- Host Agencies

- Accelerator Course

- Travel Jobs

- Travel Agent Chatter

- Etiquette & Rules

- Privacy Policy

How Much Does it Cost to Become a Travel Agent?

How much does it cost to become a travel agent ? If you want to start your own travel agency, which is the most common way future travel advisors enter the industry, we've got tons of info for you! ( If you're looking for how much travel agents make, we've got another article for you.)

Our annual travel advisor survey finds that travel agency startup costs typically run between $0-$20,000, which isn't the most helpful. This vast range illustrates just how many factors impact how much it costs to start a travel agency.

In this article, we'll break down how much it costs to become a travel agent by the most common routes people enter the industry:

- Franchise travel agencies

- Hosted travel agencies

- Independent travel agencies

Below you can see the average startup cost for a hosted travel agent in 2023 was $2,846.

This article is going to look at the latest data for how much it costs to become a travel agent when it comes to hosted travel agents, advisors overall and why it's so stinking hard to get concrete data on startups for franchise owners and independently-accredited advisors.

This resource offers a run-through of what you can expect budget-wise for four different types of travel agency models.

⭐️ HAR Article Highlights: ⭐️

How Much it Costs to Become a Travel Agent: The Big Picture (+Infographic)

- How Much it Costs to Become a Hosted Travel Agent

- How Much it Costs to Start a Travel Agency Franchise

- How Much it Costs to Become an Independent Travel Agent

Travel Agency Earnings: What You Can Expect in the First 3 Years

Income for Travel Agency Startups: The Big Picture

How much does it cost to become a travel agent: the big picture.

If you balked at the massive range people are spending to become a travel agent ($0-$20,000), you’re not alone. Why is there such a disparity in how much travel agents invest?

If you forced me to give a bottom line, shoe-string budget number on how much you’d invest at minimum to register your travel and access an accreditation number to book travel, I’d say the bargain basement budget startup cost would run around $300 at a bare minimum.

Frankly, when folks say they start an agency for nothing, I don’t know how they do it. If you’re one of those people, give me a holler. I want to know your secret! I’m thinking it’s likely they’re not factoring in the cost of registering their business, investing in their accreditation number, or purchasing a website domain. Those costs seem negligible individually but can start to add up.

We're going to look at how much it costs to become a travel agent in a bunch of different ways. How do we do this with any amount of confidence or accuracy? I'm so glad you ask!

We pull new agent data from HAR's ridiculously comprehensive annual travel agent survey results .

1. Range: The range is the lowest and highest reported startup costs. This helps give a sense of how much it can vary and will guide you in making a budget that works for you.

2. Average: The average is the total sum of startup costs divided by the number of agents who responded to the survey. I like to think of average as the “ballpark figure.” A lot of time, the average is a “middle value,” but when you have some folks invest $20 bucks and some invest $20K, sometimes these averages aren’t the best representation of what you can expect to spend.

3. Median: Median is the true middle startup cost. It’s the startup cost entry with an equal number of higher and lower-cost entries. And because we like to go big rather than go home, we’ll also look at . . .

4. Mode Startup Cost: The mode is where it becomes a popularity contest: it’s the startup cost is the value that travel agents reported most frequently.

How Much it Costs to Become a Hosted Agent:

Host agencies are a great option for new travel agents who want to start their own business, but don’t have the time/resources/people power to research and invest in every nook and cranny of the backend of running an agency ( accreditation number , E&O insurance , Seller of Travel registration , CRM . . . the list goes on) and are looking for higher commissions.

It will come as no surprise to you that we’re fans of host agencies, and we recommend it to 99% of folks who are new to the industry and want to start their travel agency business and brand.

Hosts provide that administrative framework so you can focus on developing your travel agency brand identity and focus on selling travel. (You can read more on the benefits of using a host agency here . )

If you’re starting a travel agency with a host agency, here’s how much you can expect to invest in your startup cost:

1. IQ Range 1 of Travel Agency Startup Cost for Hosted Agents in 2023 : $500-$3,000

2. Average Cost to Become a Hosted Travel Agent in 2023: $2,846

3. Median Cost to Become a Hosted Travel Agent in 2023: $1,213

4. Mode Cost to Become a Hosted Travel Agent in 2023: $1,000

That brings us to . . . .

How Much it Costs to Start a Travel Franchise:

Above, I mentioned that hosts are a great option for those who want backend support but still want to develop their brand. If you want to run your travel agency, but do not want to spend time creating a brand identity from scratch, a travel agency franchise is a great option.

With a travel franchise, you get to use the franchisor’s established branding.

The benefit of this is that, rather than starting your brand identity from the ground up, you get to hit the ground running with a brand identity that has already been established for years. (In industry lingo, they call this a turnkey travel business.)

Is that up to your alley? You can learn about travel franchises here !

For the franchise listings on our site , the startup cost to become a travel agent through the franchise route ranges from to $300-$8,995.

The latest data we have on startup costs for franchise owners is from 2020. Here's what that looked like back in the day:

1. Range of Travel Agency Startup Cost for Travel Agent Franchisees in 2020: $162-$15,000

2. Average Travel Agency Franchise Startup Cost in 2020: $5,690

3. Median Travel Agency Franchise Startup Cost in 2020: $9,250

4. Mode Travel Agency Franchise Startup Cost Mode for Franchisees in 2020: $2,000

How Much it Costs to Become an Independent Travel Agent:

When we say independent agent, what we mean is a travel agent who gets their own accreditation number, rather than using a host agency's..

Independent travel agents are on the opposite end of the spectrum from franchisees. Whereas travel franchisees (typically) have their entire business setup from backend to branding, and hosted agents typically receive backend structural support, independent agents do it all on their own.

They get their accreditation , their travel agent license , join their consortium directly, forge their relationships with travel suppliers (etc.).

Why don't we have info on startup costs for independent advisors? Because most independent advisors started out with a host agency before going it alone.

Among the 2,600+ advisors who responded to our latest survey, only 9 were new, independent advisors.

Our survey asks for startup costs for agents with 0-2 years of experience. Among the 2,600+ advisors who responded to our latest survey, only 9 were new, independent advisors.

Wowza. Because of this, we don’t have enough data on startup costs for independent agents to provide reliable data. Sad face.

If you’re a newbie independent agent, we’d love to hear from you! Let us know in the comments below if you’re willing to share how many coins you dropped! But most importantly, take our survey so we can offer great more great data in the independent segment!

Travel Agent Earnings: What You Can Expect in the First 3 Years

Now that you have an idea of approximately how much it costs to become a travel agent, let’s talk about how much you can expect to earn.

I’m not going to sugarcoat this: It may take you a few years to be able to earn a living from your travel agent career . Why? There are a few reasons:

Here are a few reasons why it can take time (typically 3-5 years) to generate a steady income as a travel agent:

- It takes a while to build a client base and develop your brand.

- Even when you do make your first bookings, you're often not paid commission until after your client completes their travel (or after final payment for some vendors). So, if you make seven bookings in January but the clients aren't traveling until November, you might not get paid until the next calendar year. Let's just say, if you're wanting to walk off your current job, thinking that the big bucks will roll in the next month, you might want to reconsider your strategy. 😉

- (Leisure) travel is something most people only do 1-2 times a year. Even with referrals and repeat clients, it can take a lot longer to build a steady business compared to a new restaurant or other service industries like a hairstylist.

Now let’s talk about moolah.

We have loads and loads of in-depth travel agent research reports . In our hosted advisor report, we have a section specifically for newly hosted travel agents with 0-3 years of experience.

I’ll offer you a brief overview of new travel agent income data, plus show you how it’s trended over time.

The Latest and Greatest New Travel Agent INCOME Data:

New advisors earned $3,198 on average, according to HAR's 2023 survey. However, those with 2 years of experience earned nearly 8x higher average income. Here's a look at what hosted advisors earned!

What Factors Lead to More Income For Travel Agents?

The secret sauce to earning a higher income as a travel agent is not a well-kept secret. We’ve been collecting data on travel agent income for years now and here’s what we’ve seen:

Income potential increases if you:

- Work full time

- Charge a fee

- Sell certain travel products

- Have employees or independent contractor agents working with you

But that’s only part of it.

Investing in travel agent startup resources is step one. Leveraging those resources is step two.

What I’m about to say is going to sound extremely obvious, but hey, it’s what leads to earning more money: Investing in these resources is step one. Leveraging resources is step two.

Getting to a point of income stability is about so much more than investing dollars in a fancy website, joining a host agency or getting an accreditation, or ticking off boxes for travel certifications. It’s just as much about taking advantage of the tools and resources that are available to you through your host or consortium.

How do you know? You can find more details than you ever wanted in our travel agent income survey archive . (Psst, if you click on that link and get a little scared by the sheer volume of data, a good start is to check out our latest longitudinal travel agent income report .)

Ready to Get Started?

Not only are travel agency startup costs affordable, but there are also plenty of resources.

If you want to get a lay of the land, check out HAR's 7DS Accelerator course options . If you just want to dip your toes into the waters to see if it’s for you, give the trial a try.

Once you hit your stride as a travel advisor, our travel agent income data shows that earnings trend upward with experience, time investment, and industry engagement.

We'd love to hear from you—new and experienced agents alike! How long did it take for your agency to become sustainable? Did you find your cost to become a travel agent was similar to those in the article? For agents with a few years under your belts, what do you wish you did differently? For new agents, where are you feeling the need for additional support?

Let us know in the comment section below or email us!

*Editor's Note: This post was originally published on July 17th, 2018. We updated the information to reflect current income trends. (You can find the original article here .)

- IQ (Interquartile) Range: Layspeak? An IQ range is a more “typical” range, looking at averages that are between the 25th percentile and 75th percentile. This helps us give advisors more of an idea of what they can realistically expect when it comes to things like income, fees, and startup costs. ↩

About the Author

Mary Stein has been working as a writer and editor for Host Agency Reviews since 2016. She loves supporting travel advisors on their entrepreneurial journey and is inspired by their passion, tenacity, and creativity. Mary is also a mom, dog lover, fiction writer, hiker, and a Great British Bake Off superfan.

- Agent Tools

- Travel Agent Basics

A Look at How Travel Agents Make Money

The average travel agent earns between $47,000 and $55,000 annually.

Most travel agents’ income is made up of their salary, but they also earn from commissions, service fees, and markups.

Generally, the more experienced and niche a travel agent is, the higher the commission and other fees they charge.

They are also multiple types of travel agents, with some specializing in leisure travel, others in business travel, and some offer niche travel services, like adventure or eco-tourism.

Table of Contents

- 1.1 1. Leisure Travel Agents

- 1.2 2. Business Travel Agents

- 1.3 3. Niche Travel Agents

- 2 How Much Commission Travel Agents Make on Flights

- 3.1 1. Markups

- 3.2 2. Service fees

- 3.3 3. Package deals

- 3.4 4. Incentives

- 4.1 1. Commissions

- 4.2 2. Service Fees

- 4.3 3. Salaries

- 5 Travel Agent Commission Rates

- 6 Travel Agents Make Good Money

- 7 Travel Agents Don’t Expect Tips

- 8 Who Even Uses Travel Agents Anymore?

3 Different Types of Travel Agents

These are the three main types of travel agents.

1. Leisure Travel Agents

Leisure travel agents specialize in vacation and leisure planning for both individuals and families.

They can book flight tickets and hotels and arrange tours and activities for travelers.

2. Business Travel Agents

Business travel agents specialize in business travel for businesses and their employees.

Their services include booking flight tickets, hotel rooms and coordinating ground transportation.

3. Niche Travel Agents

Niche travel agents specialize in niche types of traveling, like adventure travel or eco-tourism.

Each niche travel agent specializes in a specific niche, and use their niche travel knowledge to plan customized trips for niche travelers.

How Much Commission Travel Agents Make on Flights

Travel agents commonly receive commissions for selling travel products and services.

For flights, a travel agent can make 5% commission on domestic flights, and 10-20% for international flights.

For instance, a travel agent could sell an international roundtrip flight for $1,000. And if their commission rate is 15%, they’ll receive $150 for the sale.

When it comes to cruises, travel agents can expect to make approximately 10-15% of the pre-tax price on a cruise.

4 Ways Travel Agents Make Money

Besides commission, travel agents make their money through the following four ways.

Travel agents sometimes add a markup to their travel products and services to earn extra income.

For instance, a travel agent could add a $10 markup to a hotel room that costs $90.

They’ll charge the traveler $100 total for the hotel room, with the $10 being their fee for finding and booking the room.

The exact markup an agent charges depends on the products they’re selling and their arrangement with their supplier.

The most experienced travel agents naturally have the highest markup.

2. Service fees

Travel agents also sometimes charge a flat or percentage service fee.

For example, they could charge you a flat $200 for arranging your trip, or they could charge 5% for the total cost of your trip.

The service fees are charged for providing you with their services, including booking your flights and hotels, arranging for tours and transport, and filing your visa applications.

The exact fee depends on the agent’s experience and reputation.

The most experienced and well-reputed travel agents charge the highest fees.

Inexperienced agents may not charge any service fees at all.

3. Package deals

Travel agents often create and sell packages, which contain a group of products or services given at a discounted price.

These packages can be customized to specific travelers or designed to decrease costs for them.

There are four main types of package deals.

- Flight and hotel ticket packages: This package will have discounted flight and hotel tickets.

- All-inclusive packages: This will include everything from flight and hotel tickets to meals and activities – all at a discounted price.

- Tour packages: This package will include guided tours and activities in addition to flight and hotel tickets.

- Cruise packages: This package includes a cruise vacation along with pre-cruise and post-cruise flight and hotel tickets.

The agents earn from packages by adding markups, service fees, and commissions to their packages.

4. Incentives

Travel companies often provide incentives and bonuses to agents for selling a specific number of services.

The incentives range from cash rewards to complimentary trips and other benefits.

Travel agents often earn additional income from these incentives.

How Travel Agents Get Paid

Travel agents are paid via the following three ways.

1. Commissions

The travel agent receives a percentage of the sales they make for a product or service.

2. Service Fees

Travel agents sometimes charge the traveler an upfront flat or percentage service fee directly.

3. Salaries

Travel agents earn a base salary of $39,770 according to Salary.com

Travel Agent Commission Rates

Most host agencies provide between a 7% and 8% commission.

These are the usual commission tiers for annual sales:

- $0 to $49,999: 10%

- $50,000 to $249,999: 13%

- $250,000 to $499,999: 14%

- $500,000 and higher: 15%

These are the normal commission tiers in terms of passengers:

- 0 to 20 passengers: 10%

- 21 to 49 passengers: 11%

- 50 to 199 passengers: 13%

- 200 and more: 15%

Travel Agents Make Good Money

Most travel agents earn between $47,000 and $55,000 annually, including their salary and other payments.

The exact income of a travel agent depends on their skills, experience, and relationship with suppliers.

Experienced travel agents with a high number of sales and a good relationship with suppliers can earn substantially more than $55,000 per year, though.

All travel agents receive their salary every month. But the rest of their payments depend on the specific business arrangement with their clients and suppliers.

Most agents receive commissions after a customer finishes their travels. Most also receive their service fees upfront.

Travel Agents Don’t Expect Tips

Travel agents sometimes receive tips from wealthy customers.

But it’s not particularly common for them to receive tips, nor do most travel agents depend on or expect tips as part of their job.

Who Even Uses Travel Agents Anymore?

Many people still use travel agents today because they provide a personalized service, such as luxury travelers looking for a luxurious vacation that exactly matches their tastes and needs.

Travelers with complex trips that involve multiple destinations may hire travel agents to better manage their trips.

In conclusion:

- Most travel agents earn between $47,000 and $55,000 annually.

- This figure includes a salary of around $45,000, with the rest of their income coming from commissions, service fees, and markups on goods and services.

- The exact income for a travel agent depends on their skills, experience, and relationship with their suppliers.

- An experienced travel agent with a large number of annual sales, a good relationship with their suppliers, and high commission rates can earn more than $55,000.

Ella Dunham

Ella Dunham, a Freelance Travel Journalist and Marketing Manager, boasts an impressive career spanning eight years in the travel and tourism sectors.

Honored as one of "30 Under 30" by TTG Media (the world’s very first weekly travel trade newspaper), a "Tour Operator Travel Guru" and "Legend Award" winner, Ella is also a Fellow of the Institute of Travel, a Member of the Association of Women Travel Executives, has completed over 250 travel modules, and hosts travel-focused segments on national radio shows where she provides insights on travel regulations and destinations.

Ella has visited over 40 countries (with 10 more planned this year).

Related Posts:

How Do Travel Agents Make Money? [The Travel Agent Business Model]

In the past, travel agents made money from commissions from airlines and hotels. And while this is still a key revenue source for travel agents, the increasing prevalence of online booking has made them look for new sources to diversify their income. So, how do travel agents make money today?

Below, we explain the different ways in which independent professionals and online agencies generate revenue in the ever-changing travel industry. By understanding the rewards that come with taking on the role of a travel agent, you will gain insight into this often-overlooked career path and how it could fit into your own life goals.

How Do Travel Agents Work?

Travel agents work to provide their clients with a stress-free and personalized travel experience by taking care of all the details and providing expert advice and support. Travel agents can work independently or for travel agencies.

The key role of a travel agent is to assess their client’s needs and make the necessary recommendations and arrangements based on them. Services provided by travel agents include:

- Consultation – Determining the client’s travel needs, budget, and preferences. This includes asking questions about the purpose of the trip, the desired destination, preferred travel dates, accommodation preferences, and any specific requests or requirements.

- Research – Identifying the best travel options available for the client (flights, hotels, rental cars, tours, and activities).

- Booking – Making travel arrangements on behalf of the client.

- Confirmation – Verification of all details related to the booking, including providing the client with the necessary information, such as flight times, hotel reservations, and tour details.

- Follow-up – A travel agent may provide advice on travel visas, travel insurance, packing tips, and other travel-related issues.

How Do Travel Agents Get Paid?

The most common way a travel agent gets paid is from commissions from airlines, cruise lines, or tour companies for packages sold. The commission rate varies depending on the type of travel and the agreements with travel providers.

Additionally, travel agents get paid a fee by their clients for their services. The amount of the service fee is entirely up to the agent and is related to the type of services provided. Typically, it’s charged for arranging some or all segments of the travel.

If the travel agent is employed by an agency, then just like any other employee, they’ll receive a salary or hourly wages.

Net price overages are also an option for many agencies. So, for instance, if an agent books a certain number of hotel rooms, the vendor gives them a discount which is then marked up, and the difference is kept by the agency.

Some travel agents may also earn additional revenue by offering travel insurance or upgrades to accommodations or transportation.

Travel Agent Business Model

The simplest way to describe the business model of travel agents is to go by the main source of income. Based on this, there are two types of business models:

- Commission-Based

The commission-based business model allows travel agents to earn a percentage of the total cost of a travel package, such as flights, accommodations, and activities. Depending on whether the package is domestic or international, travel agent commissions may be as low as 5% or as high as 20% or more.

- Service-Fee-Based

In a service-fee-based business model, travel agents charge their clients a service fee for their expertise or assistance in planning a trip. If the travel agent is in the role of an advisor, they may recommend a popular destination or deal on a specific trip.

Alternatively, they may provide help for any given element of the trip, from booking a hotel room or flight to booking a spa treatment. The fee charged can be a flat rate or a percentage of the total trip cost.

It’s important to note that with the rise of online booking platforms, the travel industry has become more competitive, and many travel agents use a combination of commission and service fees, plus access to exclusive deals and pricing. This way, they’re able to offer their clients a unique and personalized experience while staying competitive in the market.

How Travel Agents Make Money

Here are the most common ways travel agents make money.

1. Travel Insurance Sales

Travel insurance is essential to ensure your trip is protected in case of any unexpected changes or emergencies. Travel agents can sell insurance policies for their clients, which provide coverage for things like flight cancellations, lost luggage, and medical expenses. Depending on the policy sold, agents can earn up to 40% in commission.

2. Cruise Sales

Travel agents may receive a high commission or bonus on cruises based on the number of rooms booked by their clients. Typically, the commission rate for cruises is around 12%. This is because a large number of passengers are required to fill a ship.

Note that a significant portion of clients’ bills is taxes. For instance, a booking for cruise berths priced at $4,000 might include taxes amounting to $1,500. When booking cruises, agents earn commissions only on the portion of the cost that is not taxed.

3. Car Rental

Depending on the car rental agency, agents may earn between 8% to 10% commission on bookings. Other travel agents charge a flat fee of $20–$40 for making the reservation with the car rental company.

The car rental industry is highly competitive, so the key here is for travel agents to establish relationships with different companies and shop around for the best rates for their clients.

From visiting vineyards in Tuscany to exploring the rainforest in Costa Rica, tours are an excellent way for clients to get the most out of their travels. Agents can earn commissions ranging between 10% and 20% when they book a tour package and may also receive incentives such as free rooms or discounts on future trips.

5. Premium Listings

Car companies, airlines, and cruise lines pay handsomely for premium listings on travel agents’ sites. This gives the company more visibility and may help them generate more revenue. Typically, agents negotiate a commission for booking trips with these companies or charge a flat fee for providing access to the website.

6. Vacation Packages and Deals

If a travel agent is employed, they can use the buying power of their agency to get discounts and special offers which they can then pass on to their clients in the form of reduced hotel rates, exclusive deals, and other incentives. Usually, the commission rates for booking vacation packages range between 10% and 15%.

7. Niche Travel

Focusing on a niche area can be highly profitable for travel agents because it allows them to refine their expertise and cater to clients seeking a specific type of trip, like wedding and honeymoon or sports travel.

Some agents have two distinct branches of their business. The first covers travel to various destinations worldwide, while the second specializes in a particular theme like yachting, wine, or culinary adventures. For instance, an agent could sell packages for resorts and cruises while also organizing unique wine or food-related trips.

8. Mode of Travel

Vacationers have options beyond just using traditional modes of transportation like planes, trains, and cars. For instance, they can choose to explore an area by cycling from one spot to another. It’s the agent’s responsibility to arrange the logistics of the trip, from transportation to the actual adventure.

9. Corporate Travel

Many travel agents make their money by organizing custom trips for corporations. From organizing team building, corporate retreats, or special rewards trips, corporate travel is an excellent source of revenue and provides the opportunity for the agent to make long-term relationships with companies.

Travel agents may be paid an hourly fee for their services and/or a commission on airline tickets, cruises, and hotels and resorts. They could also receive incentives to book certain properties or activities, such as golf courses or spa treatments.

How Much Do Travel Agents Make Per Booking?

A travel agent’s commission may be as low as 5% or as high as 30% and depends on various factors such as the type of booking, the element of travel, and the vendor they book with. In addition to commissions, travel agents’ income can come from other sources, such as service fees.

For example, if a travel agent earns a commission of 10% on a $2,000 booking, they would make $200. However, if the booking is a complex itinerary, such as a multi-country trip, and the travel agent charges a service fee of $200, their total income from that booking would be $400.

Do Travel Agents Get Paid Hourly?

Yes, travel agents can be paid by the hour, and it’s a more common type of compensation for travel agents who work for larger agencies. The average hourly pay of travel agents in the US currently stands at $17.71 and goes as high as $28 per hour in states like New York, California, and Nevada.

However, travel agents are typically compensated in different ways, and their pay structure may depend on the company they work for and the type of travel they book. And while some are paid on an hourly basis, most receive a salary or are paid on a commission basis.

Item added to your cart

Thinking of starting a travel agency here's the budget to start..

What's the price tag for starting a travel agency business ? What are the core expenses we should focus on? Can we kick off with a limited budget, and are there any costs we should skip?

This guide will provide you with essential information to assess how much it really takes to embark on this journey.

And if you need more detailed information please check our business plan for a travel agency and financial plan for a travel agency .

How much does it cost to start a travel agency?

What is the average budget.

On average, you can expect to spend between $5,000 to $100,000 or more to start a travel agency.

Let's break down what impacts this budget the most.

The location of your travel agency, while important, is not as critical as in retail businesses. Renting a small office in a suburban area will be much cheaper than a prime location in a city center. However, given the nature of the business, a fully remote or home-based operation is also a viable option, which can significantly reduce costs.

The primary cost for a travel agency is often technology and software. A robust booking and CRM system can range from $1,000 to $20,000 depending on the features and scale. Moreover, a professional website, which is essential for attracting clients, can cost anywhere from $500 to $10,000.

Regarding the budget per square meter, if opting for a physical location, you can expect to pay anywhere from $500 to $3,000 per sqm, depending on the area.

Interior design for a travel agency does not need to be as elaborate as other businesses. A functional and comfortable space for consultations and work can range from a few hundred to several thousand dollars.

Obtaining the necessary business licenses, permits, and professional certifications can vary by location and may cost from a few hundred to several thousand dollars.

Your initial marketing expenses are crucial. Investing in online marketing, branding materials, and possible partnerships with travel providers can cost a few thousand dollars or more.

Can you open a travel agency with no money?

No, you actually need money to open a travel agency. However, a large budget is not always necessary. Let's discuss the very minimum to open a travel agency and how it would look.

To open a travel agency at the absolute minimum, you might start with a home-based operation or a completely online model.

For example, instead of renting office space, you could work from your home, saving on rent costs. Additionally, many of the business processes can be handled using standard computer equipment and basic software, which could cost around $500 to $2,000.

With a home-based or online agency, you won't need a physical space for client consultations, which eliminates the need for a costly office setup and renovations.

Keep your marketing simple and cost-effective, focusing on social media and word-of-mouth. A minimal budget for online ads and basic branding materials might be a few hundred dollars.

In this minimal scenario, your initial investment could be as low as $1,000 to $5,000.

However, this approach may limit your visibility and growth potential. As your travel agency business grows, you can reinvest profits into better technology, marketing, and possibly a physical location to expand your client base.

Finally, if you want to determine your exact starting budget, along with a comprehensive list of expenses customized to your project, you can use the financial plan for a travel agency .

What are the expenses to start a travel agency?

Please note that you can access a detailed breakdown of all these expenses and also customize them for your own project in the financial plan for a travel agency .

The expenses related to the location of your travel agency

For a travel agency, choosing a location with good visibility and accessibility is key. Ideal locations include areas with high pedestrian traffic, such as shopping malls, tourist areas, or near busy streets. It's beneficial to be in proximity to other travel-related businesses, like hotels or tourist information centers.

The travel agency should have a welcoming atmosphere, with enough space for brochures, display screens, and consultation areas. Consider locations with potential for eye-catching displays and good storefront visibility.

Accessibility for clients, including parking facilities and proximity to public transport, is also crucial. Additionally, consider the ease of receiving marketing materials and other deliveries.

If you decide to rent the space for your travel agency

Estimated budget: between $2,000 and $8,000

Renting a space for your travel agency includes initial costs like security deposits and the first month's rent. Security deposits are typically one or two months' rent and are generally refundable.

For instance, if your monthly rent is $1,200, you can expect to pay around $2,400 initially for the security deposit and the first month's rent. Then, budget for the subsequent three months' rent, totaling $3,600.

Understanding the lease terms, including duration and rent increase conditions, is vital. Legal fees for reviewing the lease may range from $400 to $900.

Broker's fees, if applicable, are usually covered by the landlord.

If you decide to buy the space for your travel agency

Estimated budget: between $80,000 and $500,000

The cost of buying a property varies based on factors like size, location, and condition. Prices can range from $40,000 (for a small space in a less central area) to $450,000 (for a prime location in a city center).

In addition to the purchase price, closing costs including legal fees, title searches, and loan origination fees, generally range from $4,000 to $25,000.

Renovation costs for fitting out the space could be 10-20% of the purchase price, or between $8,000 and $100,000.

Property assessments may incur costs up to $3,000.

Property taxes, depending on the location, can range from 3% to 12% of the property's value, which translates to between $2,400 and $60,000.

Property insurance costs can vary, but generally, you can expect to pay between $150 and $1,500 per month.

Is it better to rent or to buy a physical space when you open a travel agency?

Renting offers lower upfront costs, more flexibility, and fewer maintenance responsibilities but may lead to variable rent costs over time.

Buying provides ownership, stable payments, and tax benefits but requires a larger initial investment and ongoing property maintenance.

The decision should be based on your financial situation, long-term goals, and the dynamics of the local real estate market.

Here is a summary table for comparison.

Equipments, furniture and interior design

Estimated Budget: around 50,000$ to 100,000$

When opening a travel agency, your initial investment should focus on a comfortable, well-equipped office space. This is crucial as it represents your brand and is where clients will plan their dream vacations.

High-quality office furniture including ergonomic chairs and desks is vital for the well-being of your staff. Expect to spend between $5,000 to $15,000, depending on the number of employees and the quality of furniture chosen.

Computers and technology are the backbone of a modern travel agency. Investing in good computers, reliable internet, and travel planning software can cost anywhere from $10,000 to $30,000, depending on the number of workstations and software licenses.

A well-designed, professional website is essential for attracting and retaining clients in the digital age. Website development costs can range from $5,000 to $20,000, depending on complexity and design elements.

Marketing and advertising, including online and offline methods, are crucial for getting your business noticed. Allocate $10,000 to $25,000 for initial marketing campaigns, including social media, print ads, and possible travel fairs participation.

For client consultations, a comfortable and inviting meeting area in your office is important. This space, equipped with high-quality seating and visual aids for presentations, might require an investment of $3,000 to $8,000.

Additionally, consider a budget for travel experience. As a travel agency, firsthand experience of destinations can be a significant advantage. Set aside $5,000 to $15,000 for staff familiarization trips to popular destinations.

Optional but beneficial investments include a CRM (Customer Relationship Management) system, costing about $1,000 to $5,000, to manage client interactions effectively, and a small library of travel guides and resources for about $500 to $2,000.

Regarding prioritizing your budget, focus on technology and office comfort first. These will directly impact your staff's efficiency and client impressions.

While it’s tempting to save on technology or furniture, remember that low-quality items can lead to discomfort and inefficiency, which can harm your business in the long run.

For marketing and advertising, a balanced approach is key. While it's important to make your presence known, careful planning can avoid overspending.

Remember, starting a travel agency is about creating a welcoming, efficient, and technologically equipped space to plan unforgettable journeys for your clients. Begin with the essentials and expand as your business and revenue grow.

Marketing, Branding and Communication

Estimated Budget: $8,000 to $15,000 for the first months of operation

Launching a travel agency in today's competitive market requires a strong emphasis on branding, marketing, and communication to stand out.

Branding for a travel agency is not just about a catchy name or a vibrant logo. It's about embedding the spirit of adventure and discovery into every aspect of your business. This could range from the design of your office, echoing exotic destinations, to the tone of your communication, reflecting excitement and cultural richness.

What is the image you want your travel agency to project? Is it luxury and exclusivity, or budget-friendly and adventurous? Your branding should be evident in everything from your travel brochures to your staff's attire and even the layout of your website.

Marketing is your beacon to potential travelers, showcasing the unique experiences you can offer. Relying solely on foot traffic or word of mouth is insufficient. Your agency needs to reach out proactively. This can be achieved through engaging social media campaigns highlighting thrilling travel destinations, informative email newsletters, or partnerships with travel influencers.

Effective marketing for a travel agency might involve immersive YouTube videos of popular travel destinations, Instagram stories featuring client testimonials, or Google Ads targeting specific travel interests. It's essential to leverage SEO strategies, ensuring your agency appears when someone searches for "best travel deals" or "adventure tours".

However, be cautious with spending on broad, non-targeted advertisements. Focus on travelers who are actively seeking your specific travel services or destinations.

Communication in a travel agency is crucial. It's about providing personalized travel advice, being responsive to inquiries, and offering support before, during, and after trips. Excellent communication builds trust and loyalty, turning one-time travelers into lifelong clients.

When it comes to your marketing budget, allocate a reasonable portion of your revenue, about 3% to 12%, to these efforts. As a new agency, starting conservatively and then adjusting based on response and growth is advisable.

Invest wisely in your marketing efforts. High-quality, appealing content for your social media, a user-friendly and informative website, and perhaps some community engagement like hosting travel workshops or collaborating with local events can be beneficial.

Regularly review your marketing strategy. You might spend more initially for a strong launch, then evolve into a consistent pattern of investment. Pay attention to what works best - if your blog is attracting a lot of potential clients, consider enhancing that channel.

Staffing and Management

Estimated Budget: $15,000 - $30,000 for the first month

Just like any business, a travel agency has specific staffing and management expenses that are crucial for its smooth operation.

Let's dive into the details.

Running a travel agency, even a small one, often requires more than one person. You'll need staff to handle various tasks such as travel consultations, booking management, customer service, and marketing. While it's possible to start solo, the breadth of tasks in a travel agency can quickly become overwhelming.

Key positions in a travel agency include a travel consultant or agent, customer service representative, and a marketing specialist. These roles are essential from the outset to ensure efficient operation, client satisfaction, and business growth. Depending on the scale and focus of your agency, you might also need a specialist in certain types of travel or destinations.

As your agency grows, consider hiring additional staff like a dedicated manager, IT support for your booking systems, or additional travel consultants with expertise in new areas or languages. These roles can be filled as your business expands and you understand your clientele better.

Regarding salaries, it's crucial to compensate your staff from the beginning of their employment. Postponing payment can lead to high turnover and a negative work environment.

Besides salaries, remember to budget for extra expenses like taxes, insurance, and benefits, which typically add 25-35% on top of the base salaries in this industry.

Training is also key in a travel agency, especially in areas like travel software use, customer service, and destination knowledge. Initially, you might need to allocate a budget for this training, which could be a few hundred to several thousand dollars, depending on the training's complexity and depth.

This investment is vital for ensuring high-quality service and maintaining a competitive edge in the travel industry. The exact budget for training will vary based on your specific needs and the expertise of your initial team.

Professional Services

Starting with a lawyer, for a travel agency, this is not just about general business setup.

A lawyer can help you understand the specific legal requirements of the travel industry, such as regulations related to package travel, tour operator liability, and customer cancellations. They can also assist in drafting contracts with travel providers and ensuring compliance with international travel laws. The cost for legal services in this field might range from $3,000 to $6,000 initially, depending on the complexity of your business model.

Travel industry consultants are invaluable for a new travel agency.

They can provide insights into market trends, help in identifying profitable niches, and advise on digital marketing strategies to reach a global audience. They can also assist in establishing relationships with hotels, airlines, and tour operators. A travel industry consultant might charge between $100 to $300 per hour, depending on their expertise and the scope of your project.

Bank services for a travel agency are crucial for managing customer payments, especially in different currencies.

You'll need a business account that can handle international transactions and offer currency exchange services. Setting up efficient online payment systems for bookings is also key. The costs will include transaction fees, currency exchange rates, and possibly monthly account fees, depending on your chosen bank and services.

Insurance for a travel agency is essential to cover risks like trip cancellations, liability claims, or emergencies during travel.

It's important to have comprehensive coverage that includes professional liability insurance, especially given the uncertainties in travel plans and potential customer disputes. Annual insurance costs for a travel agency could range from $1,500 to $6,000, varying with the extent of coverage and business size.

Lastly, for a travel agency, maintaining industry certifications and licenses is an ongoing requirement.

This includes keeping up with changes in travel advisories, destination-specific regulations, and periodic renewals of travel agency licenses. These certifications are not only a legal requirement but also enhance the credibility and trustworthiness of your agency. The cost for maintaining these certifications can vary, but expect to allocate a few hundred dollars annually for these essentials.

Ongoing Emergency Funds

Estimated Budget: $20,000 to $100,000

When you're starting a travel agency business , having an emergency fund is absolutely crucial.

It's like having a safety net when you venture into the world of travel planning; you hope you won't need it, but it's essential for your peace of mind and security.

The amount you should set aside can vary, but a common rule of thumb is to have enough to cover at least 3 to 6 months of your operating expenses. This typically translates into a range of $20,000 to $100,000, depending on the size and scale of your travel agency.

Remember, these figures can fluctuate based on your location, office rent, utilities, employee salaries, and the cost of marketing and promotional activities.

One of the main reasons you need this fund is the unpredictability of cash flow in the travel agency business. For example, you might face sudden fluctuations in travel demand, or there could be unexpected expenses related to booking cancellations or changes. These situations can significantly impact your cash flow if you're not prepared.

To avoid these potential setbacks, it's wise to not only have an emergency fund but also to diversify your travel offerings.

Relying solely on a specific destination or type of travel package can be risky, especially if external factors like natural disasters or political events affect travel plans. Offering a variety of travel options and having a broad client base can help reduce financial vulnerability.

Additionally, building strong relationships with travel suppliers, such as airlines, hotels, and tour operators, can be a lifesaver. Sometimes, they might provide exclusive deals or flexible booking terms that can help you navigate cash flow challenges.

Another key aspect is to keep a close eye on your finances. Regularly reviewing your financial statements helps you spot trends and address issues before they become major problems.

It's also a good idea to explore additional revenue streams within the travel industry. Consider offering travel insurance, visa application services, or destination-specific travel guides to enhance your income.

Lastly, never underestimate the power of excellent customer service and community engagement. Satisfied clients are more likely to return for future trips and recommend your travel agency to others, providing a stable source of revenue and growth opportunities.

Franchise Fees

Estimated Budget: $30,000 to $80,000

Only if you decide to join a travel agency franchise!

When considering opening a travel agency, franchise fees can be a significant financial consideration. On average, you might expect to pay between $30,000 to $80,000 in franchise fees for a travel agency. However, these figures can vary depending on the reputation of the travel agency brand, its market presence, and the level of support provided.

The franchise fee is typically a one-time payment that you make to the franchisor. In return, you gain the rights to operate your travel agency under their established brand and gain access to their business model, training programs, and support systems. It's important to note that the franchise fee is just one part of the financial commitment; there are also ongoing expenses such as royalty fees, marketing contributions, and operational costs.

Travel agency franchises may structure their fees differently. Some may have higher initial franchise fees but lower ongoing expenses, while others could have the opposite arrangement.

Unfortunately, negotiating the franchise fee is often challenging, as these fees are typically standardized across all franchisees within a specific travel agency brand.

However, there may be opportunities for negotiation in other aspects of the franchise agreement, such as the contract duration or specific terms and conditions. Consulting with a franchise attorney or advisor can be valuable in understanding and potentially negotiating these terms.

Regarding the timeline for recouping your investment and achieving profitability, it can vary significantly. Factors like the location of your travel agency, the reception of the brand in your area, your business skills, and overall market conditions all play a role. Typically, it may take anywhere from a few years to several years to realize a profitable return on your investment when operating a travel agency franchise.

What expenses can be cut for a travel agency business?

Managing expenses wisely is crucial for the long-term success of your travel agency business.

Just like in any business, some costs can be unnecessary, others may be overspent on, and certain expenses can be delayed until your travel agency is more established.

First and foremost, let's address unnecessary costs.

A common mistake new travel agency owners make is investing too much in a high-rent office space in a premium location. While having a professional space is important, your initial clients are more likely to value the quality and range of your travel packages over your office location. Opting for a modest office or even starting with a home office can significantly reduce your overhead costs.

Another area to cut unnecessary costs is in elaborate traditional advertising. In the age of digital marketing, you can utilize cost-effective strategies like social media marketing, search engine optimization (SEO) for your website, and targeted email campaigns. These methods can reach a wide audience without the hefty price tag of traditional advertising.

Now, let's talk about expenses that are often overspent in the travel agency business.

One common area of overspending is in stocking too many travel brochures and promotional materials. While having some physical materials is beneficial, remember that much of today's travel planning and booking is done online. Focus on developing a user-friendly website and online resources, and order physical materials in moderation based on demand.

Overstaffing is another pitfall. It's tempting to have a large team to cover all potential client needs, but it's more cost-effective to start with a small, versatile team and expand as your client base grows. This approach helps in managing labor costs more effectively, especially during slower travel seasons.

Regarding delaying expenses, consider holding off on significant investments in exclusive partnerships or expensive travel software solutions. While these can add value to your business, it's wise to establish a steady income and understand your clients' needs better before making large investments.

Similarly, delay opening multiple branch offices until you have a solid client base and understand the specific travel markets and trends. Expanding too quickly can be financially risky and may dilute the quality of your services.

In conclusion, by strategically managing your expenses, focusing on essential investments, and growing your business organically, your travel agency can achieve sustainable success and profitability.

Examples of startup budgets for travel agencies

To provide a clearer picture, let's examine the budget for three types of travel agency businesses: a small home-based travel agency, a mid-sized travel agency with a physical office, and a large, luxury travel agency with high-end facilities.

Small Home-Based Travel Agency

Total Budget Estimate: $15,000 - $30,000

Mid-Sized Travel Agency with Physical Office

Total Budget Estimate: $40,000 - $80,000

Large, Luxury Travel Agency with High-End Facilities

Total Budget Estimate: $100,000 - $200,000

These budget breakdowns show the varying levels of investment required for different scales of travel agency businesses, from a modest home setup to a luxurious agency with high-end facilities.

How to secure enough funding to start a travel agency?

Securing adequate funding for a travel agency requires a strategic approach, as the sources and types of funding can vary based on the nature of the business. Typically, travel agency owners rely on a combination of personal savings, loans from financial institutions, and sometimes contributions from family and friends.

Travel agencies, particularly smaller or start-up ones, may not draw the attention of larger investors like venture capitalists. These investors often seek high-growth, scalable businesses, whereas travel agencies are generally seen as steady, service-based businesses with moderate growth potential. Therefore, venture capital is less common in this sector.

Grants might be available, but they are less common for travel agencies, which often don't fit into the typical focus areas of grant programs, such as technology or health sectors.

When it comes to securing a loan from a bank or attracting an investor, having a comprehensive business plan is critical. This plan should include detailed financial projections, a thorough market analysis, your unique selling proposition (what sets your travel agency apart), and a clear operational strategy.

Showcasing a deep understanding of your target market and a viable path to profitability is vital. Banks and investors are keen to see that you have a firm grasp on the financial aspects of the business, including projected revenues, expenses, and cash flow. They also assess your commitment and capability to run the business effectively, which can be demonstrated through your experience in the travel industry or partnerships with experienced travel professionals.

Regarding your financial contribution, it's generally advisable to bring about 20-30% of the total startup budget. This demonstrates your commitment to the project. However, if you can convincingly demonstrate the viability of your business model and your ability to repay a loan, securing funding without significant personal financial involvement is possible.

The timing of securing funding is crucial. Ideally, you should obtain financing around 6 months before launching. This period allows for setting up the agency, developing your website and booking systems, marketing, and other pre-launch activities. It also provides a buffer for unforeseen issues.

Expecting to be cash flow positive from the first month is optimistic for any new business. It's prudent to allocate a portion of your initial funding to cover operating expenses for the first few months. A common strategy is to reserve around 20-25% of your total startup budget as working capital to sustain the business until it becomes self-sufficient.

You might also want to read our dedicated article related to the profitability of a travel agency business .

How to use the financial plan for your travel agency?

Many aspiring travel agency owners approach investors with presentations that lack clarity and structure, often featuring unorganized arguments and unprofessional financial documentation. This can significantly hinder their chances of securing necessary funding.

If you're aiming to turn your vision of starting a travel agency into reality, convincing investors or lenders to support your venture is a key step. To do this effectively, you need to present them with a comprehensive and professional business and financial plan.

Our team has developed an easy-to-use financial plan, meticulously designed for travel agency business models. This plan includes financial projections covering a three-year period, making it a valuable tool for both short-term and long-term planning.

The plan comprises all the critical financial tables and ratios needed for a solid business proposal, such as income statements, cash flow statements, break-even analysis, and provisional balance sheets. It comes with pre-filled data tailored to the travel industry, encompassing a detailed list of potential expenses. This format allows you to adjust the numbers to suit your specific project needs accurately.

Our financial plan is particularly user-friendly, making it an ideal resource for beginners. There's no need for prior financial expertise or extensive experience with complex software like Excel. The plan is automated to a great extent - you only need to fill in the designated boxes and choose from preset options. We've simplified the process to ensure it's accessible and straightforward for all entrepreneurs, regardless of their financial background.

In case you face any difficulties, our dedicated team is on standby to provide assistance and answer any queries you may have, at no additional cost. This support is part of our commitment to helping you achieve success in your travel agency venture.

The content provided here is for informational purposes only and does not imply endorsement. While we strive for accuracy, we do not guarantee the completeness or reliability of the information, including text, images, links, or other elements in this material. Following the advice or strategies presented here does not assure specific outcomes. For guidance tailored to your individual circumstances, it is recommended to consult with a professional, such as a lawyer, accountant, or business advisor.

- Choosing a selection results in a full page refresh.

- Opens in a new window.

Effortless booking

Maximize online conversions with the most intuitive checkout online.

Expand revenue with our powerful Automated E-commerce tools.

Upgrade your website to industry’s best. Fresh websites. Fresh revenue.

Amplify visibility and expand earnings with integrated OTAs and local partners.

Streamline check-ins, limit risk, and amplify customer data with built-in digital waivers.

Transform data into insights. X-ray reporting gives you customer and business intelligence.

Manage high-volume walk-up customers effortlessly with POS, ticketing, and gated entry.

Automate management of staff schedules, assignments, and staff communications

Control your business precisely the way you want with endless yet easy configurability.

Allocate equipment used in various products. Prevent overbookings and maximize profits.

Grow with Xola in our constantly expanding universe of integrations and apps.

Harness customer data to drive marketing campaigns and generate repeat business.

Transform your guests into passionate brand advocates. Perfect your products & services.

Manage your business with the most powerful mobile suite in the industry.

Perfect the guest experience by giving your staff the industry’s most intuitive software.

Efficiently manage guest flow, minimize wait times, and ensure maximum satisfaction.

Ticketing & Entry

Revolutionize your guest experience: Effortless check-ins, interactive displays, secure payments.

Boost revenue with automated rave reviews, actionable insights, and loyal customer engagement.

Efficient ticketing, digital waivers, and fast check-ins enhance on-site operations and guest satisfaction.

Explore Xola Universe: 80+ apps, limitless integrations, endless growth opportunities.

Simplify check-in and boost your marketing efforts with our integrated automated digital waivers.

With SOC 2 Type II and CCPA compliance Xola exceeds industry security standards and insures your data protection.

Access real-time insights for business growth with our powerful reporting.

Remarkable and hassle-free guest experiences with waitlist and virtual queuing.

7 Skills That All Great Tour Guides Possess

- Xola University

- Business Operations

How to create a revenue report for your tour company (Plus revenue report templates)

Keeping track of your revenue activity on a consistent basis can help you reach your financial goals — especially if you develop the practice of sharing these reports with the rest of your company. This ensures that everyone is on the same page and allows each department to make better decisions based on that data.

In this post, you’ll find several revenue report templates to help you stay on top of your bookings on a daily, weekly, monthly, and quarterly basis.

What is a revenue report template?

A revenue report template is a report or dashboard that helps you summarize your tour business’s revenue activity over a specific period of time.

The most common revenue reports include the Profit and Loss Statement, also known as the Income Statement, Balance Sheet, and Cash Flow Statement. A revenue report template will provide you with a blueprint to create each of these.

It’ll tell you what metrics to input so that the report can be made.

How often should you prepare a revenue report?

Pulling daily, weekly, monthly, or quarterly revenue reports helps you understand how your business is operating on a short- and long-term basis.

These reports reveal valuable insights into the financial health of your business. If you spend a few months without analyzing your finances, you risk losing track of important metrics that keep your company afloat.

Small businesses can benefit from looking at their Cash Flow Statement on a weekly or monthly basis. Your cash flow is the money coming in and out of your business based on the day a booking was made.

Tours and attractions should also track realized earnings, which happen once the tour or experience is complete.

Since you likely have monthly expenses like rent, it’s helpful to understand the money that comes in and out each month.

What metrics should be included in a revenue report?

The Profit and Loss Statement typically tracks four core financial metrics: income, expenses, cost of goods sold, and net income.

- Income: The money received by your tour business or attraction

- Expense: The expenses associated with running your business, including overhead and sales and marketing costs

- Cost of Sales: The cost associated with delivering a service

- Net Profit: The amount of money your business makes after deducting the cost of sales and expenses from income

The Balance Sheet tracks what your company owns and owes. It specifically looks at your company’s assets, liabilities, and shareholder equity.

- Assets: Everything your tour business or attraction owns like vehicles, equipment, building(s), etc.

- Liabilities: Everything you owe, such as a small business loan or credit card debt

- Shareholder Equity: Everything you and other shareholders of your company have invested in the business

The Cash Flow Statement gives you a snapshot of the money coming in and out of your business. This includes money received from bookings or ticket sales, investing, and financing.

In addition, these three business metrics can give you a good idea of your company’s performance:

- Sales Revenue: All the income your company has made through tour bookings or ticket sales, excluding the cost associated with refunds or chargebacks.

- Net Profit Margin: How much profit is generated as a percentage of the revenue received. Your Net Profit margin highlights how much of each revenue dollar collected by your company actually translates into profit.

- Gross Margin: The amount of money your company keeps after the direct costs associated with providing the services you provide.

- Sales Growth: Monitor your sales growth monthly or yearly to identify the pace at which your company’s sales revenue is increasing or decreasing.

- Cost of Customer Acquisition: How much it costs your company — typically in marketing expenses — to acquire a new guest.

Daily revenue report template example

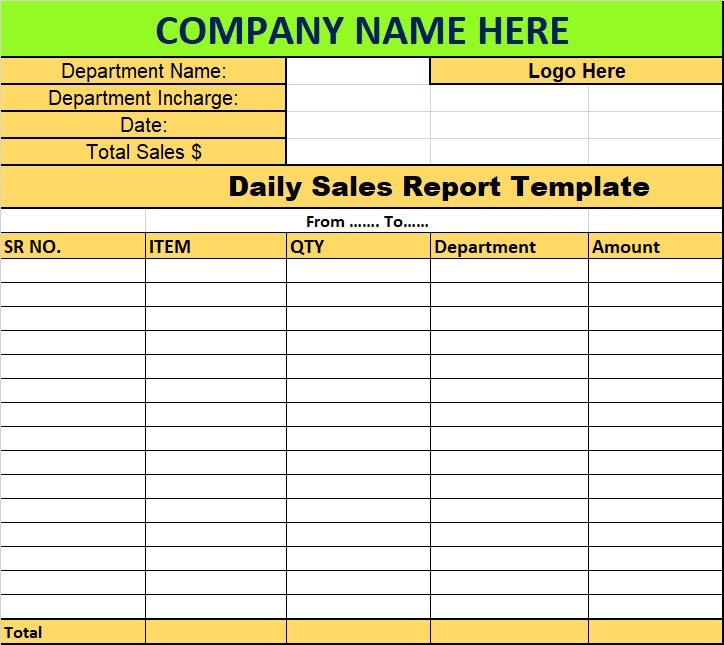

Source: Free Report Template

If you run a tour business or small attraction, you’re likely tracking your bookings or ticket sales on a daily basis. A daily revenue report shows you a summary of all your company’s transactions broken down by day.

Weekly revenue report template example

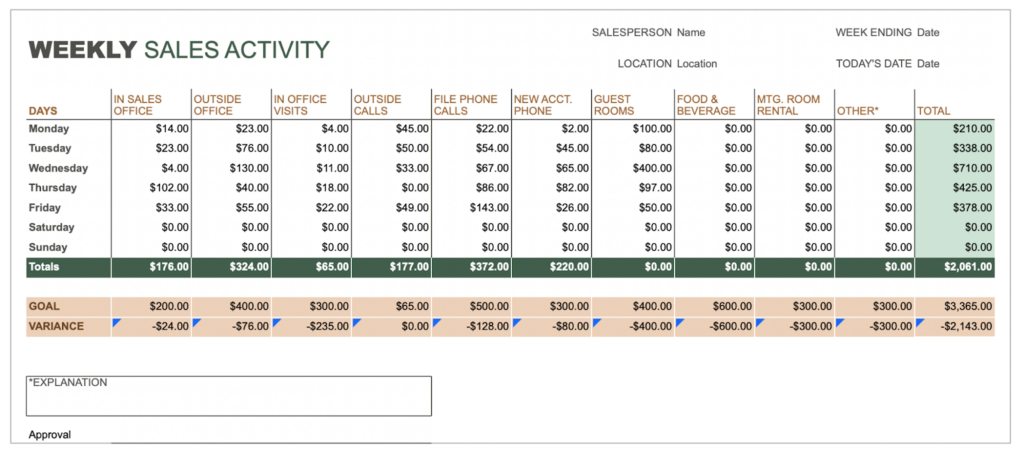

Source: Microsoft Office Templates

You can use a sales report to keep track of bookings on a weekly basis. The template above specifically tracks sales revenue against a goal.

First, edit the columns to match your business’s revenue metrics, such as in-person bookings, online bookings, third-party bookings. Then, you plug in the numbers. By the end of the week, you’ll have a complete sales activity report to present to your team.

Monthly revenue report template example

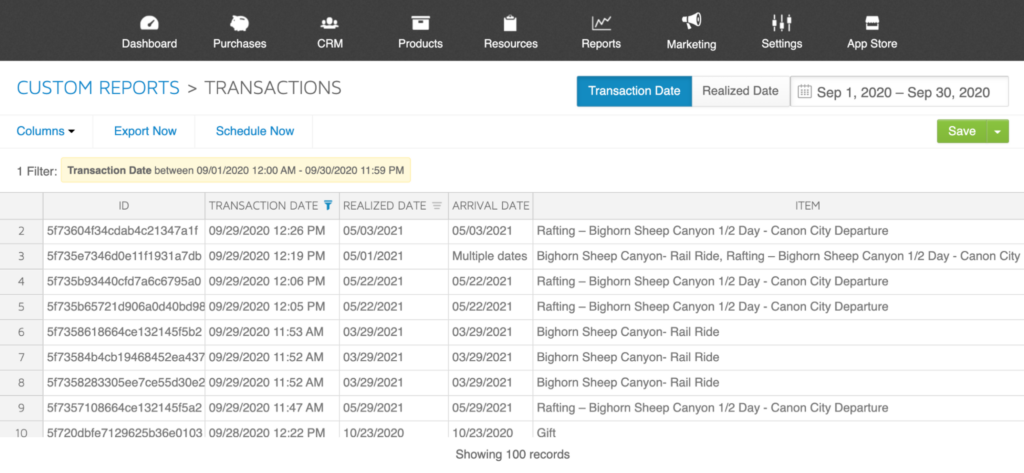

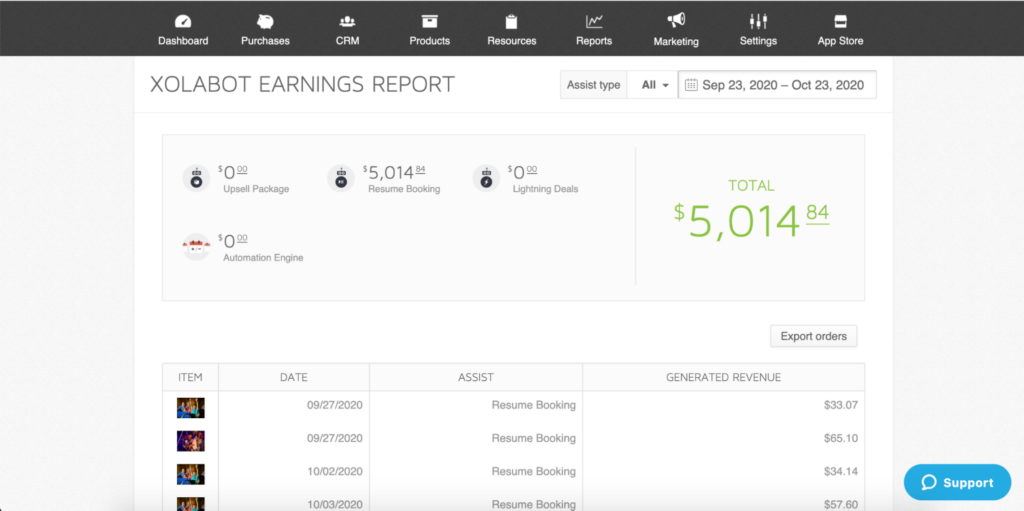

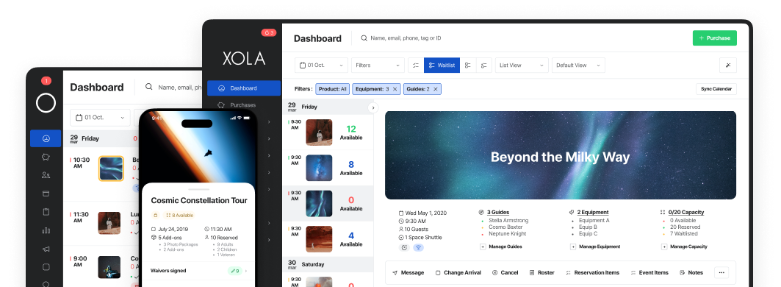

Xola’s transaction report contains financial details for every charge or refund associated with your bookings.

You can view your transactions for any date range. In this example, the report is showing the transactions made during the month of September 2020.

After viewing this report in the Xola dashboard, you can then export it into a spreadsheet.

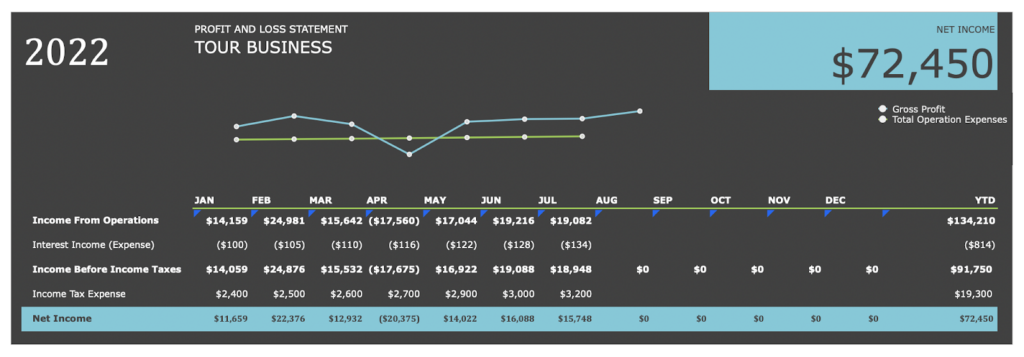

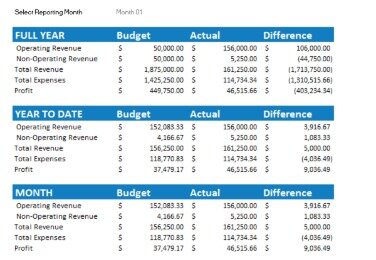

Here’s a look at a Profit and Loss Statement broken down by month. As you’ll see in the report above, the business records the income for its operations every month, as well as its expenses.

You’ll also find the net income at the bottom, or the amount your business makes after deducting costs of services provided, operating expenses, interests, and taxes.

The net income is a good indicator of your company’s profitability. Tracking this metric every month helps you understand how much of a profit your company will make over a year.

You can also pull monthly reports to see how specific marketing tools and campaigns are performing. In the example above, a monthly earnings report was pulled for Xolabot, an automatic growth feature used to upsell experiences, offer deals, and rescue abandoned bookings.

The report shows that Xolabot brought in over $5,000 with the “resume booking” feature that reminds customers to complete their purchase.

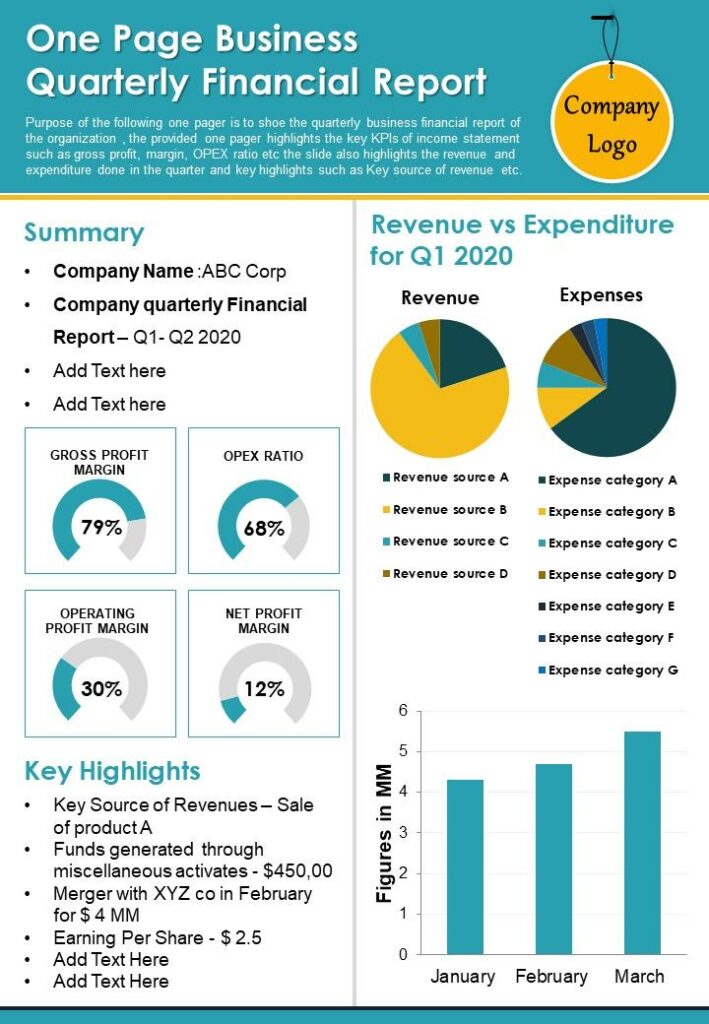

Quarterly revenue report template example

Source: Slide Team Blog

A quarterly report gives you a three-month snapshot of your financial activities. This revenue report template zeroes in on a few key metrics like gross profit margin and net profit margin — both of which help you accurately track your company’s profitability. It also takes it a step further and compares your revenue versus expenses.

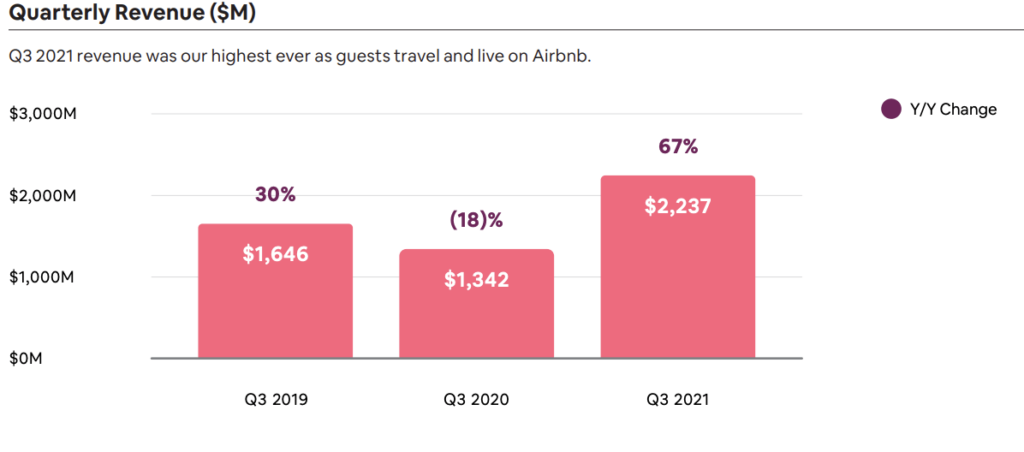

Source: Prophet Invest

As with most revenue reports, quarterly reports can be customized to display the data that matters most to your company. They can be used to track company revenue growth, as shown in the Airbnb example above.

Airbnb’s upward trajectory from Q3 2019 to Q3 2021 shows that people are traveling again, and that the service is gaining popularity in post-pandemic travel.

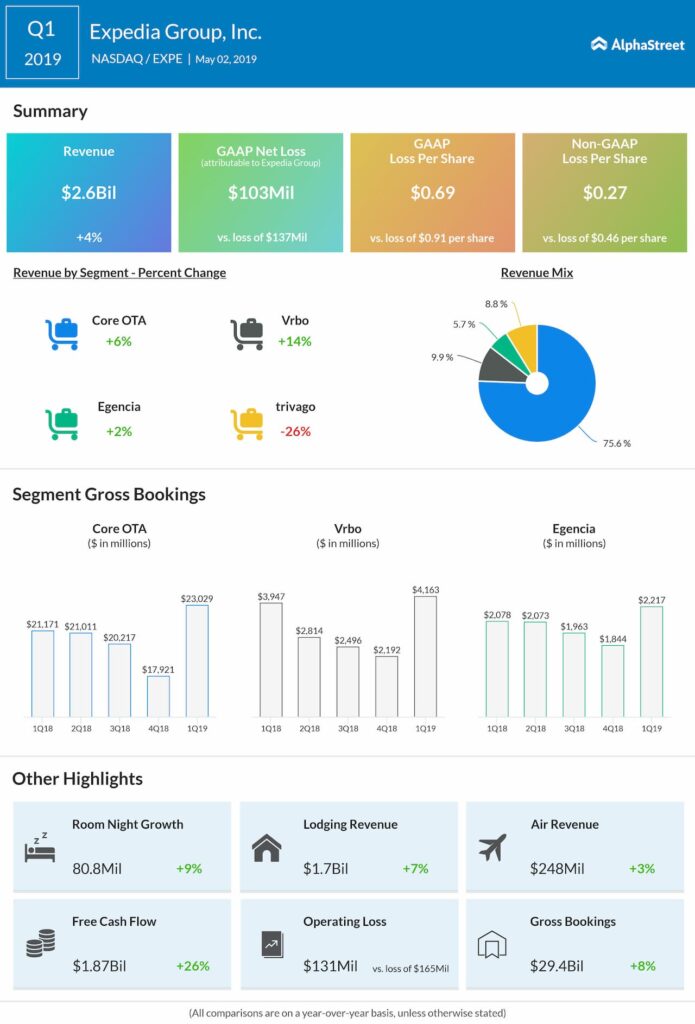

Quarterly reports can also break down your revenue by segment, as shown in this example for Expedia Group. The Online Travel Agency’s (OTA) revenue is broken down by the different brands it owns, like Vrbo and Trivago.

This gives the company a snapshot of which brands are performing best over time.

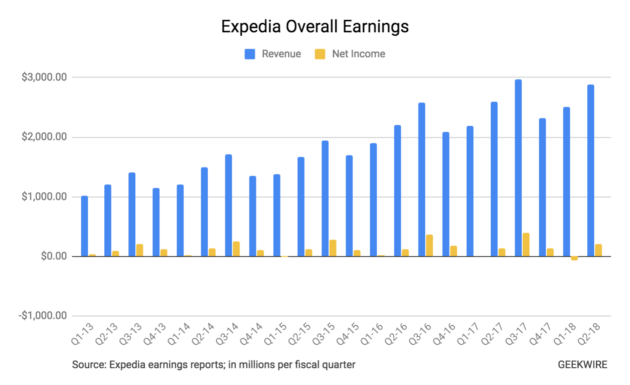

Source: GeekWire

Quarterly reports are also useful to observe historical revenue growth. In the example of Expedia shown above, the online booking marketplace displays its overall earnings broken down by quarter from 2013 to 2018.

This way, the company can compare its quarterly performance over the course of several years.

When you track your quarterly earnings, you can also make a report like this to view your company’s financial history over time.

Staying on top of your finances is the best way to ensure your profitability. And revenue reporting is the best way to do that.

The examples shown in this post can be easily used as templates to build your own reports — all you need to do is change the labels and metrics to fit your business.

Building revenue reports is even easier with a booking software like Xola, which allows you to automate the process. Xola gives you access to several financial reports so that you always have your company’s revenue data at your fingertips.

Writer Carla Vianna

Related Articles

When your business is growing, the thought of hiring, vetting, and managing tour guides can be daunting. In an earlier

How do OTAs work

Most tours and attractions consider Online Travel Agencies (OTAs) a crucial piece of their distribution strategy and a way to

An overview of the best distribution channels

You’ve likely considered the pros and cons of listing your tours with a third-party website. While your own tour website

Get the latest news and resources.

For tours and attractions delivered straight to your inbox each week.

Transform your business now.

Travel agency accounting: Travel Agency Accounting: Master The Basics

The key to effective bookkeeping is to record transactions regularly and, most preferably, daily. Most travel agencies have customer bookings happening daily, so it’s crucial to record them daily. We can help you get set up with online accounting software for the first time or clean up your existing books in QuickBooks for a travel agency or another platform. If you’re new to cloud-based accounting we’ll explain the benefits and provide as much or as little support as you need. QuickBooks™ allows travel agencies to accurately keep track of all income and expenses, while creating easy to follow reports of all this information.

Apart from financial statements, management needs some other reports too like the – booking commission report, employees and suppliers reports. The income statement provides important data for the financial planning, profit planning and debt-paying ability of the travel agency. Essentially, this statement provides vital financial information to the internal as well as external users. Financial statements are the formal output of any accounting system and are prepared to provide accurate, timely understandable, objective and comparable accounting information to the users.

What are the most important accounting procedures for a travel agency?

Yet, as a small business owner, you’re most likely going to have to be doing the bookkeeping (as well as the sales, marketing, and customer service). So let me give you a heads up on how to start your agency with a strong financial infrastructure. Cash flow analysis is a measurement of the amount of money that a travel agency has in navel at any point in time. It enumerates the net effect of the various transactions on cash and takes into account the receipts and disbursements of cash. It also summarizes and causes of changes in the cash position of a travel agency between the different dates of balance sheets. Profitability ratios are a fair indication of sound management of a travel agency.

- The income and position statements tend to be the primary source of information to the owner.

- One of the best accounting software programs that your travel business might benefit from is QuickBooks.

- In the technical world, it provides details about the resources of a travel agency and how these resources financed, either by lending funds or by investing capital in the business.

- Thus it’s very essential to know the nitty-gritty of the financial position of the firm.

Read this blog to learn the different strategies and general principles to consider for small business owners to pay themselves. Running a fast-paced and dynamic business like a travel agency and handling the accounts alone can be overwhelming at times, especially when you are looking to expand your agency and scale the business. A critical part of financial planning is budgeting from hiring to marketing, investments, growth, and everything in between needs you to set a budget upfront. A great financial plan includes extensive cash flow audits, expense analysis, negotiation with suppliers/vendors/partners and a good handle on business interruption insurance. Giersch Group advisors will develop a solid financial plan for your business. Set up your accounting software in a day through our checklist, for converting a client from your legacy software to Xero.

Otherwise, manual operations will make you re-enter data on each check while taking the chance of omitting some of the ledger entries. She worked with thousands of agents in her role as a former host agency director before leaving in 2012 to start HAR. She’s insatiably curious, loves her pups Fennec and Orion, and — in case you haven’t noticed — is pretty quirky and free-spirited. The government is going to want to know how much commission you brought in from your travel sales so you need to keep track of that, among tons of other things.

Accounting for Travel Agencies: A Specific Job!

A position statement may be defined as statements prepared with a view to measuring the true financial position of a travel agency on a certain fixed date. It is prepared by the transferring all balance that belongs either to personnel or to real accounts. Ensure you open a new bank account for your travel agency business if you don’t already have one. The financial records of your company reflect the biggest truth of your organization. Imagine you have to apply for loans or grants to grow your travel agency – your financial performance is the key there. Even basic business analysis and planning need financial information organized in one place.

The Balance Small Business has a recent article explaining the differences between an accountant, CPA, and bookkeeper if you’ve got 3 minutes. Account Receivable indicates the number of times the average receivables are turned over during a year. The higher the value of turnover, the more efficient is the management of account receivable and vice versa. We offer free 30-minute consultations online or at our offices in Milwaukee, Brookfield, or Madison, Wisconsin. Our 100% virtual services are available to businesses anywhere in the nation – just contact us online or give us a call to get started.

Income/Gains

Unless you have detailed accounting records of your business, an investor cannot predict the success or failure of your travel agency – and hence cannot invest. Most VCs or Angel investors seek up-to-date books immediately, and you won’t have much to prepare. In case proper books are not maintained, the transaction data of your travel business lies spread out all over the place. You cannot figure out what capital you’re holding, your profits, and which part of the business needs to be worked upon.

Kudos to you for thinking about your financial infrastructure from the get-go. That said, it’s complicated, and making the best decisions right now about financial structure can save you money in the long run. If you want more personalized support in regard to finances and all things starting an agency, check out HAR’s new course, The Complete Guide to Starting a Travel Agency. A travel agency is said to be ‘break’ even when its total revenues are equal to total costs. It is a point where there is no profit or loss and at this point, the contribution is equal to fixed costs. Basically, employees are concerned with job satisfaction, job security, promotion, welfare schemes and other financial incentives given by the travel agency.