You are using an outdated browser. Please upgrade your browser to improve your experience.

- Client Services

- Find People

- > Germany

- Log in / Register

- News and Deals

Linklaters advises CTG Duty-Free on the largest IPO on the HKEX this year

How would you like your page printed?

- Print web page

- Print as a PDF

Linklaters advised China Tourism Group Duty Free Corporation (CTG Duty-Free), the world’s largest travel retailer, on the global offering and listing of its H shares on the main board of the Hong Kong Stock Exchange (HKEX). The offering raised US$2.1bn in aggregate, making it the largest initial public offering (IPO) in Hong Kong SAR this year.

As a pioneer in China’s duty-free retail industry, CTG Duty-Free has the largest duty-free retail network in China, and a 24.6% market share of the global travel retail industry in 2021. As the world’s largest travel retail operator, CTG Duty-Free opened China’s first comprehensive travel retail complex in 2014 – Sanya International Duty Free Shopping Complex - which is the largest standalone integrated travel retail complex in the world. It also continuously promotes the development of China’s duty-free industry.

CTG Duty-Free's successful listing on the HKEX not only reaffirmed the financing capability of Hong Kong as an international financial centre, and its attractiveness to Chinese companies, but also marked an important milestone for CTG Duty-Free in entering the international capital market, laying a solid foundation for its future international development. As the issuer counsel, Linklaters assisted CTG Duty-Free in navigating the complex regulatory environment and obtaining important waivers, highlighting the firm’s expertise in helping Chinese issuers to raise capital in the international capital markets and its prominence in the Hong Kong IPO market.

The Linklater’s team was led by capital markets partner Iris Leung , with support from capital markets partner Lipton Li and counsel Wei Liang and corporate counsel Donnelly Chan .

Share & Connect

Press Office Asia

- Keeley McNamara Marketing & Communications Manager - Asia +85229015246 [email protected]

Key Contacts

- More about our Capital Markets practice

Close ×

You will need to log in or register to view the content

Linklaters user? Sign In

- 01. Your details

- 02. Your organisation details

Information collected as part of the registration process will be used to set up and manage your account and record your contact preferences.

Further details about how we collect and use your personal data on the Knowledge Portal, including information on your rights, are set out in our Global Privacy Notice and Cookie Notice .

Reset password

If you were registered to the previous version of our Knowledge Portal, you will need to re-register to access our content.

Moodie Davitt Report

Connect with us

China Duty Free Group parent China Tourism Group spells out growth opportunities at IPO press conference

CHINA. Today The Moodie Davitt brings you more exclusive coverage from Friday’s invitation-only press conference conducted online by China Tourism Group Duty Free Corp (China Tourism Group/CTG) and China Duty Free Group (CDFG) senior executives, which spelled out the purposes and benefits of CTG’s secondary listing on The Stock Exchange of Hong Kong, which kick-started that day.

The Moodie Davitt Report joined leading Chinese media houses in reporting on the event.

[ Note: This story was sent by e-alert to our entire opt-in readership. To join that complimentary subscription list and receive all the industry’s biggest breaking stories, many of them exclusive to The Moodie Davitt Report, direct to your inbox please email [email protected] headed E-ALERT REQUEST ]

As reported , CTG hopes to raise at least US$2.17 billion from the listing, which complements its existing presence on the Shanghai Stock Exchange.

The high-level conference was led by CTG Chairman of the Board and Executive Director Peng Hui; Executive Director and General Manager Chen Guoqiang (Charles Chen, President of CDFG); CTG Executive Director and Standing Deputy General Manager Wang Xuan; CTG Deputy General Manager, Secretary to the Board and Joint Company Secretary Chang Zhujun; and Chief Financial Officer Yu Hui.

Dealings in the H Shares on The Stock Exchange of Hong Kong are expected to commence on 25 August, with some 103 million shares on offer at between an expected HK$143.50 (US$18.30) to HK$165.50 ($20.88). CTG said that the proceeds will be used primarily to consolidate domestic channels; expand overseas business; improve supply chain efficiency; upgrade IT and marketing systems; improve membership systems; and for working capital and other general corporate purposes.

Leading off the presentations, CTG Chairman of the Board and Executive Director Peng Hui said, “This year marks my 31st year in CDFG,” Peng revealed. “I have had the honour to witness the development of CDFG and I’m really proud to be a CDFG employee.”

He added, “Since its establishment CDFG has gone through nearly 40 years of development. Over the last 40 years the market environment has been constantly changing, but CDFG’s pioneering spirit has remained unchanged. We have continuously promoted CDFG’s reform and innovation. With the joint efforts of all employees and the support of our partners, we have grown from a new duty free business to the largest travel retail operator in the world today.

A milestone in CDFG’s history

“We are committed to expanding our global presence. We will be focusing on the most important port duty free scores at home and abroad, the establishment of Hainan’s landmark duty free complex [the Haikou International Duty Free Shopping Complex -Ed] and to the innovative development of online business.”

Talking of the secondary listing, Peng said, “This is an important milestone in CDFG’s history. With the support of the world’s best investors, we are confident that we will open a new chapter in its development and take CDFG to the next level to provide better services to global travellers. I’m confident that the future of CDFG will be even brighter, while we are also committed to providing better returns for shareholders.”

CDFG President Charles Chen [who will speak at The Trinity Forum in Singapore on 1-2 November] noted that the company had become the world’s number one travel retailer by sales for the first time in 2020, a position it had maintained in 2021 [Source: The Moodie Davitt Report Top Travel Retailers].

“In 2021, we accounted for 24.6% of the global travel retail market and 77.8% of the China market,” he said, adding that for duty free in isolation, CDFG’s Chinese share was 86% in 2021. In the same year the company accounted for a 90.1% share of the Hainan offshore duty free market.

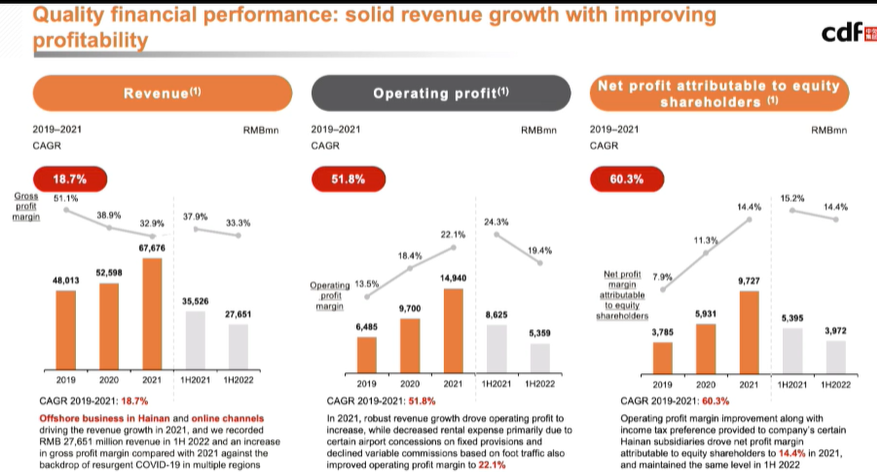

“We’re the only travel retail operator that covers all duty free retail channels in China, and we have significant advantages in terms of brands and product categories,” Chen said. “Despite the COVID resurgence in 2021, revenue and profit continued to grow at a rapid pace. Our revenue in 2021 was RMB67.7 billion and our net profit RMB9.7 billion. CAGR for revenue and net profit over the past three years reached +18.7% and +60.3% respectively.”

Today, CDFG offers more than 1,200 brands and over 316,000 skus. Importantly in terms of returning shoppers, CDFG’s membership base showed a CAGR of +311% between 2019 and 2021 to 23.3 million. “In terms of supply chain, we have established direct sourcing channels with over 430 suppliers worldwide,” Chen commented. “We have seven logistics centers, creating the one and only nationwide duty free logistics and distribution system in China.”

CDFG operates 193 stores, including 184 stores in 28 provinces, municipalities and autonomous regions across China, embracing some 100 cities. Chen said that the group expects the global travel retail market to show a CAGR of +57.4% between 2021 and 2023.

“China’s travel retail and duty free market is expected to grow to RMB450.9 billion in 2026 driven by favourable factors such as the dual circulation economic development policy; policy support for the duty free industry; consumption upgrades; rapid development with new travel retail formats; and a fast recovery from the pandemic,” he concluded on an upbeat note.

Haikou International Duty Free Complex to open on 30 September

CTG Executive Director and Standing Deputy General Manager Wang Xuan said, “As the leader in the travel retail industry we have unparalleled competitive advantages… with both scale and a huge potential for growth.

“We have ranked number one among all Chinese duty free operators for five consecutive years, with a market share of 86% in China in 2021, outpacing the number two by a factor of 20. Our growth rates far exceeded those of other top global travel retail operators.”

Wang highlighted the strength of the group’s Hainan business, particularly in Haitang Bay, which offers “the best destination for mid-to high-end tourists, giving us a prime location for travel retail in Hainan.

“We are building an even larger complex in Haikou, which will go into operations on 30 September. We have duty free concessions at nine out of the top ten airports in China. We run duty free stores at Beijing Capital International, Shanghai Pudong, Shanghai Hongqiao and Guangzhou Baiyun airports, which [collectively] served more than half of the outbound travellers from China’s airports before the outbreak of the pandemic.

“In terms of our overseas business, we have duty free stores in Hong Kong, Macau and Cambodia and at the end of 2021 we opened a flagship [downtown] store in Macau.”

Wang said that the group’s M&A activities had proven highly successful, citing the Sunrise China (2017) and Sunrise Shanghai (2018) acquisitions, deals which had brought critical access to airports in Beijing and Shanghai. “Our post-merger integration capabilities have also helped our acquired companies increase performance significantly. For example, after our acquisition of Hainan Duty Free in 2020, CDFG’s revenue to external customers increased by +258.5% year-on-year in the second half of 2020.”

Culture + commerce + tourism

On top of CDFG’s existing seven logistics centres, the company is building a new intelligent logistics centre in Haikou. “In addition, we’ve built a robust supply chain management system thanks to our strict classification system and distribution standards as well as our digital warehouse management system.

“We’re working on online-offline integration and seek long-term growth through multi-dimensional value-added services before during and after the customer journey,” Wang said. Citing the 150,000 square meters of retail space at the new Haikou operation, he added, “We’ll leverage our travel retail complexes as hubs to support duty paid business innovation and create an attractive mix of businesses and brands with culture + commerce + tourism at the core.

In an important observation, Wang noted that besides building traditional downtown stores, CDFG has developed a “replicable and scalable” travel retail complex model that can be applied to cities where the new downtown duty free policies will be implemented. That is a reference to the anticipated introduction, probably as early as 2023, of a Korean-style downtown duty free shopping model where Chinese travellers can buy (with airport pick-up) before they leave the country.

Last year, he said, CDFG had begun the construction of a duty free complex at the Guangzhou North Railway Station in cooperation with the Guangzhou City government. CDFG will operate the duty free side of the business when the project opens.

[ Editor’s note: The complex, for which ground broke on 31 December 2021, is expected to open in 2025. It will form a key part of the Guangdong-Hong Kong-Macao Greater Bay Area development as an economic hub. The CDFG operation will cover some 90,000sq m out of a total construction space of some 600,000sq including an outlet mall, office tower, two commercial towers and other facilities. It will be the first duty free complex in the Greater Bay Area.]

Wang said that the pandemic has led CDFG to accelerate its online strategy. “We launched online platforms such as CDF member shopping and adopted online preorder services. In addition, we further integrated all memberships and subsystems and used big data analytics to better understand customer behavior and improve operational efficiency,” he said.

He said that the Hainan International Duty Free Shopping Complex will attract elite customers with high spending power. It will feature many distinctive elements, including the world’s largest whisky museum and the first China-chic beauty store in a global and travel retail setting. It will also offer a world-first multi-experience store combining retail, cultural creativity and collectibles auctioning, as well as a pioneering custom-designed immersive Weta-themed atrium [designed by Weta Digital, a world-leading VFX studio =Ed].

“In addition, our Haikou complex will provide customers with a unique, experience-based hybrid business format – featuring retail + coffee shop + tearoom + bars – in an effort to provide customers with comprehensive and value-added services before during and after their travels.”

Wang emphasised CTG’s strong shareholder support and experienced management team. “Our controlling shareholder, China Tourism Group, is the largest central SOE in the tourism industry. Its business scope includes duty free, travel, investments, finance, assets, hotels and cruise ships. As a subsidiary of CTG we are able to coordinate with the group’s resources and travel agencies, transportation and other aspects of tourism. This creates a unique travel plus duty free synergy that helps us further activate our potential in travel retail and provide better services and experiences for our customers.”

The senior management team has an average of 20 years of experience in the travel retail industry, Wang said. Chairman and Executive Peng Wei has nearly 30 years of travel retail experience and was named the 2014 Travel Retail Person of the Year [by The Moodie Davitt Report], an award received by CDFG President Charles Chen four times,” he added.

Expansion opportunities

CTG Deputy General Manager, Secretary to the Board and Joint Company Secretary Chang Zhujun talked powerfully about the group’s development strategy, which he said comprises five main five areas.

“One, we’re continuing to build our competitive barriers, develop duty free business on Hainan, and take advantage of a post-pandemic recovery to enhance our airport business. We are also developing a high-quality duty paid business to ensure sustainable growth.

“Secondly, we’ll also develop new businesses including our travel retail complexes, online business, downtown stores and overseas channels, which are all future growth drivers. Thirdly, we will also strengthen our ties with brands through investments and M&A and actively seek acquisition opportunities in domestic and overseas markets to expand our global competitive position.

“Fourthly, we continue to strengthen our operational and procurement capabilities; and to improve our supply chain; upgrade our IT systems; and boost our marketing capabilities in order to enhance our management effectiveness. At the same time, we’re also focused on attracting high-quality strategic talents, building a global HR management platform and offering competitive salaries and incentives.”

“We have always implemented the concept of green low carbon and recycling, integrating energy conservation and ecological protection throughout our operation. We have also recently released a bilingual ESG report. We have made significant contributions to society through ethical corporate behaviour and results. This is our way of giving back to the society.”

Chief Financial Officer Yu Hui closed out the main session with a strong portrayal of the group’s robust financials.

“On the financial front, we have delivered a high-quality financial performance despite the impact of the pandemic in terms of revenue. This has been driven by the high growth of our Hainan business and online business. Our revenue in 2021 grew to RMB67.7 billion, up by +28.7% year-over-year.”

Noting that H1 2022 performance had been affected to some extent by the pandemic, Yu said that the situation eased from late May – especially with the lifting of the lockdown in Shanghai – boosted by the issuing of consumption vouchers in Hainan among other policies to stimulate consumption.

Interprovincial travel had recovered [pre the current hiatus in Hainan which has seen stores closed in Sanya and Haikou over recent days -Ed] and store sales had rebounded significantly since late May, he pointed out. “According to our earnings report, the company’s sales improved significantly starting in June with revenue increasing +13% year-over-year.”

Gross margin for 2019 to 2021 reached 51.1%, 38.9% and 32.9% respectively. The decrease in 2020 and 2021 was driven by discounting and promotions to combat decreasing customer traffic and temporary store closures caused by repeated outbreaks of COVID on the Mainland.

“Our gross margin has recovered to 33.3 points in the first half of 2022 through precision marketing and optimisation of promotional policies,” he said. “In terms of operating profit, solid revenue growth in 2021 supported the increase in operating profit. The rent reduction at Beijing Airport in Q3 2021 had a positive impact on our operating profit, contributing to an increase in operating profit margin to 22.1% in 2021.”

Developing the duty paid business

Yu said that the group had achieved excellent profitability and improved both the return on capital and shareholder returns year-over-year. “Our return on total assets has steadily increased over the past three years from 16.4% in 2019 to 24.6% in 2021, thanks to the high growth in net profit.”

Along with the online and new Haikou business, duty paid retail is another key growth area, he said. Duty paid sales represented 35% of revenue in 2021 but almost 40% for H1 2022. Hainan duty free revenue, which reached RMB47.1 billion in 2021, accounting for about 70% of total revenue in the year.

“This trend is continuing in 2022,” Yu said. “By product category our Hainan business and online business drove a recovery of the duty free beauty category in 2021, while sales of duty free fashion accessories and duty paid merchandise have continued to increase from 2019 through 2021.

“Our cash flow in the past few years has been excellent with operating cash flow reaching RMB8.8 billion in 2020. And it was pretty stable at around at above RMB8 billion,” he concluded.

QUESTION AND ANSWER SESSION (FIRST REPORTED ON 12 AUGUST)

In a question and answer session that followed the main presentations, CTG was asked about the positive impact of the listing.

CTG Chairman and Party Secretary Peng Hui replied: “This listing is primarily serving our strategy. We’re trying to become a more internationalised company. Internationalisation is a very important long-term goal of ours. So we highly value this Hong Kong listing, which is very important for us.

“We believe that it will further boost our global recognition and brand influence and will consolidate our leadership in the travel retail landscape.”

He added: “Secondly, this will help us access international capital. So we will have access to international capital markets and a domestic capital platform [Shanghai Stock Exchange -Ed], which will provide a lot of funding for future development. Thirdly, it will further expand and increase our financial moat. So the funds could be partially used on our Haikou project [the Haikou International Duty Free Complex, set to open later this year], downtown duty free developments and other projects.

“Fourthly, it will facilitate our overseas expansion and internationalisation.”

The Moodie Davitt Report Chairman Martin Moodie asked whether CDFG believed it had the opportunity to create a Chinese traveller-led version of DFS Group’s success story from the early 1960s through to the 90s when it built a retail empire everywhere that Japanese people travelled.

CTG Executive Director and Standing Deputy General Manager Wang Xuan replied: “Since our founding in 1984 we have always closely followed our consumers’ evolution. So as more and more Chinese consumers travel abroad and become the most important spenders in the global duty free industry, we are also following wherever they are going by opening new stores overseas.

“So for the next step, we will continue to go to top destinations for Chinese consumers in order to create more business and also more returns for us.”

Asked by powerful state media China Daily what were the key reasons for having achieved world number one travel retail status [according to the industry benchmark – The Moodie Davitt Report Top Travel Retailers ranking] Charles Chen said: “The first thing is the breadth of our channels – we are present in all of them. We run 193 stores, including 184 in the Mainland and out of ten international airports we have the concessions to run duty free stores in nine and we have signed a long-term contract with all of them.”

Chen also spelled out the company’s strong presence in Hainan where it operates in Sanya, Haikou and Bo’ao.

“The second reason is our relationship with the brand owners,” he said. “We do direct purchasing with 430 of them and we offer more than 300,000 SKUs. We have established long-term relationships with these suppliers and this was very pronounced during the COVID period, where we expressed mutual understanding and mutual support.

“Another fact is our understanding of the Chinese consumers. The mainstay of duty free shopping in the world [over recent years] has been the Chinese and we have a great understanding of them in terms of their preferences. For example, with Generation Z there have been a lot of changes in their consumption behaviours and patterns. We have a lot of insights into those consumers which other duty free or travel retail operators have no comparison with.”

Chen also cited the strong support CDFG receives from parent company CTG. “They provide us with a lot of travel resources and a lot of travellers. So there’s a strong synergy between us and a lot of sharing of resources. This is a great advantage that other duty free players cannot enjoy – we have access to the largest travel agency in China, and the hospitality system related to it.”

Experienced management is another big plus, Chen said. “I’ve been in this space for 35 years and my boss [Peng Hui] has also been in this sector for decades. And we have a lot of professional buyers, as well as employees from all over the world – from Hong Kong, Malaysia and Singapore. They are very experienced when it comes to sourcing goods.

“So all of these things contribute to our leadership as does the strength of our partnerships with suppliers. So with these advantages, it is really very hard for other players to surmount us.”

“For our sales revenue in Q3 and Q4 we expect a significant increase. So we maintain our original sales target for the entire year.”

Several reporters asked CTG about the impact of the current COVID-19 outbreak in Hainan which has seen CDFG’s stores in Haikou and Sanya closed over recent days with some limited negative impact on the company’s stock price.

Chang Zhujun replied: “As we all know, we are seeing a resurgence of the COVID pandemic in Hainan recently and our stores have also been closed as a response. But we believe that this is going to be a short-term impact. In the medium to long term, we don’t think there will be any further impact.

“Last year there were also some sporadic outbreaks. And in March to May this year we also closed stores temporarily in Hainan and in Shanghai due to the pandemic. However, at CDF, we are running a business that’s both online and offline. We embrace challenges and we are ensuring a steady growth for our business despite the pandemic.

“Last year we achieved 97.4% of traveller volume for the entire Hainan Island but our revenue actually grew by +250% compared to 2019. We also saw a very quick recovery in June this year. We achieved a margin increase year-on-year and we have also made a lot of preparations to ensure that once the ports are open again, our stores in Hainan and elsewhere will be ready to receive customers.

“We also have a number of new projects in Hainan, including the New Harbour complex in Haikou, the second site in Sanya and some additional projects. In the medium and long term they will be the growth drivers for CDFG and will also create an even better experience for our customers.

“In the near term, we actually saw a similar impact in Hainan last August, which was actually the lowest month in terms of revenue for the entire 2021. So we made adjustments.

“And from January to now our gross margin has actually been quite stable. And with the ongoing outbreak in Hainan we are also seeing that the city government in Sanya has been very proactive, and the provincial government is also very proactive in containing the pandemic.

“Because most of the people in Hainan are travellers, we are seeing the government putting a lot of efforts into COVID tests and ensuring that the recovery can happen in an orderly fashion. We therefore have reason to believe that in August and September, which are our traditional low seasons, we’ll be able to make sure that once the recovery happens we are ready for it.

“And at the same time we continue to offer our online platform so that our customers can make pre-orders and retrieve their products and their purchases at the airports. We will also open a new French-style space occupying an area of 3,000sq m in Sanya Phoenix International Airport.

“And therefore, for our sales revenue in Q3 and Q4 we expect a significant increase. So we maintain our original sales target for the entire year.”

In June The Moodie Davitt Report launched a new quarterly eZine called The Moodie Davitt China Travel Retail Report. The cover story is dedicated to China Tourism Group and CDFG. Click on the image to read the bi-lingual title. The next edition will be published in October. Please email [email protected] for a free first year subscription.

Follow us :

The Moodie Davitt Report Newsletter

Subscribe to our newsletter for critical marketing information delivered to your inbox

Related Articles

Fiyta stands as one of China’s leading watchmakers, known for its characteristic blend of traditional craftsmanship and modern technology. We speak to International Business General Manager Jobs Wang on Fiyta’s travel retail expansion plans at home and abroad.

The Moodie Davitt Report spoke to Cacaye CEO and Co-Founder Karl Obrecht to learn more about the brand’s ethos and overall mission as well as its ambitions in travel retail.

Our Hong Kong-based Associate Director Events features in this regular column focused on members of The Moodie Davitt Report team and what makes them tick.

Nature Technology Culture Lifestyle

Embrace Nature Enjoy Life

High Standard, Multi-Level

"High standard and multi-level leisure tourism products are capable of meeting diverse and individual needs"

CTG's development team will consolidate the four resources: policy, resource, capital and intelligence, into a whole in consideration of social,environment and economic benefit. What is more, it also focuses on local and developers’ benefit to turn resource advantage into economic benefit, and adheres to an enterprise strategy of resource difference operation. Learn More >>

Intelligent Human-machine Interaction

"The world's first AI-based interaction platform is creating a new era of personalized and customized tourism"

With the top 500 enterprises background and rich experience, our technical team creatively integrated cutting-edge technologies, thus successfully created the first "Smart Cloud Robot" and the Smart Travel Platform. The platform aims to offer intelligent, tailor-made and real-time travel information, reservation and many other value-added services to world leisure travelers. Learn More >>

Extraordinary Accommodation Experience

"Boutique Hotels with Chinese culture and regional characteristics bring you extraordinary accommodation experience."

The “Chinese Culture Boutique Hotel” series designed by China Tourism Group brings you high-quality tourism experience, basing on tourism destinations, highlighting local and national cultural styles, and focusing on the aesthetic experience of tourists. The hotels adopt traditional Chinese symbols embodying Chinese nation's brilliant and gorgeous classical culture. Learn More >>

Embrace Nature

"Green, natural, primitive farming life"

People in modern cities always dream of owning their own paradise to escape from urban hustle and bustle. Each eco-farm developed by China Tourism Group has a personality of its own, a refuge of rural charm, with blue sky, white cloud, green fertile ground and free creatures. Learn More >>

Culture Collection

"Rich and classic cultural gifts show profound culture and strong region color"

Arch Design

Our gift designing team, composed of famous culture masters, skilled craft technicians, and experienced marketing professionals, make every efforts in digging out the "cultural values" inside the gift to satisfy the demanding needs of our target customers. Rustic and refined, sophisticated and elegant, rich culture and history, our designed gifts are also valuable cultural collections. Learn More >>

Type to search

China Tourism Seeks $2.2bn in Hong Kong’s Biggest 2022 IPO

China tourism group duty free corp aims to raise up to $2.16 billion in a listing due to launch on august 25. it will be the biggest listing in hong kong this year..

China Tourism Group Duty Free Corp is offering a bigger discount than usual to entice investors to buy shares in a new listing in Hong Kong that aims to raise up to $2.16 billion.

The offering, expected to launch on August 25, comes amid hard times in the tourism sector, which has been hammered by repeated lockdowns under China’s rigorous zero-Covid policy.

This will be the largest share sale in the city so far in 2022, which has been a disappointing year also for listings in Hong Kong – the slowest for new listings since 2009.

Shanghai-listed China Tourism is planning to sell 102.8 million shares priced between HK$143.50 and HK$165.50 ($18.30 and $21.10) each, according to its term sheet.

The offer has already been fully subscribed, according to two people with direct knowledge of the matter. The sources spoke on condition of anonymity because they were not authorised to discuss the matter with media.

China Tourism, which has built the largest duty-free retail network in China, did not respond to a request for comment on the deal’s launch or subscription rate.

The launch of the deal comes as Hainan island, in China’s south where China Tourism has several major shopping outlets, remains under tight restrictions due to a Covid outbreak .

The price range represents a 29% to 39% discount to the stock’s 201 yuan closing price on Thursday in Shanghai.

Hong Kong share sales of Chinese-listed companies are typically offered at a discount to entice investors to buy the stock but the flagged discount of China Tourism is higher than normal. The rate was chosen to help ensure the stock trades positively in the secondary market, one source said.

China Tourism’s Shanghai-listed shares have recovered most of their losses since lockdowns across Hainan began to be ordered last week. Its shares are down 8% year to date.

China Tourism plans to set the final price next Thursday, the term sheet said, and the Hong Kong stock will start trading on Thursday week (August 25).

Almost 40% of the stock on offer in the deal has been sold to cornerstone shareholders who will invest about $795 million, according to the term sheet.

Sanya, a holiday city on the southern end of Hainan island at the centre of the Covid outbreak, reported 1,690 symptomatic and 1,504 asymptomatic cases from August to 10.

The duty-free shop operator’s deal, if executed, would surpass Tianqi Lithium’s $1.7 billion listing in June to become the biggest share sale in Hong Kong in 2022.

There has been $4.9 billion worth of initial public offerings and secondary share sales in the city this year compared to $34.7 billion at the same time last year, according to Dealogic data.

- Reuters with additional editing by Jim Pollard

China Locks Down Millions in Hainan, Tibet for Covid Testing

New hong kong stock listings plunge 90% this year, china’s tianqi lithium shares plunge 11%, recover on debut.

Jim Pollard

Jim Pollard is an Australian journalist based in Thailand since 1999. He worked for News Ltd papers in Sydney, Perth, London and Melbourne before travelling through SE Asia in the late 90s. He was a senior editor at The Nation for 17+ years.

You Might also Like

AF China Bond

- Popular News

- Asia Financial News Group

- Asia Financial Index Group

- Capital Link International

- Ads and Partnerships

- Index Tools

- Newsletters

- Legal & Privacy

- Terms & Conditions

- Privacy Policy

Asia Financial is owned by Capital Link International Holdings Ltd, 902, Wilson House 19-27 Wyndham Street, Central, Hong Kong. www.capitallinkintl.com

Everything about China's Innovation

Travel Retailer China Tourism Group Duty Free Corporation Limited Restarts Hong Kong IPO

China Tourism Group Duty Free Corporation Limited, a travel retailer , submitted its prospectus to the Hong Kong Stock Exchange again on Thursday, proposing to list on the main board, with CICC and UBS as co-sponsors.

On June 25, 2021, the company had submitted a prospectus to the HKEx and passed the initial listing hearing in mid-November of the same year. The company later decided to suspend its IPO in early December.

The company now plans to raise $2 billion to $3 billion, and expects to complete the listing in the third quarter at the earliest.

Established in 1984, China Tourism Group Duty Free Corporation Limited focuses on providing duty-free or taxed goods sales services for domestic and foreign tourists and middle and high-end consumers. It currently operates 193 stores, including 184 stores in China and 9 overseas duty-free shops.

In terms of geographical coverage, the company has the best duty-free retail outlets in China and occupies the core channels of duty-free sales in Hainan, including the Haikou Meilan International Airport, Sanya Phoenix Airport, the urban area of Haikou and Sanya, and the area for the Boao Forum in Asia.

In addition, the company operates franchised duty-free shops in major aviation hubs in China and the Asia-Pacific region, including 9 of the top 10 airports in China according to the international passenger throughput before the outbreak of COVID-19 pandemic in 2019.

According to Frost & Sullivan, from 2019 to 2021, only the airports where the company opened stores provided services for more than 2.2 billion passengers.

Further, in terms of sales revenue, the ranking of the company has improved from 19th in 2010 to 1st in 2020 and 2021. It accounted for 24.6% of the global tourism retail market share in 2021.

SEE ALSO: Venture Capital Firm Tiantu Capital Applies for Hong Kong IPO

In 2019, 2020 and 2021, the total number of registered members of the company was about 1.2 million, 12 million and 20.3 million respectively, with a compound annual growth rate of 311.3%. From 2019 to 2021, its revenue was 48.013 billion yuan, 52.598 billion yuan and 67.676 billion yuan respectively, while its net profit was 5.471 billion yuan, 7.109 billion yuan and 12.441 billion yuan respectively.

Sign in with google

Trip.com Group Forms Partnership with China International Culture Association

On November 17, Trip.com Group signed a three-year Memorandum of Understanding with the China International Culture Association to promote inbound tourism.

Airbnb CEO: China’s Outbound Tourism Will Surpass 2019 Levels by the End of 2024

On February 14th, Airbnb, the homestay booking platform, announced its financial performance for the fourth quarter and full year of 2023.

Zeekr Restarts Its US IPO

The high-end electric vehicle brand Zeekr under the Chinese car manufacturer Geely has restarted its IPO in New York to raise up to $500 million, which is lower than the previously set target of over $1 billion.

The Chinese Online Audio Platform Ximalaya Restarts IPO

Two years later, the Chinese online audio platform Ximalaya is making its fourth attempt at an IPO.

Subscribe now to get unlimited access.

- China portal

- India portal

- Vietnam portal

- Indonesia portal

- Singapore portal

- Hong Kong portal

China’s Tourism Sector Prospects in 2023-24

Amid the post-pandemic recovery, China's tourism sector is rebounding with vigor in 2023. We discuss the resurgence of outbound and domestic travel, evolving traveler behavior, and tech-enabled trends in this article. From cultural exploration to wellness escapes and digital integration, the stage is set for foreign businesses and investors to seize opportunities in this transformed landscape.

- Easing of travel restrictions;

- Increase in disposable income among Chinese consumers; and

- Growing popularity of domestic tourism.

China's evolving tourism landscape

Insights from outbound tourism in h1 of 2023.

Data from the World Tourism Alliance's reports, reveal that the outbound tourism sentiment index reached 28 percent in the first half of 2023, marking a 21-point increase from the same period in 2019. The outbound tourism market has displayed a gradual "U-shaped" recovery, emphasizing a steady resurgence rather than an abrupt rebound.

- South Korea;

- United Kingdom; and

Starting from February 20, 2023, mainland cities within the Greater Bay Area initiated a pilot implementation of visa endorsements for cross-border talent to and from Hong Kong and Macao. On May 15, 2023, policies such as the nationwide implementation of group travel endorsements for mainland residents traveling to Hong Kong and Macao were fully restored.

The streamlined and optimized policies for travel to Hong Kong and Macao prompted provinces across the mainland to organize multiple tour groups, leading to a consistent rise in mainland visitors to these regions. According to data released by the Hong Kong Tourism Board, nearly 13 million visitors arrived in Hong Kong in the first half of 2023, of which approximately 10 million were mainland visitors, accounting for around 77 percent of the total.

Furthermore, based on recent data released by the National Immigration Administration, the first half of 2023 witnessed a total of 168 million inbound and outbound individuals passing through China’s immigration, marking a year-on-year increase of 169.6 percent.

At the same time, approximately 42.798 million entry and exit permits for travel to and from Hong Kong, Macao, and Taiwan were issued, indicating a significant 1509 percent increase compared to the same period in 2022.

These figures further underline China's promising revival in outbound tourism. Indeed, Chinese tourists have once again become a significant force driving global tourism and offline consumption.

In terms of outbound travel numbers, the top 10 departure cities were: Shenzhen, Shanghai, Guangzhou, Beijing, Hangzhou, Foshan, Dongguan, Zhuhai, Chengdu, and Wuhan. This highlights that outbound travel is mainly concentrated in first-tier and new first-tier cities, with the "Guangzhou-Shenzhen-Foshan-Dongguan-Zhuhai" Greater Bay Area cities also playing a pivotal role in outbound tourism.

The primary reason driving Chinese tourists to travel abroad is leisure, with business and visiting friends and relatives (VFR) as the subsequent motivations. The rapid expansion of outbound tourism from China can be attributed to the rising incomes of the middle class , the growing desire among Chinese travelers to explore diverse countries and cultures, and the ease of obtaining visas and fulfilling entry criteria for various destinations.

The steady recovery of outbound tourism

Business travel intentions have tripled, and interest in education, family visits, and medical tourism abroad is also on the rise. Other findings align, revealing that 50 percent of Chinese travelers plan to journey internationally within the next year.

A significant shift has also occurred in travel fears, particularly concerning Covid contraction. While it topped travelers' concerns in 2022, it has diminished to the least worrisome aspect this year, as per Morning Consult's survey. This shift reflects growing traveler confidence. Factors influencing this gradual recovery go beyond preferences. A recent report from the Mastercard Economics Institute reveals a shift in Chinese residents' spending patterns.

Known for their shopping inclination, there's a rising trend toward investing in experiences over possessions, particularly in a zero-Covid environment. Despite global economic uncertainties, Asia-Pacific's, including China's, travel recovery remains steady. As travel capacity grows, costs are anticipated to decrease, fueling a more dynamic travel landscape.

The Chinese government’s recent efforts to revive outbound group travel

While the relaxed restrictions will moderately boost outbound tourism, obstacles and cautious spending persist. Nonetheless, domestic travel agencies are expected to see increased revenue, leading to employment and income growth in the sector.

Domestic tourism is thriving

The remarkable rebound of China's domestic tourism sector can be attributed to a set of factors that differentiate it from the relatively slower recovery of outbound tourism. For one, the domestic tourism industry appears to be less affected by uncertainties surrounding employment and income growth compared to other service and retail sectors.

This is primarily due to the strong yearning of Chinese consumers to explore after years of mobility limitations imposed by the pandemic.

On the other hand, the prolonged revival of outbound flights has further bolstered the domestic tourism scene. Many individuals redirected their travel plans within China as international travel remained limited.

Changing Chinese travelers’ preferences in 2023

Around 8.7 billion domestic trips were taken, indicating an annual rate of around 50 percent of pre-pandemic levels. This period allowed the domestic market to mature, and travelers became more sophisticated in their pursuits, engaging in various new leisure experiences such as beach resorts, skiing trips, and city "staycations."

- Experiences matter: Survey data reveals that the rejuvenated Chinese tourist is driven by experiential travel. While outdoor and scenic trips remain popular, the preferences have evolved. Sightseeing and culinary experiences, highly valued in the initial survey series, are now joined by a growing interest in culture and history, beaches, and resorts, as well as health and wellness. This shift solidifies the trend towards experience-driven travel. Additionally, activities like skiing and snowboarding have gained popularity, possibly influenced by the 2022 Beijing Olympic Winter Games .

- Digital expert: Chinese travelers are among the world's most digitally adept consumers, easily integrating mobile technologies and social media into their daily lives. The pandemic further propelled their online engagement. Short-form videos and livestreaming have emerged as dominant online entertainment options.

- Curious: The desire to explore novel experiences in unfamiliar destinations remains strong among Chinese travelers. Despite travel radius limitations imposed by policies, survey respondents express eagerness to visit new attractions. Instead of revisiting familiar places, 45 percent of participants prioritize short trips to new sites, while long trips to new destinations are the second most favored option.

Emerging trends and destinations

Cultural and heritage tourism.

This trend is particularly pronounced in the realm of domestic tourism, where travelers are flocking to heritage sites and cultural landmarks to gain a deeper understanding of China's rich heritage.

Wellness tourism

This evolving trend has prompted destinations like Thailand to proactively adapt by refining their offerings. Through the enhancement of health tourism services and a focus on engaging student and youth travelers, Thailand has positioned itself as a prime destination for those seeking rejuvenation and self-care during their journeys.

Tech-enabled tourism in China’s innovative travel landscape

- Smart appliances and IoT integration: China's tech-driven tourism trend showcases the integration of smart appliances and the Internet of Things (IoT) into the travel journey. Travelers now wield the power to personalize their environment and encounters via smartphone apps. Innovations range from smart hotel rooms adjusting lighting, temperature, and ambiance to IoT-enabled transportation providing real-time updates, enhancing comfort and efficiency.

- Virtual and augmented reality immersion: Tech-savvy Chinese travelers are increasingly seeking immersive encounters. Virtual and augmented reality (VR/AR) have taken center stage, enabling tourists to explore historical sites, cultural landmarks, and natural marvels through virtual tours that breathe life into destinations. This not only enhances engagement but also serves as a potent tool for destination marketing.

- Seamless contactless services and digital payments : Contactless services and digital payments have become integral to China's tech-enhanced tourism scene. Travelers can navigate touchpoints like check-in, security, dining, and shopping with minimal physical interaction. QR codes have revolutionized payment methods, enabling transactions through smartphones, and eliminating the need for physical currency or cards, in alignment with the country's cashless society drive.

Preparing for the return of Chinese tourists to the international scene

Crafting authentic and familiar experiences.

They are looking beyond traditional shopping and sightseeing, expressing a keen interest in entertainment and experiential offerings. Theme parks, cultural activities, water sports, snow sports, and shows are among the sought-after activities.

The key is to offer authentic experiences that resonate with Chinese travelers' desires for immersion, while still maintaining a touch of familiarity.

Harnessing the power of social media

The burgeoning trend of city-walking , for example, where urban exploration is undertaken solely on foot, has not only captured the attention of locals but has also made significant waves across various social media platforms. Chinese netizens are embracing this form of experiential travel, and businesses can leverage social media to align with their preferences.

Platforms like Douyin, China's counterpart to TikTok, have witnessed the rise of “city-walk content”. A recent video showcasing city-walk routes in Guangzhou amassed over 171,000 likes and found its way into the favorites of 72,000 viewers.

Furthermore, Xiaohongshu, a prominent lifestyle-sharing platform in China, reported a remarkable 30-fold increase in searches related to city walk during the first half of 2023 compared to the previous year.

Collaboration with Internet giants

For instance, Amsterdam's Schiphol Airport offers a WeChat Mini Program providing information about the airport, including duty-free shopping and travel planning. Alibaba's Alipay, renowned for its mobile payment capabilities, has partnered with tax refund agencies to streamline the tax refund process for Chinese travelers.

Prioritize direct-to-consumer (D2C) channels

Key takeaways: navigating china’s tourism resurgence.

Domestically, easier travel rules and higher incomes are fueling local exploration. Internationally, outbound tourism is gradually recovering with a focus on immersive experiences, wellness, and cultural discovery.

Chinese travelers are becoming more tech-savvy, seeking out tech-enhanced experiences like virtual reality tours. This shift is boosting cultural, heritage, and wellness tourism.

Social media, especially platforms like TikTok and WeChat, are vital for engaging with Chinese travelers effectively.

In essence, China's tourism resurgence is multifaceted, with travelers seeking enriched experiences, digital engagement, and authenticity.

Businesses that align with these preferences and capitalize on domestic and international opportunities are likely to thrive in the evolving travel landscape.

Vocational Education in China: New Law Promotes Sector’s Growth

Human Genetic Resources in China: New Draft Regulation

China Resumes License Approval: What’s Next for its Gaming Industry?

China’s First Ever Private Pension Scheme – What You Need to Know

CHANGE SECTION

Events in China

Gcc knowledge hub: china's new cross-border data transfer rules: regulatory highlights and insights.

Nathaniel Rushforth

Senior data security & compliance consultant, eusme centre: navigating cross-border data rules: a practical guide for european smes, european union chamber of commerce: understanding china's data security regulations and cross-border data transfer for sme manufacturing companies, swiss china business academy (2023-2024): manpower and employment regulations.

Bruno Hernandez

Senior associate.

Assistant Manager

Get expert guidance.

- Audit / Review

- Business Advisory

- Business Intelligence

- Corporate Setup

- Due Diligence

- HR and Payroll

- Intellectual Property

- M&A Advisory

- Outbound Investment

- Risk Management

Tell us what guidance you seek to be connected with a professional.

Let me show you how I can be of assistance.

I can help you find and connect with an advisor, get guidance, search resources, or share feedback about this site.

Please select what you’d like to do:

Our contact personel in Italy is:

Please share a few details about what guidance you seek. We can have a suitable advisor contact you within one business day.

Search our guides, media and news archives

Type keyword to begin searching...

- Login/Register

China Tourism Group reports 24% revenue growth in 2023 to RMB67.5bn

By Chris Madden in Airports , Downtown , Financial News , Latest News , Retail News April 2, 2024 Comments Off on China Tourism Group reports 24% revenue growth in 2023 to RMB67.5bn

The corporation, which owns China Duty Free Group (CDFG) reported profits of RMB20.85bn last year

China Tourism Duty Free Corporation , the parent company of China Duty Free Group ( CDFG ) saw a 24% increase in revenue last year, driven by swells in both domestic and international tourism, to his RMB67.5bn ($9.3bn)

The figures mark a significant increase on the RMB54.4bn recorded in 2022, but stay slightly short of the company’s record revenue figures of RMB67.7bn from 2021. Gross profit for the period was also up to RMB20.85bn from RMB14.86bn in 2022. The last reported data put CDFG top of the rankings for global travel retailers in the 2023 DFNI Database .

Duty-free sales accounted for RMB44.2bn in sales for CDFG during 2023, up 69.9% on the previous year, while duty-paid sales dropped 20.1% to RMB22.3bn.

Hainan was a driver of sales for CDFG in 2023

It comes against a backdrop of rapid recovery for tourism in China, according to the company, with domestic travel in the country up 93.3% in 2023 to 4.89 billion travellers. Of these, 3.76 billion came from urban areas, a 94.9% increase on 2022. International entries and exits during the period amounted to 424 million, according to the National Immigration Administration , up 266.5% year-on-year, and reaching 63% of the levels seen in 2019. 206 million of the travellers accounted for were from Mainland China , while 183 million came from Hong Kong , Macau and Taiwan . Meanwhile, the 35.5 million foreign international travellers marks a 693.1% increase year-on-year, but still sits at just 36% of pre-pandemic levels.

Hainan remains a key market for CDFG and was a driver of the company’s success, with visitor numbers rising 49.9% year-on-year to 90 million, while tourist revenue was up 71.9% to RMB181.3bn.

During the year, CDFG increased and enhanced its position, especially within the Chinese duty-free market, with the opening of Zone C at the Sanya International Duty Free complex, along with tender wins for duty-free stores in Tianjin Binhai and Zhoushuizi international airports, three port stores in Yunnan and duty-paid operations at four airports including Shanghai Pudong and Shanghai Hongqiao international airports.

The departure hall of Shanghai Pudong

Reflecting on the results, China Tourism Group Duty Free Corporation Chairman of the Board of Directors Xuan Wang said: “In 2023, in the face of a complex and ever-changing market environment, the Company propelled under pressure, focused on our main tasks of stabilizing growth, optimizing structure, improving quality and efficiency, controlling risks, and strengthening party building, and solidly carried out reform and innovation and management improvement, achieving steady improvement of quality and efficiency.”

Tagged with: CDFG CDFG's Sanya International Duty Free Shopping Complex China Tourism Group Duty Free

Related articles

Fosun Strategy

Management Team

Corporate Culture

Global Industries

Global Partners

Intelligent Manufacturing

Environmental

Policies & Reports

Corporate Governance

Fosun Ecosystem

Financial Information

Event Calendar

Stock Information

Analyst Coverage

Financial News

Media Library

Talent Development

Campus Recruitment

Professional Recruitment

Reports & Complaints

Delisting Query

Fosun Tourism Announces 2021 Interim Results Global Travel Restarted and Continues to Improve Financial Position Remains Healthy Long Term Growth with a Bright Future

Results Highlights

- In the first half of 2021, under the negative impact of the COVID-19 pandemic outbreak, the Business Volume of the Group’s tourism operations decreased to RMB2,433.8 million, representing a year-on-year decrease of 41.9%. The adjusted EBITDA decreased to RMB-565.0 million, and the loss attributable to equity holders was RMB2,004.8 million.

- The Group’s resort and destination operation businesses performed outstandingly in China. Business Volume of Club Med resorts in China grew by 171.9% year-on-year in the first half of 2021.

- In the first half of 2021, Business Volume of Atlantis Sanya recorded a year-on-year increase of 152.1%, and EBITDA margin was 49.2%.

- In July 2021, Club Med’s capacity were restored to 73.2% of that of the same period in 2019, and the average occupancy rate of worldwide resorts reached 67.1% during the period. As of 31 July 2021, the cumulative bookings of the second half of 2021 increased by 97.8% compared with the same period in 2020 and recovered to 83.9% of that of the same period in 2019.

- The Group’s cash flow remained strong. During the reporting period, the Group's cash flow from operating activities turned positive and increased to RMB1,311.0 million. As of 30 June 2021, cash and bank balances were approximately RMB5,200.0 million, whilst unused bank facilities were approximately RMB4,4 million.

On 19 August 2021, Hong Kong Fosun Tourism Group (“Fosun Tourism” or the “Group”, Hong Kong Stock Exchange Stock Code: 1992), the world’s leading leisure-focused integrated tourism group, was pleased to announce its interim results for the six months ended 30 June 2021 (“the first half of 2021” or “the reporting period”).

Facing the continued spread of Novel Coronavirus (COVID-19) (the “Pandemic”) in the first half of 2021, countries took stringent travel restriction measures, which posed a major negative impact on the resort and the tourism operations of the Group. During the reporting period, the Business Volume of the Group’s tourism operation, at a constant exchange rate, decreased by 41.9% year-on-year to RMB2,433.8 million. Revenue of the Group decreased to RMB2,781.5 million; adjusted EBITDA decreased to RMB-565.0 million; and loss attributable to equity holders was RMB2,004.8 million. Through highly efficient cash flow management, the Group maintained a healthy financial position. The Group's cash flow from operating activities turned positive to RMB1,311.0 million during the reporting period. As of 30 June 2021, cash and bank balances of the Group were approximately RMB5,200.0 million, unused bank facilities approximately RMB4,367.4 million, and bank loans due within one year approximately RMB2,282.2 million.

Global businesses have significantly rebounded since May, and Chinese businesses led the recovery of the tourism industry

The spread of the Pandemic in EMEA (Europe, Middle East, and Africa) led to the temporary closure of most resorts in the Alps from January to March, and outbound travel from major customer sourcing markets was suspended. As a result, the Business Volume of Club Med in the first half of 2021 decreased by approximately 64.2% year-on-year. Since late-May 2021, as the Pandemic in EMEA and Americas have gradually been under control, countries and regions have begun enforcing “vaccine passport” and easing lockdown measures. For May and June 2021, the cumulative bookings from EMEA and Americas for six months ended 31 December 2021 (the second half of the year) have exceeded 39% and 69% of that of the same period of 2019, respectively. The Group is well-positioned for a business rebound in the second half of 2021 and has placed considerable efforts in resuming the operations of resorts. In July 2021, 41 resorts have resumed operations with overall capacity increasing by approximately 104.3% as compared to that of 31 July 2020 and recovering to 73.2% of that of 31 July 2019. By 31 July 2021, the cumulative bookings for the second half of 2021, expressed in Business Volume and at a constant rate, increased by approximately 97.8% as compared with that for the second half of 2020 recorded as of 31 July 2020, and resumed to 83.9% of the bookings for the second half of 2019 recorded as of 31 July 2019.

In the first half of 2021, with the Pandemic outbreak well controlled in China and the increasing travel demand, by leveraging the Group’s outstanding branding and product leadership, the business of Club Med resorts in China recovered strongly, with Business Volume increased by 171.9% compared with the same period in 2020. According to the estimates by the China Tourism Academy, China’s tourism revenue resumed to 57%, 77%, and 75% respectively during Qingming Festival holiday (3 to 5 April 2021), Labor Day Holiday (1 to 5 May 2021) and Dragon Boat Festival holiday (12 to 14 June 2021) in 2021, as compared to the same periods of 2019 (before the outbreak of Pandemic). Club Med resort in China recorded significant growth in the above three public holidays, which widely outperformed the industry-wide recovery. The Business Volume increased 63%, 91%, 19% during Qingming Festival holiday, Labor Day Holiday and Dragon Boat Festival holiday in 2021, compared to the same period in 2019, before the outbreak of the Pandemic, respectively.

Since the implementation of a new offshore duty-free policy on 1 July 2020, Hainan has become a new travel hotspot. In the first half of 2021, Atlantis Sanya’s operation continued to show a strong growth momentum. Its Business Volume increased by 152.1% compared with the same period of last year, reaching RMB835.2 million, and adjusted EBITDA of reached RMB410.9 million, an increase of 309.1% compared with the same period of last year, demonstrating its operating capability on a rapid expansion of market share in the post-Pandemic period. Meanwhile, the number of visitors to Atlantis Sanya in the first half of the year increased to approximately 2.6 million from 1.4 million of the same period in 2020, among which 1.2 million and 0.6 million visited Waterpark and Aquariums respectively.

In the first half of 2021, Atlantis Sanya actively promoted upscale products and launched market collaborative projects. It set Guinness World Record successfully for the “Largest Underwater Mermaid Show”. It also actively upgraded the tourism retail in the resort, promoted the layout and development of new retail areas, and introduced brands like Kaola Global and Pop Mart.

The Pandemic never alters the pace of development, and strong resorts layout improves the global presence

The Pandemic has not stopped the development of the Group. In early 2021, the Group laid out a plan to open 16 new villages by the end of 2023, in which 8 of them are in China. The plan was on track in the first half of 2021. Club Med has opened a new resort in Seychelles in the first half of 2021. The Group also plans to renovate 12 resorts by mid-2024 based on an upscale strategy. Club Med Lijiang resort in Lijiang FOLIDAY Town, Quebec Charlevoix resort, and Changbaishan resort will open in the upcoming autumn or winter.

Casa Cook brand series, the Group's asset-light boutique hotel brands, have signed 14 franchise agreements in EMEA and 4 hotel management agreements in China as of 30 June 2021. The Group plans to operate no less than 30 hotels worldwide by the end of 2023.

Mr. Henri Giscard d’Estaing, the Vice Chairman and Deputy CEO of Fosun Tourism Group, said, “The worldwide sanitary crisis continued to have a serious impact on Club Med’s results in the first half of 2021. To fight this crisis, our Club Med team continues to work hard and take strong actions to reduce costs as well as maintain a healthy cash flow. With the support of our landlord partners around the world, we also continue to renovate our existing resorts and prepare to open new destinations to drive our future profitable growth. Against the backdrop of the Pandemic, people’s desire for holidays with freedom and safety is growing every day. Club Med’s offers match the expectation of tourists, especially that of family tourists. I am confident that we are ready to the rebound, and that with our global value strategy, direct digitalized distribution and ambitious development plan, we will deliver a profitable growth within the FOLIDAY ecosystem.”

Building FOLIDAY upscale ecosystem, the construction and pre-sale of the FOLIDAY Town progress steadily

Two FOLIDAY Town projects both performed as planned in the first half of 2021. Club Med Lijiang Resort in Lijiang FOLIDAY Town has entered the preparatory stage of opening and is expected to commence operation in the upcoming autumn. Construction of the saleable vacation inns and residence project of FOLIDAY Town Lijiang began in the first half of 2020. The project has been completed in stages since late 2020 and will be fully completed from 2022 to the end of 2023. The construction project of Taicang FOLIDAY Town is expected to be completed in stages since 2021 and will be fully completed from 2024 to the end of 2025. As of 31 July 2021, a sales permit for GFA of approximately 143,000 square meters was obtained by Taicang FOLIDAY Town, of which 823 sets of saleable units have been completed. The construction of the indoor ski domain “Alpes Snow World” has started in January 2021, while “Alpes Time Town” and Club Med Joyview Taicang Resort are under full-scale construction in June 2021.

The century-old brand is under rapid development through digital transformation

In July 2020, the Group officially relaunched the "Thomas Cook Lifestyle Platform" in China as a one-stop vacation lifestyle platform for global families. Leveraging FOLIDAY's global advantageous resources, the brand-new Thomas Cook Lifestyle Platform achieved precision marketing aimed at urban middle-class families and young clientele, with a focus on leisure and tourism services. 2021 marks the 180th anniversary of Thomas Cook, one of the most well-known tourism brands in the world. The restart of its operation will speed up the development again. As of 30 June 2021, the cumulative number of downloads of "Thomas Cook Lifestyle Platform" was approximately 1.5 million. Since 16 September 2020, the brand-new Thomas Cook Online Travel Agency was put into trial operation in the UK. In the first half of 2021, Thomas Cook China and Thomas Cook UK achieved a total Business Volume of nearly RMB274.8 million.

Consolidate the leadership in ski ecosystem

The Group operates 15 mountain (ski) resorts in Europe and four in Asia Pacific, and is committed to creating a complete and diversified ski ecosystem. By the end of 2023, the Group has six to eight mountain resorts in the pipeline, among which there are two new mountain resorts in China, including Changbaishan Resort and Chongli Thai Woo Resort. By then, the Group is expected to operate six to eight mountain resorts in and around China.

The Group’s tourism destination brand-“FOLIDAY Town” (復遊城) is becoming a leading brand of the integrated sports-travel complex. “Alpes Snow World” in Taicang FOLIDAY Town is a large-scale indoor ski resort in East China, and is jointly managed by the Group and Compagnie des Alpes (CDA), a French ski domain operator based in French who was also one of the contractors of Winter Olympics. With five ski slopes, seven "magic carpets" serving as conveyors, the “Alpes Snow World” offers over 20 ski and leisure activities. In terms of ski practice and training, there is an all-ages ski school under Club Med, offering visitors professional-level ski instruction which is from the European system.

The Group's indoor ski simulators brand "Foryou Ski" (復遊雪) is dedicated to providing quality solutions for urban skiers. It has opened seven stores.

Mr. Qian Jiannong, Chairman and CEO of Fosun Tourism Group, said, "I always believe that we are the one deciding our own destiny and future. Hence, we have never stopped gearing up ourselves and seizing the opportunity to explore a better future and potential development even amid the challenges to the tourism industry posed by the Pandemic. With a healthy financial position during the first half of the year, our businesses in China secured a rapid growth.

We are well assured that we are fully prepared for the global business recovery in the second half of the year. From the rapid recovery of our overseas businesses in July, we see a silver lining towards the recovery of the Company's global business in the second half of the year. During the crisis, the Company has never stopped the planning for a long-term growth. Therefore, we have been in full commitment in promoting the development of the resort and tourism destination businesses, as well as building the Group's digital and vacation content ecosystem. As a result, we are confident that as countries ease travel restrictions and release purchasing power for travel and vacation, the Company’s global businesses will be back on the growth track by riding on Fosun Tourism’s global influential products, brand power and globalized talent system.”

HOME | ABOUT CTA | MANAGEMENT | STRUCTURE | RESEARCH TEAM | ACHIEVEMENTS | CULTURE | MILESTONES

Annual Report on the Development of China’s Tourism Groups

The tourism group represents a particular type of corporate group, comprising two or more enterprises which meet the demand of tourists. Viewed from an international perspective, the tourism group is a corporate conglomerate, in which member enterprises are linked by property rights, closely associated in commercial activities such as investment and financing, planning and accounting, product R&D, marketing, brand incubation, human resources development, etc., and coordinated in their actions to achieve the group’s overall strategic objective.

The tourism group is a natural result of commercial logic in the field of industrial organization. It is a complicated tourism corporate organization; its momentum stems from its internal coupling efficacy; and the boundary of its growth is defined by its escalating internal transaction costs.

In the past 30 years, Chinese tourism enterprises, along with the development of the national tourism, have navigated their way of conglomeration through difficulties and ups and downs. As the representative of advanced productive force in the tourism industry, the explorer of commercial innovations in tourism, as well as the undertaker of industrial missions, tourism groups not only play a leading role in the development history of China’s tourism industry, but also serve as the core and dominant element thereof, representing our “national team” in the international tourism competition. In the era of great development for our tourism industry, tourism groups serve as a major platform for the dual market of tourism demand and production factors and carry on the dream of building our nation a great power of tourism.

Although the importance of tourism groups to the tourism industry is apparent, the present academic and industrial researches on tourism groups remain in a spontaneous stage, our knowledge about tourism groups is still inadequate, our homegrown experience and development mode have not been systematically sorted out and summarized, and there is still a lack of macro comprehension and theoretical guidance for the development of tourism groups.

Against such a background, we are called upon urgently by our times to review the past and look into the future, and summarize and sort out the historical process and current conditions of our tourism groups. To this end, China Tourism Association and China Tourism Academy jointly organized a tourism development forum and released the Report on the Development of China’s Tourism Groups based on relevant surveys. All of this was intended to drive the industrial development to a strategic height, grasp the nature of tourism groups, sort out the historical clues, summarize successful experience, offer suggestions for the conglomeration of China’s tourism enterprises, and cry out for the great development of the tourism industry.

Enter the valid email address

- Regional News

- Asia & Pacific

China Tourism Group Duty Free Corp launches HK Stock Exchange listing

By Charlotte Turner | Monday, 15 August 2022 12:44

Reporting $10bn in sales from its duty free and duty paid operations combined in 2021, the leading travel retailer’s network consists of 193 stores in total; 184 of which are located in China.

As reported, the company is already listed on the Shanghai Stock Exchange and planned to list in Hong Kong last year, with expectations that it could raise in the region of $5bn at the time. However, this was postponed due to widely reported market volatility.

In what is being touted as the largest offering of the year for Hong Kong, CTG is initially offering 5,138,200 shares, representing approximately 5% of the total number that will be available under the Global Offering.

Books are open from Friday until the 18 August, when shares are expected to be priced, according to Bloomberg analysts.

Recent developments

Reporting on ‘recent developments’ in an online prospectus document, CTG outlined its response to the arrival of the Omicron Covid variant in early 2022, which resulted in ‘control measures’ being implemented.

Charles Chen, CDFG President.

“The COVID-19 pandemic situation in China in March, April and May 2022 was more severe as compared to 2021 and 2020 due to clusters in multiple regions simultaneously. As a result, increased pandemic control measures, including strengthened travel restrictions, were introduced.

“Our business and operations faced disruptions and our total revenue decreased by RMB7,875.2 million, or 22.2%, from RMB35,526.0 million for the six months ended June 30, 2021 to RMB27,650.8 million for the six months ended June 30, 2022.

“Our […] sales decreased by RMB3,632.3 million, or 16.5%, from RMB22,065.3 million for the six months ended June 30, 2021 to RMB18,433.0 million for the six months ended June 30, 2022.

“Our gross profit decreased by RMB4,242.9 million, or 31.5%, from RMB13,460.7 million for the six months ended June 30, 2021 to gross profit of RMB9,217.8 million for the six months ended June 30, 2022.”

CTG has entered into agreements with nine cornerstone investors who have agreed, subject to certain conditions, to “subscribe for such number of Offer Shares (rounded down to the nearest whole board lot of 100 H Shares) , which may be purchased for an aggregate amount of approximately HK$6,238 million at the Offer Price,” said CTG.

Those investors are: AMOREPACIFIC Group; China State-Owned Enterprise Mixed Ownership Reform Fund Co. Ltd; China Structural Reform Fund Corporation Limited; COSCO Shipping (Hong Kong) Co., Limited; Hainan Free Trade Port Construction Investment Fund Co., Ltd; Luzhou Laojiao Co., Ltd; The Oaktree Funds; Rongshi International Holding Company Limited and Shanghai Airport Investment Corporation Limited.

Like what you’re reading? Follow TRBusiness on Linkedin:

Most popular

- Most Shared

TR Consumer Forum: Agenda & speakers revealed

Influential speakers will unpack the most effective strategies for understanding and engaging...

OUT NOW: March/April Leading Americas Operators

The TRBusiness March/April 2024 edition boasting the inimitable leading Americas Operators...

IAADFS evolves; Americas summit to move to Miami

The International Association of Airport and Duty Free Stores (IAADFS) has adopted a new...

In the Magazine

TRBusiness Magazine is free to access. Read the latest issue now.

E-mail this link to a friend

In case you missed it....

- women in travel

State-Owned China Tourism Group Duty Free Plans IPO

China Tourism Group Duty Free, which runs China’s biggest duty-free retail network, is planning an initial public offering (IPO) in Hong Kong that could raise as much as $2 billion, Reuters reported Friday (Aug. 12).

The offering is fully subscribed, and the stock is likely to begin trading Aug. 25, according to the report. As is common with China-related exchanges, shares will be offered at a discount to start.

“After the tepid performance by Tianqi Lithium, the only way they could get away with the China Tourism deal was by offering it at a decent discount,” Aequitas Research Director Sumeet Singh said, per the report. “If it does go well, other deals should follow as the pipeline for Hong Kong deals is now fairly full and needs to get moving soon.”

The company had planned an IPO for late last year but scrapped that plan due to “sluggish market conditions ,” the South China Morning Post (SCMP) reported Wednesday (Aug. 10).

The government-owned company, according to the South China Morning Post, plans to use proceeds from the IPO to open new stores in rail stations and airports and at seaports and border crossings, SCMP reported.

In other IPO news, Instacart will likely go public before the end of the year, a move coming earlier than expected.

Read more: Instacart Eyes IPO Before Year’s End, Report Says

The company is looking into a traditional IPO, which would raise cash to be used for future acquisitions, but nothing is set in stone yet, and things could change depending on a variety of factors.

The new IPO news comes during an extremely slow market for new stock listings. This year has been one of the worst for IPOs in more than a decade.

Recommended

Trending news, the big story, featured news, partner with pymnts.

We’re always on the lookout for opportunities to partner with innovators and disruptors.

- China Edition

- China Daily PDF

- China Daily E-paper

China Tourism Group Duty Free makes trading debut on Hong Kong Stock Exchange

Xinhua | Updated: 2022-08-25 17:24

HONG KONG -- China Tourism Group Duty Free Corporation, which operates the most duty-free shops in China, on Thursday made its trading debut on the Hong Kong Stock Exchange after raising HK$16.2 billion ($2.1 billion) of proceeds in the financial hub's biggest listing so far this year.

The company, already listed on the Shanghai Stock Exchange, issued some 102.8 million shares and set its Hong Kong initial public offering (IPO) price at HK$158 ($20.14) per share.

Nine cornerstone investors agree to subscribe to the offering, according to the company's prospectus. Among them, China State-Owned Enterprise Mixed Ownership Reform Fund Co Ltd takes the lead with $150 million, followed by $100 million by cosmetics giant Amorepacific Corp of South Korea.

Established in 1984 and after nearly 40 years of development, the Beijing-based company has become the largest travel retail operator in the world primarily focusing on sales of high-quality duty-free and duty-paid merchandise, according to the prospectus.

The firm said it operates 193 stores, including 184 stores in 100 cities across 28 provinces, municipalities and autonomous regions in the Chinese mainland, and nine duty-free stores overseas.

The firm said it benefited from the favorable domestic duty-free policies, which led to increases in both revenue and net profit in 2020 and 2021 despite the impact of the COVID-19 pandemic.

The company reported a revenue of over 67.67 billion yuan ($9.88 billion) in 2021, up 28.67 percent year-on-year.

- Ping An Insurance posts 4.3% growth

- Trading card games make inroads among anime-obsessed kids

- PwC report predicts home floats of US-listed companies

- Homeward bound

- Blind boxes under tighter guideline

- Get 7 Days Free

China Tourism Group Duty Free Jumps on Solid Revenue Growth, Brighter Prospects

By Bingyan Wang