e-filing and Centralized Processing Center

e-Filing of Income Tax Return or Forms and other value added services & Intimation, Rectification, Refund and other Income Tax Processing Related Queries

1800 103 0025 (or)

1800 419 0025

+91-80-46122000

+91-80-61464700

08:00 hrs - 20:00 hrs

(Monday to Friday)

Tax Information Network - NSDL

Queries related to PAN & TAN application for Issuance / Update through NSDL

+91-20-27218080

07:00 hrs - 23:00 hrs

AIS and Reporting Portal

Queries related to AIS, TIS, SFT Preliminary response, Response to e-campaigns or e-Verification

1800 103 4215

09:30 hrs - 18:00 hrs

- Guidance to file Tax Return

- Return / Forms applicable to me

- Deductions on which I can get tax benefit

- Update my profile details

- Assisted filing

- Guidance to file Tax return

- Registration

- Service Available

- API Specifications

- Central & State Government Department/Approved Undertaking Agency

- RBI Approved Banks

Quick Links

Our success enablers.

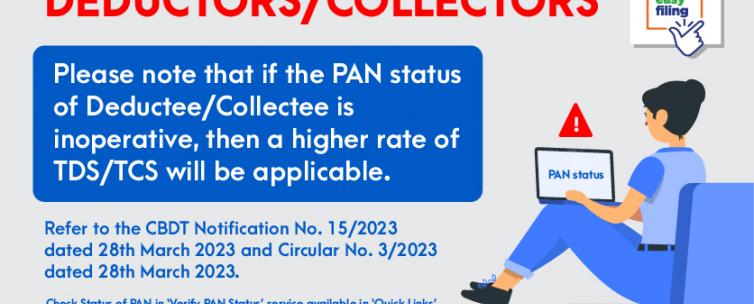

1. ITR-1, ITR-2,ITR-3, ITR-4 & ITR-6 for AY 2024-25 are enabled for filing in offline as well as Online mode at e-filing portal ! Excel Utilities of ITR-1, ITR-2, ITR-3,ITR-4 and ITR-6 for AY 2024-25 are also live now !! 2. ATTENTION! CBDT vide Circular No. 7/2024 has extended the due date for filing of Form 10A & 10AB to 30.06.2024 for the category of applicants as mentioned in the circular. Refer to latest updates for more details. 3. Attention Deductors/Collectors!! Deductee having PAN status as 'Inoperative' attracts higher TDS/TCS rates. However, for the transactions entered into upto 31.03.2024 with inoperative PANs, deductors/ collectors shall have no liability to deduct TDS/TCS at higher rate if PAN becomes operative on or before 31.05.2024. Refer Latest Updates. 4. New Forms 1 (Aircraft Leasing business), 10-IEA, 1 {Dividend exempt u/s 10(34B)} , 3AF, 1 (Ship Leasing Business), 10-IFA has been enabled on portal. Refer Latest Updates for details. 5. According to the RBI Notification, in the case of non-individuals, a Legal Entity Identifier (LEI) No. is required for Credit of Refunds exceeding Rs. 50 crore. For hassle-free refund processing, please submit LEI details in Login->Dashboard->Services->LEI.

Stay Alert, Stay Safe!!

Validate your Bank Account

Tax deductors/ collectors.

Latest Updates

E-campaigns, things to know.

- How to ...Videos

- Awareness Videos

How to file ITR 1?

How to file ITR 4?

Old Vs New Tax Regime (Part 1)

Old Vs New Tax Regime (Part 2)

Do not get lured by phishing!

Got a email/SMS from ITD

e-Filing Portal

File Grievances & respond to e-proceedings

e-file Returns

Taxpayer voices #itdindia.

Thank you issue resolved the staff was very aggressive in follow up which was good and issue resolved.

Thanks a lot and appreciate your assistance in the matter 🙏

Thank you @IncomeTaxIndia for resolving the issue.

@nsitharamanoffc @nsitharaman @narendramodi Very Glad for your support today, your team resolve issues and guide us today, very happy ... thank you for developing such IT Cell for resolving issues…

Thank you very much @IncomeTaxIndia for launching new filter in E-proceedings tab, this will help a lot where many proceedings are there for particular taxpayer. Along with this E-proceedings has become more stable issue of scrolling up automatically is also sorted out.

The new and intuitive official website of Income Tax Department which deals with e-Filing of returns/forms and other related functionalities.

Follow us on

Last reviewed and updated on : current time

This site is best viewed in 1024 * 768 resolution with latest version of Chrome, Firefox, Safari and Microsoft Edge.

Copyright @ Income Tax Department, Ministry of Finance, Government of India. All Rights Reserved.

"Due to maintenance activity, TIN website will not be available from 00:00 hrs. on July 20, 2019 to 01:00 hrs. on July 21, 2019. Inconvenience caused is regretted" --> "As there have been fluctuations in the response with regard to Aadhaar authentication/e-KYC from UIDAI, Online PAN applicants may face problem in completing the application. Such applicants are requested to wait and proceed after some time." Due to maintenance activity, TIN website will not be available from 00:00 hrs. on July 13, 2019 to 01:00 hrs. on July 14, 2019 Inconvenience caused is regretted --> Due to maintenance activity, TIN website will not be available from 23:00 hrs on December 21, 2018 to 05:00 hrs on December 22, 2018 and Online services will not be available from 23:00 hrs on December 21, 2018 to 02:00 hrs on December 22, 2018. Inconvenience caused is regretted. --> Due to maintenance activity, TIN applications will not be available on September 19, 2018 from 23:00 hrs. to 07:00 hrs. of September 20, 2018. Inconvenience caused is regretted. --> Due to system upgrade activity, Online PAN applications will not be available. Inconvenience caused is regretted. --> Due to maintenance activity, TIN applications will not be available from 23:00 hrs. on May 19, 2018 to 07:00 hrs. on May 20, 2018. Inconvenience caused is regretted. --> Due to maintenance activity, TIN applications will not be available from 23:00 hrs. on May 20, 2018 to 07:00 hrs. on May 21, 2018. Inconvenience caused is regretted. --> Due to maintenance activity, Online services will not be available on December 9, 2017 from 23:00 hrs to 04:00 hrs on December 10, 2017. Inconvenience caused is highly regretted. --> "Due to maintenance activity, online services will not be available on December 1st, 2017 from 23:00 hrs to 04:00 hrs on December 2nd, 2017. Inconvenience caused is highly regretted." --> "As there have been fluctuations in the response with regard to Aadhaar authentication/e-KYC from UIDAI, Online PAN applicants may face problem in completing the application. Such applicants are requested to wait and proceed after some time" --> Paperless facility of "e-KYC and/or e-Sign" based online PAN applications has been temporarily disabled for system upgradation. You may continue to use the physical mode of online application for generation of acknowledgement receipt and number. --> As there have been fluctuations in the response with regard to Aadhaar authentication/e-KYC from UIDAI, Online PAN applicants may face problem in completing the application. Such applicants are requested to wait and proceed after some time. --> As there have been fluctuations in the response with regard to Aadhaar authentication/e-KYC from UIDAI, Online PAN applicants may face problem in completing the application. Such applicants are requested to wait and proceed after some time. New --> Due to maintenance activity, online services will not be available on June 10, 2019 from 22:00 hrs.to 23:00 hrs. of June 10, 2019. Inconvenience caused is regretted. --> “As there have been fluctuations in the response with regard to Aadhaar authentication/e-KYC from UIDAI, Online PAN applicants may face problem in completing the application. Such applicants are requested to wait and proceed after some time.” --> As per the Income Tax Department notification 36/2019 dated April 12 2019, the new format to furnish the Form 24Q Quarter 4 statement is applicable with effect from May 12, 2019 onwards. Please download the new version of RPU and FVU to prepare and validate the e-TDS statements New --> Caution - Online PAN applicants TIN Call Center will not be available on April 23, 2019 on account of General elections 2019. --> W. e. f. March 14, 2019, fees for PAN application form filled online using Aadhaar Authentication services have undergone a change due to UIDAI charges as per UIDAI notification no. 1 of 2019 dated March 6, 2019. --> 1. PAN-Aadhaar linking deadline extended till 30.9.2019 vide ITD Notification No.31/2019 2. As per provisions of Section 272B of the Income Tax Act., 1961, a penalty of ₹ 10,000 can be levied on possession of more than one PAN. 3. e-PAN is now a valid mode of issue of Permanent Account Number (PAN). 4. Biometric Aadhaar Authentication is required for Aadhaar linking in cases of Demographic Data mismatch in PAN and Aadhaar. Please visit designated PAN centre for Biometric Aadhaar Authentication. "No need to remember multiple numbers to reach TIN Call Centre!!! To serve you better, we have unified the Call Centre numbers to one number (020-27218080)." --> "As there have been fluctuations in the response with regard to Aadhaar authentication/e-KYC from UIDAI, Online PAN applicants may face problem in completing the application. Such applicants are requested to wait and proceed after some time." --> NSDL e-Gov Cautions Public Against Spurious Calls

Link aadhaar to permanent account number (pan) new, paperless pan application using aadhaar based e-kyc & e-sign (only where applicants mobile no. &/or e-mail id is registered with uidai) new.

- PAN Verification

Frequently asked questions

What is the current rpu version for preparation of e-tds/tcs statements.

Return Preparation Utility (RPU) version 2.8 is to be used for preparation of e-TDS/TCS regular and correction statements pertains to Financial Year 2007-08 onwards.

To download the RPU, please visit the link https://www.tin-nsdl.com/downloads/e-tds/eTDS-download-regular.html

What is the current FVU version to validate e-TDS/TCS statements?

- File Validation Utility (FVU) version 6.3 is to be used to validate e-TDS/TCS statements pertaining to FY 2010-11 onwards.

- File Validation Utility (FVU) version 2.159 is to be used to validate e-TDS/TCS statements pertaining up-to FY 2009-10.

To download the FVU, please visit the link https://www.tin-nsdl.com/downloads/e-tds/eTDS-download-regular.html

What documents should I submit along with the application form?

You have to submit the following documents with the application form:

01) Proof of identity (POI), 02) Proof of address (POA), 03) Proof of date of birth (PODB) (applicable only for Individual & HUF status of applicant.) (POA) The documents for POI and POA depend on the citizenship and the status of the applicant.

To know the list of documents, please visit the link https://www.tin-nsdl.com/services/pan/documents-change.html

Note:- Ensure that the document submitted are within the validity period

How will I know the status of my PAN application?

Please click on below URL to know the status of your PAN application. https://tin.tin.nsdl.com/pantan/StatusTrack.html

What are the due dates for filing quarterly TDS statements?

The due dates for filing quarterly TDS returns, both electronic and paper are as under:

For quarter April to June - Due date is 31 July . For quarter July to September – Due date is 31 October For quarter October to December – Due date 31 January For quarter January to March – Due date 31 May

What is TDS on Rent?

The Finance Act, 2017 has introduced section 194-IB providing that Tenant of a property making monthly rent payment exceeding ₹ 50, 000 is required to deduct tax at the rate of 5% from the rent payable to a resident landlord

Who is responsible to deduct the TDS on Rent of Property ?

The tenant of the property being an individual or a HUF (not liable to audit u/s 44AB) would have to deduct the TDS and deposit the same in Government treasury.

How can I use this facility to pay TDS on rent of Property?

The Tenant of the property (deductor of tax) has to furnish information regarding the transaction, online on the TIN website and make the payment accordingly. Please visit the link https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Is there any change in the file format for Form 24Q quarter 4?

Yes. As per the Income Tax Department notification 36/2019 dated April 12, 2019 the file format for Form 24Q Quarter 4 has been revised. The new format is applicable from May 12, 2019 onwards

Who can submit the SFT statement at TIN-FCs managed by NSDL e-Gov?

The government categories such as Post office and Sub-registrar office can submit the Statement of Financial Transaction at TIN FCs managed by NSDL e-Gov.

What is the timelines to submit the SFT statement?

For FY 2016-17 the last date to submit the SFT statement is May 31, 2017

I am post office / sub-registrar office, where should I submit the SFT statement?

To submit the SFT statement you may approach the nearest TIN FC. Please click on https://www.tin-nsdl.com/tin-facilities.html to find the nearest TIN FC.

- W.e.f. March 14, 2019, fees for PAN application form filled online using Aadhaar Authentication services have undergone a change due to UIDAI charges as per UIDAI notification no. 1 of 2019 dated March 6, 2019.

- "W.e.f July 1, 2017 it is mandatory to quote Aadhaar /Enrolment ID of Aadhaar application form, for making an application for allotment of Permanent Account Number (PAN) for Indian Citizen (Form 49A)."

- Revision in PAN/TAN processing charges on account of Goods and Service Tax @ 18% w.e.f July 1, 2017.

- Filing of Statement of Financial Transactions (SFT)

- -->Link Aadhaar to Permanent Account Number ( PAN)

- e-TDS/TCS RPU version 2.8 for Statement(s) from FY 2007-08 onwards is released (27/06/2019).

- e-TDS/TCS File validation utility (FVU) versions 2.159 for FY 2007-08 to FY 2009-10 and 6.3 for FY 2010-11 onwards are released (27/06/2019).

- New online PAN application facility has been launched for PAN applicants with an option of paperless submission of application using Aadhaar based e-Sign

- In case of PAN applications from non-individuals, Seal and/or Stamp is not required on PAN application Form 49A or 49AA or Form for Change or Correction...

- “W. e. f. July 1, 2017, the PAN application fees have been revised as under: 1. For dispatch of PAN card in India:- ₹ 110 (inclusive of Goods and Service Tax) 2. For dispatch of PAN card outside India: - ₹ 1020 (inclusive of Goods and Service Tax)” 3. For TAN applications:- ₹ 65 (inclusive of Goods and Service Tax)

- FVU for AIR with new validations released...

- Form 24G Return Preparation Utility (RPU) and File Validation Utility (FVU) Version 1.5 for the Form 24G Statements from FY 2005-06 onwards released (27/03/2015)...

- PAN cards are now being printed with Enhanced Quick Response (QR) Code .For more details, click here

- e-PAN is a digitally signed PAN card issued in electronic form and it is a valid proof of allotment of PAN.

TIN Facilitation Centers cum PAN centers

PAN Centers

Bank Branch Locator

Search for Bank Branch near your location

Pay taxes Online

e-Payment facilitates payment of taxes online by taxpayers

Click to pay tax online

Complains / Queries

NSDL Addresses

Attention PAN Card Applicants

PAN cards are now being printed with Enhanced Quick Response (QR) Code.

Specimen of the PAN Card as per new design is as under:

Features of new PAN Card design:

- Enhanced QR Code will contain Photograph & Signature of PAN applicant apart from existing information i.e., PAN, Name, Father’s Name/Mother’s Name, Date of Birth/Incorporation/Formation. The aforesaid details will be digitally signed & coded on the Enhanced QR Code.

- Enhanced QR Code shall be readable by specific Mobile App which is available on Google Play Store (Key words – ‘ Enhanced PAN QR Code Reader ’). An auto focus camera having resolution of 12 Mega Pixel and above is recommended for reading of the Enhanced QR Code.

- Positions of Photograph, Signature, Hologram and dimension of QR Code have changed.

- The Enhanced QR code will also be provided in the e-PAN Card issued to the PAN applicants.

It is clarified that PAN cards and e–PAN Cards issued prior to July 7, 2018 in old design will also remain valid.

Welcome to TIN website

The general public is hereby informed that the Income Tax Department (ITD), Government of India has appointed only two entities namely NSDL e-Governance Infrastructure Limited (NSDL e-Gov.) and UTI Infrastructure Technologies Services Limited for purpose of receiving and processing of PAN applications. No other entity has been authorised to undertake this activity on behalf of ITD.

For more details please click here>>

External Site Alert

Tax Information Network

This link shall take you to a webpage outside www.tin-nsdl.com. For any query regarding the contents of the linked page. Please contact the webmaster of the concerned website in case of any concern

This link shall take you to a webpage outside www.protean-tinpan.com. For any query regarding the contents of the linked page. Please contact the webmaster of the concerned website in case of any concern

Still Confused? Search from Here...

- Date of Deposit

- Challan Serial Number

- Major Head Code with description

- Name of Tax Payer

- Received by TIN on (i.e. date of receipt by TIN)

- Confirmation that the amount entered is correct (if amount is entered)

- Major Head Code with descriprtion

- Minor Head Code

- Nature of Payment

Challan Status Enquiry for Banks

- Challan Tender Date

- Name of Taxpayer

- Date of receipt by TIN

b) Nodal Bank Branch :

- Nodal Branch Scroll Number

- Scroll Date

- Major Head Code - Description

- Total Amount

- Number of Branches

- Number of Challans

- Branch Scroll Number

- Branch Scroll Date

How to Surrender PAN Card?

Maharshi Shah

Income Tax Department (ITD) issues Permanent Account Number (PAN) an alphanumeric ID in a form of card to any “person” who applies for it or to whom the department allows the number without an application. Every Permanent Account Number allotted and PAN card issued is valid for a lifetime. In a situation where the PAN holders lose their PAN or damage it, the ITD issues a duplicate PAN card to the PAN holder.

There are two ways to apply for the Duplicate PAN card :

- Online Method

- Offline Method

There are many cases where individuals have more than one PAN. For instance, if an individual loses his/her PAN card and wants to reissue, but there are discrepancies in the address. In such cases to avoid the hassle involved in applying for re-issuance with an address change, sometimes a person may apply for a new one and end up having two PANs.

How to Surrender PAN Card Online

Follow the steps given below to surrender your PAN card:

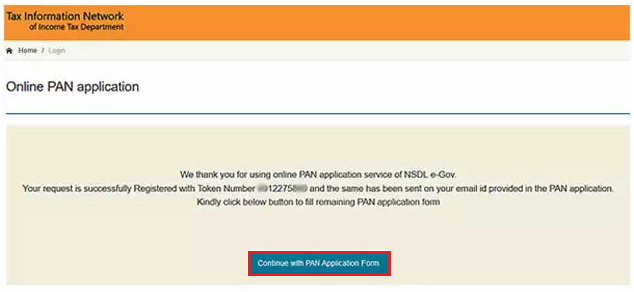

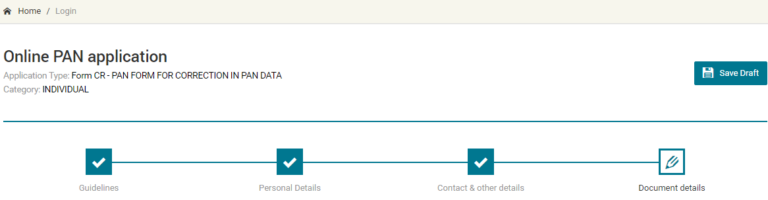

Visit the TIN-NSDL portal and select the “Changes/Correction in existing PAN Data/Reprint of PAN Card” option from the “Application Type” drop-down list. Enter the PAN details of the PAN card you wish to retain here.

Upload the scanned images of your photograph, signature and the required documents. If an individual is requesting the surrender of PAN, they themselves should sign the acknowledgment receipt, else they must be signed by the authorized signatories.

Thus, once the payment is successful you will be able to download print the acknowledgment form for future reference and as proof of payment. Therefore, you have to send a printed copy of the acknowledgment form to the NSDL e-Gov along with two photographs. Furthermore, label the envelope as “ Application for PAN Cancellation ” and the acknowledgment number. Hence, send it to the following address:

NSDL e-Gov at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016

You may fill and submit the PAN Change Request application form by mentioning the PAN which you are using currently on top of the form. All other PAN/s inadvertently allotted to you should be mentioned at item no. 11 of the form and the corresponding PAN card copy/s should be submitted for cancellation along with the form.

If you wish to cancel/ surrender your PAN (which you are currently using), then you need to visit your local Income Tax Assessing Officer with a request letter to cancel/ surrender your PAN.

Any one of the following documents can be submitted as proof of PAN surrendered: 1. Copy of PAN card 2. Copy of PAN allotment letter No other documents are acceptable as valid proof of PAN surrendered. If any proof of PAN surrendered is not available, then the application will not be accepted.

Last Updated on 3 years by

Request for Reprint of PAN Card

Instructions : --> 1. This facility can be availed by those PAN holders whose latest PAN application was processed through Protean (formerly NSDL e-Governance Infrastructure Limited) or have obtained PAN using �Instant e-PAN� facility on e-filling portal of ITD. 2. Click here to download e-PAN card free of cost (For PANs allotted/changes confirmed by ITD in last 30 days). 3. Charges for Reprint of PAN card: � For dispatch of PAN card within India(inclusive of taxes) - Rs 50.00 � For dispatch of PAN card outside India(inclusive of taxes) - Rs 959.00 4. PAN card will be dispatched to the communication address as per the latest details available with Income Tax Department.

Note: If you have not linked your Aadhaar with PAN then you are requested to link your Aadhaar with PAN on or before March 31, 2020.

Note: If you have not linked your Aadhaar with PAN then you are requested to link your Aadhaar with PAN on or before March 31, 2022.

- Skip to main content

- Screen Reader Access

- Language: English हिन्दी

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana

Aadhaar seva kendra, visit utiitsl aadhaar seva kendra for aadhaar services, get pan card at your doorstep, hassle free online processing and minimum documentation.

- Go for paperless PAN Card through Aadhaar e-KYC

- Get your coloured PAN Card today

- Verify PAN Card with new QR Code design

- Link your Aadhaar with your PAN

- Aadhaar verified with UIDAI

- Get e-PAN Card on your email

IT Services

Harnessing technology, solutions at their best, empowered by innovation, technology and client satisfaction, your gateway to a richer life, utiitsl as a mutual fund distributor, invest today through utiitsl.....

Nunc tincidunt venenatis elit. Etiam venenatis quam vel maximus bibendum Pellentesque elementum dapibus diam tristique

Medical Bill Processing

Seamless e-adjudication settlement of medical claims.

- Medical Claims Online

- Cashless Treatment Bills

- Real-time Tracking

- Bill Processing Transparency

- Speedy Settlement

Infrastructure Solutions

Properties, Interiors, Valuation and More...

About UTIITSL

UTI Infrastructure Technology And Services Limited (UTIITSL) is a Government Company under section 2(45) of the Companies Act 2013, registered under the Companies Act 1956 since 1993. UTIITSL being an Information Technology services company is also an active AMFI registered Mutual Fund Distributor empanelled with various Mutual Fund houses. We play a pivotal and valuable role in promoting sale of Mutual Funds by facilitating investors in buying and selling of Mutual Fund products. We have proven market leadership in Mutual Fund Distribution & Sales, R&T Agent services (as a SEBI registered Permanent Category-1 Registrar to an Issue and Share Transfer Agent), PAN Card Issuance/ Printing (on behalf of Income Tax Department of India, CBDT) and PAN Verification services, Medical Bill Processing Agency (e-Adjudication & Settlement of Medical Claims for empanelled facilities on behalf of CGHS, ECHS, ESIC, ESIS, Railways, NIMHANS etc.) ...

Our Services

PAN Card Services

Go for Paperless PAN Card

Mutual Fund Distribution

Invest today through us in a Right Way

Seamless e-Adjudication of Medical Claims

Harnessing technology Solutions at Best

UTIITSL Services

One of the largest Financial Service Providers

Infrastructure Services

R & T Services

You invest... We Care Mutual Funds and Bonds

Aadhaar Services

One Card Multiple Usages

PM-JAY Services

Vision of Universal Health Coverage

For SUUTI Schemes Investors

Find your unclaimed investments, information for ars & us64 bond holders, contact details.

Media Corner

19 December 2020

UTIITSL Inaugurates Aadhaar Seva Kendra at Kolkata

18 December 2020 - Sangbad Ekalavya

UTIITSL Inaugurates its Aadhaar Seva Kendra at Kolkata

18 December 2020 - United News of India

27 September 2020 - Raigad Observer

UTIITSL Inaugurates 2nd Aadhaar Seva Kendra

26 September 2020 - Global Prime News

UTIITSL Inaugurates its 2nd Aadhaar Seva Kendra

25 September 2020 - Mumbai News Network

News & Updates

As per guidelines issued by income tax department vide notification no. 17/2022 dated 29th march 2022, regarding aadhaar pan linking, existing aadhaar pan linking facilities through sms and pan cr application (including address update facility) are disabled till further instruction. (download circular), uti infrastructure technology and services limited (utiitsl) announces the opening of its second aadhaar seva kendra (ask) for aadhaar enrolment and update services at its cbd belapur, navi mumbai office. (address: plot no. 3, sector-11, cbd belapur, navi mumbai, maharashtra - 400614) visiting hours : monday to friday (9:30 am to 5:00 pm) & saturday (9:30 am to 3:00 pm), uti infrastructure technology and services limited (utiitsl) announces the opening of its first aadhaar seva kendra for aadhaar enrolment and update services at its new delhi office. (address: 1/28 sunlight building, asaf ali road, new delhi - 110002) visiting hours : monday to friday (9:30 am to 5:00 pm) & saturday (9:30 am to 3:00 pm), click to apply pan card for both physical pan card and e-pan card @rs.107/- (rs.1017/- for dispatch outside india), e-pan is a valid electronic mode of document bearing permanent account number (pan). applicants now can download e-pan card (click here to download), click to apply for e-pan card only, no physical pan card @rs.72/- (epan card will be sent to applicant`s e-mail id as per income tax department records), some of our esteemed clients availing our top-notch services: (click below to view more).

COMMENTS

As per ITD guidelines,'Request for New PAN Card or/and Changes or Correction in PAN Data' application is presently to be used only for update/correction in PAN database. For procedure to link Aadhaar with PAN, please click here.. As per provisions of Section 272B of the Income Tax Act., 1961, a penalty of ₹ 10,000 can be levied on possession of more than one PAN.

Queries related to PAN & TAN application for Issuance / Update through NSDL +91-20-27218080. ... AIS and Reporting Portal. Queries related to AIS, TIS, SFT Preliminary response, Response to e-campaigns or e-Verification. 1800 103 4215. 09:30 hrs - 18:00 hrs (Monday to Friday) View All. Select your language.

Direct tax payments facility have been migrated from OLTAS 'e-payment: Pay Taxes Online' to e-Pay Tax facility of E-Filing portal. Users are advised to navigate to 'e ...

Tax Information Network :: Homepage. Login for DSC based Users. Login for PAN Users. Login for Other Password based Users. Register for Pan Inquiry. Check Status of PAN Inquiry. Direct Reset Password for online view of Annual Tax Statement (Form 26AS)

Track your PAN/TAN Application Status. Please select type of application: Application Type. -- Select -- PAN - New / Change Request TAN - New / Change Request. ACKNOWLEDGEMENT NUMBER. N- (Please enter 15 digit numeric number) * Verify Status of Application. Please enter alphabets and digits only and Characters are Case Sensitive.

Please tap to make e-Payment of taxes or view Status of your tax Refund

Terms and Conditions for Usage of Digital Signature Certificate. Important (For DSC based users):-In order to use the new components for digital signing and verification, Digital Signature Certificate (DSC) based users are required to comply with the following pre-requisites with respect to the system configuration of the client machines:

Deductors can login using its TAN as the User Id and Password to verify the status of their statements. TAN views are available for quarterly statements only (F.Y. 2005-06 onwards)

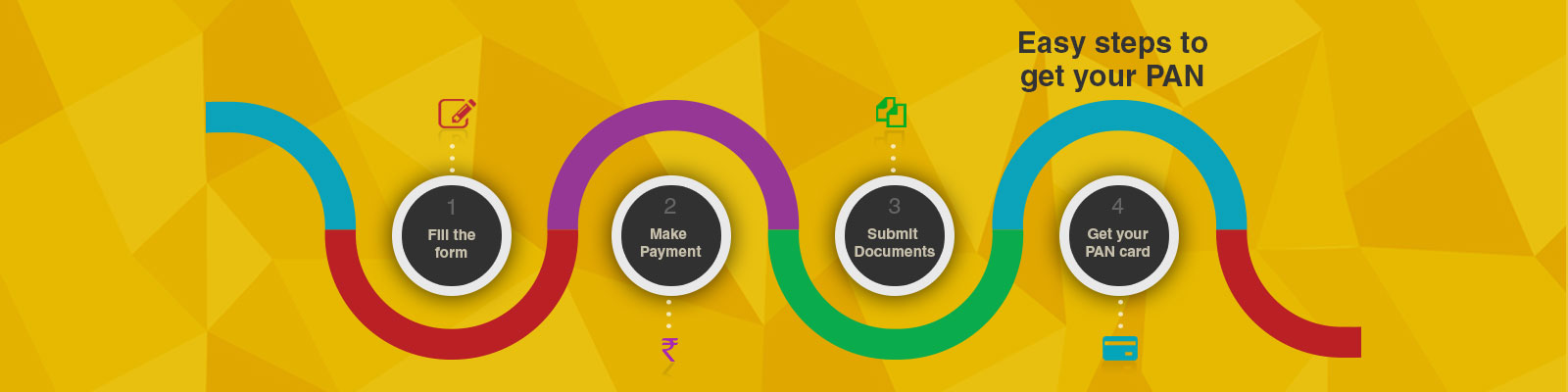

Visit the TIN-NSDL portal. Click on the Services > PAN option from the dashboard of the TIN-NSDL portal. Click on the "Apply" option. As discussed earlier, Form 49A is for the citizens of India, and Form 49AA is for the foreign citizens. Fill in the following details manually or select the options from the drop-down list as required:

Track your TAN application status. As per RBI guidelines, the entities making e-commerce transactions are required to provide PIN (Personal Identification Number) while executing an online transaction. Accordingly, before making payment for online PAN/TAN applications using credit/debit card, please ensure that the PIN is obtained from your ...

Steps to Apply for a Duplicate/Reprint of PAN Card. Visit the TIN-NSDL portal. Go to "Reprint of PAN" on Home Page. After accessing the application form for "Reprint of PAN" enter in the following details. PAN Number, Aadhaar (Only in the case of individuals), Date of Birth (D.o.B). Enter the Captcha code from the image given below.

Caution - Online PAN applicants. 1. PAN-Aadhaar linking deadline extended till 30.9.2019 vide ITD Notification No.31/2019 2. As per provisions of Section 272B of the Income Tax Act., 1961, a penalty of ₹ 10,000 can be levied on possession of more than one PAN.

Visit the TIN-NSDL portal to update the Address on the PAN. Click on "Paperless Address Update in PAN". Click on the check-box. Enter the captcha code from the given image. Click on the "Submit" option. Hence, the e-KYC page. The mobile number linked to your Aadhaar will receive an OTP. Click on "Continue with e-KYC".

To view and download CSI file for challans generated directly at www.incometax.gov.in, please login and navigate to e-Pay Tax Service -> Payment History tab -> Select date range in Filter options. Using this feature, tax payers can track online the status of their challans deposited in banks.This offers two kind of search.

Visit the TIN-NSDL portal. Click on the Services > PAN option from the dashboard. Scroll down the page till you reach the "Change/Correction in PAN Data" section. click on the "Apply" option. we move to the online application form. We land on the personal details section. Furthermore, you will be given an option to opt for a physical card.

As per ITD guidelines,'Request for New PAN Card or/and Changes or Correction in PAN Data' application is presently to be used only for update/correction in PAN database. For procedure to link Aadhaar with PAN, please click here.. As per provisions of Section 272B of the Income Tax Act., 1961, a penalty of ₹ 10,000 can be levied on possession of more than one PAN.

How to Surrender PAN Card Online. Follow the steps given below to surrender your PAN card: Visit the TIN-NSDL portal. Visit the TIN-NSDL portal and select the "Changes/Correction in existing PAN Data/Reprint of PAN Card" option from the "Application Type" drop-down list. Enter the PAN details of the PAN card you wish to retain here.

1. I understand that my Aadhaar data shall be used for the purpose of Reprint of card and my identity shall be authenticated through the Aadhaar Authentication system (Aadhaar based e-KYC services of UIDAI) in accordance with the provisions of the Aadhaar (Targeted Delivery of Financial and other Subsidies, Benefits and Services) Act, 2016 and the allied rules and regulations notified ...

Important Update : Now, PAN holders can link their Aadhaar with PAN through designated TIN-FC/PAN Centres having biometric devices. The new feature is available under 'Acceptance' menu with tab name as Aadhaar Seeding. Please refer TIN Circular No. Protean/TIN/2023/008 Dated June 19, 2023, for more details. ... (formerly NSDL e-Governance ...

Hassle free online processingand Minimum documentation. Go for paperless PAN Card through Aadhaar e-KYC. Get your coloured PAN Card today. Verify PAN Card with new QR Code design. Link your Aadhaar with your PAN. Aadhaar verified with UIDAI. Get e-PAN Card on your email.