Get healthcare cover abroad with a UK GHIC or UK EHIC

The UK Global Health Insurance Card (GHIC) lets you get necessary state healthcare in the European Economic Area (EEA), and some other countries, on the same basis as a resident of that country. This may be free or it may require a payment equivalent to that which a local resident would pay.

The UK GHIC has replaced the existing European Health Insurance Card (EHIC). If you have an existing EHIC you can continue to use it until the expiry date on the card. Once it expires, you'll need to apply for a UK GHIC to replace it.

You can apply for a new card up to 9 months before your current card expires.

A UK GHIC is free and lasts for up to 5 years. Apply for your new card through the NHS website. Avoid unofficial websites – they may charge you a fee to apply.

If you have rights under the Withdrawal Agreement, you can choose to apply for a new UK EHIC instead.

The UK GHIC is not a replacement for travel insurance. We advise you to have private travel and medical insurance for the duration of your trip.

We also recommend you check FCDO travel advice on GOV.UK for the country you're visiting.

You can apply for a UK GHIC if you're a resident in the UK. You can also add your family members to your application when you apply.

You'll need to provide your:

- date of birth

- National Insurance number

- Health and Care number (if you're from Northern Ireland)

Applying for family members

Every member of your family needs their own card. You can add your spouse, civil partner and children to your application when you apply. You must enter your own details first and apply for any additional cards when prompted.

If you've already completed your application and want to add additional family members contact NHS Overseas Healthcare Services . You'll need to give us your reference number, name, date of birth and address so we can access your record.

After you apply

After you've submitted your application, we'll email you within 24 hours to let you know whether it has been approved or not (if you don't get a reply, check your junk folder). We may need to see additional information or documents before approving it.

Once your application has been approved, you should receive your new card within 15 working days. It will be sent to you by post.

If you do not receive it before you travel, and need medically necessary treatment during your visit, you can apply for a Provisional Replacement Certificate (PRC) to get temporary cover. For more information, see "If you don't have your card with you" towards the end of this page.

If you have rights under the Withdrawal Agreement

If you have rights under the Withdrawal Agreement, you can choose to apply for a new UK EHIC rather than a UK GHIC. Like the UK GHIC, it's free and lasts up to 5 years. You can find out if you have rights under the Withdrawal Agreement on GOV.UK .

What your card covers

You can use your card to get state healthcare that cannot reasonably wait until you come back to the UK (sometimes called "medically necessary healthcare"). This includes things like:

- emergency treatment and visits to A&E

- treatment or routine medical care for long-term or pre-existing medical conditions

- routine maternity care, as long as you're not going abroad to give birth

You'll need to pre-arrange some treatments with the relevant healthcare provider in the country you're visiting – for example, kidney dialysis or chemotherapy – as it's not guaranteed that local healthcare providers will always have the capacity to provide this care.

Whether treatment is medically necessary is decided by the healthcare provider in the country you're visiting.

Not all state healthcare is free outside of the UK. You may have to pay for treatment that you would get for free on the NHS, if a local resident would be expected to pay in the country you're visiting.

Before travelling, you should check the state-provided healthcare services in the country you're visiting and any potential charges you may face.

Check the relevant country guide on GOV.UK for information on how to access treatment in the country you're visiting

What your card does not cover

A UK GHIC (or UK EHIC) does not replace travel and medical insurance or cover services like:

- being flown back to the UK (medical repatriation)

- treatment in a private medical facility

- ski or mountain rescue

We advise that you have a UK GHIC (or UK EHIC) and private travel and medical insurance for the duration of your trip.

Where you can use your card

You can use a UK GHIC when you're visiting:

- a country in the European Economic Area (EEA) – see a list of EEA countries on GOV.UK

- Jersey, Guernsey and the Isle of Man

- St Helena, Tristan and Ascension

You can use a UK GHIC in Switzerland if you're one of the following:

- a British national

- a Swiss national

- an EU citizen

- a stateless person

- a family member of someone who holds one of the above nationalities or statuses

The UK government is negotiating with other countries to expand the use of the UK GHIC, so always check coverage before you travel.

You can use a UK EHIC when you're visiting:

- Switzerland

Visiting Montenegro

You can get free emergency treatment in Montenegro but you'll have to pay for your prescribed medicines and for other medical treatment.

If you're a UK national, your UK passport will give you access to emergency healthcare in Montenegro.

If you're a UK resident but not a UK national you'll need your passport and a UK GHIC (or UK EHIC) to get emergency healthcare.

Getting healthcare in other countries

You'll have to pay for treatment unless the UK has a healthcare agreement with that country .

Check if you're eligible for a UK GHIC

You'll be entitled to a UK GHIC if both of these things apply:

- you're ordinarily and legally resident in the UK

- you do not have healthcare cover provided by an EEA country or Switzerland

There is information about what "ordinarily resident" means on GOV.UK

You may also be entitled to a UK GHIC if you're:

- living in the EEA or Switzerland with a registered S1 form

- living in the EEA or Switzerland with an A1 document issued by the UK

- a family member or dependant of an entitled individual already listed

Check if you're eligible for a UK EHIC

You may be eligible for a new UK EHIC if you meet one of the following criteria:

- you're living in the EEA or Switzerland and have been since before 1 January 2021 with a registered S1, E121, E106 or E109 form issued by the UK

- you're living in the EEA or Switzerland since before 1 January 2021 with an A1 issued by the UK

- you're a national of the EEA or Switzerland who has legally resided in the UK since before 1 January 2021 and are covered under the Withdrawal Agreement – you may not be covered if you are also a UK national or if you were born in the UK

- you're a family member or dependant of an entitled individual already listed

If your circumstances change and you no longer meet one of the above criteria, you may not be entitled to continue using the card and should contact NHS Overseas Healthcare Services .

You must be entitled to use your UK GHIC or UK EHIC at the time of the treatment. If you use it to access healthcare that you're not entitled to, you may be liable for the full cost of all treatment received or face prosecution.

Applying for a UK Student EHIC or UK GHIC

To apply for a UK Student EHIC or UK GHIC, you'll need a letter from your university or college showing:

- the name and address of the UK educational institution if you're travelling as part of your course

- the address of where you're studying in the EEA or Switzerland

- details of the qualification you're studying for

- the dates your study period in the EEA or Switzerland started and is due to finish

- your permanent residential address in the UK

If the letter from your university or college does not include your permanent residential address in the UK, you'll be asked to provide further evidence to confirm this.

This is in addition to the information set out in "How to apply" above.

Students studying in the EEA or Switzerland applying for a UK Student EHIC or UK GHIC

If you normally live in the UK and have been studying in the EEA or Switzerland since before 1 January 2021, you may be eligible for a new UK Student EHIC for use in the EEA, Switzerland and your country of study.

If you started your course after 1 January 2021, or you're planning to study in an EEA country or Switzerland, you'll need to apply for a UK Student GHIC.

Using a UK GHIC (or UK EHIC) when abroad

You should take your UK GHIC (or UK EHIC) with you when you travel abroad. If you need medically necessary treatment, you'll need to present the card to the hospital (or other service provider) that is treating you – make sure that you are being treated at a public health provider and not a private one. Keep all receipts and paperwork.

Depending on the country you visit you may be expected to pay all or part of your bill upfront and then claim a refund afterwards.

Some countries ask patients to pay a contribution towards the cost of their care. This is known as a co-payment or patient share. You can claim back the difference between the total bill and the co-payment, but the actual co-payment is not refundable.

Your UK GHIC or UK EHIC will not cover costs that a local resident would have to pay.

If you don't have your card with you

If you need emergency treatment when you're in another country and do not have your UK GHIC (or UK EHIC) with you, you can apply for a Provisional Replacement Certificate (PRC). A PRC gives you the same level of cover as a UK GHIC or UK EHIC.

A PRC also covers you if you've applied for a UK GHIC or UK EHIC and it has not arrived yet.

Find out more about PRCs and how to apply for one

You'll need to pay in full for treatment if you do not have a UK GHIC, UK EHIC or PRC. You should ask for a copy of your invoice and obtain a receipt.

How to claim a refund

To claim a refund for healthcare covered by your UK GHIC or UK EHIC, you'll need to download and fill in a refund claim form and send it to NHS Overseas Healthcare Services. You should include receipts and any supporting documents with your claim form.

Find out how to claim a refund for healthcare covered by your UK GHIC or UK EHIC

Incorrect charges for treatment

If you think you've been incorrectly charged for medical treatment, contact NHS Overseas Healthcare Services .

Keep all documents relating to your treatment. You may need to provide more information to confirm your eligibility and the cost of the treatment you had. This could include:

- receipts or invoices relating to treatment

- confirmation that the treatment was state-provided

- confirmation of payments made to healthcare institutions

- documents relating to insurance cover if your insurer paid for treatment

- discharge documents

NHS Overseas Healthcare Services will look at your claim to decide whether you were charged when you should have been covered. If they determine that your treatment should have been covered by the UK GHIC or UK EHIC, they'll reimburse you or your insurer for the costs of treatment that are covered by your card.

If you suspect GHIC or EHIC fraud

If you suspect that somebody has fraudulently applied for or used a UK GHIC or UK EHIC they are not entitled to, you can report this to the NHS Counter Fraud Authority .

Alternatively, you can email your concern to [email protected] Only emails about the misuse of GHIC or EHIC will be responded to.

Page last reviewed: 12 December 2023 Next review due: 12 December 2026

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Cancellation and Refund Policy

- Subscribe to our Newsletter

UK Travel Health Insurance

If you’re planning on visiting the UK, you are advised to take out travel health insurance in order to cover potential healthcare costs during your stay.

For more information about your visit to the UK, don’t hesitate to get in touch with one of our trusted legal advisors today on 0333 305 9375 , or contact us online .

Read our 1001 reviews

Who Needs Travel Health Insurance When Visiting the UK?

If you’re planning to visit the UK from a country outside the European Economic Area (EEA) for less than 6 months, it is recommended that you take out valid travel insurance cover for the whole duration of your stay to help pay for medical care.

If you’re visiting from the EEA, you are entitled to free healthcare with a valid European Health Insurance Card (EHIC), Provisional Replacement Certificate (PRC) or S2 form.

However, it is also advised that you take out travel health insurance in case of other unexpected expenses and incidents that may occur during your visit, such as repatriation costs or lost or stolen property.

If you’re staying in the UK for more than 6 months, you will have to pay the Immigration Health Surcharge (IHS) unless exempt. You will normally have to pay the fee for the IHS when submitting your visa application for your stay.

Paying the IHS allows you to access NHS services. However, it may still be advisable to take out private health insurance on top of that for other services not covered by the IHS during your stay in the UK.

Why Should I Take Out Travel Health Insurance When Visiting the UK?

Travel insurance is an important part of any trip, especially if you end up requiring unexpected medical care during your stay.

If you are visiting the UK from a non-EEA country, you will be charged at 150% of the standard NHS rate if you have not arranged insurance. As a result, it’s essential that you purchase travel insurance with medical cover before travelling to the UK so you can reclaim any healthcare costs you are required to pay from your insurer.

Travel insurance is also important as your pre-existing health insurance policy may not cover you outside of your home country, or its international coverage may be limited.

In addition, there is also the possibility of falling ill unexpectedly, suffering accidents, illness, or needing medical care because of pre-existing conditions.

Travel health insurance may also help to cover costs if your travel or accommodation plans change unexpectedly or if you misplace important documents such as your passport or airline tickets. Many insurance policies will provide you with assistance with these matters as well as reimburse you if there will be any financial costs incurred.

What Should My Travel Health Insurance Cover?

Your travel health insurance to the UK should cover most of the following:

- Emergency medical expenses, including ambulance, medication and hospital fees

- Medical treatment for pre-existing medical conditions

- Personal injury and accidents

- Repatriation costs

- Reimbursement for any unused travel and accommodation costs should your trip be cut short

- Cover for lost or damaged items, including luggage, passports, credit cards, money or airline documents

- Emergency legal aid and translation services

- Assistance in finding suitable medical facilities in the UK

It’s important to check that the travel insurance cover necessary travel and healthcare needs to make sure you can get the treatment and medical care abroad during the period of your visit.

Insurance is particularly important for those with pre-existing medical conditions. You must tell your insurance company about any pre-existing medical conditions you have to make sure you can get the cover you need. In some cases, you may have to take out specialist cover rather than standard cover for this.

It’s advised to speak to your doctor for advice before you travel and make plans for how to care for your condition when you are in the UK. You should also bring your health condition identification or a letter saying what medication you are taking.

What Isn’t Covered By Travel Health Insurance?

Travel health insurance policies often have exclusions, which are specific situations or circumstances that will not be covered by the insurance policy.

For example, not declaring your pre-existing medical condition to your insurer will mean that you won’t be able to claim for medical care related to your condition during your trip.

In addition, you likely won’t be able to claim back costs if you do any of the following:

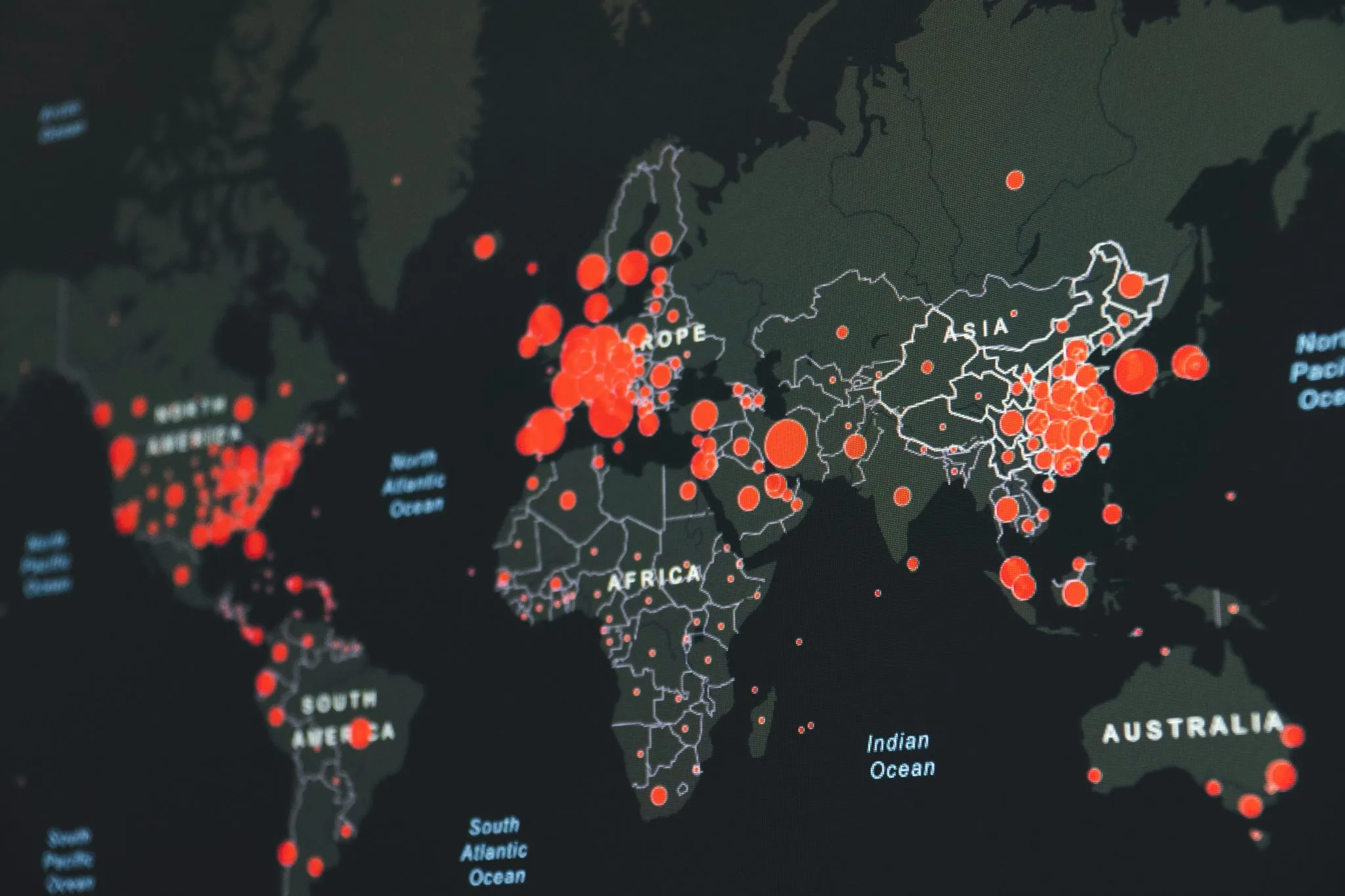

- Travel against government advice, such as if the country you’re travelling from places an active travel warning on the UK

- Travel despite known events, such as natural disasters or pandemics

- Incur losses due to carelessness or lack of reasonable safety measures, such as leaving your belongings unattended in a public place

- Engage in reckless behaviour, such as ignoring safety protocols, safety instructions, or if you injured yourself under the influence of drugs or alcohol

- Break the law, such as violating local traffic laws

In addition to these, if you cancel or change your plans for any reason not listed in your base plan, you won’t be able to claim the costs on your insurance.

However, most insurance providers will provide an optional Cancel For Any Reason coverage to your policy that will allow you to change or cancel plans for any reason and claim back some or all of the money.

It’s essential that you familiarise yourself with the details of your insurance policy carefully before setting off on your trip to the UK. Many travel health insurance policies have strict guidelines on what they do and do not cover, so it’s important to know what these are in order to prevent unexpected costs during your trip.

What Else Should I Look For When Taking Out an Insurance Policy?

As previously mentioned, it’s essential that your insurance policy covers any essential travel and medical expenses that may be incurred during your visit to the UK, especially if you have a pre-existing medical condition.

In addition to this, you should also consider the following:

Who You’re Travelling With

If you’re travelling with other people, it may be cheaper and more convenient to get a single insurance policy that covers the whole party rather than individual policies for each person.

For example, many insurance providers offer travel health insurance for couples, families, or groups of friends.

Note that if a person in your party has a pre-existing medical condition, they may require their own individual specialist cover separate from the rest of the group due to differences in coverage plans.

You may find travel health insurance more expensive if you’re over the age of 65. As a result, you may have to look for specialist policies for older travellers to ensure that you have the coverage you need.

Sports or Recreational Activities

If you plan to take part in sports or recreational activities, you will need to ensure that your travel health insurance covers these. This is especially the case if they’re considered to be high-risk activities, such as surfing, BMX, scuba diving, or winter sports.

Method of Travel

It’s worth noting that some methods of travel such as cruises or budget airlines may be excluded from certain travel insurance policies. You should always make sure that your method of travel is covered by your policy, in case of unexpected delays, cancellations or complications.

Add-ons and Extensions

You may wish to purchase additional add-ons or extensions to your travel health policy. For example, if you’re bringing a lot of expensive gadgets or equipment with you to the UK, you may want to purchase extra gadget cover as part of your insurance policy.

Additionally, you may want to add on additional Cancel For Any Reason cover if you want greater freedom and flexibility in being able to change or cancel your travel plans for reasons not covered by your base policy.

Do I Need Single Trip Cover or Annual Multi-Trip Cover for my Trip?

You can buy either single trip cover or annual multi-trip cover before your departure.

Single trip cover only grants you insurance coverage for a single holiday. Your coverage can start either as soon as you book the holiday or the date of your departure, and will end as soon as you come home.

Meanwhile, annual multi-trip insurance grants you coverage for every single trip you take within a 12 month period. The trips you take during this time may be limited to a certain length of time – for example, 31 days.

It may be cheaper to get annual multi-trip cover if you’re planning to go on several trips in a 12 month period. However, if you’re not planning on making many other trips other than your single trip to the UK, it may be cheaper to stick to single trip cover.

If you’re unsure about how many trips you might take in the next 12 months, it may be cheaper and easier to take out an annual multi-trip policy so you know you are covered if you do decide to go abroad.

It’s always best to carefully examine your own circumstances and plans to see which specific type of cover will be more cost-effective and suitable for you.

When Should I Buy Travel Health Insurance?

It’s usually recommended to buy travel health insurance as soon as you’ve booked your trip, or as soon as you’ve made a financial commitment towards it.

This is because it’s best to be covered in the event of your trip being cancelled prior to your departure. Having a valid travel insurance policy will protect you in case any of the following happens:

- Your trip is cancelled due to weather, or other uncontrollable circumstances

- You have to cancel your trip due to personal reasons, such as a bereavement

- You become too ill to travel

- You’re made redundant before your trip

If any of these happen, it may be the case that your insurer could cover some or all of the costs of your trip.

If you’ve left it late to buy travel health insurance before your visit to the UK, it’s still worth looking for insurance providers who will be able to provide you with quick and immediate cover. You just need to ensure that you’ve not yet left home for your trip and that the insurance policy covers everything you need for your visit.

How Much Does Travel Health Insurance Cost?

How much you will have to pay for travel health insurance depends greatly on a number of factors, such as your age, your health, the length of your trip and the complexity of the cover you need.

The specific figures you’ll pay for your insurance will vary based on your country of residence and the insurance company you choose.

Note that the information below uses British travellers buying insurance for trips away from the UK as an example.

The difference between a single trip and annual multi-trip insurance can be reasonably small. For example, British travellers travelling to Europe may pay around £9 for single trip cover but around £12 for annual multi-trip cover.

The average price for older travellers is also much higher. The average price of a single trip cover for British adults travelling to Europe in their 30s, 40s or 50s maybe around £11. However, this figure jumps up to around £30 for people in their 70s, and over £100 for people in their 80s.

How comprehensive your insurance coverage is will also affect the price. A policy that offers higher levels of coverage will cost more than a policy with basic level coverage, as well as offering lower levels of excess.

For British travellers taking our multi-trip cover to Europe, a cover with £1,000 worth of cancellation cover will cost around $17. For £2,000 cancellation cover, this price rises to around £24. For £3,000, it rises again to around £32.

These prices also rise in a similar way when buying couples, group or family travel health insurance cover.

You will also have to pay additional costs on your insurance policy if you have a pre-existing medical condition or choose to add optional extra cover such as for gadgets, winter sports and Cancel For Any Reason coverage.

Which NHS Services Are Free for Visitors?

When you visit the UK, you will be able to take advantage of certain NHS services that you don’t have to claim for on your travel health insurance.

As a result, you will not need to claim on your insurance if you take advantage of these services during your visit. These include:

- A&E services (not including emergency medical treatment if admitted to hospital)

- Family planning services (not including abortions or infertility treatment)

- Treatment for most infectious diseases, including sexually transmitted infections (STIs)

- Treatment required for a physical or mental condition caused by torture, female genital mutilation (FGM), domestic violence or sexual violence (does not apply if you have come to the UK to seek this treatment)

In addition, if you’re visiting the UK and need to see a GP, you can register as a temporary patient with a local GP practice.

You will need to be in the area for more than 24 hours but less than 3 months in order to do this.

However, it will be up to the GP practice whether to accept new patients, even if you’re only looking to become a temporary patient.

Other NHS services, such as hospital treatments and prescription medicines, are not free without a valid EHIC, PRC or S2 form or if you’re from a non-EEA country. You should consider travel insurance packages that provide cover for such medical costs and others outside the NHS services.

For assistance with with your visit to the UK, contact us today.

How Can IAS Help?

If you’re planning to travel to the UK, it’s essential to ensure that you have the right coverage to help assist you in the event of accidents, injury or unexpected incidents.

If you have any questions about your trip to the UK, including what type of insurance you need, what type of healthcare you’re entitled to, or what to do in the event of an emergency, IAS is here to help.

We are specialists and immigration lawyers who specialise in advising visitors to the UK as well as assisting them to obtain the right permits and visas and travelling to the UK. We can help advise you on how to get the right insurance cover for your trip, as well as any other concerns you may have about your visit to the UK.

For more information, don’t hesitate to get in touch with one of our trusted legal advisors on 0333 305 9375 , or contact us through our form online .

We can help you if you need help with your visit to the UK.

Table of Contents

Written by Immigration Advice Service

Editorial team.

This content was developed by a team of researchers, writers, SEO specialists, editors, and lawyers who provide valuable information to those with immigration queries.

Legal Disclaimer

The information provided is for general informational purposes only and does not constitute legal advice. While we make every effort to ensure accuracy, the law may change, and the information may not reflect the most current legal developments. No warranty is given regarding the accuracy or completeness of the information, and we do not accept liability in such cases. We recommend consulting with a qualified lawyer at Immigration Advice Service before making any decisions based on the content provided.

Services we Provide

Need help with an immigration issue? Book a one-to-one advice session with one of our legal caseworkers.

We can complete your visa application on your behalf, taking the stress and hassle out of the process.

Need to submit an application quickly? We can help you complete and send it off in as little as 24 hours.

Ensure you have the greatest chance of a successful appeal with our legal support and guidance.

Related Posts

Living in England as an American

‘The Donald Dash’: 1 in 4 Americans Weigh Emigration After Trump’s 2024 Comeback

Why Are Countries Curbing Immigration?

The 9 best countries for americans to move to .

How to immigrate to Canada from the USA in 4 easy steps (and why are people moving now)

UK Visa for Lebanon Nationals

Digital Nomad Visas for Americans

How Soon Can I Renew My UK Visa Before It Expires

UK Immigration News November Update

Get in touch with our team.

Learn about our professional services and find out how we can help.

Get in Touch

Head Office:

Immigration Advice Service Ashwood House, Ellen Street Oldham, OL9 6QR, United Kingdom

Head Office Phone:

We have over 12 offices across the world, find a branch near you.

Call us now at +44 (0)333 414 9244 or request a call back using the form below.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

All medical conditions considered

Includes 24/7 outpatient medical support

Under 18's with no medical conditions go free

A choice of travel insurance to suit you

We have different types of cover for whatever you have planned. And we consider all medical conditions.

Single-trip cover

Offering cover for anything from a short UK break to a year of travelling around the world

- Covers you for a one-off trip up to 365 days (2)

- Perfect for short or long trips for anywhere in the UK or abroad

- No age limit

Annual multi-trip cover

Travelling more than once this year? An annual multi-trip policy could save you time and money

- Cover for multiple-trips for a 12-month period

- 31-day trip limit, with extensions available up to 45 and 60 days

- Available for everyone aged up to 75 years

Backpacker cover

Looking for a gap year, career break or to travel the world? We could have the cover you're after

- Cover for a one-off trip up to 18 months

- Option to return home for up to 7 days on 3 occasions

- Available for those aged 18 – 60

Medical Assistance Plus: 24/7 holiday health support

Have peace of mind when you travel knowing that health professionals are just one click away.

Medical Assistance Plus (3), powered by Air Doctor, comes free with all our travel insurance policies. It gives you access to outpatient medical support while you’re abroad.

Through the service you can book an in-person or video consultation with a doctor. You can also get prescriptions delivered to your nearest pharmacy.

We’ll send you an SMS reminder about the service the day before you travel (for single-trip and backpacker cover) or the day before your policy begins (for annual multi-trip cover).

(3) Medical Assistance Plus is not available for trips taken in the UK, only for international travel. The service allows up to 3 separate medical events per person listed on the policy, and up to 3 appointments per event. All appointment charges are covered by your travel insurance policy. You will not need to pay any excess fees for this service. You may need to pay for your prescription upfront and claim on your return home.

Living with a medical condition shouldn’t stop you seeing the world. And, with the right travel insurance in place, you can enjoy peace of mind on your adventures – just in case something unfortunate happens.

At Post Office, we cover most pre-existing conditions. Contact us for a quote to see if we can cover you. It’s important to declare upfront all your medical conditions and any medication you're taking.

If we can’t help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777.

Choose a travel insurance cover level

We can offer you a choice of economy, standard and premier cover levels.

Policy wording

(4) Increased to £750 if you bought your foreign currency from Post Office.

Upgrade your cover with ease

Need cover for your policy that's not included as standard? Just pay a little more to add these upgrades – optional or mandatory depending on the trip type.

This optional extra helps protect you from the impact of airspace disruption, natural catastrophes, terrorist acts or Covid-19

If you’re happy with the cover offered, but worried about excess fees, you can opt for an excess waiver. For an additional premium, you can add it to any Post Office level of cover for zero excess fees

Insure all your devices with our easy-to-add gadget cover. It’s perfect to protect all your smartphones, tablets, laptops and consoles

Specialist cover is mandatory for winter sports like skiing and snowboarding. There’s greater risk of emergency costs. Make sure you’re protected on the pistes

If you're going on a cruise, specialist cover is both important and mandatory. It covers missed departure due to breakdown, falling ill on board, being confined to your cabin, lost baggage and more

Trip extensions are available up to 45 or 60 days, increasing from the standard 31 days

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

What is travel insurance?

Travel insurance may be able to protect you against a range of unexpected events. From losing valuables to medical emergencies, and anything else that could spoil your holiday. Take a look at our policy documents to make sure that you’re getting the cover that meets your needs.

Cancellation and cutting short your trip

- Emergency medical expenses

- Missed departure

- Delayed departure

Personal liability and legal costs

We'll repay you for any non-refundable, unused travel and accommodation costs if you have to cancel or cut short a trip due to reasons set out in the policy. This includes pre-booked activities and excursions, car hire, cattery and kennel fees, up to the limits shown

We may be able to help if you need emergency medical treatment, return to the UK (getting you back home) and more while you’re abroad

Missed departure (6)

We’ll also cover any extra travel and accommodation costs you're charged if you arrive too late to travel on your booked transport. As long as they match the reasons set out in the policy

Delayed departure (6)

You’re covered if your first outbound or final inbound international departure is delayed by 4 or more hours. As long as it matches certain reasons set out in the policy wording

Items that are usually carried or worn during a trip are covered if they get lost, stolen or damaged

You'll also get protection for any unexpected legal costs you might be charged while you're away

(6) Delayed and missed departure are only available with our standard and premier cover levels.

An award-winning provider

Best travel insurance provider.

Post Office won a ‘Best Travel Insurance Provider’ award at the Your Money Awards in 2021, 2022 and 2023

Post Office won a “Best Travel Insurance Provider” award at the British Travel Awards in 2023

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Cover you can count on. We’ve paid out over £177 million in travel insurance claims since 2007

Common travel insurance questions, what does travel insurance cover.

Post Office Travel Insurance can cover you for a single trip of up to 365 days(2), or multiple trips in a single year. This applies to trips taken anywhere in the UK and abroad too. We also offer backpacker cover(7) for a single trip of up to 18 months.

The type and level of cover provided depends on the insurance policy type and options you choose. It can include cover for:

- Cancellation

- Cutting your trip short and abandonment of your trip

- Lost, stolen or damaged baggage

- Lost, stolen or damaged passports

- Lost, stolen or damaged personal money

- Personal accidents and liability

- Legal protection

You can add additional cover to your policy. Options include:

- Gadget cover

- Excess waiver

- Trip disruption

- 45- or 60-day trip extensions (on annual multi-trip only)

Winter sports cover is compulsory for winter sports trips and cruise cover is mandatory if you’re going on a cruise. It’s important to check the different travel insurances available, and their various options and add-ons you can buy. This way, you’re sure to be fully covered for your trip and all you’ll do on it.

Why is it important to have travel insurance?

Having travel insurance is a worthwhile purchase for anyone going abroad for their holidays. Even in relatively safe locations such as central Europe, a number of things can go wrong.

Flights can be delayed. Airlines can lose your luggage. Tourist areas may be prone to opportunist thieves who may target your belongings. And you could fall ill anywhere in the world, to the detriment of your holiday plans.

We hope that none of these events happen to you. But, if they do, you could be out of pocket. And with emergency medical problems it could be by tens or even hundreds of thousands of pounds.

Holiday insurance may be able to help avoid some of this risk. It’s a way to insure for travel you, those travelling with you and your belongings.

If your luggage is lost, holiday insurance may not be able to replace it, but the payout from a claim can help recover any costs that you have had to pay to get replacements.

In particular, the medical cover outside of the EU offered by insurance is a necessity.

Within the EU, you may think that an European Health Insurance Card (Ehic) or its replacement, the UK Global Health Insurance Card (Ghic), can cover all your medical needs. This isn’t true. Some of the most expensive medical services, such as repatriation, aren’t covered by the Ehic or Ghic. They're limited to health cover and won’t help at all with things like cancellation, loss or theft. And the Ehic no longer provides access to healthcare for UK nationals travelling to Iceland, Liechtenstein, Norway or Switzerland.

Even if you’re staying in the UK for your break , having holiday insurance will provide cover for lost, damaged or stolen possessions such as baggage, and cancellation, cutting your trip short or delay to your trip in some circumstances.

To qualify for cover on our annual multi-trip policies, UK trips must consist of:

- At least one night's pre-booked and paid-for accommodation, or

- A stay at least 100 miles from your home, or

- At least one sea crossing

Why choose Post Office?

You’re in safe hands with Post Office. We won Best Travel Insurance Provider at the Your Money Awards in 2021, 2022 and 2023. We also won bronze for Best Travel Insurance Provider at the British Travel Awards 2023, voted for by the UK public.

Our premier cover is 5 Star Defaqto Rated. Defaqto is a financial information business, helping financial institutions and consumers make better informed decisions.

We have a range of cover options available to suit lots of different holidays, so you can choose the cover that suits you best. We’re there for our customers when they need us the most; since we launched travel insurance in 2007, we’ve paid out over £177 million in claims.

What cover is there for Covid-19 as standard?

Policies purchased from the 31 March 2022 onwards provide cover if:

- you test positive for Covid-19 within 14 days of your trip and are required to self-isolate by a medical practitioner, the NHS or any UK government body

- a medical practitioner certifies you as too ill to travel due to Covid-19

- you, someone you’re travelling with, or someone you’re staying with is required to self-isolate by a medical practitioner, UK government body or health authority

- you, an immediate relative (8) or someone you plan to travel or stay with dies or is hospitalised due to Covid-19

If an insured trip has to be cut short, the unused portion of it can be claimed for if:

- you test positive for Covid-19 after you’ve left the UK and have to self-isolate

- you test positive on arrival in your destination and are not allowed to continue your trip

- you, an immediate relative (8) or someone you’re travelling or staying with dies or is hospitalised due to Covid-19

There’s also cover for medical and repatriation costs if you fall ill with Covid-19 while away. Call our emergency assistance line and we’ll help you seek treatment or, if needed, arrange to bring you back to the UK.

There’s no other coronavirus cover on our policies, but for extra reassurance you can add our trip disruption cover upgrade option. This gives you added protection against missed departures and expenses incurred due to change of testing or quarantine requirements. Add it to your preferred policy for an extra premium.

For policies sold on or after the 31 March 2022

Should the FCDO advise against all travel to your destination, there's no cover under any section of the policy if you decide to travel.

If the FCDO have advised to only undertake essential travel to a destination and your trip's not essential and you choose to travel, we'll only cover a claim if the cause is not linked to the reason for the FCDO advice. This limitation applies even if you've purchased an optional trip disruption cover upgrade. You may be able to travel with full cover if we authorise in writing that your trip's essential before you depart. Should you like to request this, please email [email protected]

Please make sure you’re clear what’s covered and what’s not. Check the answers to common questions about coronavirus cover and the full policy wording for more details.

Does Post Office Travel Insurance cover medical expenses?

Yes, our travel insurance covers you for unexpected medical expenses. This includes emergency treatment and hospitalisation, plus repatriation if you need it. Cover's provided up to the limit specified in the policy wording for the specific cover level you choose.

Emergency medical assistance

If you need emergency medical assistance, you can call our dedicated team. They're here 24 hours a day, 7 days a week to get you the help you need. Check the correct contact details for your policy on our travel insurance help and support page .

Non-emergency medical support

If it’s not an emergency but you still need to see a medical professional, you can use our Medical Assistance Plus (3) service. This outpatient service is included free with all new Post Office Travel Insurance policies.

Get easy access to medical experts such as doctors, dentists and gastroenterologists. The single online platform can be used wherever you are abroad.

Choose whether you’re seen at a clinic, in your hotel or via an online video consultation. All sessions are in your own language. They even have prescriptions delivered to your nearest pharmacy.

This takes away the stress of finding medical help, so you can kick back and enjoy your holiday to the full.

Do I need travel insurance for UK trips?

We provide cover whether you’re taking a break in the UK or going on holiday overseas. You’re covered if your luggage or personal belongings are lost, stolen or damaged while you’re staying away from home in Britain. And if you have to cancel or cut short your trip in some circumstances, we can cover that too. As long as it matches the reasons set out in your policy.

Our annual multi-trip travel insurance can cover you for UK trips too. The minimum requirements are one night’s pre-booked and paid accommodation. Or your stay must be at least 100 miles from your home. Or you must have at least one sea crossing.

Where can I go on holiday in the UK or overseas?

The UK Government provides guidance on travel 24 hours a day, 7 days a week. Visit the Foreign, Commonwealth & Development Office website for the latest travel information. It lists if it's safe to visit your chosen country. This information can change at short notice. So it's a good idea to check the FCDO page regularly.

Remember, your cover won’t be valid if you travel against the FDCO advice of all travel, and local government advice. Check the latest on the FCDO site or read our where can I go on holiday guide .

Does travel insurance include gadget cover?

Our standard travel insurance policies will only provide limited cover for electronic items such as mobile/smart phones, camcorders and their accessories, all photographic/ digital/ optical/ audio/ video media and equipment, iPods, MP3/4 players or similar and/or accessories, E-book readers, and satellite navigation systems up to the single article limit. The single article limit depends on the cover you’ve taken out. For economy it’s £150, for standard it’s £250, and for premier it’s £400.

Gadget cover is an optional add on you can buy at any time to add protection for your devices. Check the policy wording for full terms.

Do you offer a student discount?

Yes, we do. We’ve partnered with Student Beans to offer a discount to students. To claim it, you’ll need to either register for a Student Beans account (to verify your student status) or log in with your existing account . You’ll be given a unique code, which you’ll need to enter in the promotion code box that appears when getting your travel insurance quote. The discount will be taken off your quote total.

Do you offer a discount for graduates?

Yes, we do. We’ve partnered with Grad Beans to offer a discount to graduates. To claim it, you’ll need to either register for a Grad Beans account (to verify your graduate status) or log in with your existing account . You’ll be given a unique code, which you’ll need to enter in the promotion code box that appears when getting your travel insurance quote. The discount will be taken off your quote total.

- Read more travel insurance FAQs

(7) Backpacker policies only available on the economy level of cover.

(8) Immediate relative: your mother, father, sister, brother, spouse, civil partner, fiance/e, your children (including adopted and fostered), grandparent , grandchild, parent- in- law, daughter-in -law; sister-in-law, son-in- law, brother- in- law, aunt, uncle, cousin, nephew, niece, step-parent, step- child, step-brother, step-sister or legal guardian.

Need some help?

Travel insurance help and support.

For emergency medical assistance, to make a claim, find answers to common questions about our cover or get in touch:

Visit our travel insurance support page

We’re here to help on your travels

Access your travel insurance policy anywhere.

You can buy travel insurance and view your policy all in our free Post Office travel app. Plus you can order and top-up our Travel Money Card wherever you are too

Travel money made easy

Buy your travel money online. You can click and collect from a branch near you or choose next-day delivery to your home

Related travel guides and services

Don’t let illness spoil your perfect holiday – book an online doctor

There’s nothing worse than falling ill while away from home. Along with the worry of the cost of visiting a doctor and getting treatment, being poorly can put a real ...

Travelling while you work or vice versa

The opportunities to combine business and leisure have never been greater. You could be planning some ‘bleisure’ time, taking a ‘workation’ or diving into becoming a ...

Gap year travel advice for solo travellers

Exploring the globe can be scary, but there’s so much to find at the edge of your comfort zone. We look at some of the top destinations to visit on your own – and share ...

Post Office Travel Insurance Winter Sports Survey

With the winter sports season upon us, we conducted a Winter Sports Survey for the second year running. It found as many as four in 10 UK travellers (39%) planned to ...

What to do if your airline or holiday company goes bust

Finding out that your airline or holiday company has gone bust is a shock – especially if you’re on holiday at the time. But there are plenty of laws and regulations in ...

The Travel Safety Index for Solo Travellers

Travelling solo means freedom and independence, making new connections and never having to compromise.

Travel insurance for Japan

If you’re jetting off to Japan soon make sure you have good travel insurance to cover your trip. The right policy may offer more protection than the standard medical ...

Travel insurance for South Africa

How safe is South Africa to visit and why is having travel insurance important when you go? Our guide looks at the potential travel risks and the cover you may want to ...

Travel insurance for New Zealand

Find out what medical care Brits can access in New Zealand and travel risks to be aware of like natural catastrophes, however rare.

Holiday packing and pre-travel checklist

So, you’ve booked your flights, accommodation and activities. What next?

Travel insurance for Dubai

Planning on living the high life with a trip to the UAE’s iconic mega-city, Dubai? Make sure you’re aware of the local culture, travel risks and have travel insurance to ...

Don't make these holiday mistakes

Booking a last-minute holiday can get the blood pumping with the sudden thrill of adventure, but it also makes it easier to overlook things.

Travel insurance for Mexico

Find out about medical care available to Brits in Mexico, as well as travel risks, transport options and the importance of taking travel insurance.

Travel insurance for Italy

Find out about the safety of travelling to Italy as well as the medical care available to Brits and how to get around.

Travel insurance for Egypt

Make sure you’re travelling safely in Egypt with the latest advice and risks, and learn about getting around and local culture.

Travel insurance for France

It may be a short hop away, but a trip to France is not without its travel risks. Make sure you’re clued up on what they are and have travel insurance in place to help ...

Travel insurance for Canada

Canada is a vast country of diverse delights – everything from bustling cities to snow-capped mountains, deep forests and crystal clear lakes. If you're thinking of ...

Travel insurance for India

For many UK holidaymakers, India is an intriguing and diverse culture with colourful traditions and engrossing history. For many others, it’s a home from home.

Travel insurance for Thailand

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting alternative scene are a draw for Brits. A trip can be a once-in-a-lifetime event.

Travel insurance for Cuba

Today, Cuba is more accessible than it has been for many decades, and those who decide to holiday there can expect a mixture of colourful city life and luxurious ...

Travel insurance for Ireland

Do UK residents need travel insurance for Ireland? And what healthcare is available for Brits if they’re visiting the country?

European and Global Health Insurance Cards

If you're travelling to an EU country from the UK, make sure you take a Global Health Insurance Card (Ghic) with you or existing European health Insurance Card (Ehic), ...

When to buy travel insurance

Do you need travel insurance for your trip? Is travel insurance worth it? And, if yes, when is the right time to buy cover?

Safe travels: where can I go on holiday?

Travel’s a great way to unwind, see the world, open the mind and expand horizons. But rapidly changing situations around the world can soon impact such plans.

Travel insurance for the Canary Islands

People flock to the Canary Islands from all over Europe. No wonder, with such appealing beaches, landscapes and temperatures to enjoy.

Travel insurance for Greece

Greece and the Greek islands have long been a popular travel destination for us Brits. But are there any travel risks or other factors to keep in mind before and when ...

Do I need travel vaccinations?

There’s no better feeling than planning an amazing trip to an exotic destination. Make staying safe with travel vaccinations top of your to-do list.

Find hot holiday destinations any time of year

If you're the type of sunchaser who looks forward to that sizzling summer break, can’t wait to escape to warmer climes in the UK’s winter months or can't be away from ...

Travel insurance for the Balearic Islands

It’s one of the most popular holiday hotspots for UK holidaymakers. But what can you expect from a trip to the Balearics?

How to pack a suitcase

Whether you’re heading to the beach for a much-needed break or boarding a boat for a cruise somewhere breath-taking, it’s important to know what to pack in advance so ...

How to get assisted travel at airports

Lots of people who need assisted travel at airports are missing out simply because they don’t know how to go about asking for it.

How to protect your travel documents

Everything you need to know about embassies

Learn the difference between embassies and consulates, and why you might need them when travelling.

Do I need travel insurance for a UK break or staycation?

Travel insurance for a holiday in the UK isn't something you must have, but it might be something you want to have.

Top tips for going to festivals overseas

With festivals overseas becoming the new norm, festivalgoers need to do a bit more planning than for a UK festival.

10 ways to look after your valuables at the beach

The whole idea of lounging around on the beach is to switch off and enjoy the sunshine. But the reality is that opportunistic thieves are on the lookout for unattended ...

Great tips for people travelling alone

Whether you’re travelling solo because of business, you’re hoping to meet someone, or simply because you enjoy it, being by yourself can sometimes be a daunting prospect ...

8 tips on staying safe while you enjoy your winter sports

The white stuff is alluring, so make sure you can enjoy it safely, are ready for the unexpected and pack travel insurance for extra reassurance.

Vaccinations needed for Thailand

Some vaccinations for Thailand are recommended and some are mandatory in certain circumstances. It’s important to know which vaccinations or injections for Thailand you ...

How to get a free flight upgrade

There are several ways to get to the top of the class on your flight – whether that's business or even first.

What is ATOL protected?

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure consumers are covered if travel firms fall into financial difficulties.

What is ABTA?

Over 60 million people travel from the UK most years for holidays or business. The vast majority enjoy smooth, trouble-free journeys. Sometimes, though, things go wrong.

10 tips for keeping kids safe on holiday

We all know the feeling – getting to the airport, then a wave of panic comes over you. Did you remember your passport? What time's the flight? And where on earth did you ...

Kids’ travel insurance

It's a proud feeling when children turn eighteen and start holidaying on their own. Although, perhaps it's tinged with a feeling of relief. But you can't help but worry ...

Family travel insurance

If you're travelling abroad as a family, it makes sense to take out insurance that covers you all. Especially if you have little ones.

Worldwide travel insurance

Fancy trekking in a remote Asian rainforest? A wild time in New York? Flying over Niagara Falls in a helicopter? Or maybe taking in the sights of Athens or Rome?

10 best holidays to take teenagers on

Holidays for teenagers can take some imagination to make sure they’ve got the right mixture of destination, activity and social life – and make sure you have a great ...

How to travel with your dog

Taking your best friend on holiday with you is everyone's ideal situation, but travelling with a dog can be a complicated process. Make sure you know how.

Need a holiday? These travel hacks could save you money

Satisfy your travel craving while making your holiday budget go further. We’ve gathered tips to help you cut out costs and hassle – and enjoy a well-earned break.

Getting travel insurance for an adventure holiday

Adventurous holidays can take many forms, from action-packed itineraries in unusual places to taking part in the odd activity during a more traditional break.

Schengen travel insurance

The status of Schengen visas for international students resident in the UK is currently uncertain. This page will be updated when more detail is available.

Travel insurance for Spain

Every year, millions of holidaymakers from the UK head to Spain for its combination of glistening beaches, unique culture and Mediterranean cuisine.

Travel insurance for Turkey

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder it’s so popular with holidaymakers from the UK and elsewhere.

Travel insurance for USA

The famous cliché of America is that it's big. And it is. Across its six time zones are examples of virtually every type of geography on earth, from the baked deserts of ...

Travel insurance for Australia

Heading down under for a trip to or around Australia? Make sure you’ve got the right level of travel insurance cover for where you’ll be going and what you’ll be doing.

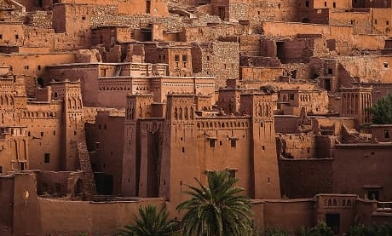

Travel insurance for Morocco

Perched on the northern tip of Africa, Morocco’s long been a popular destination for UK holidaymakers. If you’re heading there soon, make sure you’ve got good travel ...

What you should do about delayed, lost or damaged luggage

The last thing you want to happen on holiday is standing the luggage carousel at the airport waiting for bags that don't appear. It's a huge inconvenience that can cost ...

Teenagers going on holiday without their parents

Having your son or daughter go on holiday without you for the first time can be one of the most traumatic experiences for a parent, but one of the most exciting for a ...

A complete list of backpacking essential items

Going backpacking is one of life’s great adventures. But before you set off you’ll need some packing tips so you're not weighed down on the way.

Is Airbnb safe? Tips on staying safe

The arrival of Airbnb has helped to transform the travel industry in recent years. On any one night, over two million people stay in homes advertised through Airbnb in ...

Travel insurance for cancer patients

If you're living with cancer but love to travel, can you get travel insurance for your trip?

Travel insurance for people with high blood pressure

Travelling with high blood pressure is fine – but it’s important to make sure you’ve got the right cover in case something goes wrong abroad.

Travel insurance for seniors and pensioners

As you get older, being able to go where you want when you want is all part of the joy. And changes in your medical needs shouldn’t stand in the way of your desire to ...

Travel insurance for diabetics

You should be able to get the right cover to travel abroad if you’re diabetic, making sure that your medical needs are taken care of.

Tips for travelling with grandchildren

Enjoy that precious time away with your grandchildren, and take some of the pressure off by getting good travel insurance – just in case something goes wrong.

Travelling without insurance

In an average year, millions of Britons go abroad without the right travel insurance – or even without any cover at all. Are you one of them?

Travel tips for babies, toddlers and young kids

It’s your holiday too, and good preparation can take some of the worry out of travelling with your littleuns.

What can I take on a plane?

Ready to jet off on a much-needed break but worrying about what you can take with you on the flight?

Flight delays and compensation

Most of the time, getting a flight is a hassle-free event. If you only take hand luggage, have your boarding pass saved to your phone and everything’s running to plan ...

Winter sun holiday destinations to escape to

Dark mornings, cold hands, heating bills and chapped lips are among the most disliked things about the British winter, according to our new study. Half of the nation ...

Travelling during your pregnancy

Before your little bundle of joy arrives, you may be considering taking a holiday. But is it safe? And what precautions should you consider before making a booking?

About our travel insurance

Post Office® Travel Insurance is arranged by Post Office Limited and Post Office Management Services Limited.

Post Office Limited is an appointed representative of Post Office Management Services Limited which is authorised and regulated by the Financial Conduct Authority, FRN 630318. Post Office Limited and Post Office Management Services Limited are registered in England and Wales. Registered numbers 2154540 and 08459718 respectively. Registered Office: 100 Wood Street, London, EC2V 7ER. Post Office and the Post Office logo are registered trademarks of Post Office Limited.

The above details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

Things you need to know

(2) For economy, standard and premier policies, the single-trip policy will cover you for one trip up to:

- 365 days for persons aged up to and including age 70

- 90 days for persons aged between 71 and 75

- 31 days for persons aged between 76 and above

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Foreign travel insurance

If you’re travelling abroad, you should take out appropriate travel insurance before you go.

If you travel internationally you should buy appropriate travel insurance before you go, covering you for existing physical or mental health conditions (including those currently under investigation) and any activities you will be doing whilst you are away.

If you do not have appropriate insurance before you travel, you could be liable for emergency expenses, including medical treatment, which may cost thousands of pounds. For example:

You should buy your travel insurance as soon as possible after booking your trip. Read the small print and familiarise yourself with any exclusion clauses for the policy.

The Association of British Insurers (ABI) represents over 300 insurance and long-term savings firms. Read the ABI’s advice on travel insurance , and their guide on choosing the right travel insurance policy . In addition, see the MoneyHelper travel insurance directory for further information.

In addition to making sure you have appropriate insurance, you should also check Foreign, Commonwealth & Development Office (FCDO) travel advice and sign up to alerts for your destination. If you travel to a destination where FCDO advises against all but essential travel or all travel, your insurance may be invalidated.

When you travel, make sure you take your insurance policy details with you, including the policy number and your insurer’s emergency assistance telephone number. Share your policy details with people you’re travelling with and friends or family at home, in case they need to contact your insurance company on your behalf.

What your travel insurance should cover

Check whether your policy covers:

- the full length of your trip (many policies have a maximum trip length and/or an annual limit on how much time in total you can spend outside the UK)

- treatment in state or private hospitals (emergency treatment and hospital bills can be enormously expensive)

- emergency transport, such as an ambulance: this is often charged separately to other medical expenses and emergency travel home on medical grounds can be very expensive

- pre-existing medical conditions: declare existing conditions or pending treatment or tests so that you are covered if there are related complications during your trip; failing to declare something may invalidate your travel insurance

- all activities you may undertake on holiday, such as sports or adventure tourism (you may need specialist insurance or an add-on for some activities)

- all the places you intend to visit, even if only in transit, in case anyone needs emergency treatment in a transit country

- repatriation costs if you or a family member die abroad

- getting home after medical treatment if you cannot use your original ticket

- reasonable costs for a family member or friend to stay with you, or travel out to accompany you home if required

Check also whether:

- the insurance provider has 24-hour assistance helplines to offer support and advice about appropriate treatment

- the insurance policy provides cover if an airline or travel agent goes out of business – typically this is not covered. ATOL is a consumer protection scheme for air holidays and flights, managed by the Civil Aviation Authority (CAA) . Choose an ATOL-protected holiday or a travel insurance policy that includes airline or supplier failure cover

If you are going on a cruise, check the booking conditions of the operator you plan to sail with as cruises generally require an additional level of cover because it is more difficult to get to hospital for treatment.

Specialist health and medical insurance

If you have a serious medical condition, you may need a specialist insurance provider or policy. The British Insurance Brokers’ Association (BIBA) has a Travel Medical Directory which has a list of specialist providers who cover serious medical conditions.

A Global Health Insurance Card (GHIC) or European Health Insurance Card (EHIC) allows you to access state-provided medically necessary healthcare within the EU, Switzerland and some other countries on the same terms as residents of these countries.

EHIC and GHIC are not alternatives to travel insurance as they do not cover any private medical healthcare costs, repatriation or additional costs such as mountain rescue in ski resorts.

Some insurers may waive any excess on medical treatment if you use an EHIC or GHIC. Check the terms of your policy or contact your insurer to see if this is the case.

Find out more about the EHIC and GHIC, including how to apply for one free of charge .

Policy exclusions to look out for

Check how or whether an insurance policy covers:

- alcohol and drugs: most travel insurance policies do not cover events that happen after you have drunk excessive alcohol or taken recreational drugs or other substances

- high risk destinations: many travel insurance policies will not cover travel to a high risk destination where the Foreign, Commonwealth & Development Office (FCDO) advises against all but essential travel or all travel. Check your policy wording and the relevant country travel advice pages before booking your trip and buying insurance

- mental health conditions: you must declare mental health conditions or risk invalidating your policy. Be aware that some may exclude cover for treatment related to a pre-existing mental health condition. See foreign travel advice for people with mental health issues for more guidance

- age restrictions, particularly if you are buying an annual policy: read the Money Advice Service and the ABI guidance on insurance for older people (PDF, 411 KB) for advice on how to choose the right level of cover, get the best deal, make a travel insurance claim and guidance for travellers over the age of 65 or with pre-existing medical conditions

- sports such as bungee jumping, jet skiing, winter sports or skydiving: these are not usually included in standard policies

- use/hire of quad bikes or mopeds: they are not usually covered

- driving overseas: if you’re hiring a car, check what you’re covered for with the hire company; if you are driving your own vehicle, check your motor insurance policy to see what it covers; check our advice on driving abroad

- terrorist acts: most travel insurers offer only limited cover for terrorist acts but some offer policy add-ons to provide additional cover if there is a terrorist attack in your destination; this may include cancellation cover, if your destination is affected by a terrorist attack before your trip and you no longer wish to travel; as a minimum, make sure your policy covers you for emergency medical expenses and travel home if you are caught up in an attack

- natural disasters (such as an earthquake or tropical cyclone): some policies only offer limited cover for claims related to or caused by a natural disaster

- civil unrest, strikes or other industrial action: you may not be covered for some claims that arise from these kinds of incidents, especially if they were known publicly when you booked your trip and/or bought your travel insurance policy

Insurance for extended periods of travel

‘Long-stay’ travel insurance can cover extended periods of continuous travel. Check carefully the maximum duration allowed in any policy you consider buying to ensure that it meets your needs.

Make sure that the entire policy meets your needs, including specific activities and work (paid or unpaid) you may undertake.

Insurance if you live abroad or go for work or study

Travel insurance is not intended for permanent residence abroad. If you live overseas, or you’re planning to move to a different country to live, work or study, you should consider your insurance needs carefully.

Read the healthcare guidance in the Living in country guides for the country where you live to ensure you have the right healthcare arrangements for your circumstances.

You can buy private medical insurance for UK expatriates. Local law may require you to have medical insurance, including as part of a visa application.

You can buy insurance from local providers abroad. You should always check policies carefully, including seeing whether you could transfer medical cover if you re-locate to other countries in the future.

Support for British nationals abroad

Support for British nationals abroad explains how the FCDO can provide support to British nationals if things go wrong abroad.

Updates to this page

Guidance fully reviewed and updated, including updated costs of emergency treatment. New 'Specialist health and medical insurance' section added.

Reviewed and updated guidance in full.

Updated guidance on using an EHIC or GHIC to access healthcare in Switzerland.

Updated to reflect new rules for travelling to amber list countries.

Updated COVID-19 section on new rules for international travel from 17 May.

Updated to reflect current COVID-19 travel guidance

New link to the declaration form for international travel (for England), from 8 March.

Edited grey box at top of page to provide further information on requirements coming into affect from 15 February

From 15 February you will need to quarantine in a government-approved hotel if you arrive in the UK from countries on the travel ban list.

Updated with new requirements coming into effect from 4am on 18 January 2021.

Updated with information on pre-departure testing for everyone travelling into England and Scotland.

Updated to reflect latest UK COVID-19 restrictions.

Updated the section on travel to Iceland, Liechtenstein, Norway and Switzerland, to reflect changes from 1 January 2021.

Updated ‘Travel to the EU’ section to reflect that UK-issued European Health Insurance Cards (EHIC) will still be accepted in EU countries, with different guidance for people travelling to Norway, Iceland, Liechtenstein and Switzerland from 1 January 2021.

Updated COVID-19 travel guidance

Updated to reflect the latest Tier-based COVID-19 rules for England

Updated to reflect the 5 November national restrictions for England relating to travel

Updated EU travel section with information on EHIC validity

New information on making sure your travel insurance covers you for coronavirus-related events

Update to contents including addition of new segments; travel insurance after starting travel or changing your plans, making a travel insurance claim, other financial protection and if you’re not covered.

Added information on financial protection of package holidays.

Information on the use of European Health Insurance cards (EHIC) in the event of a no deal added to the EU Exit update section

EU Exit update with advice on checking insurance coverage when travelling to Europe after the UK leaves the EU.

Content and format changes

Inclusion of Association of Travel Insurance Intermediaries (ATII) information.

Updated information on travel insurance

First published.

Sign up for emails or print this page

Related content, is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Health Insurance

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- The Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

International Health Insurance for Expatriates in the United Kingdom