevant

When to think about options besides American Express Travelers Cheques

One of the reasons for the decline of travelers cheques is that you have many more options when it comes to spending money abroad:

- You can use a prepaid travel money card that you top up with currency before you travel and use like a regular debit card

- You can use a credit or debit card that doesn’t charge a foreign transaction fee, like the TransferWise Borderless Account card

- You can compare all your different options for travel money, including fees and exchange rates, with our easy-to-use tool

You might also like these AMEX alternatives

- How it Works

- Why choose us

- Snowbirds Real Estate

- Personal Expenses

- Importing Businesses

- Exporting Businesses

- Property Buyers

- International Students

Get started

What Are Traveller’s Cheques and How Do They Work?

You’ve probably heard of traveller’s cheques but may not have used them. A traveller’s cheque is among the many cashless methods of paying for services or goods. However, traveller’s cheques have been losing their popularity since the onset of credit and debit cards.

The good news is that traveller’s cheques are still functional and can save you from the stress and risk of carrying a huge chunk of money while travelling.

Here, we will answer the following questions:

- What are traveller’s cheques?

- How do they work?

- What are the benefits of traveller’s cheques?

- Can traveller’s cheques be a hassle?

- What are alternatives to traveller’s cheques?

Let’s get started.

Don't Waste Money With Banks. Get Exchange Rates Up to 2% Better With KnightsbridgeFX

What are Traveller’s Cheques?

A traveller’s cheque is a printed cheque that allows payment from one person to another and across currencies. So, travellers get the cheque before they travel to exchange it with the local currency after getting to their destination.

You can easily get traveller’s cheques in Canada from financial institutions like American Express or Visa. Also, some local banks offer traveller’s cheques, but most of them scrapped it a long time ago.

How Do Traveller’s Cheques Work?

Traveller’s cheques do not bounce since you pay upfront for a specific amount that you wish to spend. The cheque will have a fixed value and a unique serial number.

Once you receive your traveller’s cheque, you should be conversant with how to use it. So, you should follow the issuer’s instructions and sign the traveller’s cheque upon receipt.

When making purchases, countersign the cheque in the presence of the receiver; the recipient should compare the signatures and confirm that they match. Any change is returned in the local currency since the traveller’s cheque is accepted at the same exchange rate as a cash payment.

However, you must enquire from the recipient if they accept traveller’s cheques as a means of payment before making any purchases. While the traveller’s cheques still work, some institutions and persons refer to them as outdated and do not accept them. You can still make the purchases in such cases, but you need to deposit the traveller’s cheque and receive cash in the local currency. Also, do your research ahead of your trip. Ensure that you can easily access services via your traveller’s cheque before purchasing them.

Most importantly, keep the details of your traveller’s cheque safe. If you lose your traveller’s cheque, you need to provide proof of purchase and the unique serial number to get a refund. Also, contact your cheque issuer immediately after losing your traveller’s cheque.

The traveller’s cheques do not expire. Therefore, you can keep them safe and use them in the future. Alternatively, you can deposit them in your bank account once you get home.

Benefits of Traveller’s Cheques

Here are the various advantages of traveller’s cheques.

- Safety: Traveller’s cheques are safe and can allow you to carry a large amount of money while travelling.

- Refunds are possible: With traveller’s cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank once you get home.

- Does not expire: Your traveller’s cheque does not expire and can be kept and used again in the future.

- Branded Cheques: The American Express and Visa offer branded traveller’s cheques that come in various denominations and are readily acceptable globally.

- Good exchange rates: In some cases, traveller’s cheques can access a better conversion rate.

Can Traveller’s Cheques Be A Hassle?

Traveller’s cheques have several advantages, but today, you can experience many struggles while using them.

For starters, the cheques have become outdated. Therefore, most hotels, banks, and individuals will decline them.

As a result, you will likely be forced to hunt down banks and hotels that will accept the traveller’s cheques prior to travelling. If you travel without doing your research, you can be frustrated finding that the cheques are not accepted at your destination.

Also, most banks no longer offer traveller’s cheques. The few banks that offer the cheques might charge you traveller’s cheque fees for the service.

Other Payment Methods That You Might Consider

Purchasing a traveller’s cheque may save you from the stress of carrying a large amount of money that can get lost or stolen. However, it has several limitations.

So, while travelling, you may need to consider the following alternatives:

Debit Cards

The popularity of debit cards is increasing every day. The size of the card and its acceptability rate make it among the most convenient methods of payment. So, many foreign banks, hotels, and ATMs accept foreign debit cards.

Credit Cards

Like a debit card, a credit card is small and secure to travel to various places. Besides, credit cards like MasterCard, Visa, and American Express are accepted as a method of payment in most countries globally.

Although carrying a huge amount of money while travelling is risky, it’s ideal to have a certain amount of money in cash for emergency purposes. For that reason, ensure you bring with you a given amount in the form of cash.

Prepaid Card

Prepaid cards work like debit cards and credit cards since you load them with your bank account money. Therefore, you can use your prepaid card as a debit card on the ATMs and credit card when making purchases and in hotels.

Traveller’s cheques are a safer, cashless method to use when travelling.

However, with the growing popularity of debit cards and credit cards, traveller’s cheques are quickly losing their place in the payment method.

Also, they are unacceptable in most places, making them more unreliable when travelling to destinations that limit their use. So, alongside your traveller’s cheque, carry your debit card, credit card, and some little cash to enjoy your travels .

Stop overpaying with your bank on foreign exchange

We are built to beat bank exchange rates and save you money

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788. Like most financial institutions, we are required to validate the identity of all clients. We have strict measures in place to protect your privacy.

You're 0% there.

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788 .

130,000+ Satisfied customers

There is no obligation to transact and no hidden fees.

We guarantee to beat your bank's rate 100% of the time.

Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Month January February March April May June July August September October November December

Year 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Are you or any close relative a Politically Exposed Foreign Person?

(Head of State, Member of Senate, House of Commons, or Legistrature, etc)*

I confirm I am not transacting on behalf of a third party and I have read and I agree to the Terms and Conditions*

- Daily Update (2,681)

- Editorials (40)

- Finance Tips (23)

- Guides (285)

- Holiday Hours (1)

- In the News (34)

- International Money Transfer (10)

- Monthly Canadian Dollar Outlook/Forecast (109)

- Real Estate (11)

- Trading Tips (15)

- Travel Tips (34)

- Uncategorized (6)

Recent Posts

- Canadian Dollar Update – Canadian Dollar struggling

- FX Monthly Update | May 2024

- Canadian Dollar Update – Canadian Dollar Climbs as risk sentiment improves

- Canadian Dollar Update – Canadian Dollar survives the Fed

- Canadian Dollar Update – Canadian Dollar Sinks into FOMC meeting

- Canadian Dollar Update – Canadian Dollar awaiting GDP

- Canadian Dollar Update – Canadian Dollar opens nearly unchanged from Friday

- Canadian Dollar Update – Canadian Dollar rising

- Canadian Dollar Update – Canadian Dollar firming ahead of US GDP

- Canadian Dollar Update – Canadian Dollar gains on shaky ground

- Canadian Dollar Update – Canadian Dollar rises as Middle East tensions fall

- Canadian Dollar Update – Canadian Dollar caught in a geopolitical vortex

- Canadian Dollar Update – Canadian Dollar Ignores Federal Budget

- Canadian Dollar Update – Canadian Dollar Awaits CPI

- Canadian Dollar Update – Canadian Dollar recoups some losses

Foreign/Currency Exchange Resources

- Currency converter Canada

- Currency Conversion

- Foreign Exchange

- $100 USD in CAD

- RBC currency converter

- RBC foreign exchange rate

- BMO exchange rate

- CIBC exchange rate

- BMO currency exchange

- Tire Bank Exchange Rate

- Scotiabank exchange rate

- HSBC exchange rate

- PayPal conversion rate

- Knightsbridge FX Reviews

- Canadian Dollar History

Useful Links

- Why Choose Us

- Get Started

- Send Money to US

- Currency Exchange Canada

- Currency Converter

- USD to CAD Exchange

Our Offices

Main office (Appointment only)

First Canadian Place

100 King Street West Suite 5700 Toronto, ON, M5X 1C7

(416) 479-0834 Toll-Free: 1-877-355-5239 Fax: 1-877-355-5239

Local offices

Toronto : (416) 479-0834 Montreal : (514) 613-0393 Calgary : (403) 800-3025 Ottawa : (613) 704-1798 Vancouver : (604) 229-1065 Victoria : (877) 355-5239 Winnipeg : (204) 318-1150 Halifax : (902) 800-2063

Get up to 5% better than the bank

Choose your currency pair and get rate alerts

All rights reserved. Knightsbridge Foreign Exchange

Currency Exchange Canada.

- EXPLORE Random Article

How to Obtain Traveler's Checks

Last Updated: July 26, 2018

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time. This article has been viewed 16,546 times.

It is a good idea to give some thought to currency exchange prior to traveling outside of your home country. Most international destinations accept cash, credit or debit cards, but traveler's checks offer the highest level of security, as they are refundable if lost or stolen. Traveler's checks come in a wide variety of denominations and currencies and are available for purchase through most financial institutions, currency-exchange offices and some travel-service organizations. Read the following article to learn how to obtain traveler's checks.

- 4 Inspect your traveler's checks for accuracy.

Expert Q&A

- Pay attention to the currency-exchange rate when traveling. Sometimes cash may receive a better rate than traveler's checks. Sometimes the opposite will be true. Thanks Helpful 0 Not Helpful 0

- Large-denomination checks may be difficult to cash outside of major cities. Thanks Helpful 0 Not Helpful 0

You Might Also Like

About this article

Did this article help you.

- About wikiHow

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

You are using an outdated browser. Please upgrade your browser to improve your experience.

Personal Accounts

Business Accounts

Online Services

Help & Support

Personal Cards

Businesses Cards

Featured Personal and Business Cards

Discover More

Online Travel

Business Travel

Other Travel Services

Credit Card

Membership Rewards® Program

Other Reward Programs

Benefits and Offers

Refer a Friend

Corporations

Small Business

Global Network

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

American Express® Travelers Cheques

American Express Travelers Cheques are no longer sold in Canada.

If you have any outstanding Travelers Cheques, please visit our Travelers Cheque Website or contact +1-800-221-7282 .

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

How To Cash a Check Without a Bank Account or ID

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

According to the latest figures from the Federal Deposit Insurance Corp., almost 6 million U.S. households were “unbanked” as of 2021. That means that no one in the household has a checking or savings account at a bank or credit union . This rate is the lowest since the FDIC started tracking the figure in 2009.

However, the millions of Americans without a bank account sometimes still need access to banking services, such as check cashing . If you’re wondering where you can cash a check without a bank account or ID, keep reading to learn how and where. Some methods even let you cash a check without ID.

How To Cash a Check Without a Bank Account

There are many ways to cash a check even if you don’t have a bank account. Here are some options to consider:

- Bring it to the bank that issued it.

- Go to a retail store that cashes checks.

- Visit a check-cashing store.

- Deposit it to a prepaid debit card.

- Sign it over to someone with a bank account.

- Deposit it to a mobile payment app.

- Open a checking account.

1. Bring It to the Bank That Issued It

You can try to go to the bank that issued the check and see if they will cash it for you since it was written by an account holder at that bank. However, some banks may not cash a check if you don’t have an account. They may also charge a fee, and they will require identification to cash it.

2. Go to a Retail Store That Cashes Checks

Some retailers offer check-cashing services for a small fee. Walmart , for example, will cash payroll, government, tax refund, cashier’s, insurance settlement and 401(k) checks at most stores and two-party personal checks at select stores for a maximum fee of $4 for checks up to $1,000. The cashing limit at Walmart is $5,000 — or $7,500 from January to April — and you’ll pay a fee of up to $8. You can get cash or load a Walmart MoneyCard for convenience — all you need is a valid ID card.

Other retailers will have varying policies. For example, some may only cash personal checks, while others may only cash paychecks or checks from a government entity. When using paycheck-cashing services, you may need to register with the store of your choice, which takes a little more time.

Some retailers, however, may only offer check-cashing services at certain locations, if at all. Most stores will have their policies online so that you can check them before making the trip.

3. Visit a Check-Cashing Store

Though they are in the business of cashing checks, check-cashing stores may have the highest fees. Still, it’s an option for you to consider. Amscot, for example, will cash almost all kinds of checks with no limits. However, according to Amscot’s posted rates, it charges a minimum of $3 for all checks and fees of 9.9% on personal checks and money orders .

The benefits of check-cashing stores include fast processing time — you can get the cash almost instantly. Some stores may also be open during late hours or on weekends.

4. Deposit It to a Prepaid Debit Card

Another option is to get a prepaid debit card . Some prepaid cards will allow you to deposit checks through mobile deposit. You might need to download an app and deposit your check by endorsing it and taking photos to upload. However, free processing may take up to 10 days. To get your money sooner, you may need to pay relatively high fees.

If you are trying to cash paychecks, some prepaid cards allow you to set up direct deposit by using the routing number for your card. Therefore, you can skip the check-cashing process altogether.

5. Sign It Over to Someone With a Bank Account

If all else fails, you can consider signing the check over to a trusted individual who has a bank account and have them cash it for you. You might want to go with them in case they have questions about the check or require your identification.

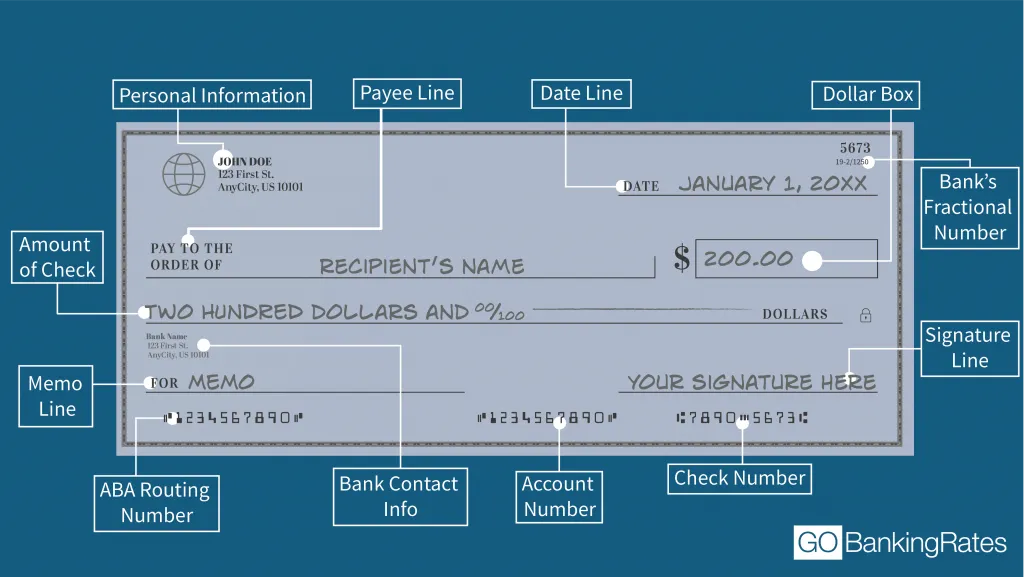

Here’s an example of how a check typically looks:

Your name should appear on the payee line, and the person who wrote the check will sign the signature line. To sign the check over to someone else, you’ll need to sign the back of the check, on the line that says “ Endorse Check Here. “

6. Deposit It to a Mobile Payment App

Several mobile apps let you deposit checks into your account by mobile or direct deposit and then use your account balance to send money and make purchases — without a prepaid card. For example, PayPal users with a PayPal Balance account can mobile-deposit checks and then draw against their balance to pay for purchases and send money.

7. Open a Checking Account

Despite valid reasons for not opening a bank account — difficulty being approved because of past banking history, or concern over account minimums and fees, for example — the truth is that just about everyone age 18 or older can and should have one, regardless of banking history. Capital One stopped using ChexSystems to screen new customers a decade ago, and its checking account has no fees or minimums. SoFi also doesn’t use ChexSystems. It combines its interest-bearing checking account with a high-yield savings account . There are no fees or minimums.

It only takes a few minutes to open an account online. Deposit your check into the new account and withdraw the money after it clears.

Who knows — opening an account to deposit checks might lead to other positive financial habits. You could even wind up socking away money in a savings account or CD .

How To Cash a Large Check Without a Bank Account

Amscot will cash large checks if you have a valid ID. The check goes through the company’s verification system, which can take 15 or 20 minutes. If the store doesn’t have the cash on hand, it can issue you money orders in $1,000 increments that you can cash for free at any Amscot store. However, you’ll still pay a fee to cash the check.

Where Can I Cash a $20,000 Check Without a Bank Account?

You can cash a $20,000 check at Amscot. It’s a good idea to call in advance to make sure they have the cash on hand, though. If not, you can still cash the check, but you’ll have to take money orders for it instead of cash.

Can You Cash a Check at an ATM Without a Bank Account?

Not directly because you need an account to cover the check in case it bounces. However, you can load it onto a prepaid card and then use the prepaid card to withdraw money at the ATM.

How To Cash a Check Without an ID

Most check-cashing methods require an ID because most service providers are required to verify your identity, according to the Consumer Financial Protection Bureau. One possible exception is signing a check over to a third party. While some banks will only accept the check if you and the individual cashing or depositing it both are present, that individual’s bank might not.

What To Consider Before Cashing a Check Without a Checking Account

While there are several options for cashing a check without a checking account , there are a few things you should consider.

You May Have To Pay a Fee

Depending on where you cash your check, you may need to pay a fee. Check-cashing stores have the highest fees and should be avoided if possible.

Prepaid cards are reloadable, so once you buy the card, you can deposit checks repeatedly without additional fees.

You Will Likely Need Some Form of Identification

Typically, if you are cashing your check at the issuing bank, a retailer or other stores, you will have to provide some form of identification.

Daria Uhlig and Scott Jeffries contributed to the reporting for this article.

Information is accurate as of April 23, 2024.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy .

- PNC. 2023. "How To Endorse a Check to Someone Else."

Share This Article:

- Best Free Checking with No Minimum Balance

- Best Free Checking with No Minimum Deposit

- Best Checking Account Bonuses This Month

Learn More About Checking Accounts

- What is a Checking Account?

- Types of Checking Accounts

- Checking Accounts vs Savings Accounts

How Many Checking Accounts Should You Have?

- How Much Money Should You Keep In Your Checking Account?

- How to Open a Checking Account

- How to Write a Check

GOBankingRates' Best Banks

- Best High-Yield Savings Accounts

- Best Checking Accounts

- Best CD Accounts & Rates

- Best Online Banks

- Best National Banks

- Best Neobanks

- Best Money Market Accounts

- Best Premium Checking Accounts

- Best Regional Banks

Related Content

Checking Account

5 Best Teen Checking Accounts for May 2024

May 02, 2024

Bank Routing Numbers: What They Are and How To Find Them

April 30, 2024

What Are Joint Bank Accounts and How Do They Work?

April 29, 2024

Chase Overdraft Fees: How Much They Cost and How To Avoid Them

How Long Does Direct Deposit Take?

Best Places To Buy Cheap Personal Checks

7 Things You Should Know If You Deposit More Than $10K Into Your Checking Account

April 22, 2024

How To Open a Chase Checking Account

April 19, 2024

10 Best Checking Account Bonuses for April 2024

April 18, 2024

Best Checking Accounts April 2024

April 17, 2024

How To Write Numbers in Words on a Check

April 15, 2024

Can I Get a Checking Account With Bad Credit?

April 12, 2024

How Long Does It Take for a Check to Clear?

April 09, 2024

Here's How to Add $200 to Your Wallet -- Just For Banking Like You Normally Would

May 03, 2024

Your Guide To Chase Bank SWIFT Codes

April 08, 2024

Sign Up For Our Free Newsletter!

Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy . You can click on the 'unsubscribe' link in the email at anytime.

Thank you for signing up!

BEFORE YOU GO

See today's best banking offers.

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here .

Politics latest: MoD contractor hacked by China 'has contracts across Whitehall'

The defence secretary has given a statement about a hacking attack on the UK's Ministry of Defence, which Sky News understands China was behind. The government has been criticised for not naming the perpetrator, and concern is mounting over the contractor that was targeted.

Tuesday 7 May 2024 23:09, UK

- China hacked Ministry of Defence, Sky News learns

- Contractor behind system named in House of Commons

- Sam Coates: This could get quite sticky

- Scotland's new first minister voted in

- Labour rejects PM's election prediction

- Jon Craig: MPs hold most heated Gaza debate since war began

- Live reporting by Ben Bloch and (earlier) Faith Ridler

Thank you for joining us on the Politics Hub for a busy day in Westminster.

Here's what happened:

- The defence secretary, Grant Shapps, gave a statement to the Commons confirming that a hack had hit the Ministry of Defence's payroll system, run by an external contractor, with personal details of British service people targeted;

- But he did not confirm Sky's revelation that China is behind the hack because it is a months-long process for such a formal designation to be made by ministers (China firmly denies it is behind the cyber attack);

- The refusal to blame China provoked fury from many MPs who want stronger action from the government against China - but Rishi Sunak defended his policy as "robust";

- The defence secretary did state in the Commons that contractor SSCL was responsible, with the government launching an investigation into all SSCL work with government;

- The deputy foreign secretary told the Commons that the government is firmly opposed to an Israeli offensive in the Rafah area of Gaza, with the PM saying he is "deeply concerned" by the prospect;

- Shadow chancellor Rachel Reeves gave a speech in which she blasted Tory "economic fiction", saying ministers arguing the economy is turning a corner is not reflecting "reality";

- New SNP leader John Swinney was formally elected the new first minister of Scotland, with him expected to formally take the role as soon as tomorrow.

Join us again from 6am for the very latest political news - and the first PMQs since the local elections at noon.

The Garrick Club, a central London gentlemen's club, has voted to accept women into the ranks of its membership for the first time in its near two-century history.

Founded in 1831, it is one of the oldest members' clubs in the world, and its membership is drawn from across the British establishment.

Among its ranks are said to be 1,500 members including at least 160 senior legal professionals, at least 10 serving MPs, dozens of Lords, heads of public institutions, actors, artists and businessmen.

King Charles is even said to be a member, along with around 150 men with knighthoods who cough up the around £1,000 a year to get access to its dining rooms, luxury lounges and exclusive bedrooms.

Women have been effectively banned from becoming members, and until 2010 were barred from even visiting the club as the guest or spouse of a member.

But in a vote this evening, the membership changed the rules to allow women to become full members.

One member told Sky News that 944 members attended a meeting tonight, either in person or remotely, and said: "It was fairly clear the majority was in favour of admitting women."

The club had been at the centre of a controversy after the UK's chief civil servant, Simon Case, came under heavy criticism for his membership, which he eventually resigned in March ( more here ).

A list of members of the club was recently published by The Guardian newspaper, which included the King, Deputy Prime Minister Oliver Dowden and Sir Richard Moore, the head of MI6.

Read more about the club from our political reporter Tim Baker here:

An early release prison measure, used to relieve capacity problems in jails across England and Wales, has been extended for a second time since its introduction in October.

As of 23 May, some male prisoners will now be freed up to 70 days before the end of their sentence in order to free up space, under the End of Custody Supervised License scheme.

Originally - it was 18 days, later extended to between 35 and 60 days.

In an email sent to prison and probation officers informing them of the extension, seen by Sky News, staff were told that "despite the push" and efforts of the scheme in previous months, that "pressures continue" in male prisons, and so further extensions to this emergency scheme are necessary.

Sex offenders, terrorists and category A prisoners, plus those serving four years or more, are excluded and aren't eligible for release.

However, sources close to the service have expressed concern about the extent to which the scheme is being amended, at pace, and often with little warning.

Read the full story from our news correspondent Mollie Malone here:

By Jenness Mitchell, Scotland reporter

John Swinney will become Scotland's new first minister after being backed by a majority of MSPs.

Following his victory in the SNP leadership race on Monday, the 60-year-old faced a vote at Holyrood to confirm him as Humza Yousaf's successor.

The Scottish Greens abstained from the vote, with Mr Swinney able to fend off challenges from Scottish Tory leader Douglas Ross, Scottish Labour leader Anas Sarwar, and Scottish Liberal Democrats leader Alex Cole-Hamilton.

His name will now be submitted to the King, with an official swearing-in ceremony expected to take place at the Court of Session in Edinburgh as early as Wednesday.

Mr Swinney will then be able to appoint his cabinet.

Read the full story here:

We've just had a statement from the Home Office amid chaos at UK airports due to a nationwide issue with the border system.

A spokesperson said: "We are aware of a technical issue affecting eGates across the country.

"We are working closely with Border Force and affected airports to resolve the issue as soon as possible and apologise to all passengers for the inconvenience caused."

Queues are building at airports across the country as flights land, but passengers are unable to be processed.

Follow live updates on the outage affecting the UK border on our dedicated live page here:

Are you affected? Send us a message on WhatsApp . Check our contact us page for more information.

By Tim Baker , political reporter

The government is "gaslighting" the public about the state of the economy, the shadow chancellor has said.

Rachel Reeves attacked the Conservatives in a speech in the City of London, as the opposition takes the fight to the government on their own turf ahead of the general election.

Running a strong economy has long been the focus of Conservative election campaigns.

And with a raft of economic data coming out this week, Ms Reeves is looking to get ahead of the government's messaging - saying Chancellor Jeremy Hunt and Prime Minister Rishi Sunak claiming the economy is improving is "deluded".

Over a year ago, Rishi Sunak made five pledges for voters to judge him on.

The prime minister met his promise to halve inflation by the end of 2023.

But with the general election approaching, how is Mr Sunak doing on delivering his other promises?

You can see the progress for yourself below:

Chaos has been reported at airports across the UK - as two airports have confirmed a nationwide border issue.

A Heathrow spokesperson said: "Border Force is currently experiencing a nationwide issue which is impacting passengers being processed through the border.

"Our teams are supporting Border Force with their contingency plans to help resolve the problem as quickly as possible and are on hand to provide passenger welfare. We apologise for any impact this is having to passenger journeys."

Manchester Airport also confirmed that the UK Border System is down as part of a nationwide outage.

It said its teams are working to assist passengers in the airport.

Sky News has contacted the Home Office for comment and further details:

The Sky News live poll tracker - collated and updated by our Data and Forensics team - aggregates various surveys to indicate how voters feel about the different political parties.

With the local elections complete, Labour is still sitting comfortably ahead, with the Tories trailing behind.

See the latest update below - and you can read more about the methodology behind the tracker here .

Two of Westminster's best-connected journalists, Sky News's Sam Coates and Politico's Jack Blanchard, guide you through their top predictions for the next seven days in British politics.

Following the local and mayoral elections, Jack and Sam discuss how Rishi Sunak will try to get back onto the front foot and whether the Conservative rebels will continue to plot against him.

They also predict that the country will come out of recession and look forward to a new SNP leader in Scotland following the resignation of Humza Yousaf.

Email with your thoughts and rate how their predictions play out: [email protected] or [email protected]

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

VIDEO

COMMENTS

To find out locations where you can cash Travelers Cheques and how to redeem your Travelers Cheques directly with American Express please click here

The key advantage of travellers cheques is that they are safer to carry around than cash. Provided you have noted down the serial number of each cheque you were originally issued, you will be able to get them replaced should they be stolen or lost. Remember to keep your note of the serial numbers separate from the cheques themselves.

Cash in Travellers Cheques: A Quick Guide • Travellers Cheques Guide • Learn how to easily cash in Travellers Cheques with this step-by-step guide. Find out ...

A traveler's check contains a fixed amount of money and operates like cash. Bring a traveler's check to a merchant to buy goods or services while traveling abroad. You can get traveler's checks from financial institutions like banks and credit unions. Traveler's checks can come in a variety of currencies, so you can designate the ...

When using travellers' cheques, you may encounter various fees, typically ranging from 2-3% in commission charges. Additionally, handling fees and cashing-in charges may apply. These fees can vary significantly depending on the provider, country of use, and the specific bank, retailer, or agent. It's always recommended to inquire about these ...

Deposit Without Fees. Avoid service fees by depositing the traveler's checks into your checking or savings account. Make the check payable to yourself and countersign the check in the presence of a teller. Most banks will post the deposit to your account by midnight of the same day; posting date will vary per financial institution. Advertisement.

While American Express Travellers Cheques are recognised around the world and can be used like cash in many locations, or exchanged for local currency at banks, foreign exchange bureaux and American Express Travel Service locations, acceptance is becoming increasingly uncommon.

A traveler's check is a secure, prepaid form of money you can use when traveling. Think of it as a prepaid form of cash with built-in security features. When you purchase traveler's checks, you'll receive a set of checks with specific amounts, like $20 or $50. Many banks, currency exchange offices, and businesses recognize and accept them ...

American Express is one company that offers travelers checks which can be exchanged for local currency at banks, hotels and other locations around the world. Knowing where to cash American Express travelers checks is essential when planning your trip abroad. There are many places where you can cash these checks such as banks, currency exchange ...

In short, a traveler's check is a check issued to you in exchange for your cash. It typically requires your signature at two separate occasions — first in the presence of the agent issuing the traveler's check, and again when you use the check to make a purchase. You can typically purchase traveler's checks at banks and credit unions.

What Monito Dislikes About AMEX Travelers Cheques. Can be difficult to find locations to buy travelers cheques. Can be difficult to find locations to redeem or cash in travelers cheques. Not as widely accepted as they once were. High commission fees and poor exchange rates can make travelers cheques expensive to use.

Here are the various advantages of traveller's cheques. Safety: Traveller's cheques are safe and can allow you to carry a large amount of money while travelling. Refunds are possible: With traveller's cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank ...

The same exact process is involved with money orders and checks made out to the deceased, and any other related property that may be in the deceased's name. If you can't fix it with one of the above 'easy ways', what you'll probably need to do is request the court that handled probate for your father for a letter explicitly granting you the ...

What to know when using Visa Traveller's Cheques. Be as careful with your cheques as you would be with cash. Do not countersign the cheques until you want to use them. Keep your purchase agreement separate from your cheques. Write down cheque serial numbers and emergency contact numbers for your destinations and keep them separate from your ...

Lost or stolen traveller's cheques are reimbursed, making them a safe payment system. Credit cards, debit cards, and prepaid cards are popular modern alternatives to cheques. Digital payment systems like PayPal and Venmo are also popular with tech-savvy users. It's imperative to keep your money safe whenever you venture abroad, though that ...

4. Inspect your traveler's checks for accuracy. 5. Sign the checks on the appropriate line to activate them so you'll be protected in case of loss or theft. You will need to remit payment in full for your traveler's checks at the time of purchase. 6. Store your traveler's checks in a safe location.

To find out locations where you can cash Travelers Cheques and how to redeem your Travelers Cheques directly with American Express, please click here.

American Express® Travelers Cheques. American Express Travelers Cheques are no longer sold in Canada. If you have any outstanding Travelers Cheques, please visit our Travelers Cheque Website or contact +1-800-221-7282. Travelers Cheques Service Centre. Get help with your Travelers Cheques and find answers to common questions about them.

2. Go to a Retail Store That Cashes Checks. Some retailers offer check-cashing services for a small fee. Walmart, for example, will cash payroll, government, tax refund, cashier's, insurance settlement and 401(k) checks at most stores and two-party personal checks at select stores for a maximum fee of $4 for checks up to $1,000.The cashing limit at Walmart is $5,000 — or $7,500 from ...

We're now hearing from tonight's panel on the issue of Israel and Gaza, which is still very much dominating British politics. Amid public controversy about Labour's stance over the last few months ...