Lead-to-Cash, the cornerstone of your business

An efficient Lead-to-Cash process is a cornerstone of business success, influencing revenue, customer satisfaction, operational effectiveness, and overall competitiveness in the market. Businesses that prioritize and optimize this process can achieve sustained growth and resilience in a dynamic business environment.

The Lead-to-Cash (L2C) process is a comprehensive business workflow that spans from the initial generation of a sales lead to the collection of cash or payment for the goods or services provided. It encompasses various stages of the customer lifecycle and involves multiple departments within an organization.

The Lead to Cash process typically includes the following key areas:

- Lead management

- Product Data management

- Order Management and Procurement

- Account Receivables

- Account payables

- Customer onboarding and customer data management

Why ServiceNow?

ServiceNow can be used to manage most if not all parts of the Lead-to-Cash process. Here are some reasons to use ServiceNow:

- ServiceNow provides a unified platform that can integrate various business processes, including lead management, order fulfilment and customer support. Having a centralized system can streamline communication and data flow across different stages of the Lead-to-Cash process.

- ServiceNow excels at workflow automation. It can automate routine tasks, approvals and notifications, reducing manual effort and improving efficiency. Business logic can be added to automate purchase order creation to vendors and automated fulfilment of orders.

- ServiceNow is cconfigurable, allowing organizations to tailor it to their specific business needs. This adaptability can be advantageous for accommodating variations in the Lead-to-Cash process based on industry, business model, or specific requirements.

- ServiceNow can integrate with various third-party applications and systems, such as CRM tools, billing systems, and marketing platforms. This ensures a smooth flow of data between different stages of the Lead-to-Cash process and avoids data silos.

- ServiceNow’s service catalog and request management capabilities can be leveraged to streamline the ordering and fulfillment stages of the Lead-to-Cash process. This can include creating requests for new services, managing product configurations, approvals and tracking order status.

- ServiceNow provides analytics and reporting tools that can help organizations track key performance indicators (KPIs) related to the Lead-to-Cash process. This data-driven approach enables better decision-making and continuous process improvement.

At Sofigate we have implemented several projects related to different phases of the Lead-to-Cash process. Join us in our upcoming webinar , where we’ll show real-life examples and discuss the implementation of different phases of the Lead-to-Cash process. Depending on the license agreement, customers have different options on how to implement certain requirements, we will explain some of these in our webinar.

Olga Antonova is a Delivery Manager at Sofigate. Olga and her team specialize in helping IT and telecom service providers. Olga has been working with processes and service management tools for the last 15 years.

Related Insights

Diverse Paths, Shared Goals: Laura and Erkki show that different backgrounds create a great culture for learning

Public savings do not come from development cuts – but from investing in development

Managing DORA Compliance with ServiceNow

The Ultimate Guide to Understanding the Lead-to-Cash Cycle

F or every business cash is the lifeblood and needs to generate enough cash from its activities so that it can meet its expenses. A Lead-to-cash cycle is essential for any business since it helps achieve efficient revenue generation by streamlining the entire sale process from start to finish. Grow Asia makes this end-to-end, top-level business cycle more resilient beginning with marketing and ending with revenue collection. This L2C cycle involves several key stages:

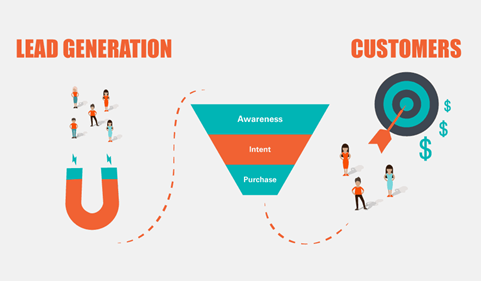

Lead Generation :

This is the initial stage where businesses identify and generate potential leads or prospects. Leads can come from various sources such as marketing campaigns, website visitors, social media, trade shows, or referrals.

Lead Generation

Lead Qualification :

Not all leads are equal. In this stage, businesses assess the quality and potential of each lead. This typically involves determining whether the lead has a genuine interest in the product or service and whether they meet the criteria of an ideal customer.

Lead Qualification

Sales Engagement :

Once a lead is qualified, it is handed over to the sales team. Sales representatives engage with the lead to nurture the relationship, provide information about the product or service, address questions and concerns, and ultimately persuade the lead to make a purchase.

Sales Engagement

Quote/Proposal and Negotiation :

In some cases, particularly in B2B (business-to-business) sales, a formal quote or proposal is generated for the lead. This document outlines the terms, pricing, and other details of the sale. Negotiations may occur at this stage as the lead and the sales team work out the specifics.

Closing the Deal :

This is the stage where the lead commits to making a purchase. It involves signing contracts or agreements, making payments, and formalizing the sale.

Closing the Deal

Order Fulfillment :

After the deal is closed, the business must fulfill the order. This could involve delivering a product, providing a service, or making the necessary arrangements based on the nature of the sale.

Order Fulfillment

Invoicing and Payment:

In this stage, the business issues an invoice to the customer, specifying the amount due and payment terms. Once the customer pays, the revenue is captured.

Invoicing and Payment

Customer Relationship Management (CRM):

Maintaining a good relationship with the customer is crucial for future sales and customer retention. This stage involves post-sale support, addressing customer inquiries, and ensuring a positive customer experience.

Customer Relationship Management (CRM)

Revenue Recognition :

This is an accounting process where the revenue generated from the sale is recognized on the company’s financial statements. The timing of revenue recognition can vary based on accounting standards and the nature of the transaction.

Revenue Recognition

Analytics and Feedback :

Throughout the lead to cash cycle, data is collected and analyzed to improve the process. This includes tracking conversion rates, customer feedback, and other key performance indicators to identify areas for optimization.

Analytics and Feedback

Lead-to-Cash cycle is a comprehensive business process that encompasses the entire customer acquisition and revenue generation journey within an organization. A well-implemented process can optimize a business’s operations, enhance customer satisfaction, and contribute to the overall growth and profitability of the company.

Send us an email on [email protected] – we can help you work through this process.

Related items

Explore Offshoring 2.0

In today’s dynamic business landscape, companies harness offshoring to unlock global talen

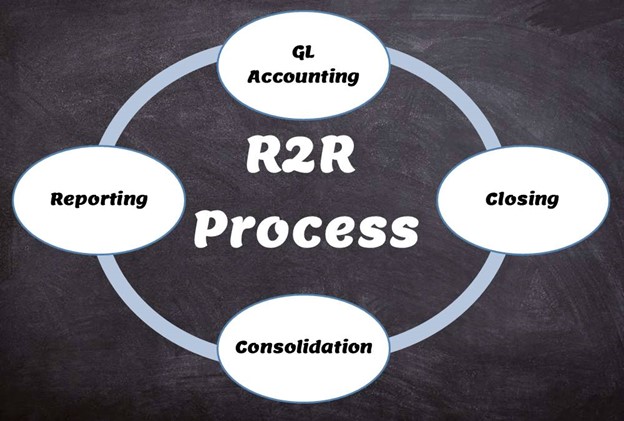

Understanding the Key Components of the Record-to-Report Cycle

In today’s dynamic world, Record to Report is a key part of the financial management and r

Top 10 ways to develop a winning mindset for customer service and collection roles

Developing a winning mindset is essential for excelling in customer service, collections,

Write a Comment (Cancel reply)

Your email address will not be published. Required fields are marked *

- Lead to Cash

What is Lead to Cash?

The L2C process covers all aspects of customer interaction, from the first contact to the final payment.

It captures the entire B2B sales cycle, typically lasting four to seven months , and involves collaboration between numerous departments and personnel. It’s naturally complex, and challenges are embedded in every stage of the journey.

To build smoother, more efficient L2C processes, forward-thinking companies invest in innovative tools like Configure, Price, Quote (CPQ) software.

CPQ supports and enhances each step of L2C, delivering superior customer experiences and tightly aligned operations from sales to manufacturing.

A well-executed L2C strategy, augmented with the right technological solutions like CPQ, can be decisive in winning and retaining customers.

This article explores the L2C process in detail, alongside challenges and opportunities for transformation and improvement.

Introduction to the Lead to Cash (L2C) Process

The L2C process is integral to business operations.

It encompasses the entire journey from the first interaction with a potential customer to finalizing a sale and service delivery.

Here’s an overview of the critical steps:

1. Lead Generation and Qualification

Businesses kick off the L2C journey by identifying and capturing potential customer leads.

This involves diverse strategies like digital marketing, networking events, and leveraging social media platforms to generate a list of potential leads interested in the company's products or services.

Once leads are generated, they undergo a qualification process, considering criteria such as the potential customer's interest level, purchasing power, and compatibility with the product or service.

2. Lead Nurturing

Qualified leads are then nurtured , which means building and maintaining relationships pre-sale.

Nurtured leads have a 23% shorter sales cycle and tend to make larger purchases, so this step is crucial in converting leads into tangible sales opportunities.

Communication strategies like personalized emails, targeted content, and regular follow-ups keep the company's offerings at the forefront of the lead's mind.

3. Sales Quote and Proposal Creation

Here, the focus shifts to crafting persuasive proposals and quotes tailored to each potential customer's specific needs and requirements.

This step is crucial in convincing the leads about the value proposition of the company's offerings.

The more complex products are, the more critical accurate quotes and proposals become. They ensure alignment between customer expectations, the teams involved in bringing those to life, and the final product.

4. Negotiation and Contracting

Negotiation and contracting involve finalizing the terms and conditions of the sale.

This includes pricing agreements, delivery schedules, and other contractual details crucial for closing the deal. Close collaboration between sales and finance teams is vital.

5. Billing and Invoicing

Once a sale is agreed, the process moves to billing and invoicing. This phase ensures invoices are generated promptly and accurately reflect the details of the sale agreement.

Smooth and efficient billing processes are key to delivering a delightful customer experience. Hold-ups or errors are frustrating on the buyer side and can ruin an otherwise frictionless L2C process.

6. Payment Terms

This stage, involving accounts receivable, ensures invoice payment terms are agreed.

Payments are either settled pre- or post-production or delivery or split between stages depending on the business relationship, transaction/order volume, risk, and other factors.

7. Fulfillment and Delivery

After payment terms are agreed, the focus shifts to manufacturing, fulfilling, and delivering the product or service.

This includes all activities related to the preparation, shipping, and execution of services as per the agreement.

8. Customer Service and Support

The final stage, post-sale customer interaction and support, is vital for customer satisfaction and retention. Studies show that 85% of B2B buyers value quality customer service as much as the product's performance.

This after-sales phase cements long-term customer relationships by addressing needs that arise after purchase. It involves providing excellent service, responding to customer queries on time, and handling any feedback or complaints with care.

Challenges in the Lead-to-Cash Process

The L2C process is inherently complex, especially given the length of B2B sales cycles and the average number of stakeholders involved (which is 11, according to Gartner .)

Challenges are embedded within each process, from the initial generation of leads to aftercare support.

Let’s explore the leading L2C challenges companies face in detail.

Inefficiencies in Manual Processes

L2C involves collaboration and communication between numerous departments.

Typically, the sales team handles lead generation and nurturing before deals progress to design and product teams and, eventually, accounting, manufacturing, and after-sales support.

Manual tasks such as data entry, document processing, and manual tracking of sales and customer interactions can severely hamper the L2C pipeline at every juncture, leading to:

- Increased Error Rates : Manual entry and processing increase the risk of errors in customer data, order details, and financial transactions. Error rates are generally around 1% , which mounts up across the entire L2C pipeline.

- Delayed Responses : Manual handling of customer inquiries and order processing can result in slower response times, affecting customer satisfaction.

- Reduced Workflow Effectiveness : The reliance on manual tasks can lead to efficiency-killing bottlenecks.

- Higher Operational Costs : Manual processes require more labor and resources, which increase costs and come directly off a company's bottom line profits.

Data Management and Integration Issues

Effective data management and integration are crucial to building a slick L2C process.

Well-integrated systems furnish businesses with analytics and insights to improve processes. 67% of companies use data integration to support analytics and business intelligence (BI).

However, the majority struggle to manage integration efficiently or use their data effectively, which has negative impacts:

- Inconsistent Customer Data : Disjointed systems can result in erratic and incomplete customer profiles, affecting personalized service and sales strategies.

- Impaired Sales Forecasting : Lack of integrated data hampers accurate sales forecasting, essential for strategic planning and inventory management.

- Inefficient Order Processing : Poor data integration can lead to inefficiencies in order processing, from sales to fulfillment.

Navigating Varied Customer Preferences and Channels

Customer preferences are exceptionally diverse today, the impacts of which are felt throughout the L2C process. For instance, millennial buyers have increased by over 70% in recent years , driving a shift from in-person sales to their preferred online sales channels.

Catering to varied customer preferences across channels requires a balance between personalization and operational efficiency:

- Customization Needs : Addressing specific customer demands for product customization can complicate order management and production.

- Varied Pricing Structures : Offering flexible pricing options and catering to different customer segments while maintaining profitability introduces complexity.

- Cultural and Regional Differences : Navigating cultural and regional differences in customer behavior, compliance, and expectations presents communication challenges, particularly at the sales end.

Communication Breakdown in Custom or Complex Orders

Effective communication is fundamental to managing custom or complex orders within the L2C process.

Demand for custom orders has soared recently, with B2B buyers expecting in-depth product personalization. This increases product complexity, which in turn increases L2C complexity pre- and post-order.

Custom orders need to be effectively communicated between teams. Miscommunication, in particular, becomes a key issue that can slow the cycle down and lead to:

- Production Errors : Lack of clear communication can result in production errors, impacting the quality of the final product.

- Order Delays : Misunderstandings in order specifications can lead to delays in order fulfillment.

- Increased Costs : Inaccurate or incomplete communication can cause rework and waste, increasing production costs.

- Customer Dissatisfaction : Failures in accurately delivering custom orders can result in customer dissatisfaction and potential loss of future business.

Compliance and Security Concerns

The L2C process sends, receives, and processes sensitive or personally identifiable information (PII) data at almost every step. Failing to protect that data can lead to non-compliance and an increased risk of data breaches.

The vast majority of businesses state they wouldn’t purchase from a company they don’t trust with their data, so demonstrating trust and security credentials throughout the L2C process is paramount. This involves:

- Data Security : Implementing and continuously updating robust security measures is crucial to protect sensitive customer and transaction data from cyber threats.

- Regulatory Compliance : Businesses must adhere to a range of local and international regulations related to data privacy (like CCPA or GDPR), financial reporting, and industry-specific standards to ensure compliance.

- Audit Trails : Maintaining transparent and accurate records for auditing is vital. This involves using reliable systems that can track and document each step of the L2C process accurately.

- Secure Communication : Ensuring secure and confidential communication of customer details between personnel and teams is a major challenge without safe transmission protocols.

How CPQ Systems Address L2C Challenges

Configure, Price, Quote (CPQ) systems streamline the complex process of gathering customized orders from sales and shepherding them through manufacturing to fulfillment.

These tools simplify the intricate details required to produce and deliver products to each client's specifications by assisting in:

- Configuration : Helping sales teams or customers select suitable product options and features based on specific requirements, ensuring valid and feasible configurations.

- Pricing : Using an automated no-code engine to calculate prices, factoring in customizations, quantities, discounts, and special customer agreements.

- Quoting : Producing detailed and precise sales quotes with comprehensive information, including product descriptions, sales drawings, pricing, delivery schedules, and terms.

CPQ’s features combine to support the end-to-end L2C process, from collecting and quoting orders to manufacturing and after-sale data integration.

Let’s explore these benefits in detail and how they combat the challenges of L2C processes.

Enhancing Pricing and Quotation Accuracy

CPQ technology improves accuracy across pricing and quotations, some of the first processes handled in the L2C cycle.

Here, CPQ effectively manages complex pricing models, ensuring every quotation is accurate and consistent. This ensures alignment across the remainder of the cycle through to production.

- Handling Complex Pricing : CPQ systems adeptly navigate various pricing models, including bulk discounts and promotional offers.

- Consistent Quotation Accuracy : Ensuring consistent accuracy across all quotes, CPQ technology reduces errors and protects credibility.

Personalizing the Customer Experience

Robust CPQ systems elevate the customer experience by offering interactive and personalized sales features and guided selling. These tools allow customers to configure products visually in 3D and augmented reality alongside a sales rep or independently online.

Sales reps benefit from a visual product configured with in-built guided sales scripts, helping them serve the customer and meet the demand for complex, custom products with thousands of options.

Customers benefit from the ability to self-serve. They also gain a crystal clear visual understanding of their final product before committing to a purchase. This transparency reduces purchase anxiety and boosts conversion rates by 40% (the average for Epicor customers.)

Integrating for Efficient Data Management

By integrating with CRM, ERP, CAD, and other back-office systems, CPQ software slots right into modern enterprise workflows, supporting efficient data management across the L2C cycle. It bridges the communication gaps between sales, engineering, manufacturing, finance, and operations, building a seamless data flow.

- Bridging Departmental Gaps : CPQ integration connects various teams, ensuring consistent communication and collaboration.

- Real-Time Data Sharing : It facilitates real-time data exchange across departments, enhancing operational efficiency and decision-making.

Reducing Manual Workloads

Automation is central to CPQ, streamlining processes from when a product is ordered to when it enters production.

For example, CPQ solutions like Epicor CPQ auto-create CAD drawings, bills of materials (BOMs), and other manufacturing information to ensure engineering and shop floor teams are readily equipped with the data they need to begin production.

Tight alignment between what the customer orders and the end product enables a more cohesive L2C cycle, as everyone has access to the same single source of truth they need to fulfill their tasks.

Additionally, automation across the L2C processes minimizes human errors, streamlines communication, and frees up valuable labor hours for strategic tasks.

- Minimizing Human Errors : By automating routine tasks, CPQ systems reduce the likelihood of costly mistakes.

- Freeing Up Staff for Strategic Tasks : Reducing manual workload allows staff to focus on more value-added activities, improving productivity and innovation.

Ensuring Compliance and Security

CPQ platforms are instrumental in maintaining compliance with industry regulations and data security standards, important commitments that many businesses grapple with.

By adopting cutting-edge CPQ with enterprise-grade security, businesses can build and retain customer trust in the sales process.

- Compliance with Industry Regulations : CPQ systems like Epicor CPQ are hosted in the cloud with best-in-class security, ensuring sensitive data is kept secure across the L2C cycle.

- Data Centralization : CPQ centralizes data into a single source of truth, protecting it as it passes through the L2C process from department to department. This minimizes data transfer via email, spreadsheets, or paperwork–which are potentially insecure.

Reporting and Analysis

In addition to integrating with CRM, ERP, and other back-office systems, CPQ produces data and supports analytics in its own right.

It arms businesses with actionable insights into customer behavior and product selections, driving continuous improvement. It also supports process mining initiatives, where repeated business processes are identified for optimization and automation.

- Reporting and Analysis: CPQ systems capture data that can feed into data analysis and business intelligence (BI) strategies. It provides insights into customer trends, operational bottlenecks, and efficiency opportunities.

- Predictive Analytics : By leveraging historical data, CPQ systems can offer predictive analytics, helping in strategic planning, inventory management, and targeted marketing efforts.

In Conclusion

The L2C process is more than just a series of operational steps. It's the heartbeat of customer engagement and business growth. As companies meet demand for complex, customizable products, the L2C cycle itself has evolved to adapt to new business processes.

Managing complex L2C pipelines, while challenging, offers an opportunity for businesses to go above and beyond in delivering impactful customer experiences. The key lies in optimizing the L2C process, leveraging advanced tools such as CPQ software.

These tools are not just solutions but transformative agents that redefine customer engagement and operational efficiency. A streamlined, efficient L2C process, equipped with tools like Epicor CPQ , is a powerful driver for customer satisfaction, loyalty, and repeat business.

What is the Lead to Cash (L2C) process, and how does it contribute to revenue growth?

The lead-to-cash process encompasses all the stages, from initial customer contact to final payment. It's integral for driving revenue growth as it streamlines the sales, billing, and fulfillment process, ensuring efficient and effective revenue generation.

How does revenue recognition work within the L2C process, especially for professional services?

In a business that provides professional services, like consulting or legal work, it's important to record the money earned (revenue) at the time the service is actually delivered. This helps match the money made with the time period when the work was performed, which is important for preparing accurate financial reports and following rules and regulations.

What are the common causes of revenue leakage in the L2C process, and how can they be addressed?

Revenue leakage often occurs due to inefficient processes, errors in billing, or missed sales opportunities. It can be addressed by adopting robust systems like Epicor CPQ , SAP Sales Cloud, or Salesforce CPQ that streamline the sales order and billing processes and provide better visibility and control over the entire L2C cycle.

How does integrating customer success strategies into the L2C process enhance customer experience and loyalty?

Integrating customer success strategies into the L2C process focuses a company’s efforts where they matter most: on long-term customer satisfaction.

This approach ensures customers receive continuous value from their purchases, fostering loyalty and leading to repeat business and referrals.

Can the L2C process benefit from automation, and if so, how?

Yes, automating the L2C process can significantly improve efficiency and accuracy, from lead generation to final invoicing.

Automation tools can help manage customer data, track sales orders, generate accurate quotes and invoices, and ensure timely follow-ups, all of which contribute to a smoother and more reliable process.

What role do CRM systems like SAP Customer Experience and Salesforce Sales Cloud play in the L2C process?

CRM systems like SAP Customer Experience, Salesforce Sales Cloud, and Epicor CPQ (which has built-in CRM capabilities) are critical in managing customer interactions and data throughout the L2C process.

They provide valuable insights into customer needs and behaviors, facilitate effective communication, and help track the progress of sales opportunities, all of which are key to optimizing the L2C cycle.

Free downloads

Featured Resource

Complimentary Nucleus Report

The Epicor CPQ Top 10

Choose another CPQ term

- 3D Configuration

- B2B eCommerce

- B2B Manufacturing

- CAD Automation

- Complex Product Configurator

- CPQ Implementation

- CPQ Product Rules

- CPQ Software

- Design Automation

- Digital Transformation

- Dynamic Pricing

- Engineer to Order

- Industry 4.0 and the 4th Industrial Revolution

- Make-to-Order (MTO) Manufacturing

- Manufacturing Automation

- Omnichannel Retailing

- Order to Cash

- Product Configuration

- Product Visualization and 3D Product Visualization

- Proposal Software

- Quote to Cash

- Sales Automation Software

- Salesforce CPQ

- Visual Configuration

Mapping the Service Business Processes to the Lead-to-Cash Process

After completing this lesson, you will be able to summarize the lead-to-cash – service process based on SAP Best Practices

Integrated Service Solution

The Bike Company implementation project is currently in the Realization phase, in which the end-to-end processes are tested by the project team.

You are already familiar with the detailed structures of the different areas, such as financial accounting, management accounting, human resources, purchasing, production, and sales. You will find out now how the Bike Company benefits from using the integrated service solution.

The selected scope items for all areas were assigned to the business processes of the Bike Company by Ivan. This enables the project team to understand which summarized scope items are used to represent a core process within the Bike Company.

Based on best practice scope items, Ivan has created a summarized business process for the Bike Company’s service process. The following is a high-level overview of the steps in the service process that Ivan created.

Please select the business process steps below or select Next to learn more.

Log in to track your progress & complete quizzes

What is Lead-to-Cash: Understanding the End-to-End Sales Process

- Under Business

- Be the 1st to leave a comment

In the business world, a smooth flow of cash is the lifeblood of any organization. But how do you convert a potential customer’s interest into that sweet, sweet revenue?

That’s where the concept of Lead-to-Cash (L2C) comes in.

What is Lead-to-Cash?

Lead to cash is a comprehensive end-to-end business process that encompasses the entire sales cycle, from initial customer interest to the final receipt of payment. It represents the journey of a lead (potential customer) as it moves through the stages of the sales funnel to become a cash-paying customer.

This process is critical for businesses as it directly impacts revenue generation and customer relationship management.

Understanding this process is critical for anyone involved in an organization. It ensures that your sales process is efficient and that all your systems work together seamlessly.

- Lead to cash

- Lead-to-cash cycle

- Lead-to-cash process

The lead-to-cash method not only enhances the internal workflow of a company but also maintains focus on the customer’s experience throughout their interaction with your business.

This process is deeply ingrained in the operations of any successful business and impacts numerous stakeholders across multiple departments. Sales, marketing, finance, and customer service teams must coordinate their efforts to navigate customers smoothly from point A to point B in your sales process.

Embracing the lead-to-cash framework can equip your organization with the agility needed to convert leads into revenue more effectively by using data-driven strategies and integrated systems.

Understanding the Lead to Cash Process (Workflow)

The lead to cash process typically includes the following stages:

1) lead generation

Lead generation marks the initiation of the lead-to-cash process. It’s about attracting potential customers to your product or service. Effective lead generation is pivotal, as it fills the sales funnel with prospects.

Here are key aspects:

- Channels and Strategies : Utilize a mix of digital marketing strategies including SEO, content marketing, social media advertising, and email campaigns to capture a wide audience.

- Content is King : Offer valuable and relevant content to solve problems or address the needs of your target audience, which can significantly increase lead generation rates.

- Landing Pages and Calls-to-Action : Design landing pages specifically for lead capture, ensuring they contain clear and compelling calls-to-action (CTAs) to encourage sign-ups or inquiries.

- Lead Magnets : Provide lead magnets like ebooks, webinars, or free trials, which offer value in exchange for contact information.

- Measurement and Optimization : Constantly analyze the performance of your lead generation efforts and optimize them for better outcomes.

2) Lead management

Once leads are generated, they enter the lead management stage. This phase is crucial for qualifying leads and preparing them for the sales process.

- Lead Scoring : Implement a lead scoring system to prioritize leads based on their engagement level and likelihood to purchase.

- Lead Nurturing : Use automated email marketing campaigns to nurture leads by providing further information, value, and engagement opportunities.

- CRM Integration : Ensure all lead data is captured in a CRM system for effective tracking and management.

- Sales and Marketing Alignment : Maintain constant communication between sales and marketing teams to ensure leads are appropriately managed and handed off.

- Feedback Loop : Establish a feedback loop to refine the lead management process based on the sales team’s experiences and conversion rates.

3) Quote to order

The next phase involves transforming interested leads into actual sales opportunities. This is where salesforce effectiveness really comes into play. Quotes are carefully crafted with detailed pricing , discounts , and proposals .

Tools like Salesforce CPQ (Configure, Price, Quote) streamline this process with automation , making creating personalized quotes efficient.

- Customized Quoting : Generate personalized quotes based on the specific needs and preferences of the lead, using CRM data to tailor the offer.

- Approval Processes : Set up an efficient approval process for quotes to ensure they meet pricing and discount policies.

- Follow-up Strategies : Implement systematic follow-ups on quotes to address concerns and adjust offers as necessary.

- Automation Tools : Use automation tools to streamline the quote creation process, reducing errors and saving time.

- Conversion Tracking : Monitor the conversion rate from quotes to orders to identify areas for improvement in the sales process.

4) Order management

Order Management involves the processing and fulfillment of orders. This step is key to ensuring customer satisfaction and operational efficiency.

- Order Processing : Implement an automated system for order entry, validation, and processing to minimize delays.

- Inventory Management : Keep real-time track of inventory levels to ensure product availability and timely order fulfillment.

- Delivery and Fulfillment : Coordinate with logistics to ensure timely and accurate product delivery. Provide customers with tracking information.

- Change Management : Allow for order modifications while maintaining efficiency and customer satisfaction.

- Issue Resolution : Establish a clear process for handling order issues, ensuring quick resolution to maintain customer trust.

5) Billing and invoicing

The Billing and Invoicing step is where the company’s efforts are translated into revenue. It’s crucial for cash flow and customer satisfaction.

- Automated Invoicing : Utilize software to automate the creation and distribution of invoices, ensuring accuracy and timeliness.

- Flexible Payment Options : Offer multiple payment methods to accommodate customer preferences, improving the payment experience.

- Compliance and Accuracy : Ensure invoices comply with local tax laws and regulations. Double-check for accuracy to avoid disputes.

- Dispute Management : Implement a process for efficiently resolving billing disputes to maintain customer satisfaction.

- Follow-up and Collections : Establish polite but persistent follow-up procedures for late payments to maintain positive cash flow.

6) Payment management

In the Payment Management phase, businesses oversee the receipt and processing of payments from customers, crucial for maintaining healthy cash flow.

- Secure Payment Processing : Employ secure, reliable payment gateways to protect customer information and ensure transaction safety.

- Reconciliation : Regularly reconcile payments received with invoices issued to ensure accuracy in accounts receivable.

- Late Payment Strategies : Implement strategies for managing late payments, including reminders, fees, and payment plans.

- Customer Communication : Maintain clear communication with customers regarding payment statuses and issues to foster trust and transparency.

- Financial Reporting : Integrate payment data into financial reports for accurate revenue tracking and forecasting.

7) Revenue recognition

Revenue Recognition is the final step, focusing on accurately recording revenue in the financial statements. It’s crucial for financial reporting and compliance.

- Compliance with Standards : Ensure that revenue recognition practices comply with applicable accounting standards (e.g., GAAP, IFRS).

- Timing and Criteria : Recognize revenue when the product is delivered or the service is performed, and all criteria for revenue recognition are met.

- Contract Management : Review contracts to determine the appropriate revenue recognition method based on delivery and performance obligations.

- Automation for Accuracy : Use automated systems to track and recognize revenue, reducing manual errors and ensuring consistency.

- Audit and Review : Regularly audit revenue recognition practices to ensure compliance and identify areas for improvement.

By carefully managing each of these stages, businesses can optimize their lead-to-cash process, enhancing efficiency, customer satisfaction, and revenue growth.

8) Post-sale service and analysis

After the sale, your focus should shift to providing excellent customer service to ensure customer satisfaction and encourage repeat business. Also, data analysis and reporting are vital to evaluate the process, identify bottlenecks or data silos , and improve the overall efficiency of the Lead to Cash cycle.

What is the difference between order-to-cash and lead to cash?

The difference between order-to-cash (OTC) and lead-to-cash (LTC) lies in the scope of the processes they cover. Order-to-cash is a subset of the broader lead-to-cash process.

Order-to-Cash (OTC) focuses on the processes that take place after a customer places an order. It includes the steps involved in order management, fulfillment, shipping, invoicing, payment collection, and accounts receivable. Essentially, OTC encompasses the backend processes that occur from the moment an order is received until the payment is collected and recorded.

It is a critical component of a company’s revenue cycle management and is concerned with executing and managing the order effectively and efficiently.

Lead-to-Cash (LTC) , on the other hand, is a more comprehensive end-to-end process that begins much earlier in the sales cycle. It starts with the initial customer engagement (lead generation) and includes every step through to the final receipt of payment. LTC covers lead generation, lead qualification, lead nurturing, opportunity management, quoting, order management (which includes the OTC process), invoicing, payment processing, and customer service.

It also involves strategies for customer retention and repeat business.

So while order-to-cash is specifically about fulfilling and monetizing orders, lead-to-cash is about the entire customer acquisition and retention cycle, including the order-to-cash process within it.

Enhancing Lead to Cash Through Technology

By leveraging technology, you can streamline your lead-to-cash process. This improves the collaboration between sales and finance, enhances efficiency with automation, utilizes analytics for better forecasting, and maintains a customer-centric approach for superior service.

Integrating Sales and Finance

Integrating your sales and finance operations is critical. An ERP (Enterprise Resource Planning) system can act as a bridge, ensuring that the moment a sales opportunity is identified, both your sales force and your finance team are aligned. This real-time connection helps avoid discrepancies and fosters more accurate quotes and financial forecasting.

Automation for Efficiency and Accuracy

Automation plays a vital role in reducing manual processes and improving accuracy . From generating quotes to order processing, automation ensures that every step is conducted with precision. By implementing a robust lead-to-cash solution , repetitive tasks are minimized, and your team can focus on more strategic activities.

Analytics and Forecasting for Strategic Decisions

Employing analytics and forecasting tools within your CRM (Customer Relationship Management) system can reveal important trends and enable data-driven strategic decisions. You’ll understand customer behaviors and preferences, which is essential for customer acquisition , loyalty , and tailoring customer experiences .

Customer-Centric Approach

A customer-centric strategy prioritizes customer experiences at each step of the lead-to-cash process. Utilize marketing automation to deliver tailored messages and offers that resonate with your customer base. This approach not only enhances loyalty but also optimizes the efficiency of your customer acquisition strategies.

Lead to Cash FAQs

How does the lead-to-cash process enhance sales performance.

The lead-to-cash process enhances sales performance by creating a streamlined pathway from initial customer inquiry to final payment, improving efficiency and providing a better customer experience.

What are the key stages of the lead-to-cash cycle in a business?

Key stages of the lead-to-cash cycle include lead generation, customer acquisition, sales order processing, delivery of goods or services, and payment collection, ensuring that each step is optimized for faster conversion and revenue recognition.

What benefits do telecom companies experience from implementing lead-to-cash systems?

Telecom companies experience significant benefits from implementing lead to cash systems, including improved customer satisfaction, reduced time-to-market for services, and streamlined billing processes.

How do Salesforce and SAP platforms facilitate the lead to cash process?

Platforms like Salesforce and SAP facilitate the lead to cash process by offering integrated solutions that manage customer interactions and transactions, thus improving data accuracy and operational efficiency.

Can you detail the transformative impact of lead to cash on customer relationship management?

Lead to cash can transform customer relationship management. It enables personalized customer engagements and delivers insights that inform targeted and effective sales strategies.

About Moneyspace

Main topics:, latest articles.

Forex Trading in Kenya (Quick Guide)

How to Start Trading in Kenya: A Beginner’s Guide

The New KFC Menu Prices (Updated for 2024

- Oracle Billing and Revenue Management

- Oracle Digital Experience

- Unified Orchestration and Assurance(OSS)

- Oracle Cloud Applications

- Multi cloud deployment, orchestration and Management Services

- DevSecOps, Observability and Monitoring

- Application Management and Support

- Generative AI

- Smart Cities

- Adptx TM Cloud

- Adptx TM Suite

- Adptx TM Comm

- Adptx TM Utilities

- Financial Services

- Communications, Media & Technology

- Energy & Utilities

- Public Services

- Brand Story

- Vision & Mission

- Connecting to Roots - CSR Initiatives

- Digital Transformation

- Oracle Breakthroughs

- Case Studies

- Whitepapers

Unlocking Success: The Contract to Cash Journey in the Lead to Cash Cycle

In today’s dynamic business landscape, optimizing operations and maximizing efficiency are critical for sustainable success. At the heart of the sales cycle lies the contract to cash (C2C) process, a pivotal driver in converting leads into revenue. This blog aims to provide a comprehensive understanding of the contract to cash process, highlighting its definition, key features, and its remarkable ability to resolve common pain points faced by businesses. By fully embracing C2C, organizations can enhance customer satisfaction, expedite revenue generation, and achieve optimal operational effectiveness.

Defining the Contract to Cash Journey:

Contract to cash encompasses a seamless end-to-end business process that guides organizations from initial sales agreements to the realization of revenue. It is a vital component of the lead to cash (L2C) cycle, representing the transformation from signed contracts to cash collection. This comprehensive process involves managing contract terms, fulfilling orders, generating accurate invoices, recognizing revenue, and efficiently collecting payments. By aligning sales, finance, and operations, the contract to cash process ensures a smooth transition from customer acquisition to revenue realization.

Key Features Empowering Contract to Cash:

1. Streamlined Contract Management:

Effective contract management sets the foundation for C2C success. By automating contract creation and approval workflows, businesses can minimize errors and expedite the contract negotiation process, enhancing efficiency and reducing bottlenecks.

2. Efficient Order Fulfillment:

Once the contract is in place, the order fulfillment phase begins. This critical step involves coordinating product delivery or service provision while ensuring adherence to contractual obligations. Streamlining this process reduces delays, boosts customer satisfaction, and prevents revenue leakage.

3. Accurate Invoicing and Revenue Recognition:

Timely and precise invoicing is paramount for revenue recognition. C2C systems automate invoice generation and delivery, guaranteeing accuracy and mitigating the risk of errors. Proper revenue recognition ensures financial transparency and compliance with accounting standards.

4. Optimal Payment Collection:

The final stage of the C2C process revolves around collecting payments promptly. Organizations leverage automated payment methods, such as online portals or electronic funds transfer (EFT), to accelerate cash flow and reduce payment delays. Efficient payment collection minimizes bad debt risks and optimizes working capital management.

Resolving Common Pain Points with Contract to Cash:

The contract to cash process effectively resolves several prevalent pain points encountered by businesses:

- Streamlining Manual and Disconnected Processes : Traditional manual processes are prone to errors, delays, and communication breakdowns. C2C streamlines workflows by integrating sales, finance, and operations, fostering collaboration, eliminating redundancy, and enhancing overall process efficiency.

- Mitigating Revenue Leakage: Incomplete or inaccurate contracts, delays in order fulfillment, and invoicing errors can lead to revenue leakage. The comprehensive nature of C2C ensures end-to-end visibility and control over the revenue generation process, minimizing revenue leakage and maximizing profitability.

- Optimizing Cash Flow: Sluggish payment collection negatively impacts cash flow, hindering business growth and financial stability. Through C2C implementation, organizations can automate payment collection processes, facilitating faster and more efficient cash flow. This optimization is vital for sustaining operations, investing in growth initiatives, and managing working capital effectively.

- Ensuring Compliance and Audit Readiness: Inadequate contract management and revenue recognition practices expose businesses to compliance and audit risks. By implementing a robust C2C process, organizations can ensure adherence to regulatory requirements, minimize audit exposure, and maintain a clean audit trail.

Conclusion:

In today’s competitive business landscape, unlocking the full potential of the lead to cash cycle is vital. The contract to cash process serves as a powerful catalyst, enabling organizations to streamline operations, optimize revenue realization, and deliver enhanced customer satisfaction. By embracing C2C, businesses can achieve operational excellence, foster sustainable growth, and secure a distinct competitive advantage.

Get in touch with us to know more.

Facebook | Linkedin | Twitter | Instagram

The Rising Tide of Household Debt and the Importance of Credit History

In recent times, household debt has reached alarming levels, with a total of $17.06 trillion in Q2 2023, as reported by the New York Federal Reserve. One significant factor contributing to this surge is the increase in credit card balances, which have hit a record high of $1.03 trillion. While mortgage balances have remained stable … Continue reading “The Rising Tide of Household Debt and the Importance of Credit History”

Achieving Efficiency and Growth Potential through Standardization in the Quote-to-Cash Process

In order to fully realize the potential of a B2B subscription business, it is essential to implement standardization within the Quote-to-Cash (QTC) process. By adopting standardization practices, businesses can unlock greater efficiency and drive sustainable growth. In this article, we will explore the various strategies that can be employed to achieve this goal. 1. Streamlined … Continue reading “Achieving Efficiency and Growth Potential through Standardization in the Quote-to-Cash Process”

Achieving Quote to Cash Excellence for B2B Subscription Businesses

In today’s dynamic business landscape, B2B subscription businesses face unique challenges in driving growth and ensuring customer satisfaction. One critical aspect that plays a pivotal role in their success is the quote to cash (QTC) process. QTC encompasses the entire customer journey, from generating a quote to receiving payment, and it can significantly impact a … Continue reading “Achieving Quote to Cash Excellence for B2B Subscription Businesses”

Aarav Solutions announces Bhavin Patel as new Chief Operating Officer

Exciting news at Aarav Solutions! We’re thrilled to announce Bhavin Patel as our new Chief Operating Officer (COO). Bhavin’s promotion is a testament to his exceptional leadership, strategic thinking, and industry expertise. As COO, he’ll lead operational initiatives, driving growth, customer success, and fostering a high-performing team. Raj Darji, our CEO, highlighted Bhavin’s … Continue reading “Aarav Solutions announces Bhavin Patel as new Chief Operating Officer”

Application Readiness Assessment – Paving the Path to Seamless Cloud Migration

As the digital landscape continues to evolve, the cloud emerges as a pivotal catalyst for successful transformation. Yet, the journey to cloud migration is far from a mere lift-and-shift affair. In this article, we embark on a comprehensive exploration of the essential factors that demand consideration before migrating your applications to the cloud, ensuring a … Continue reading “Application Readiness Assessment – Paving the Path to Seamless Cloud Migration”

What is Regression Testing and Its Types?

In the dynamic landscape of software development, change is constant. Applications are frequently modified to introduce new features, address bugs, or improve performance. However, these changes can inadvertently disrupt existing functionality, leading to broken features and poor performance. This is where the importance of regression testing comes into play. In this article, we’ll delve into … Continue reading “What is Regression Testing and Its Types?”

Join our mailing list to receive monthly updates on the latest insights on emerging technology and critical issues that global businesses are facing.

Welcome Aboard! Thank You for subscribing to our newsletter.

email has been subscribed to

Thank you for your interest!

Your digital treasure is on its way to your inbox - keep an eye out for an email from Aarav Solutions. Happy exploring!

Your resource is on the way, please check your inbox.

Your digital treasure is on its way to your inbox – keep an eye out for an email from Aarav Solutions. Happy exploring!

Lead to cash / Order to cash

We deliver end-to-end customer experiences that build sales.

- How we can help you

- Experiences with clients

What’s on our mind

What our clients say, meet the experts.

At the core of every business are the set of end-to-end steps a customer goes through when purchasing, paying for and receiving a product. Lead-to-cash (L2C) or Order-to-cash (O2C) refers to the processes, technology and capabilities an organisation utilises to enable that customer journey. At Clarasys, we understand how our clients can optimise their lead-to-cash processes to create excellent customer experiences and maximise revenue.

We work with you to innovate and transform your L2C / O2C journey – from the initial strategy, right through to implementation. We track your progress, improve employee experience and help you deliver go-to-market solutions. We do this by:

- Analysing your existing end-to-end journey

- Understanding your pain points on cost, revenue or CX

- Identifying opportunities to improve based on our knowledge of what works

If you're thinking about SAP S/4HANA and its role in L2C / O2C, read more about our services here.

Lead-to-cash / Order-to-cash helps to enhance customer experiences, and achieve better business performance.

At Clarasys, our role is to diagnose the symptoms of L2C / O2C issues, identify root causes and define a path to sustained improvement. We use the Clarasys Agile Method (CAM), taking the principles of Agile project management and applying them across the entire organisation.

A CAM-centred approach allows us to work with you to identify the pain points that matter, prioritise customer scenarios and create a roadmap for future change.

GROW & BUILD RESILIENCE WITH SUBSCRIPTION PRODUCTS

Is your business making the move to a subscription model?

Experiences with clients.

Taking a strategic pause: Why you should prioritise a SAP S/4HANA upgrade over other business initiatives

The relentless pursuit of growth and innovation can put pressure on businesses to rush forward, chasing the latest technological advancements. But, as you stand on the brink of introducing SAP...

SAP S/4HANA: What's the big deal? A closer look at its role in ERP & order to cash

In the dynamic, fast-paced world of Enterprise Resource Planning (ERP), SAP S/4HANA has emerged as a revolutionary force that is reshaping how businesses operate. This advanced ERP solution is...

TESTIMONIALS

In a very short period of time, and really efficiently with a really low level of intrusion on the daily working of the team, Clarasys were able to deliver a project in exactly the form that they said it would be delivered…they delivered a finished product exactly as promised.

We had a really good chemistry with the Clarasys guys. They came in, no airs and graces. They talked to the people who really mattered at the front line which you don’t necessarily get, I find, when talking to other consultants.

Swinton Insurance

Anthony mclaughlin.

Ben has over 11 years of cross-industry consulting experience having joined Clarasys from Accenture in 2015. Ben has a broad range of project and CRM experience across the lifecycle including project/delivery management, business analysis and implementation. He is comfortable managing onshore and offshore teams through complex releases with strong stakeholder management skills and is able to translate functional and technical issues into a clear direction. Ben applies agile principles and innovation/expertise to projects. Ben spends lots of his time away from work participating in and watching an array of sports.

Matt Brooks

Matt is an experienced business consultant with expertise in the implementation and improvement of CRM and subscription billing technologies and processes. His specialisms include supporting clients in the adoption of subscription business models and supporting technologies, with a focus on improving their customer experience. Most recently, he has worked on the agile delivery of a subscription billing platform for a global education publishing and assessment company, who were looking to transition their legacy business model to a subscription-based offering.

Richard Hibbert

Business leader that excels at discovering ways to improve CX and save cost. Works with C-suite stakeholders to uncover options for transformation, evaluate trade-offs and deliver against strategy. Over 15 years experience at consulting firms and in industry - so able to offer “real world” experience as well as a consultative approach to change. Focus and specialisms: customer-facing processes, including sales and service; operational discovery; data analysis and visualisation, contact centres; customer experience; cost transformation; Information services & media.

Find out how we can make your business [ thrive ]

Stay up to date with notifications from The Independent

Notifications can be managed in browser preferences.

UK Edition Change

- UK Politics

- News Videos

- Paris 2024 Olympics

- Rugby Union

- Sport Videos

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Sean O’Grady

- Photography

- Theatre & Dance

- Culture Videos

- Fitness & Wellbeing

- Food & Drink

- Health & Families

- Royal Family

- Electric Vehicles

- Car Insurance Deals

- Lifestyle Videos

- Hotel Reviews

- News & Advice

- Simon Calder

- Australia & New Zealand

- South America

- C. America & Caribbean

- Middle East

- Politics Explained

- News Analysis

- Today’s Edition

- Home & Garden

- Broadband deals

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- Climate 100

- Sustainable Living

- Climate Videos

- Solar Panels

- Behind The Headlines

- On The Ground

- Decomplicated

- You Ask The Questions

- Binge Watch

- Travel Smart

- Watch on your TV

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Wine Offers

- Betting Sites

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in

From leads to cash: the crucial business process you need to streamline now

The articles on these pages are produced by business reporter, which takes sole responsibility for the contents.

Article bookmarked

Find your bookmarks in your Independent Premium section, under my profile

Enigen is a Business Reporter client.

“Outperformers achieve higher growth by carefully considering the sales journey and balancing rigourous process discipline with the flexibility to meet individual customer needs.” – McKinsey & Company

According to McKinsey, “Outperformers” focus on optimising their Lead-to-Cash (L2C) process by implementing tools and strategies that improve efficiency, customer satisfaction, and connected data.

In recent years, there has been a growing trend among businesses to optimise their L2C process. This is largely driven by the increasing demand for faster, more efficient sales processes that can deliver better customer experiences and improve revenue growth.

When it comes to L2C, the adoption of digital technologies is key. By investing in the right technologies, businesses can streamline their sales processes, improve customer engagement, and automate the manual tasks involved in lead generation and sales. Too often overlooked is the integration of the sales and finance functions. By aligning these two areas of the business, companies can achieve greater visibility into their sales performance, improve cash flow, and reduce the risk of errors and disputes.

To remain competitive in today’s fast-paced and digitally driven marketplace, businesses must adopt and innovate with modern technology supporting the whole L2C process, from start to finish. Businesses need a solution that is designed to be flexible and scalable so that connecting departments and applications do not become convoluted as the enterprise grows. As well as this, clients need to be afforded the power to orchestrate complex orders and collect the cash at the right time – empowering the customer while driving improved efficiency, accuracy, and process automation across the lifecycle of the order.

Digital consultancy, Enigen has been working in Business Transformation with Oracle technology for over 13 years, partnering with some of the world’s most customer-centric businesses to give them the technology they need to deliver and exceed expectations.

Enigen has seen first-hand the challenges businesses have with retaining transparency and consistency and that without effective integration across departments, these businesses risk incurring significant costs. Alex Love, Managing Director of Enigen, has mentioned: “There is a real tangle of on and off systems working in this area that costs businesses huge sums of money in efficiency and human error. Getting it synchronised, automated, and data-driven helps improve those challenges and makes you more competitive and faster to react to client needs which drives a better customer experience”.

Enigen has designed a comprehensive single-platform solution built entirely on Oracle that encompasses the full spectrum of Lead Acquisition, Opportunity Management, Quote Production, Order Management, and Finance.

By leveraging components of Oracle Fusion Cloud Applications Suite, Enigen offers a solution that is reliable, efficient, and easy to manage.

Siobhan Wilson, senior vice president applications, Oracle EMEA and UK Country Leader, said “Enigen’s approach to addressing Lead-to-Cash is an excellent example of how Oracle Fusion Cloud Applications can increase productivity, improve controls, gain better insights and reduce costs. By leveraging the power of Oracle Cloud, Enigen can offer a solution to our joint customers that is both robust and scalable, providing businesses with the flexibility they need to adapt and grow in a rapidly changing market".

By carefully considering the sales journey and balancing rigorous process discipline with the flexibility to meet individual customer needs, businesses can achieve higher growth and outperform their competitors.

To see more on Enigen’s lead-to-cash solution in action, check out the video: To begin your journey, get in contact with Enigen at www.enigen.co.uk or email Aja at [email protected] .

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

New to The Independent?

Or if you would prefer:

Hi {{indy.fullName}}

- My Independent Premium

- Account details

- Help centre

Revenue Hub

Accelerate revenue execution

CPQ (Configure Price Quote)

Automate quotes & subscriptions

CLM (Contract Lifecycle Management)

Streamline contract signings

Manage revenue lifecycle

Subscriptions

Unlock recurring revenue

Expert Implementation & Success

Top integrations, top features.

Revenue Operations Events

Revenue Operations Jobs

Revenue Operations Podcast

Revenue Operations Swag

Revenue Operations Terms

Trending Topics

- Infographics

- Customer Portal

- Pricing & Plans

- Feature Comparison

- Request a Demo

- Request a demo

Lead-to-Order (L2O)

Table of Contents

What is lead-to-order .

Lead-to-Order (L2O) is an end-to-end approach to managing the customer lifecycle. It integrates Sales, Order Management, and Product Delivery for a seamless customer experience and efficient sales and fulfillment cycle. Implementing lead-to-order management ensures effective measurement of business performance throughout the customer lifecycle and insights into inefficiencies that may impact revenue growth.

- Lead-to-order management

- Sales cycle

Lead-to-Order Management

Managing lead-to-order as an end-to-end business process helps organizations manage leads, improve conversion rates, and generate more accurate quotes that convert to closed-won deals . An integrated system ensures companies can track their sales performance and its impact on revenue. It also helps measure the efficiency and effectiveness of marketing, sales, and finance operations.

Below is the lead-to-order process flow that connects the stages of the customer lifecycle:

Sales Opportunity Management

The L2O process begins with acquiring and qualifying leads. After the lead has been qualified and the sales rep determines that an opportunity exists to close a deal successfully, the prospect moves to the Opportunity stage of the pipeline. The potential customer is then nurtured throughout the opportunity management process.

Configure-Price-Quote

In the course of sales conversations, the prospect discusses their budget, purchase timeline, and product/service requirements with the sales rep. The salesperson then prepares a quote and generates a formal proposal or digital sales room . The negotiation and approval stage may involve many stakeholders on both sides of the deal; however, automated workflows within CPQ software and templated sales proposals and contracts can streamline the process.

Order Management

Once the deal is closed-won, the order desk verifies the order details, BOM, CAD drawings, or other product configuration requirements from the quote. The order is then placed and sent to fulfillment or engineering if it’s a custom-manufactured product.

Once the order is placed, an invoice can be created and sent to the customer. Within the billing platform, invoices can be tracked, subscriptions can be managed, and accounts receivable can follow up on late invoices

Service or Product Delivery

An end-to-end L2O process also manages service or product delivery based on the product or service configuration, customer specifications, and order details.

Lead-to-Order KPIs

Lead-to-order KPIs are performance metrics used to measure a company’s effectiveness in turning leads into orders. These KPIs provide insight into the success of a company’s sales, marketing, and customer service teams in converting prospective customers into paying customers. By tracking these key performance indicators, companies can assess their effectiveness in targeting potential customers and delivering on their promises.

Some common lead-to-order KPIs include:

- Lead response time: This measures the time it takes for a sales or customer service representative to respond to an inquiry from a potential customer. Keeping this metric as low as possible indicates that representatives are responding quickly and efficiently, which will lead to higher conversion rates.

- Lead conversion rate: This is the ratio of total leads received compared to total orders generated over a certain period of time. A high conversion rate shows that the company is effectively targeting its prospects and ensuring they become customers. This also implies that the sales team is effectively closing deals with prospects.

- Customer acquisition cost (CAC): This metric measures the total cost associated with acquiring new customers over a given period of time. It includes any expenses associated with marketing campaigns or other initiatives to generate new leads or drive sales from existing ones. CAC is critical because it helps companies understand how much they spend on acquiring new customers compared to revenue generated from them.

These three key performance indicators help companies assess their performance in generating orders from prospective customers, enabling them to make informed decisions about their sales, marketing, and customer service strategies. Using this data helps companies optimize their processes to maximize conversions while minimizing operational costs. In addition, evaluating formative behavior, such as website clicks and social media engagements, can also provide further insights into buyer behavior and preferences, which helps improve L2O KPIs even further.

Why Businesses Need Lead-to-Order Process Automation

B2B businesses often find it difficult to connect the stages of their lead-to-order process through a unified platform that will provide sales and revenue intelligence to maximize business efficiency while ensuring a positive customer experience. Therefore, L2O technology has been developed to mitigate the following challenges businesses face:

- Support for omnichannel selling

- Building complex product configurations

- Quoting based on array of pricing models

- Disconnected sales and finance technology

- Poor tracking of sales and revenue KPIs relevant to the lead-to-order process

Automating the L2O process streamlines how businesses qualify leads and convert them into customers while also providing valuable insights into the success of their sales efforts. By setting clear lead qualification criteria upfront and creating automated workflows for capturing data accurately throughout each stage, businesses can save valuable time without compromising on customer satisfaction levels or sacrificing any potential revenue from qualified sales opportunities.

Lead-to-Order Management Systems

Lead-to-order management systems enable businesses to bring all their lead, opportunity, quote, order, and billing systems into one platform.

Connecting lead qualification, opportunity management, quote generation, order placement, and automated billing streamlines the sales process, from the initial customer inquiry to the order fulfillment.

In addition, the software provides a comprehensive overview of customer inquiries and orders, allowing sales teams to quickly identify what customers are interested in, what products they are looking for, and what orders they have placed.

This data can then be used to target potential customer prospects and develop more efficient strategies for responding to inquiries and fulfilling orders.

Lead-to-order management systems typically include features such as tracking customer inquiries, allowing customers to place orders online, managing payment information and setting up automatic follow-up emails or messages regarding order status.

This automation helps improve efficiency by removing manual processes and reduces errors that might occur during the ordering process.

Additionally, it enables businesses to quickly analyze customer patterns that can be used for marketing purposes or to understand better what leads are likely to convert into sales.

People Also Ask

What is the lead-to-cash process.

The lead-to-cash process is a customer’s journey from the initial inquiry of a product or service to making the final payment. It includes a variety of activities, both online and offline, that aim to convert leads into paying customers. The lead-to-cash process typically starts with qualifying leads. This step involves researching potential customers to identify those who have the greatest likelihood of becoming paying customers. Once qualified leads are identified, businesses can begin nurturing them by providing relevant content and opportunities for engagement with their products or services. This often includes conducting outreach via phone calls or emails to explain further how their offering may benefit customers. In addition to nurturing leads, businesses should also focus on creating strong relationships with them throughout the lead-to-cash process. This could involve enhancing customer support capabilities so that any queries or concerns are quickly addressed in an efficient manner. Moreover, companies should also monitor how their various offerings fare among different market segments to adjust their strategy when it comes time for customers to make payments. Finally, companies need effective methods for collecting payments once all necessary steps have been taken and customers are ready to purchase products or services. Secure payment gateways should be used to ensure that all transactions take place safely and efficiently without any issues arising during processing time frames. At every stage of the lead-to-cash process, businesses should remember that it is essential for them to not only attract new customers but also retain existing ones by providing positive experiences with their products or services throughout each interaction, including invoicing and payment.

What is the difference between lead-to-order and order-to-cash?

Lead-to-order and order-to-cash are business processes often used in organizations to manage customer orders. Lead-to-order is the process of capturing customer interest, converting it into an opportunity, and ultimately turning it into a sales order. It involves gathering information, generating quotations, and closing sales. On the other hand, order-to-cash is a process that starts with receiving an order and ends with receiving payment from the customer. It involves verifying the purchase order, scheduling deliveries or services, invoicing, and collecting payments. The main difference between lead-to-order and order-to-cash is that lead-to-order focuses on converting potential customers into sales orders. In contrast, order-to-cash focuses on fulfilling orders and collecting payments for them. Another key difference is that lead-to-order typically deals with prospects or leads who may have yet to purchase from the organization while order-to-cash generally deals with existing customers who have already made a purchase before. Additionally, lead-to-order requires more marketing efforts and customer relationship management ( CRM ) processes, while order-to-cash requires more operational workflows and financial management processes.

Multistep request a demo popup

- Turn emails from customers & suppliers into fast, accurate digital transactions.

- AI-powered Sales Order Automation so you can ship more perfect orders.

- Maximize touchless automation to deliver more perfect orders.

- Eliminate the errors and CSR effort from repetitive order exceptions.

- Rapid-deploy deep integration with all leading ERPs.

- Empower your Customer Service team within Salesforce.

- Anti-phishing security layer helps protect against breaches and ransomware.

- Deliver an Amazon-like digital order experience to more customers.

- Cut costs and earn more discounts from your suppliers.

- Increase real-time visibility into order status for your customers.

- Manufacturers

- Distributors

2.5 Billion Dollar Chemical Company

- Automating 1,2000 trading partners across 14 countries.

- Re-deployed staff to spend more time serving customers.

- Automating 200,000 lines monthly to improve order response time.

- Discover why our customers process orders from 95,000 trading partners using Conexiom.

AI-Powered Strategies to Maximize Profitability and Sales Efficiency

- Best practices and trends to deliver exceptional customer experiences.

- Real-life examples and case studies to guide your automation journey.

- Chat with our experts at an upcoming in-person or digital event.

- Build your business case for order automation.

- Calculate ROI of Order Digitization

- Learn about Conexiom's mission and meet our leadership team.

- Come work with us on revolutionizing order automation.

- Stay updated with the latest industry trends, insights, and developments.

What Is the Order-to-Cash Process and What Are its 8 Stages?

June 10, 2024 |, pierce smith.

Managing cash flow from orders to payments is a complex balancing act of satisfying customers and optimizing resource allocation for sustainable growth. Yet many companies struggle with inefficiencies that disrupt operations and compromise financial stability. The solution is to implement a robust order-to-cash (O2C) process.

Your customer service team stands at the epicenter of a complex ecosystem, where each order sets off a chain reaction through your manufacturing and distribution channels. But beneath the hum of machinery and the whir of conveyor belts lurks an unseen threat: a fragmented order-to-cash process silently siphoning away your profits and customer goodwill.

While you're focused on optimizing production lines and streamlining logistics, could you be overlooking a critical weak link in your operational chain?

As industry margins tighten and customer expectations soar, one pivotal question emerges: How can you transform your order-to-cash cycle from a liability into a catalyst for efficiency and customer loyalty? The answer may revolutionize not just your bottom line, but your entire approach to customer service in manufacturing and distribution.

Read on to learn how effectively managing cash flow from start to finish can boost efficiency and speed up cash conversion.

The TL;DR Version

Cross-functional Workflow: The Order-to-Cash (O2C) process is a comprehensive cycle that starts with a customer order and ends with payment receipt, involving multiple departments like sales, finance, and logistics.

Strategic Importance: In B2B manufacturing and distribution, the O2C process is crucial for maintaining regulatory compliance, financial accuracy, and strong business relationships, enhancing strategic planning and trustworthiness.

Automation Benefits: Implementing technology to optimize the O2C process reduces manual errors, speeds up transactions, and supports scalability, providing significant competitive advantages.

Key Benefits of Optimization: Enhances customer satisfaction, accelerates cash conversion cycles, improves data visibility and analytics, reduces operational costs, and supports business growth.