You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

Aircare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Take the worry out of your travels with affordable flight or trip insurance.

Looking to plan the vacation of a lifetime or flying home for the holidays? Trip insurance and flight insurance can provide the peace of mind you need for your next journey. The GEICO Insurance Agency, with Berkshire Hathaway Travel Protection (BHTP), offers comprehensive travel insurance coverage, with prompt service and global assistance. Get an online travel insurance quote today and confidently protect your next adventure.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected like:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

The main difference is that a flight insurance policy only covers your airfare. On the other hand, a travel insurance policy helps protect your flight as well as other parts of your trip. While you're planning your next trip, think about where you're going and what you'll be doing. Once you have that, it'll be easier to choose which policy works best for your trip.

What does a flight insurance policy cover?

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What does a travel insurance policy cover?

ExactCare Travel Insurance provides all-in-one travel protection, with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

What is not covered by travel insurance?

Your coverage is based on the plan you choose. However, in general some things that aren't normally covered by travel insurance are:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How much does travel insurance cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Worldwide service and claims information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance: Get the answers you're looking for.

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Can I get trip insurance for an extended overseas stay? Yes. We can help you with getting insurance for overseas. Please visit our overseas insurance page for information about all the options we have for you!

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- Tips for saving money on your next vacation. No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

Please note:

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

12 Best Travel Insurance Policies and Why You Need Them

By Suzanne Rowan Kelleher

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers. We don't review or include all companies, or all available products. Moreover, the editorial content on this page was not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are entirely those of Condé Nast Traveler's editorial team.

You’ve purchased your flights and booked your hotel. Now, what about travel insurance? These days, it’s easy to add coverage to your trip, but what's the best travel insurance policy to buy? And is the extra cost always necessary?

When planning a trip, nobody loves imagining worst-case scenarios and everyone has a different risk tolerance. For a weekend road trip , you may be willing to cross your fingers and suck up your losses should something go awry. But what if you’re shelling out for a longer, more complex and more expensive trip? You’ll likely want peace of mind when your risk and financial investment are greater.

When do you need travel insurance?

There’s nothing like bad luck to turn you into an insurance evangelist. For travel writer Katherine Fan, the epiphany came after a thunderstorm disrupted her flight in Chicago . “My bags didn't make it to Italy for more than five days, and my travel insurance covered all the costs for replacement items as well as the alternative transportation I had to rebook because of the delay,” she says. “I'll never live without it now.”

In general, the older you are and the more remote your destination, the more crucial it is to buy travel insurance. Lou Desiderio, a communications executive from Long Island, New York, recalls the time his octogenarian father became ill during a European cruise , and doctors recommended that his parents return home immediately. His parents’ travel insurance covered the lion’s share of the $9,500 they subsequently racked up in medical costs, ground transportation, flights, hotel, and meals. “You always wonder if the cost of insurance is worth it,” says Desiderio. “In this instance, it was absolutely worth it.”

“Not all domestic health and medical insurance plans will follow you outside your home country,” says Justin Tysdal, CEO of Seven Corners , a travel insurance provider. “Something as simple as twisting your ankle in a foreign country may not be covered and could result in expensive medical bills.”

Simply having travel insurance can have side benefits, too. “One of the best hidden perks is the 24/7 global travel assistance provided by the plan,” says Stan Sandberg, CEO of TravelInsurance.com . The hotline can be helpful in dealing with a multitude of unexpected issues, from currency conversion or cash transfers to replacing passports or IDs to finding a local physician.

Where can you find a good policy?

Travel agencies, airlines, cruise lines, and tour operators often offer an optional insurance add-on, but these plans tend to have been run through the company’s legal team and contain more exclusions. Travel rewards credit cards also offer some built-in insurance benefits to their cardholders, like trip cancellation coverage, delayed baggage coverage, and trip interruption and delay coverage. But you’ll often be better served by a plan from a third-party insurer, which tend to offer more holistic plans.

The good news is that it has never been easier to buy exactly the type of travel insurance you need at a reasonable price. Most people buy comprehensive insurance for a single trip, but annual travel insurance plans that cover multiple trips in a one-year period are becoming more popular.

You can find some of the best travel insurance policies by visiting an insurance comparison site like TravelInsurance.com, InsureMyTrip.com or SquareMouth.com . Plug in your trip details and you’ll get instant quotes for multiple insurance plans that you can compare on price, coverage limitations, and other parameters. Be sure to read the policy details, as inclusions can vary from plan to plan but will end up making all the difference to your particular needs.

What’s it going to cost?

The cost of travel insurance depends on a variety of factors, including the price and length of the trip, your age, destination, and any optional add-ons. For your average domestic or international trip with flights and hotels , expect to pay anywhere from 3 to 7 percent of your trip’s cost, depending on inclusions.

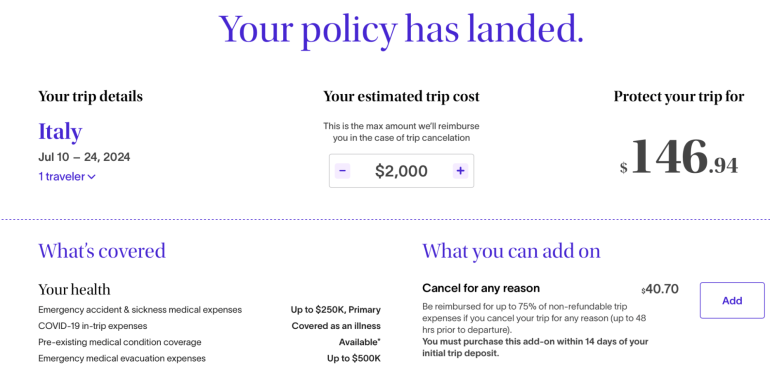

So for a $2,000 trip, you might expect a typical comprehensive plan with trip cancellation, interruption, and delay, along with baggage loss and delay, and emergency medical coverage and evacuation to cost in the $100 ballpark. Some upgrades, like a “cancel for any reason” provision, will cost more.

When should you buy travel insurance?

Don’t procrastinate. “Some benefits and coverages are available only if you’ve purchased your policy within a short window, typically seven to 21 days from when you make the first payment towards your trip,” says Sandberg. Buy early and you may qualify for a pre-existing condition waiver or a ‘cancel for any reason’ upgrade.

It’s especially important not to delay buying travel insurance if you’re traveling to, say, the Caribbean during hurricane season. Once a major storm has been named, the window of opportunity slams shut, and you can no longer buy insurance for that hurricane. “If you purchase a policy after a storm is named, trip cancellation and trip interruption are excluded from coverage,” says Sandberg.

What’s not covered?

“Some people believe that a travel insurance plan is designed to give you the flexibility to cancel your trip for any reason whatsoever,” says Sandberg. “But the standard plan is not going to provide cancellation coverage for a change of heart or a relationship break-up or an outbreak of Zika in your destination.” If you need that flexibility, opt for the ‘cancel for any reason’ upgrade.

“As far as medical coverage, people often believe a travel insurance plan will cover preventative services such as immunizations and annual check-ups,” says Tysdal. “But travel insurance is intended to cover illnesses and injuries that originate during a trip, and that’s why it’s relatively inexpensive.” Be careful about overindulging, too. “If you injure yourself as a result of being intoxicated beyond a legal limit, your travel insurance policy will not likely cover you,” says Sandberg. Ditto for drug use.

How easy is it to file a claim?

“Documentation is key,” says Meghan Walch, product manager for InsureMyTrip. If luggage is lost or items are stolen, file a report with the airline or police. You may need to provide original receipts for the stolen items in order to receive reimbursement up to the policy limits.“ Also, be aware that baggage coverage only offers coverage up to a set amount,” says Walch. “So, if you are carrying, say, a fancy $3,000 Nikon or Canon camera , you’ll likely need to buy additional insurance elsewhere or cover it under a homeowner's policy.” Note, also, that many plans specifically exclude computers and electronics.

What about car rental insurance?

It’s often possible to add car rental insurance, also known as the Collision Damage Waiver (CDW), to a comprehensive travel insurance plan, which can save you from a serious headache should you get into an accident while driving. “But the biggest mistake people make when renting a car is to waste money on duplicate coverage,” says Jonathan Weinberg, CEO of AutoSlash , the car rental deal-finding site. “The reality is that if you own your own vehicle and have car insurance, you are likely already covered when renting in the U.S.”

Jessica Puckett

Lee Marshall

Meaghan Kenny

And if you don’t own a car? “Your credit card may also cover you when renting,” says Weinberg. “It's always important to check to be sure, but why pay again for coverage you already have?” Indeed, paying for your rental with the right travel rewards credit card might cover your collision insurance, with some policies covering damage up to the value of the car. Travel outside the U.S. and Canada , though, and it’s a different story. “Most personal auto insurance policies will not cover a claim for damage to a rental outside the U.S. or Canada,” says Weinberg. “Likewise, different credit cards have different exclusions when it comes to covering damage to a rental car in a foreign country.”

Types of travel insurance

Most travelers opt for a comprehensive plan, but you should know what each type of coverage does, so you’ll know if a package truly fits your needs. Here’s a brief rundown of the main types of coverage.

Trip protection

Often known simply as “travel insurance,” this type of comprehensive package is the most common purchase.

Commonly covers: Reimbursement for money spent on your trip due to cancellations, interruptions, and delays; medical expenses if you become sick or injured and, if necessary, emergency medical evacuation and repatriation; and coverage for your belongings if lost, stolen, damaged, or delayed.

How to get it: Compare plans at Square Mouth , Seven Corners , InsureMyTrip.com , and TravelInsurance.com

Trip cancellation

This benefit can reimburse 100 percent of your trip cost—flights, hotels, cruises, and pre-paid activities—if you need to cancel for a covered reason.

Commonly covers: Unforeseen illness or injury; the death of you, a family member, or a traveling companion; terrorism; inclement weather; natural disasters.

Fine print: Some policies also include other covered reasons, such as jury duty or an employment layoff.

Trip interruption

You’ll be reimbursed for your costs if your trip is interrupted for a covered reason. The payout may exceed the total trip cost if you need to incur additional expenses to return home, but some policies limit coverage to a return flight home.

How to get it: Signing up for travel rewards cards like the Chase Sapphire Reserve can automatically give you this coverage for all trips booked on the card.

Learn more about signing up for the Chase Sapphire Reserve here .

Cancel for any reason

This upgrade provides reimbursement for 50 to 75 percent of prepaid and non-refundable trip payments if you cancel a trip for any reason not otherwise covered by your policy.

Watch out: You’ll be required to insure your trip’s entire cost, which will typically increase your premium by roughly 40 percent.

Fine print: Typically available for purchase up to seven to 21 days from the date you make your initial trip deposit. You must cancel the entire trip at least two to three days before your departure date.

Travel delay

If your trip is unexpectedly delayed by a designated amount of time (typically three to 12 hours, depending on the policy), this benefit provides a per-diem dollar amount (typically $150 to $200) that can be used for meals, hotels, and other necessary expenses during the delay.

Commonly covers: Inclement weather and mechanical breakdowns of “common carriers,” meaning public transportation such as planes, trains, or buses.

How to get it: Signing up for travel rewards cards like the Chase Sapphire Reserve can automatically give you this coverage for all trips booked on the card that meet the requirements.

Missed connection

You’ll be reimbursed for additional costs for you to catch up to your trip if you miss your departure due to a common carrier delay of a specified amount of time. It's usually an added feature of larger insurance packages.

Commonly covers: Inclement weather and mechanical breakdowns of common carriers.

Watch out: Some policies only reimburse if you need to catch up to a cruise or tour. Since the wording typically specifies public transportation delays, you would be out of luck if you’re driving and miss your connection because you got caught in traffic.

Baggage and personal items loss

You’ll be covered for lost, stolen, or damaged luggage. Expect limits in both overall coverage and per-item coverage. It's included with many travel rewards credit card benefits.

Watch out: While most policies cover your personal belongings throughout the entire trip, some will only cover luggage while it is checked with an airline or transportation carrier.

Baggage delay

If your luggage is delayed for a specified period of time—typically 12 or 24 hours—this coverage will reimburse you for any clothing, toiletries, and other essential items you need to purchase. Expect a maximum coverage amount per person, as well as a daily limit. It's also included as a cardholder benefit with many travel credit cards.

Emergency medical coverage

This covers the costs to treat a medical emergency, including treatment, hospitalization, and medication. This type of coverage is highly recommended for international trips and cruises.

Watch out: You would pay for medical care out-of-pocket, and then file a claim for reimbursement when you return home. In certain situations, an insurer might pre-authorize payment of medical bills, but it is not guaranteed.

How to get it: Browse medical coverage plans at Seven Corners .

Emergency evacuation coverage

This coverage is for transportation to the nearest medical facility in the event of a medical emergency during your trip. It's usually an add-on to larger medical coverage.

Commonly covers: If the treating physician recommends that you should return home for further medical attention, this benefit can also cover those transportation expenses. In the case of a death, repatriation can transport a traveler’s remains back home. It's usually an add-on to a larger travel insurance policy.

Pre-existing medical conditions waiver

Most policies have built-in exclusions for pre-existing conditions. So if you’ve been seriously ill in the past or need ongoing treatment, consider looking for a plan that offers a pre-existing condition exclusion waiver.

Fine print: You’ll need to purchase the plan within a few weeks from the date you make your initial trip payment.

Hazardous/adventure sports coverage

Are you an adrenaline junkie? Adventure activities such as heli-skiing, off-trail snowboarding, bungee jumping, wakeboarding, Jet Skiing, spelunking, rock climbing, and scuba diving are almost always excluded from coverage in most travel insurance plans.

Fine print: You can buy coverage as an optional upgrade, which is an especially smart bet if you’re planning an adventure trip outside the United States.

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers.

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Shop for Car Insurance

Other Insurance Products

Types of mortgages

Calculators

Find & Compare Credit Cards

Cards with Rewards

Cards for a Purpose

Cards for Building Credit

Credit Card Reviews

Understanding Credit & Score

Student Loans

Paying for College

Personal Finance for College Students

Life Events

Our Review of the Top 10 Travel Insurance Providers for Any Destination

Reviews of the Top 10 Best Travel Insurance Companies

Quality Verified

Updated: October 27, 2022

- Top 10 Travel Insurance Providers

Our Methodology

Before you buy.

Advertising & Editorial Disclosure

Whether you're planning your honeymoon, a family trip to Hawaii or a business trip to meet new clients, travel insurance can provide protection when your plans go astray. There are generally three main types of travel insurance: travel cancellation and disruption; medical assistance and evacuation; and baggage loss and delay. We researched dozens of travel insurance companies to pick the best in the industry. The right plan for you may depend on the nature of your travels, who is traveling and your budget. But whatever your needs, these 10 picks are financially stable, reliable companies with a good track record and comprehensive coverage.

Our Top 10 Travel Insurance Providers

Best : Overall, and for families with kids Travelex Insurance Services is a leading travel insurance provider based in Omaha, Neb. Its parent company, Travelex, has been a worldwide leader in foreign currency exchange for decades, and Travelex Insurance was started in 1996. The company's travel insurance policies are underwritten by Old Republic Insurance Company and Transamerica Casualty Insurance company, which has a financial rating of A+ from A.M. Best, and TransAmerica Casualty Insurance Company, which has A.M. Best ratings of A. The company has won the international luxury travel network Virtuoso's Best Travel Insurance Provider award for eleven years in a row. It is accredited by the Better Business Bureau, which gives it an A+ rating.

Coverage: Travelex offers two main coverage plans - basic and select (family-friendly) - and two flight insurance opt-ins. They offer protection for both leisure and business travelers. Like many companies here, they cover younger children (17 and under) at no additional cost. The company boasts a high claims paid rate (previously reported at 94 percent).

Website/mobile apps: The Travelex mobile website allows you to shop and purchase policies, get emergency assistance, and access trip-related documents from your phone. You can initiate a claim and check the status of your claim online.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Basic $377, Select $333, Max $895

Best for : Frequent travelers Allianz Travel Insurance is part of the giant multinational corporation Allianz, which has over 140,000 employees on five continents. Allianz insures over 80 million customers worldwide. The company has been around for over 100 years. In fact, Allianz insured the Wright Brothers' first flight in 1903. Today Allianz is accredited with the Better Business Bureau, which gives them an A+ rating. Its financial rating from A.M. Best is A+.

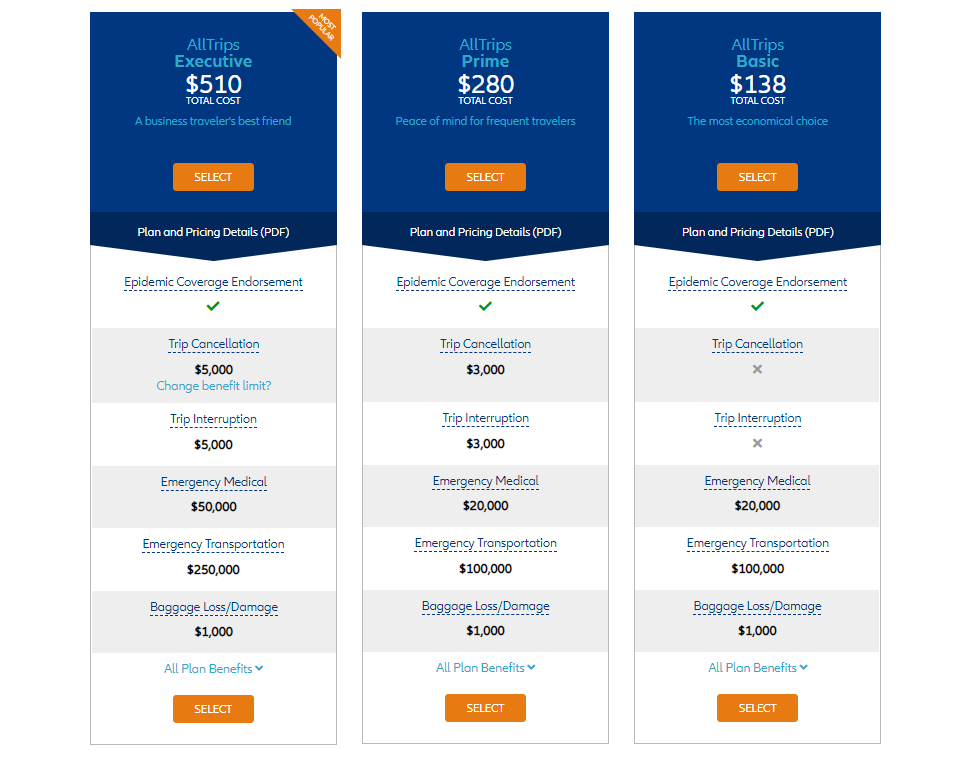

Coverage: Allianz offers a handful of distinct plans including those for frequent travelers. If you travel for business, for example, it might be worth investing in an annual plan that covers both medical and lost baggage expenses for all your trips throughout the year.

Website/mobile apps: Back in 2013 Allianz won an award for its TravelSmart mobile app, which connects travelers to approved hospitals in over 120 countries. The app also allows travelers to check on flight statuses, get emergency international assistance, and access their policy while on the road.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $304.

Best for : Luxury Travel TravelGuard is a subsidiary of AIG. Its policies are underwritten by National Union Fire Insurance Company of Pittsburgh, which has an A.M. Best financial rating of A. The company is accredited with the Better Business Bureau and has a rating of A+.

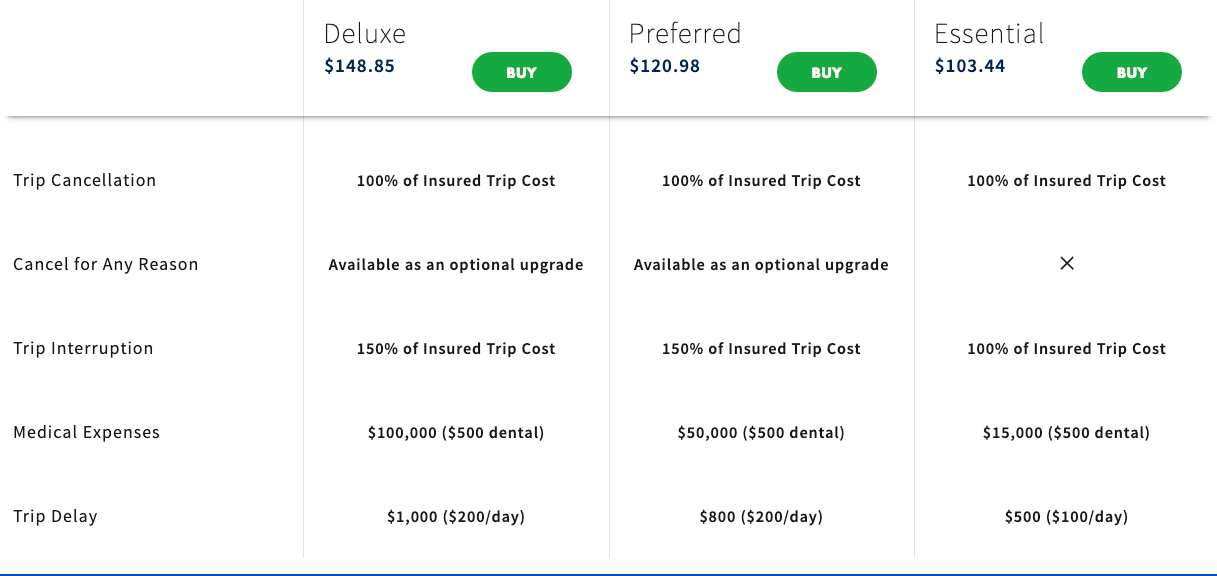

Coverage: TravelGuard includes trip assistance - including dealing with lost bags, cancelled flights, or medical emergencies - via agents who are available 24 hours a day. They offer three basic plan levels - Deluxe, Preferred, Essential - as well as numerous additional upgrades and packages. Upgrades can cover things like last-minute trips where cancellation isn't a factor. TravelGuard stands out in its overage levels - it will insure a trip coverage up to $500,000, higher than the average industry coverage. All of its plans include concierge service and 24-hour emergency assistance.

Website/mobile apps: TravelGuard has an online Claims tool that allows clients to easily file a claim from a computer or mobile device. The tool speeds up the claims process while allowing users to upload photos and documents, electronically sign claims forms, and check the status of a claim from their phones.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Silver $252/Gold $309 / Platinum $655

Best for : Traveling with pets San Diego-based Generali Global Assistance has provided travel insurance since 1991. The insurance division has previously been known as CSA Travel Protection. Generali Global is accredited by the Better Business Bureau and has an A+ rating and an A financial rating from A.M. Best.

Coverage: CSA offers three plans: Standard, Preferred and Premium. It covers telemedicine services with its plans and medical costs if a person becomes sick or injured during their trip. It also reimburses medical costs if you pay out of pocket. As with most travel insurance companies, CSA offers 24/7 emergency assistance, concierge services, identity theft resolution services and a 10-day "free look" period. If you change your mind within 30 days of purchasing the insurance and before you start your trip, the company will provide a full refund. It offers pet relocation services: If you have a medical emergency and cannot take care of your pet while on vacation, it will return your pet home. It also has a Pet Service Locator to help you find vets or other pet services on your travels. For pre-existing medical conditions, you would need to purchase the Premium plan before or at least 24 hours in advance of your final trip payment. You will also need to be medically able to travel, and your prepaid expenses are insured.

Website/mobile apps: They walk you through the claim-filing process step-by-step on their website .

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $298.52 Standard / $346.28 Preferred / $398 Premium

Best for : Budget Adventure Travel World Nomads has targeted its insurance at independent travellers and adventure-seekers. If your vacation includes activities like kite sailing, snowboarding, or bungee jumping, this might be the company for you. The company is recommended by Lonely Planet and National Geographic Adventure... But you don't have to be an adventure seeker to benefit from the very competitive rates offered by World Nomads. The company's policies are underwritten by Lloyd's, which has an A financial rating from A.M. Best.

Coverage: World Nomad offers two levels of insurance plans, which include all of the typical coverage options. In addition, it offers coverage for cameras, laptops, digital gear, and all sorts of travel activities.

Website: World Nomads has an interactive website that allows you to ask questions related to travel and receive both informative articles and blog posts from fellow travelers. It has also developed language apps for iPhones. And you can purchase policies and file claims online from anywhere in the world.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $185 to $255. World Nomad doesn't ask the cost of your trip for the online quote, or the number of travelers, but does distinguish between single, couple, and family groups. The quote tool offers an option to donate to a cause in your destination as well.

Best for : Workaholics In addition to providing travel insurance, AXA offers trip other assistance through its network of over 9,000 staff members in over 30 offices around the world. The company has a financial rating of A from A.M. Best. American Modern Home Insurance - which has an A+ financial rating from A.M. Best - underwrites AXA travel policies. AXA Assistance has an A+ rating from the Better Business Bureau.

Coverage: AXA offers three plans (gold, silver, platinum). It offers an additional "cancel for any reason" policy, which will cover up to 75 percent of your pre-paid non-refundable trip costs. This option must be purchased within 14 days of your first trip payment, but it's a good option for people whose jobs are unpredictable.

Website/mobile app: The website provides a clear chart outlining the three levels of service and their coverage, and it is fast and easy to get an online quote.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $342 Silver / $395 Platinum / $492 Gold

Best for : Study abroad/Expats HTH Travel Insurance is a leader in providing medical coverage for international students and expatriates. The company's policies are underwritten by Nationwide, which has an A+ financial rating from A.M. Best. HTH is not rated by the Better Business Bureau, but it is a member of the U.S. Travel Insurance Association (USTIA) and has signed on to its Code of Ethics.

Coverage: In addition to providing traditional comprehensive trip insurance, HTH specializes in providing medical coverage for students, faculty, and expats living abroad. The long-term overseas coverage only covers medical issues, not trip cancellation or lost baggage. The plan will pay up to $1,000,000 for a medical evacuation and contains no lifetime limit.

Website/mobile apps: The website offers a lot of information about overseas travel and living and provides straightforward quotes. The mPassport app gives you access to thousands of doctors around the world who speak English.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Economy $389, Classic $456, Preferred $546.

Best for : Mobile app aficionados Warren Buffet's Berkshire Hathaway is not known for travel insurance, but it is rapidly gaining recognition in the market for its technological advances in the field. It launched its travel protection program in 2014 and has been winning over customers with its fast claims payments. Berkshire Hathaway has an A.M. Best financial rating of A++. It is accredited with the Better Business Bureau and has an A+ rating.

Coverage: BHTP offers six distinct plans tailored to meet your specific travel needs. Options are available for adrenaline junkies, low-budget fliers, family vacationers, business travelers, and even those looking to relax on a cruise.

Website/mobile apps: Berkshire Hathaway is a leader in providing mobile apps to facilitate rapid claims and payments. You can file a claim online or via the mobile app, which also allows you to track flights, get help finding lost luggage, rebook flights and purchase policies. Getting an online quote is also possible, but the process isn't quite as smooth.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: ExactCare Family: $249; ExactCare: $346.

Best for : International volunteers or employees The Indiana-based Seven Corners began offering international medical insurance in 1993. Today Seven Corners offers a wide range of travel insurance to U.S. residents and foreigners visiting the U.S. It also offers group plans to companies, non-profits and U.S. government agencies seeking to protect their staff and volunteers when traveling. It is the travel insurance provider for the Peace Corps and other U.S. government agencies. Different plans are underwritten by different companies. The popular RoundTrip comprehensive plans are underwritten by Nationwide, with an A+ financial rating from A.M. Best. Other plans are underwritten by Lloyds of London or U.S. Fire Insurance Company, both of which have A ratings from A.M. Best.

Plans: Seven Corners offers a wide range of plans for almost every conceivable coverage option. Its RoundTrip plans provide comprehensive trip coverage (including trip cancellation, medical treatment, and lost property). The RoundTrip Elite plan allows you to cancel for any reason (with 75% reimbursement) and covers pre-existing conditions as long as you purchase the plan within 20 days of your trip deposit and fully insure your trip.

Website/mobile app: In 2016, Seven Corners launched a new mobile website that allows consumers to purchase plans, get 24-assistance and learn about travel insurance from their smartphones.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: Economy $416, Choice $441, Elite $462.

Best for : Hassle-free claims Founded in 1988 in France, April International now operates in 33 countries. April has an A+ financial rating from A.M. Best. Its U.S. travel insurance policies are underwritten by American Modern Home Insurance, which also has an A.M. Best rating of A+. The company is accredited with the Better Business Bureau and has an A+ rating, and it's a member of the U.S. Travel Insurance Association.

Coverage: April provides traditional comprehensive travel insurance, but it also offers an annual plan designed for people who travel at least three times per year. For fairly low prices, you can get basic coverage for trip interruption or delay, medical expenses, and baggage delay or loss. These are plans designed for frequent travelers who don't want to sweat the many small complications that can add up to big expenses. April prides itself on its Stress Less Benefits, which often allows policyholders to avoid a claims process and instead just call in their issue while traveling. If a claims report is needed, the company seeks to get it paid within 30 days.

Website/mobile apps: April has an easy to use website (though some reimbursements require the old-fashioned way) as well as a fully functional "Easy Claim" app.

Sample online quote: Family of four, going on a 10-day, $10,000 trip: $482.

We reviewed dozens of travel insurance providers to come up with this list of top companies. Our criteria for inclusion included:

Experts recommend you do your homework before buying a travel insurance policy. The industry is known for excessive exclusions and confusing language in small print. The National Consumer League recommends that you:

Check to see if you're already covered through another policy. Lots of insurance policies (including home, auto, and life) and credit cards offer partial coverage for trip interruption or medical emergencies.

Read the fine print - especially regarding exclusions. Things like pre-existing conditions, pregnancy-related issues, job loss or travel in a country that has reported a high threat of terrorism may be excluded.

Remember that you can get your money back. Lots of travel insurance companies allow you to get your money back if you cancel the plan within ten days (before travel).

Don't purchase travel insurance through airlines. Airlines aggressively push these cancellation insurance plans and pay commissions of 10 to 40 percent to the travel agents who sell them.

Consumer Reports recommends that you use an online travel insurance broker to search for a good match for your travel. Sites like Squaremouth , InsureMyTrip.com , or QuoteWright.com all allow you to shop and compare quotes. Even if you use such a service, however, Consumer Reports recommends contacting the carrier directly to go over the coverage and fine print before purchasing a policy.

U.S. Travel Insurance Association (USTIA) This professional association represents travel insurance companies and promotes ethical and professional industry standards. You can search its database for member organizations.

National Association of Insurance Commissioners (NAIC) Provides information and advice for consumers regarding when and how to purchase travel insurance.

Insurance Information Institute (III) The III is dedicated to promoting a public understanding of insurance. It has a page providing travel insurance facts.

Your state Insurance Commissioner All insurance is regulated at the state level. NAIC provides an interactive map so that you can click on your state and be directed to your state's Insurance Commissioner.

Better Business Bureau (BBB) The BBB allows you to search its vast online database to check on the reputation and any complaints that have been filed against a company.

About Mary Purcell, MA

Mary Purcell is a freelance writer and health and finance researcher in Piedmont, Calif., with expertise in policy analysis. She is fluent in Spanish and has a master's degree in Latin American studies from Georgetown University. Her articles have appeared on LimeHealth, Narrative, Consumer Health Interactive, and other outlets.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

8 Cheapest Travel Insurance Companies Worth the Cost

Trawick International »

World Nomads Travel Insurance »

AXA Assistance USA »

Generali Global Assistance »

Seven Corners »

Allianz Travel Insurance »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Cheapest Travel Insurance Companies.

Table of Contents

- Trawick International

- World Nomads Travel Insurance

- AXA Assistance USA

There are plenty of smart ways to save money on your travel plans, but refusing to buy travel insurance isn't necessarily one of them. Not having travel insurance can mean being on the hook for exorbitant medical bills or costs for emergency transportation if you become sick or injured during your trip. You could also face significant financial losses if your trip is delayed or your bags are lost or stolen, and without travel insurance you won't have a third party to rely on for assistance.

Buying affordable travel insurance makes more sense than skipping this coverage altogether, so read on to find out which companies offer the cheapest plans and all the protections you can get for a low cost.

How We Chose the Cheapest Travel Insurance Companies

To determine the cheapest travel insurance companies, U.S. News created sample traveler profiles for three separate eight-day trips to different destinations (the Cayman Islands, Spain and California) at a range of price points ($6,500, $10,500 and $8,500, respectively). We used that information to get quotes for the cheapest option for 100% trip cancellation coverage for each trip. We then calculated the average cost of the trips.

The travel insurance companies that made our ranking have a high credit rating and offer the lowest average cost, outlined below. (Note: The sample average costs are not price quotes from U.S. News. To find a travel insurance price quote, use the "View plans" link to enter your trip details and find more information.)

- Generali Global Assistance

- Seven Corners

- Allianz Travel Insurance

- IMG Travel Insurance

- Trip cancellation coverage (up to $30,000) for 100% of the insured vacation

- Trip interruption coverage (up to $30,000) for 100% of the insured vacation

- Trip delay coverage worth up to $1,000 ($150 per day for delays of 12 hours or more)

- $750 in coverage for lost and damaged luggage; $200 for baggage delays

- Up to $500 in coverage for missed connections of three hours or more

- Up to $50,000 in emergency medical coverage ($750 sublimit for emergency dental)

- Up to $200,000 in coverage for emergency medical evacuation

- Up to $2,500 of trip protection for cancellation or interruption

- Up to $1,000 in coverage of lost, stolen or damaged baggage; up to $750 for baggage delays on your outward journey

- Up to $100,000 in emergency medical insurance; $750 dental sublimit

- Up to $300,000 in coverage for emergency medical evacuation

- 24-hour travel assistance services

- Up to 100% coverage for trip cancellation and interruption

- Up to $500 in coverage for trip delays ($100 per day)

- Up to $500 in coverage for missed connections

- Up to $25,000 in coverage for emergency medical expenses

- Up to $100,000 in coverage for emergency medical evacuation

- Up to $750 in coverage for baggage and personal effects; $200 for baggage delays

- Up to $10,000 in coverage for accidental death and dismemberment (AD&D)

- Up to $25,000 in coverage for common carrier AD&D

- Coverage up to 100% of the insured vacation for trip cancellation

- Up to 125% of the insured vacation cost for trip interruption

- Travel delay coverage worth up to $1,000 per person ($150 per person daily limit)

- Up to $1,000 per person for lost, damaged or stolen bags; $200 per person for baggage delays

- Up to $500 per person for missed connections

- Up to $50,000 in emergency medical and dental coverage

- Up to $250,000 in coverage for emergency assistance and transportation

- AD&D coverage for air travel worth up to $50,000 per person ($100,000 per plan)

- Trip cancellation coverage up to $30,000

- Trip interruption coverage up to 100% of the cost of the trip

- Trip delay coverage worth up to $600 (for six-hour delays; $200 limit per person per day)

- Lost, stolen or damaged baggage coverage up to $500

- Baggage delay coverage worth up to $500 (for six-hour delays; $100 per day)

- Missed cruise or tour coverage worth up to $500 ($250 per day)

- Emergency accident and sickness medical coverage worth up to $100,000 (secondary coverage)

- Up to $750 in emergency dental coverage

- Up to $250,000 in protection for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to $10,000 per traveler

- Trip interruption coverage worth up to $10,000 per traveler

- Travel delay coverage worth up to $300 ($150 per day)

- Luggage loss and damage protection up to $500 per traveler

- Baggage delay coverage worth up to $200 per day

- Emergency medical and dental coverage up to $10,000 ($500 for dental expenses)

- Emergency medical transportation coverage worth up to $50,000

- 24-hour hotline assistance

- Up to 100% in coverage for trip cancellation

- Trip interruption benefit worth up to 125% of the trip cost

- Up to $500 for travel delays per person ($125 daily maximum per person)

- Up to $750 for lost, damaged or stolen bags ($250 maximum per item)

- Up to $150 in luggage delay coverage

- Up to $100,000 in emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to 100% of trip cost (up to $10,000)

- Trip interruption coverage up to 100% of trip cost

- Up to $500 in coverage for travel delays (five-hour delay required; $100 daily limit)

- Coverage worth up to $1,000 for lost, damaged or stolen baggage ($250 per item)

- Coverage worth up to $200 for baggage delays of 12 hours or more

- Up to $250 in coverage for airline reissue or cancellation fees

- Up to $250 in coverage for reinstatement of frequent traveler awards

- Emergency medical and illness coverage worth up to $10,000

- Up to $500 in coverage for emergency dental expenses

- Up to $250,000 in coverage for emergency medical evacuation and repatriation of remains

- AD&D coverage worth up to $10,000

- Travel assistance services

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

Holly Johnson

These are the scenarios when travel insurance makes most sense.

9 Best Travel Insurance Companies of 2024

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

The 5 Best International Travel Insurance Companies for 2024

International travel insurance is a must-have for every trip abroad, and for more reasons than one.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

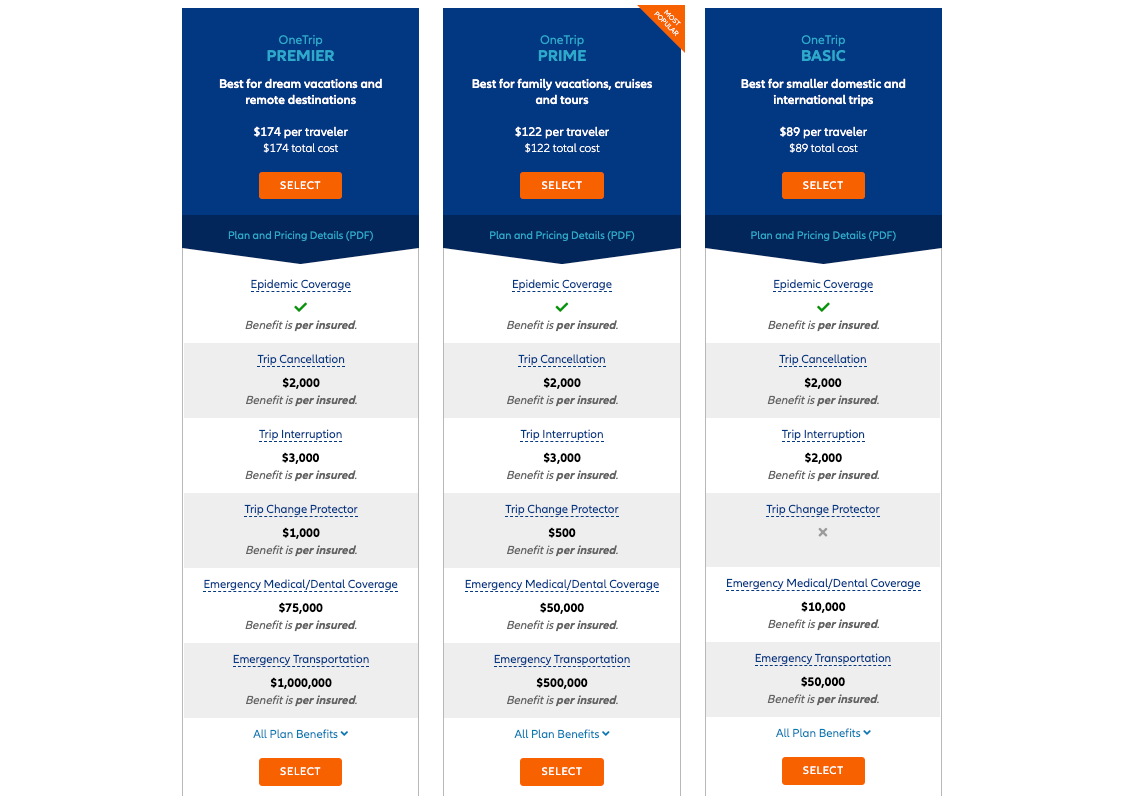

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

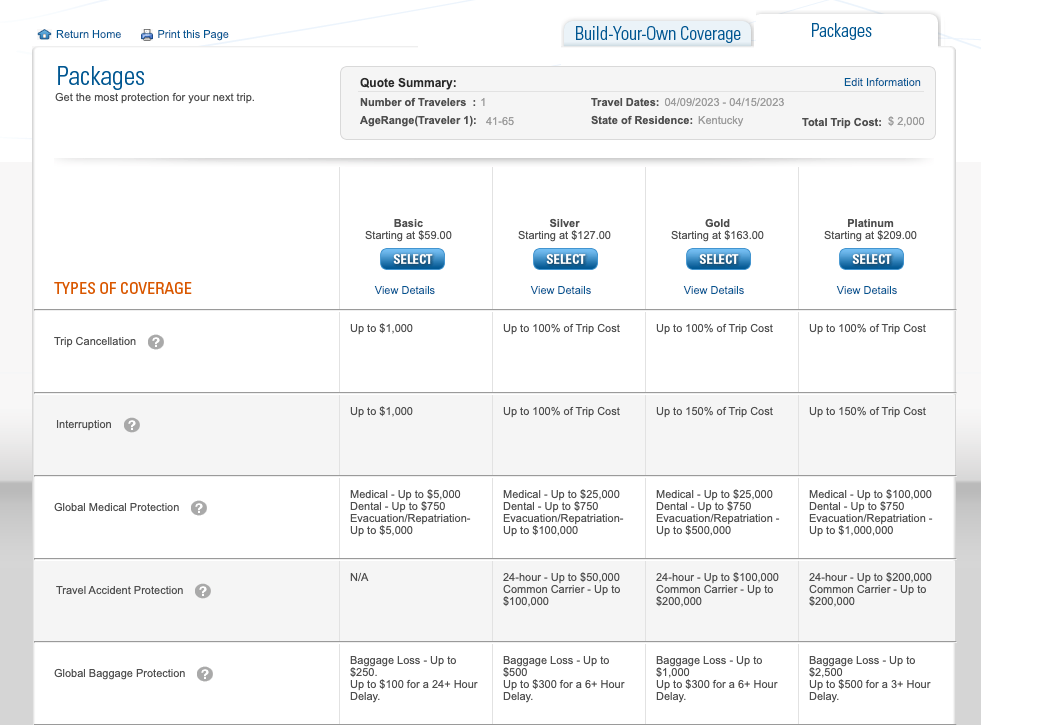

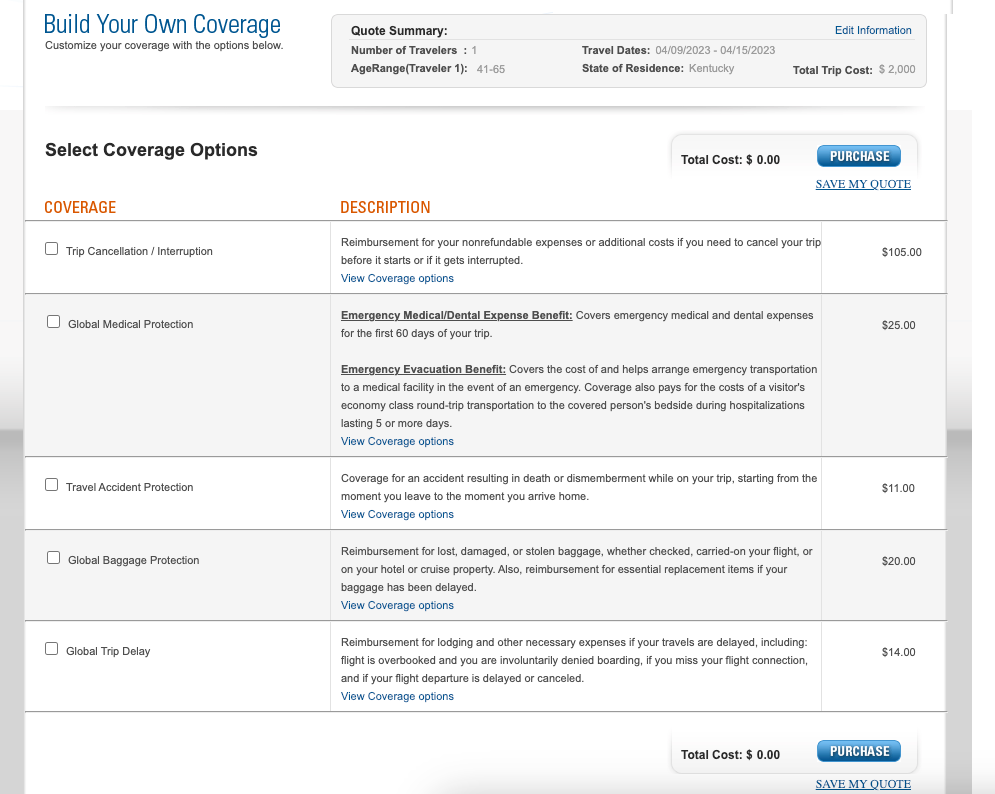

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

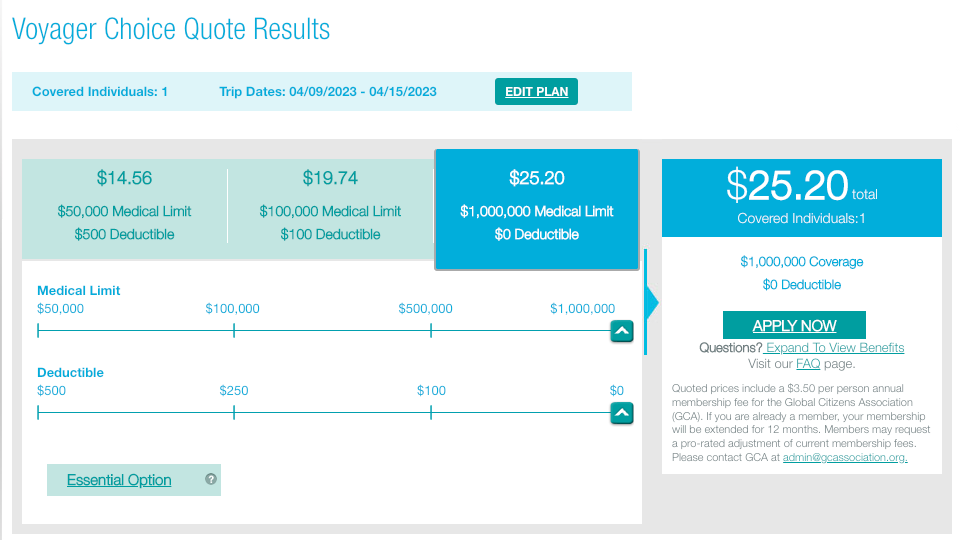

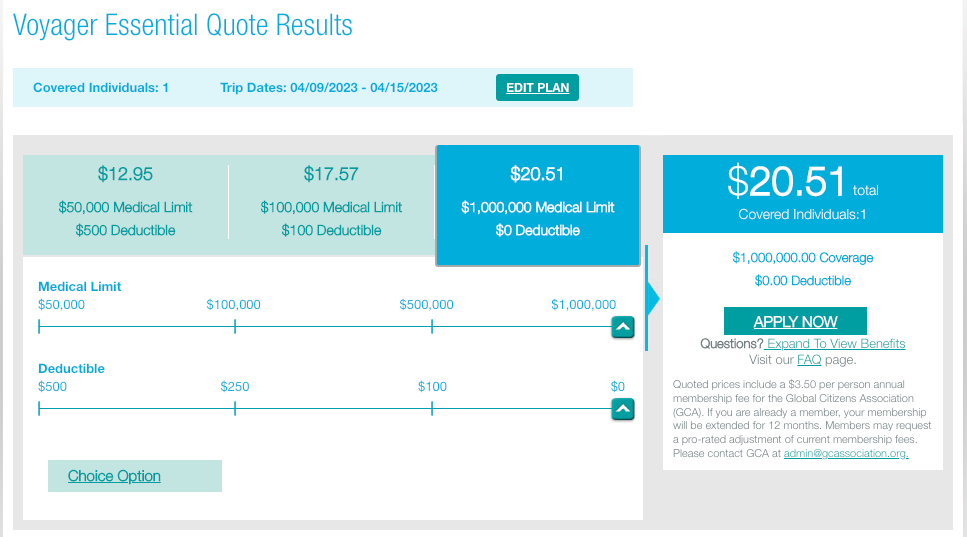

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

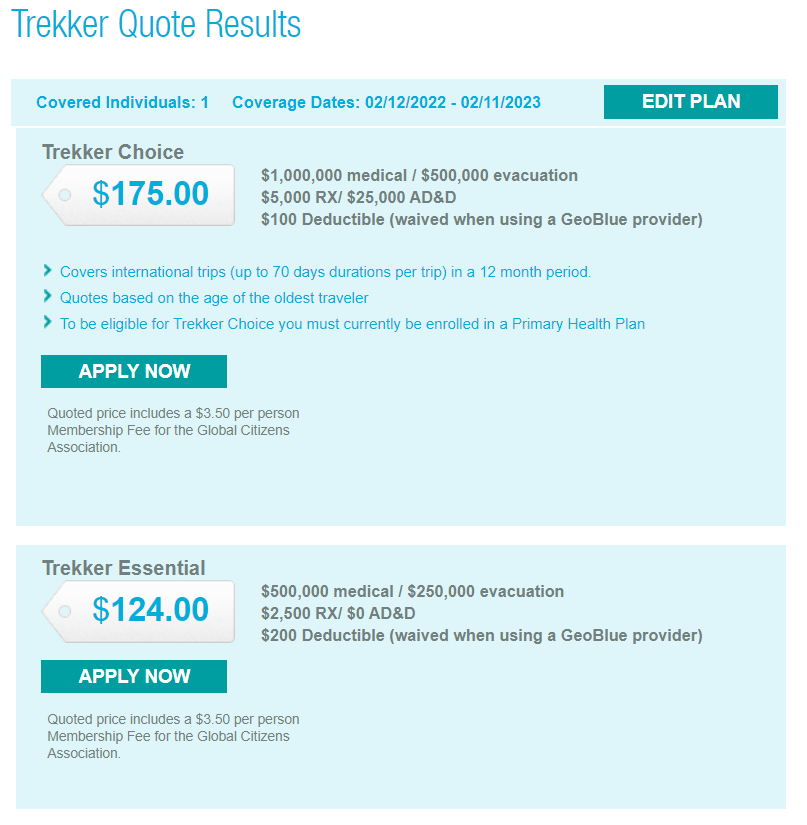

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

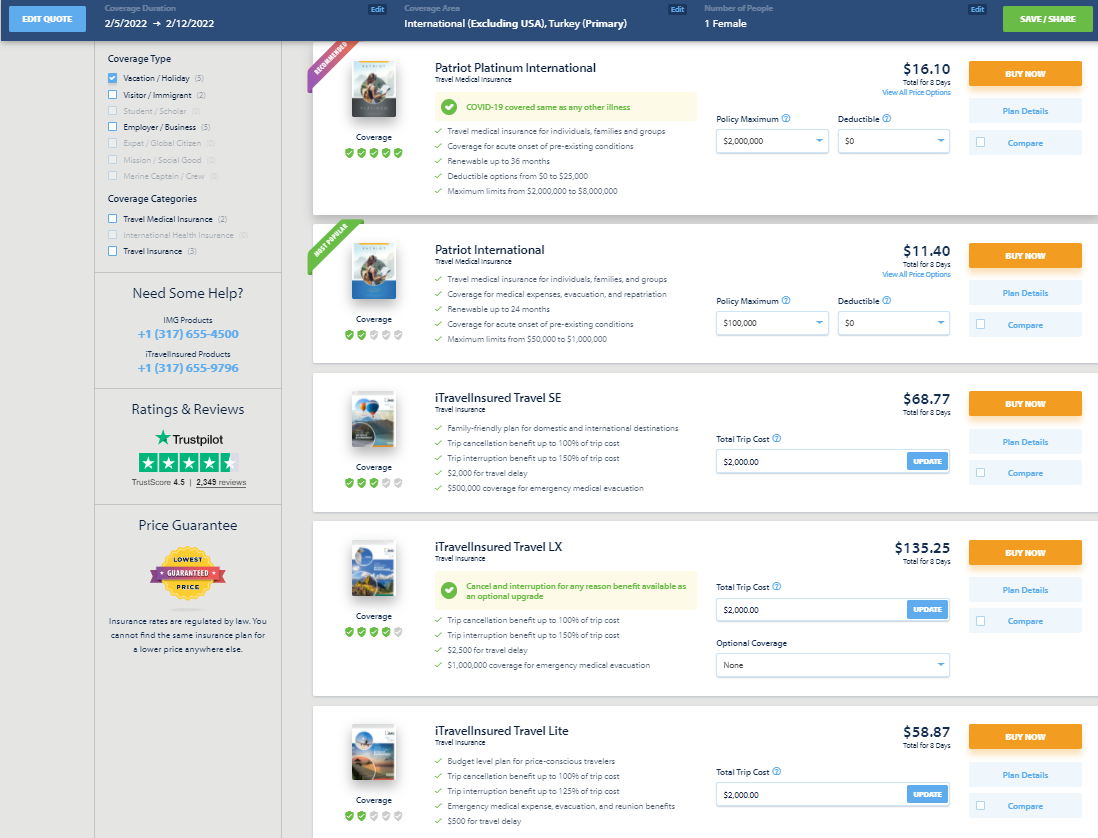

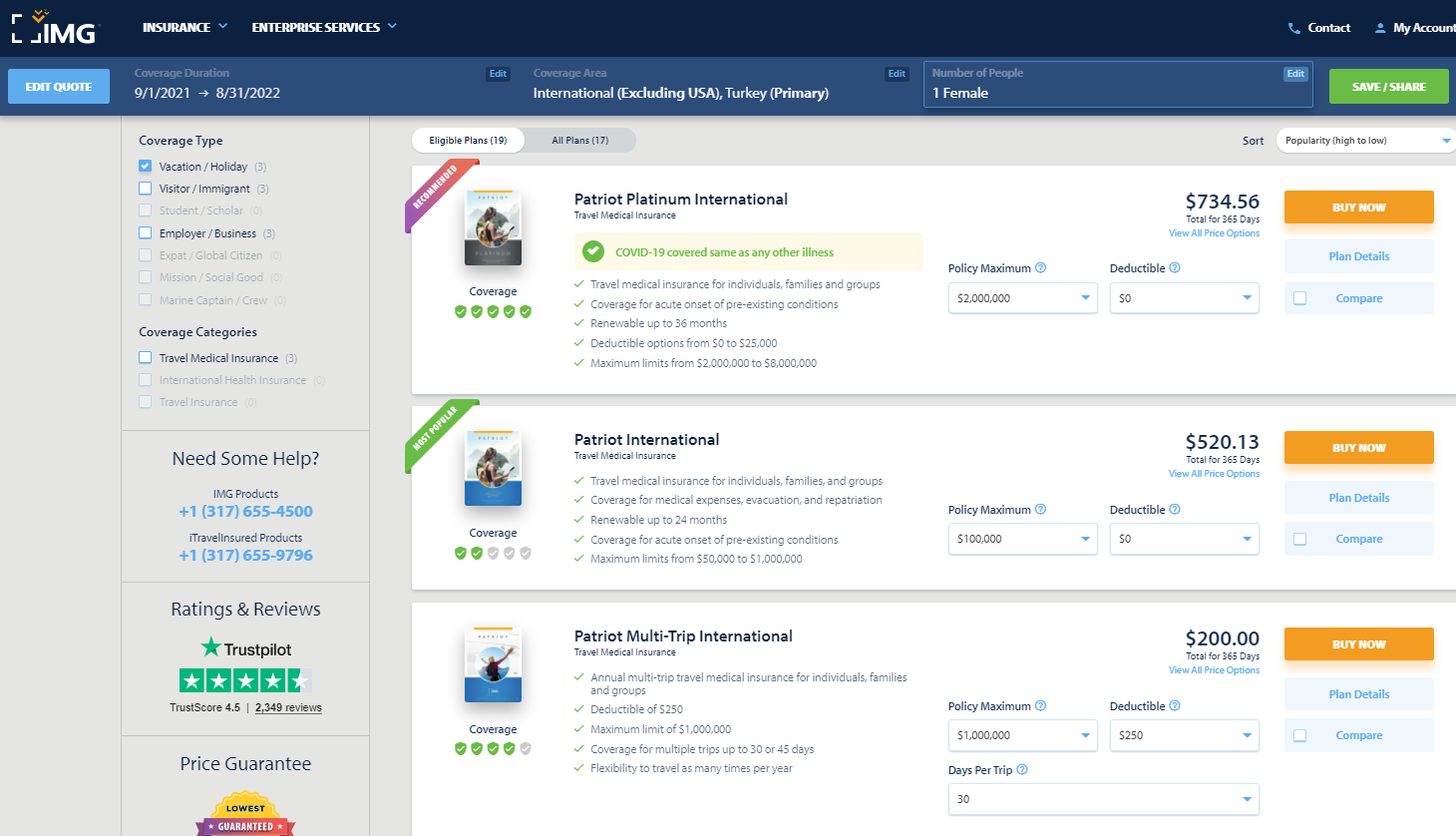

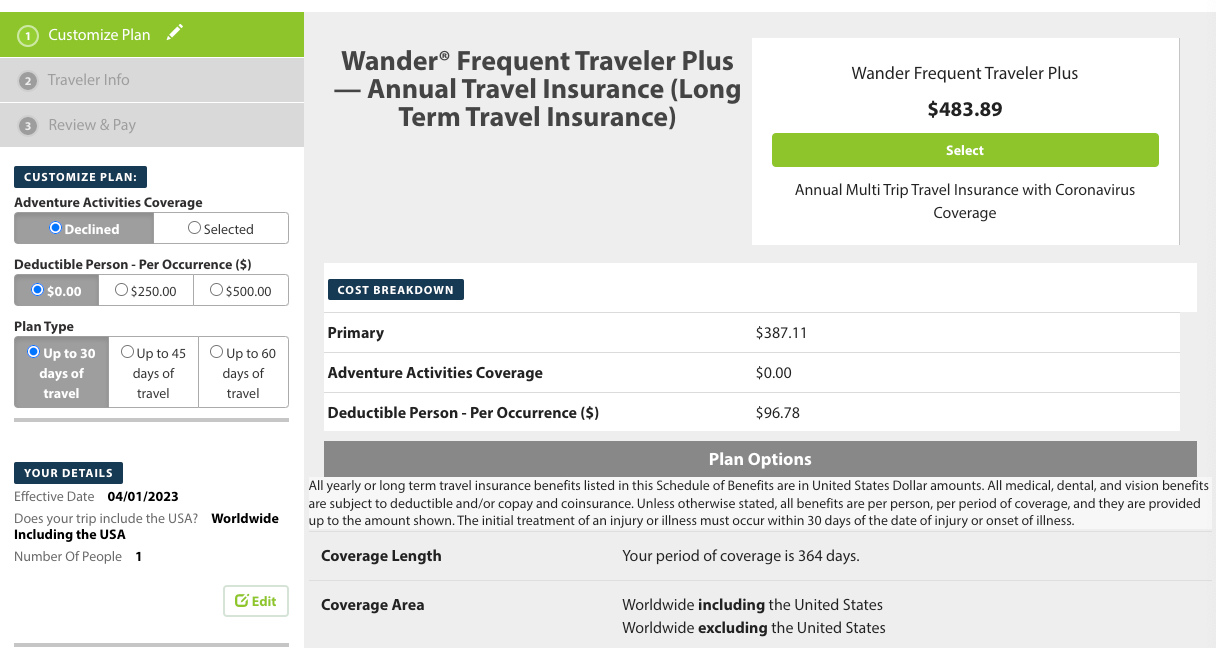

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

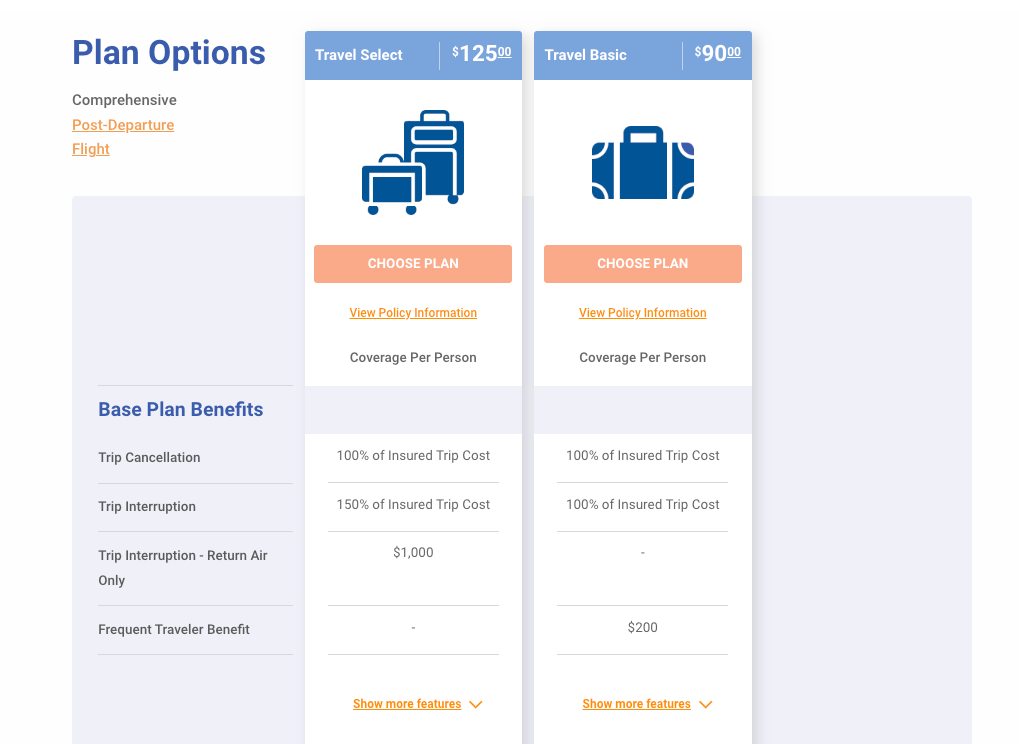

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

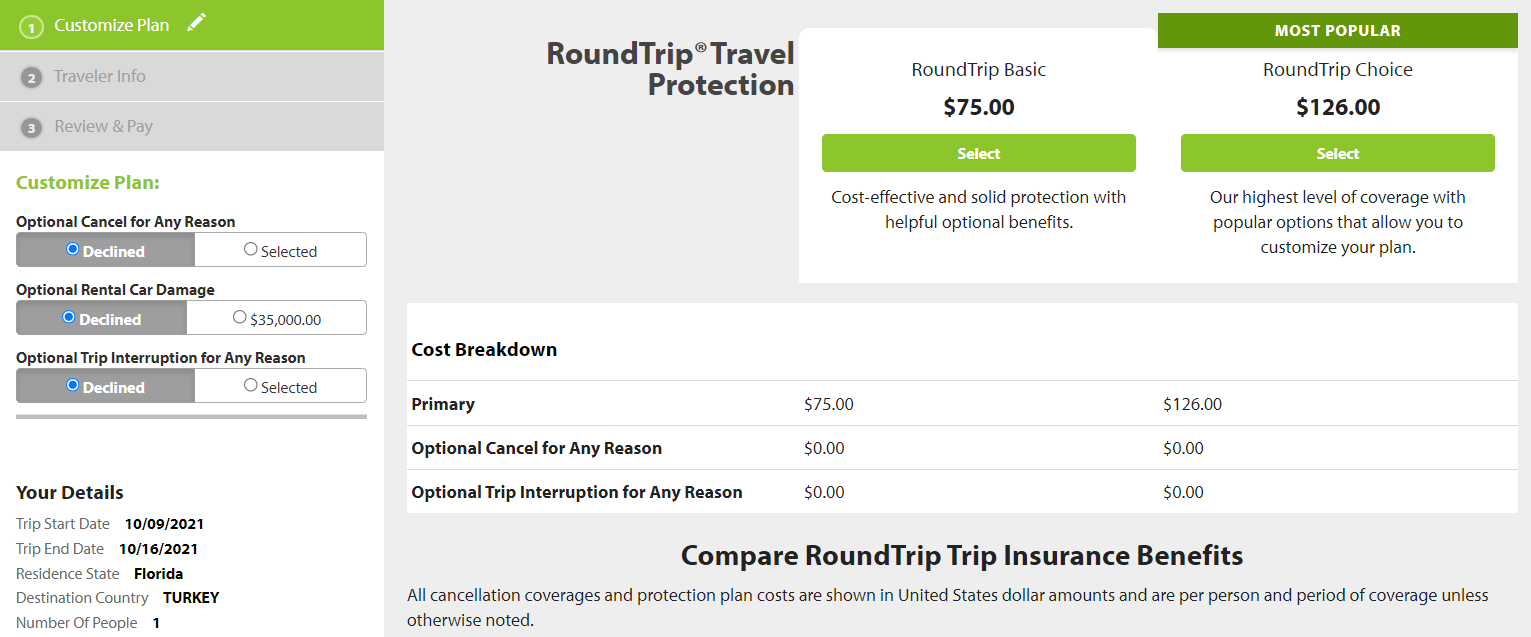

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

+1 (330) 893-1501

Compare & Quote Best Travel Insurance Online for Easy, Safe Trip

Travel insurance is an essential aspect of planning a trip, providing travelers with a safety net to protect against unforeseen circumstances such as trip cancellations, medical emergencies, and lost luggage. By understanding the various options available, individuals can choose the right coverage to suit their needs and ensure peace of mind while away from home.

Get Insurance Quote

Our preferred partners:

With numerous providers offering a wide range of policies, it’s crucial for travelers to familiarize themselves with the key features and details of travel insurance, including coverage types and limits, exclusions, and how to make a claim. It’s equally important to consider factors such as the destination, trip duration, specific activities, and any potential health-related concerns when selecting a policy.

Key Takeaways

- Travel insurance offers protection against unexpected events during a trip, such as cancellations and medical emergencies.

- Key features to consider when choosing travel insurance include coverage limits, exclusions, and the claims process.

- Factors such as destination, activities, and personal health should influence the selection of a suitable policy.

Understanding Travel Insurance

Travel insurance is a safeguard against financial risks and losses that may occur during your travels. It can cover a wide range of situations, from minor setbacks like a delayed suitcase to more significant events such as a last-minute trip cancellation or overseas medical emergencies.