Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, whic are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

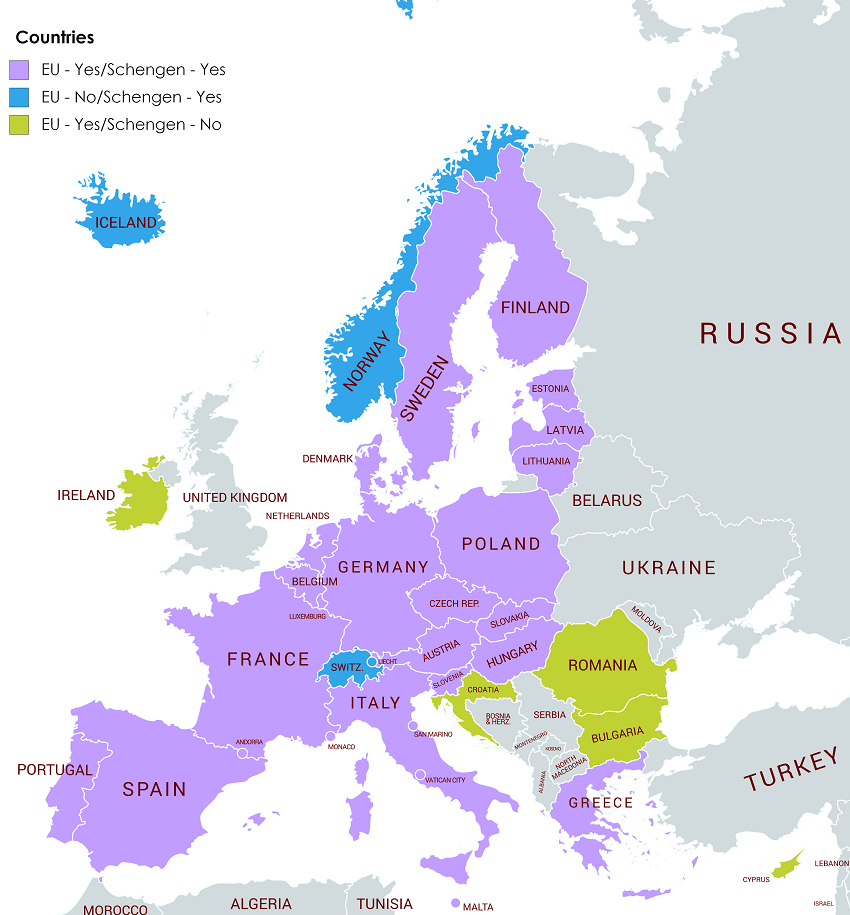

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

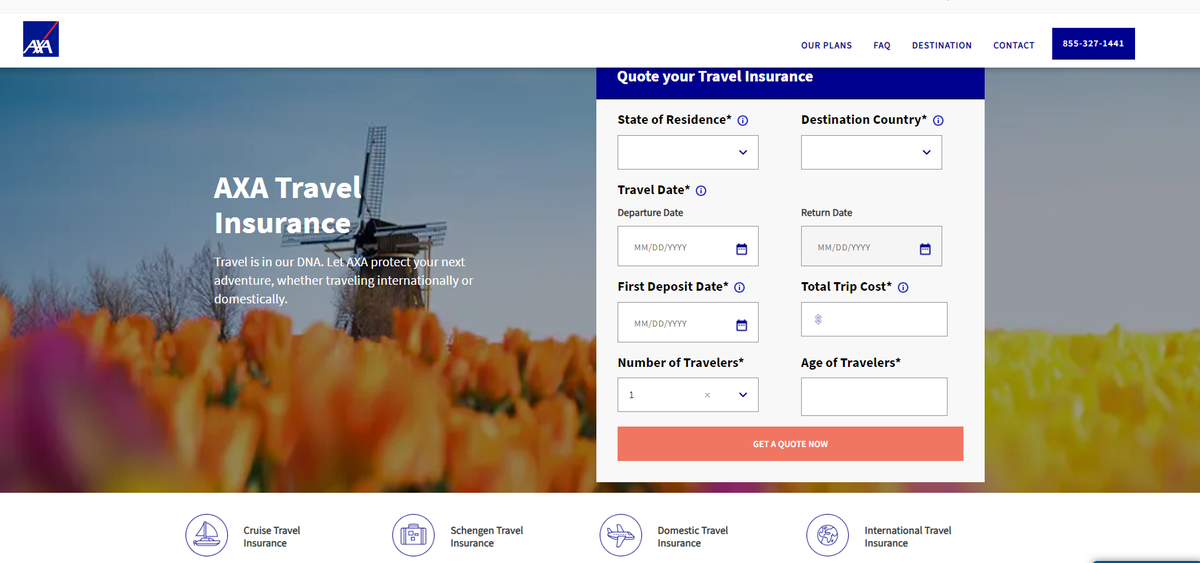

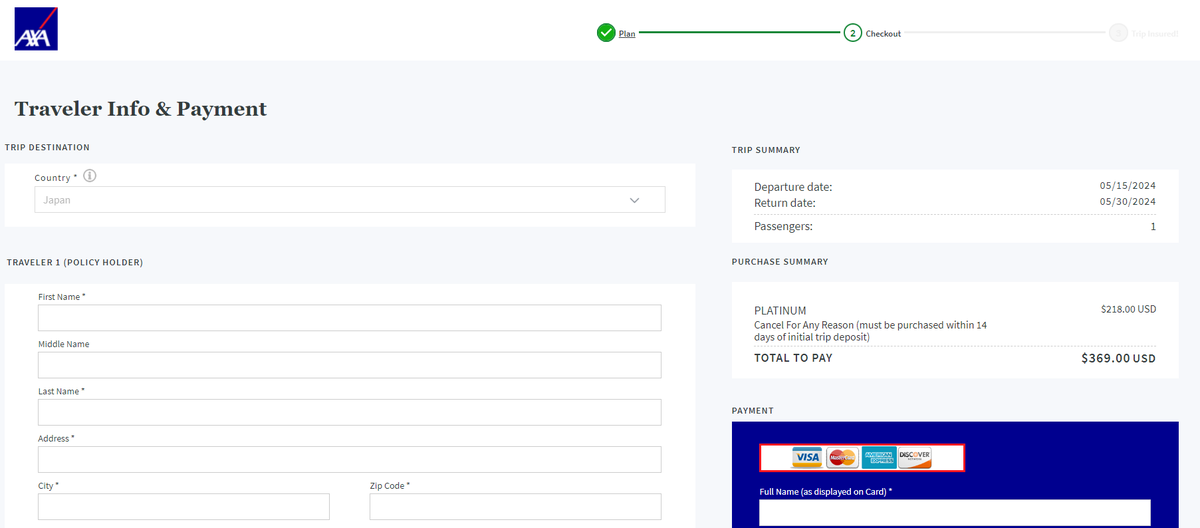

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

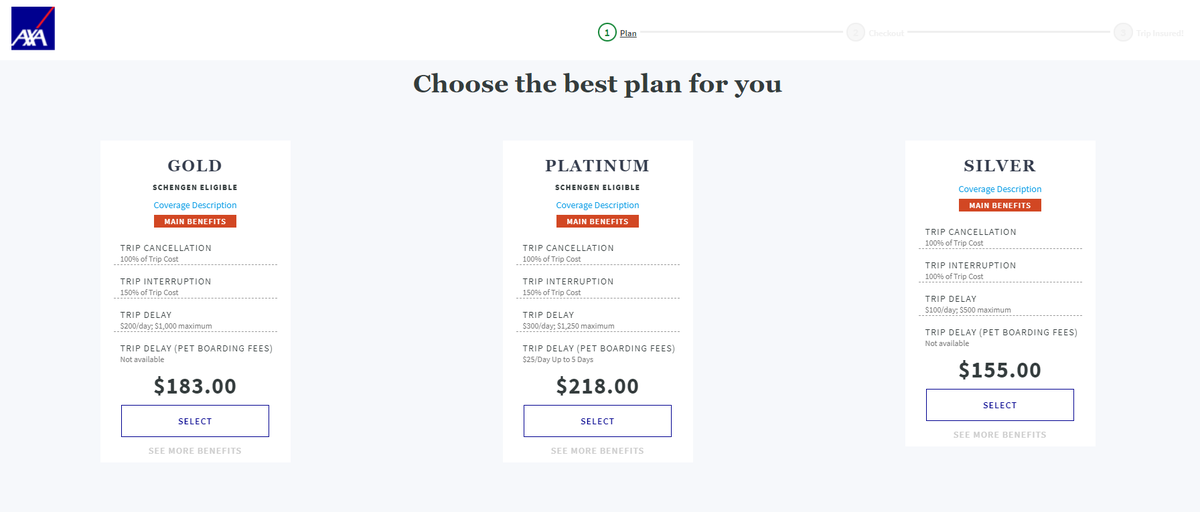

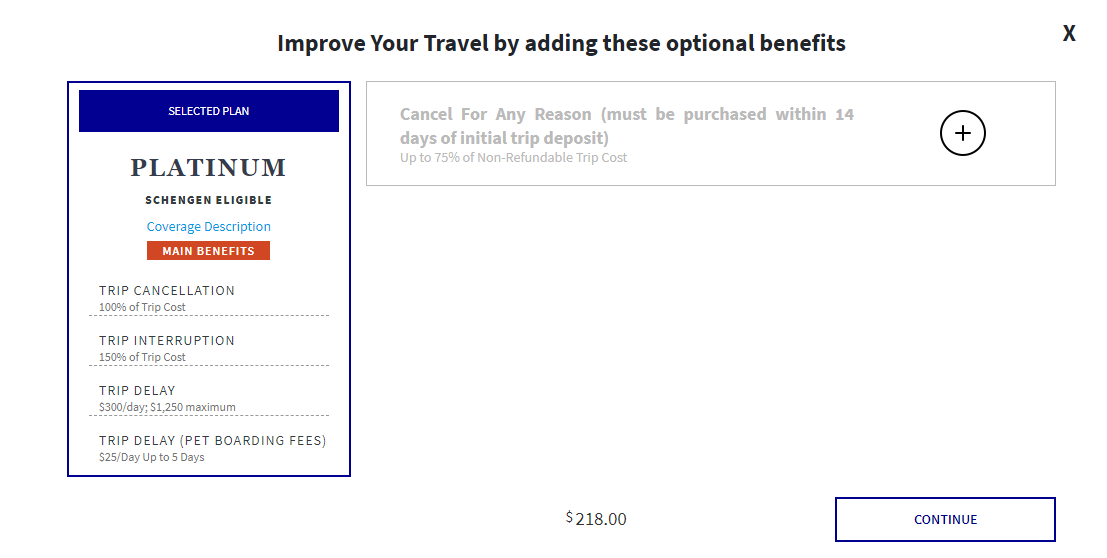

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

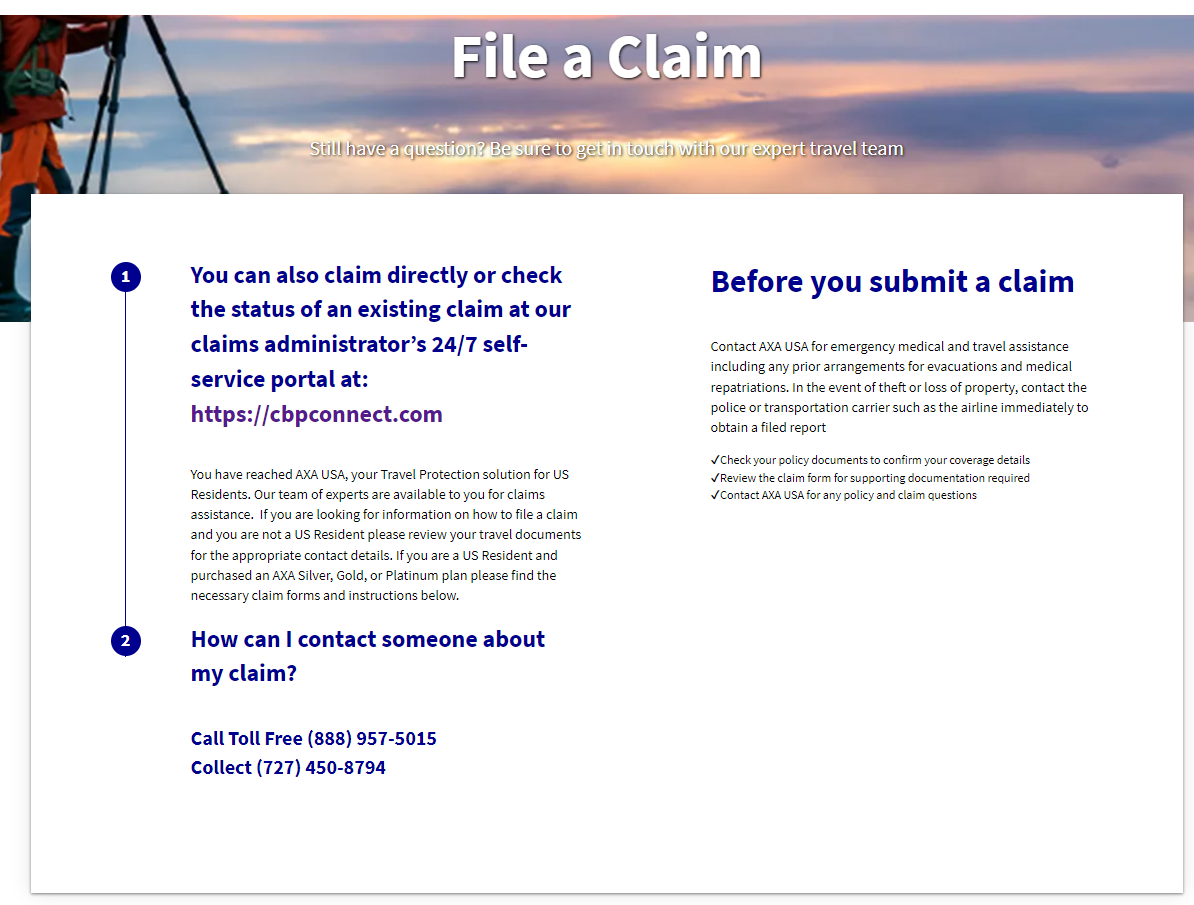

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

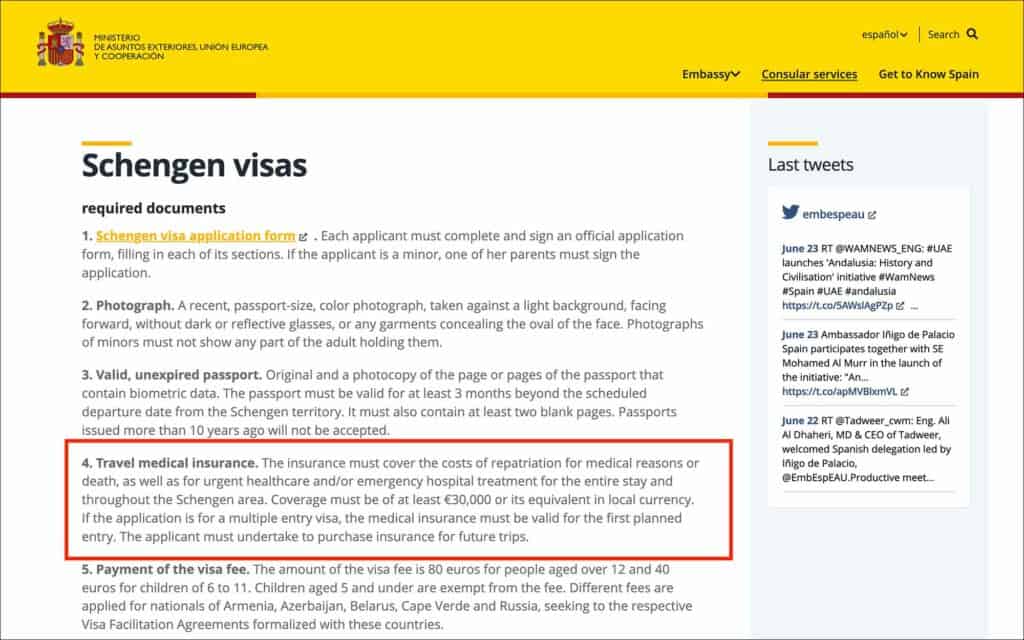

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

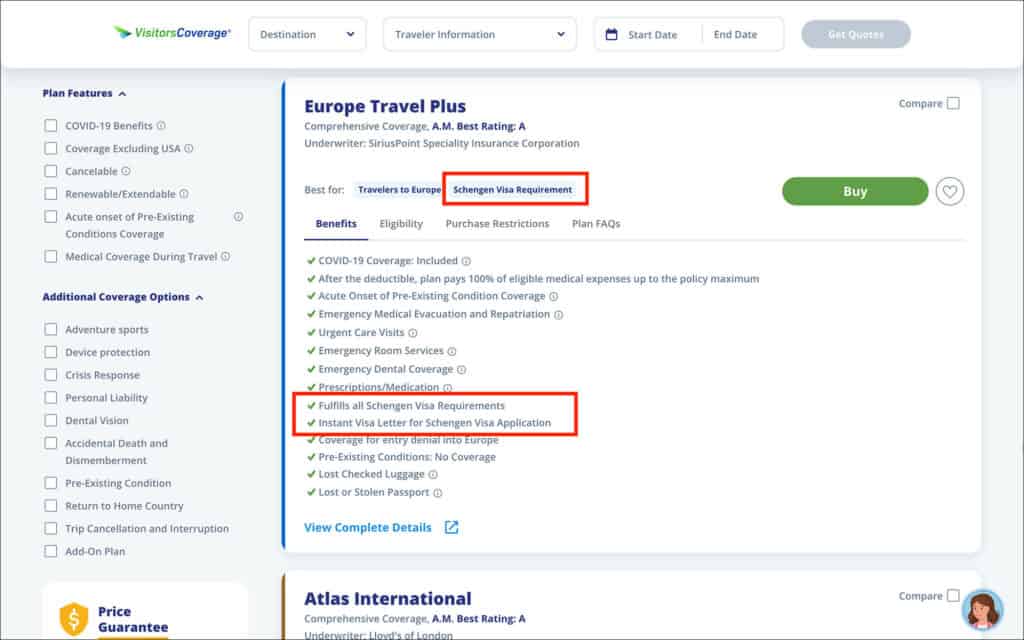

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

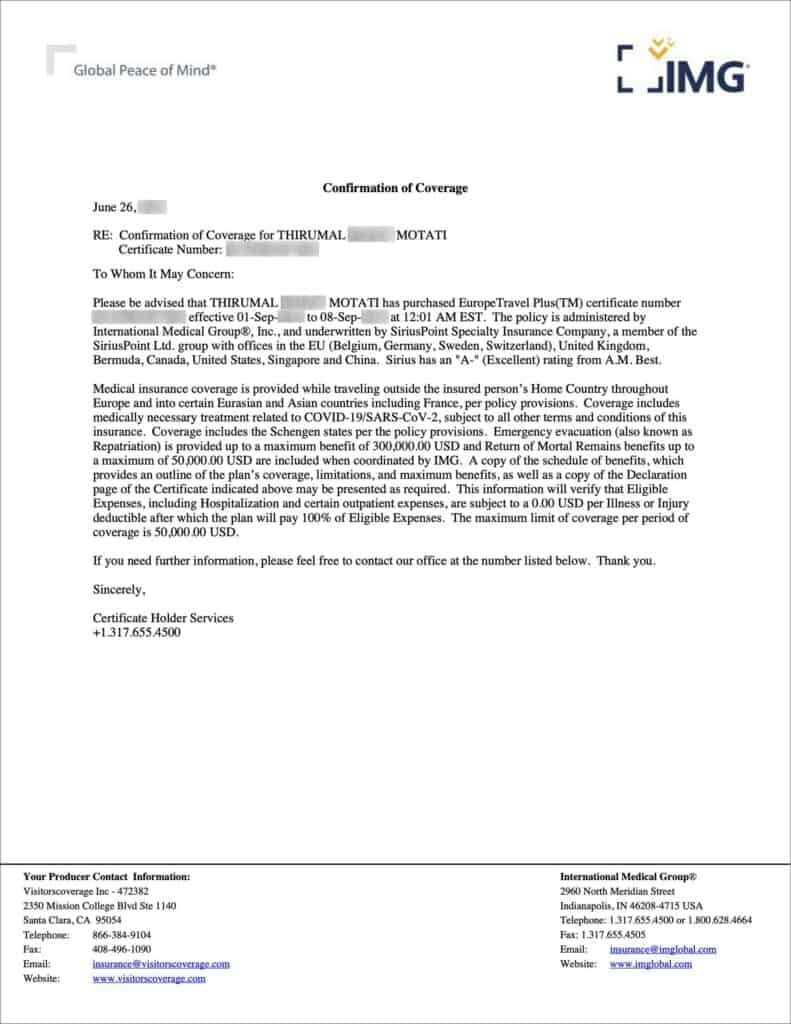

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

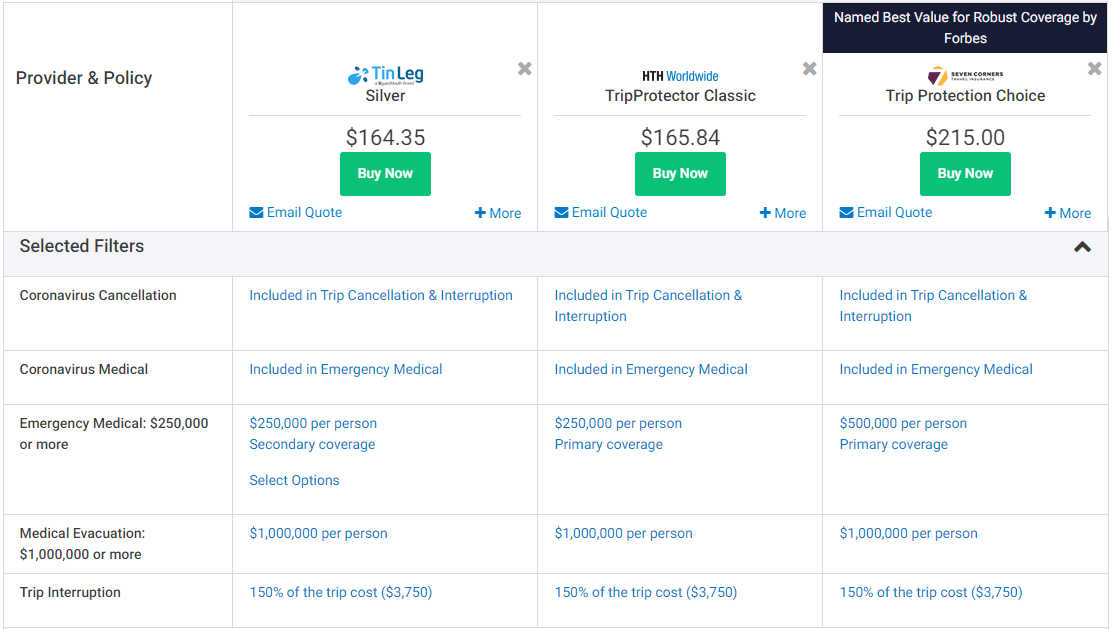

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

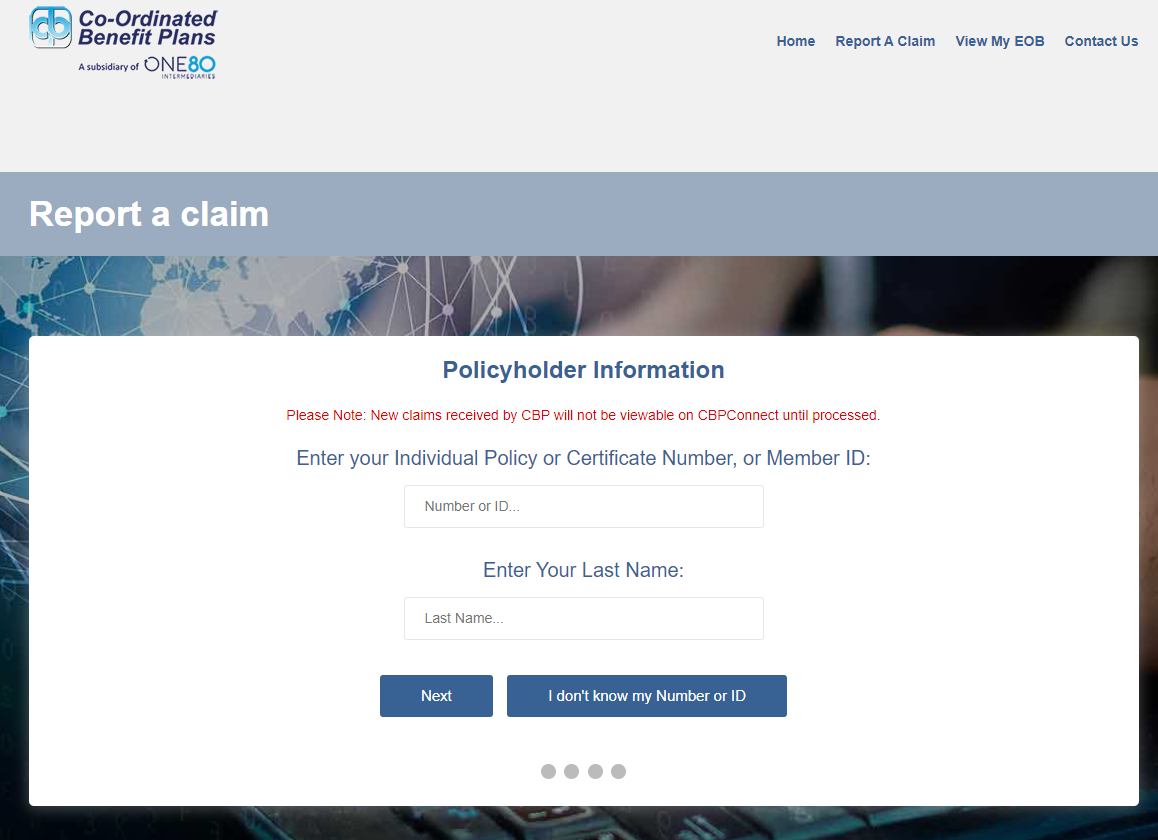

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

5 Tips for Buying Schengen Visa Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Decide which type of insurance you’d like

2. get multiple quotes, 3. use this as an opportunity to maximize credit card bonus points, 4. double-check the policy before purchasing, 5. consider using a credit card that provides trip insurance instead of buying a new policy, if you’re looking to buy travel insurance for a schengen visa.

Travel insurance can be a very important accompaniment to your trip, especially when you’re traveling throughout multiple countries. Europe is a prime example of this, where the border-free Schengen zone allows you to traverse multiple countries without passing passport control. Finding Schengen visa travel insurance isn’t always simple, however, and you’ll want to ensure that you have coverage regardless of your location.

There are plenty of things to think about before buying travel insurance when traveling throughout Europe, including: the coverage you’re looking for, how you’ll be paying and whether your credit card already offers insurance.

Let’s take a look at Schengen travel insurance and five easy tips for making sure you’re good to go — no matter where you travel within the region.

Although there aren’t generally any Schengen visa travel insurance requirements, there are multiple types of travel insurance coverage available depending on your needs. Consider carefully the type of coverage you’re looking for. Common types includes:

Travel medical insurance .

Trip interruption insurance .

Cancel for any reason insurance .

Trip cancellation insurance .

Lost luggage insurance .

Rental car insurance .

Accidental death insurance .

Emergency evacuation insurance.

Note that the U.K. left the Schengen zone a few years ago, so you’ll want to double-check whether coverage in the U.K. is valid for your travel insurance policy.

» Learn more: Is travel insurance worth it?

It’s always in your best interest to get multiple quotes before purchasing insurance. The amount you’ll pay will be heavily dependent on the type of coverage you receive, its length and any deductibles that you may have.

Cancel For Any Reason insurance, or CFAR, allows you to recoup most or all of your nonrefundable costs — no matter why you’ve chosen not to travel.

There are plenty of different websites that’ll allow you to compare different insurance plans such as TravelInsurance.com or SquareMouth.com (a NerdWallet partner), which will gather together multiple quotes in one easy search.

There are several details you’ll need to have on hand when looking for quotes. These include:

The total cost of your trip.

Your destination.

Your dates of travel.

The number of travelers.

The age of travelers.

Where you live.

When you booked your trip.

Once you’ve got all your information gathered together, it’s simple to find a policy that fits your need for travel insurance in the Schengen zone on one of the comparison websites.

» Learn more: What is travel insurance?

If you’re planning a vacation to Europe, hopefully you’ve already acquired a travel credit card or two. However, cards that focus on travel rewards won’t necessarily optimize insurance purchases.

» Learn more: How to choose a credit card for Europe travel

In this case, you’ll want to double down on rewards with a card that’ll maximize everyday spend. These cards will give you bonus points on all purchases, no matter their category. Great options for this include:

Capital One Venture Rewards Credit Card : Earn 2x Capital One Miles per dollar spent on all purchases.

Citi Double Cash® Card : Earn 2% cash back in the form of Citi ThankYou points on all purchases: 1% when you make your purchase and another 1% when you pay your bill. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal .

Chase Freedom Unlimited® : Typically earn 1.5% cash back on all non-bonus category purchases.

The Blue Business® Plus Credit Card from American Express : Earn 2 American Express Membership Rewards on the first $50,000 in purchases each year. Terms apply.

Pair your Chase Freedom Unlimited® card with a Chase Sapphire Preferred® Card card or Chase Sapphire Reserve® card to unlock the full suite of Chase Ultimate Rewards® transfer partners. This strategy is sometimes referred to as the Chase Trifecta .

While you likely won’t be earning a ton of points for your travel insurance purchase (unless your costs are exorbitantly high), maximizing your earnings is always a good idea. Don’t leave money on the table.

» Learn more: The best travel insurance companies

Not all travel insurance policies are created equal. This is probably no great revelation, but it’s definitely something of which you’ll want to be aware.

This is especially pertinent when it comes to the current travel climate in the COVID-19 era. While you may purchase a health insurance plan that covers most medical costs, it may specifically exclude those incurred by COVID-19. And even if it does reimburse you for any hospital costs, it may not pay for a forced quarantine in the event of illness.

These are things you’ll want to check for when buying travel insurance for any trip. Be sure to read the terms and conditions of your policy carefully, and if there’s very specific coverage you’re looking for (such as that offering protection in the event you catch COVID-19), you can often use search filters to narrow down your options.

» Learn more: Is there travel insurance that covers COVID quarantine?

One great feature of travel credit cards is the complimentary trip insurance they often provide. In order for your trip to be eligible for coverage, you’ll need to use the card to pay for your trip. In exchange, however, you can receive some pretty powerful benefits without needing to pay out of pocket.

The Chase Sapphire Preferred® Card card, for example, provides primary rental car insurance. This means that when you decline the insurance offered at the counter, your entire rental will be covered against collision up to the actual value of the rental car.

What’s most powerful about this feature is that, as primary, it comes before your own personal insurance — possibly saving you expensive premium jumps and claims on your policy.

Other cards that include powerful travel insurance protection such as interruption, cancellation or baggage coverage include The Platinum Card® from American Express and the Chase Sapphire Reserve® card. Terms apply.

» Learn more: The cheapest flights to Europe on points

It makes sense to purchase travel insurance in many circumstances, especially with the uncertainty in today’s travel world. Take advantage of these five tips to make sure you’re properly prepared for your trip — whether you’re heading to France, Finland or any of the over two dozen Schengen countries.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

4 Best Travel Insurance for Europe in 2024

Home | Travel | Europe | 4 Best Travel Insurance for Europe in 2024

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Getting European travel insurance is one of the main requirements for obtaining a Schengen visa, whether for traveling, studying, or working overseas.

However, if you don’t need a Schengen Visa , you may ask yourself, Do I need travel insurance for Europe ? Well, it’s always a good idea. As I mentioned in my guide to the best international travel insurance companies , you should buy coverage if you want the peace of mind that comes with knowing you’re protected in any unforeseen circumstances.

4 Best travel insurance for Europe in 2024

Of course, not everyone needs the same kind of coverage, so in this article, I’m sharing the best travel insurance for Europe and Schengen travel insurance that meets all the visa requirements:

- Schengen visa travel insurance requirements

- Europe travel insurance cost & comparison

- Best travel insurance for Europe

What should European travel insurance cover?

Not to spoil the surprise, but Heymondo is the best option for Europe trip insurance and Schengen Area travel insurance . Heymondo offers comprehensive coverage at an affordable price, and it’s the only company that pays your medical expenses upfront , so you don’t have to worry about filing a reimbursement claim.

5% OFF your travel insurance

Another great option, if you’re traveling on a budget and don’t mind having a deductible, is SafetyWing . Just be aware that there is a $250 deductible per claim, and they don’t cover medical expenses upfront. You will need to pay out of your pocket and ask for reimbursement later, but it is the cheapest option by far.

I’ll give you a full review of other top travel insurance for Europe below .

Is travel insurance for Europe mandatory?

If you’re required to have a visa to enter the Schengen Area, you must have travel medical insurance for a Europe trip . Be aware that not all travelers need a Schengen visa, so check the requirements for different countries below.

If you’re a citizen of a country in the Schengen Area, you don’t need travel insurance for Europe , but it’s wise to have coverage for your trip .

What countries need a Schengen Visa to visit Europe?

Travelers from the following countries must purchase European travel insurance to obtain a Schengen visa and visit the Schengen Area:

Schengen visa insurance requirements

To obtain a Schengen visa, you must have Schengen Area travel insurance . That is, insurance that covers the Schengen Area and meets these requirements:

- At least $30,000 in coverage for medical emergencies and accidents : Healthcare and medical expenses in Europe aren’t cheap, so emergency medical coverage is a requirement. No matter where you travel in the Schengen Area, your insurance will cover the medical fees if you get sick or injured.

- Repatriation coverage in case of medical incidents or death : If you fall gravely ill in a remote area or require further medical attention for a serious injury, you may need to be transported back to your home country. This is an expensive service, so your insurance should include repatriation coverage. This way, you won’t have to pay big bucks for transportation fees.

- Coverage in all 26 Schengen Area countries for the entire duration of your trip : Even if you’re not planning to visit all 26 countries (which would be incredibly ambitious!), your insurance policy must cover all of them. The best Schengen travel insurance policies allow you to select “Europe” as your coverage area, so you don’t have to worry. I always recommend reading the fine print to ensure you don’t encounter any problems when applying for your Schengen visa.

What countries are in the Schengen Area?

The 26 countries that make up the Schengen Area are:

- Czech Republic

- Liechtenstein

- Netherlands

- Switzerland

Of those countries, Iceland, Liechtenstein, Norway, and Switzerland are the only countries that don’t also belong to the European Union.

How much does European travel insurance cost?

Choosing the best travel health insurance for Europe is one of the most frequent doubts among tourists. We currently have a policy with Heymondo , and we’re very happy with it. The company has been super responsive and helpful whenever we’ve needed assistance. I love that they take care of medical payments for us upfront, so we don’t need to pay out of pocket and file a claim.

If you’re still unsure which European tourist insurance best suits you and your needs , look at the table below. I’ve compared the cost of European travel insurance from 4 different companies. To be as impartial as possible, I’ve simulated the prices for a 30-year-old American traveling to Spain for two weeks with a trip cost of $2,500.

*Price used for example

For this European travel insurance comparison , I chose the cheapest policies that cover the Schengen Area and meet all the requirements. While Heymondo isn’t the cheapest, it offers better coverage than the others, and it’s the only one that pays for medical expenses upfront.

Also, remember that these prices are just an example and can vary depending on your trip’s duration, your country of origin, destination, and other factors. However, no matter the cost, you want travel insurance, even for the cheapest places to visit in Europe .

Best Europe travel insurance

Again, each European travel insurance company has its advantages, so I’m sharing an overview of each option below to help you make the best choice.

1. Heymondo , the best travel insurance for Europe

Heymondo is the best holiday insurance for Europe , offering $200,000 in emergency medical coverage and no deductible. One of the main advantages of Heymondo insurance is the 24/7 customer support and medical chat . This way, you can quickly consult a doctor or get directions to the nearest hospital.

Another thing I like about Heymondo is that it takes care of everything, so you won’t have to pay a single bill out of pocket . No more filing claims and waiting for reimbursement! Just remember that for Heymondo to cover expenses upfront, you must contact them before going to the doctor. If you forget or don’t have time, don’t worry. Heymondo will refund your money after you send them the medical invoice.

Besides, it covers electronic equipment , something that most travel insurance doesn’t include. For us, that coverage is crucial since we always travel with two laptops and professional camera gear.

We’ve been using Heymondo’s annual travel insurance and have been delighted with the experience. We have had to use the customer support more than once, and the team has always been professional, efficient, and kind. If you choose this company for your European travel health insurance , you can save 5% with our Heymondo discount .

2. SafetyWing , a cheap European travel insurance

If you’re looking for a low-cost Schengen travel insurance policy, look into SafetyWing . It’s one of the cheapest travel insurance companies on the market, offering excellent coverage without a hefty price.

SafetyWing’s European travel health insurance includes extensive emergency medical coverage, evacuation and repatriation protection, and up to $5,000 in trip interruption benefits for added peace of mind.

However, while SafetyWing has some of the lowest prices on the market, remember that it’s more of a medical travel insurance , so its trip-related coverage is minimal.

Also, there is a $250 deductible, so you’ll have to pay $250 before the company covers your medical costs. If you don’t want to deal with a deductible and want the added benefit of having your expenses paid upfront, I recommend Heymondo .

3. Trawick International , the best Europe travel insurance for seniors

Trawick International is another option to consider, especially if you’re looking for a good travel insurance plan for seniors . Trawick is affordable and features great medical benefits, including coverage for pre-existing conditions. The company also offers decent protection for natural disasters and repatriation.

This company also has travel insurance with Cancel For Any Reason (CFAR) . So, if you add CFAR to your policy, you’ll get reimbursed for your flight and accommodation expenses if you call the trip off, regardless of the reason for your cancellation. However, there are specific terms and conditions, so I recommend reading the policy thoroughly.

It’s important to review the different Trawick policies since some pertain to European travel insurance while others are tailored to students or tourists coming to the USA. In our comparison, we looked at the Safe Travels Explorer plan, which includes decent trip cancellation and interruption coverage, but only a small amount of baggage loss protection.

Overall, you can get much more coverage for the same price or a bit more. For example, Heymondo offers $200,000 in emergency medical expenses compared to Trawick’s $50,000. Plus, Heymondo pays your medical expenses upfront.

4. Travelex , another good travel health insurance for Europe

Lastly, Travelex is dependable tourist insurance for Europe that meets all Schengen visa insurance requirements. Its Select plan is the more expensive option, but it includes extensive repatriation and evacuation coverage, as well as natural disaster protection.

You’ll also be covered for travel-related expenses like baggage loss/theft, trip cancellation/interruption, and trip delay. Travelex is also a travel insurance that covers pre-existing conditions , making it a good choice if you want your policy to cover treatments and medication abroad for chronic diseases like diabetes.

On the other hand, the Select plan is the most expensive option of the policies we looked at, and the emergency medical expense coverage is very low. In comparison, Heymondo offers much better coverage for a lower price.

What should travel insurance for Europe cover?

When shopping around for travel medical insurance for Europe , make sure you’re looking for the best coverage. Below, you can see what the best European travel insurance should include:

Emergency medical expenses

Emergency medical coverage is the most basic and essential requirement for any European holiday insurance . Even the cheapest policies include this type of coverage. With emergency medical expenses protection, you’ll be covered for any visits, tests, treatments, and hospitalizations during the trip due to illness or injury.

However, chronic illnesses or sicknesses that existed before the start of the trip are excluded from this coverage. For example, the insurance won’t cover treatment for cancer, as that’s a chronic disease that must be treated in your country of origin. On the other hand, an emergency operation for appendicitis would be covered.

Emergency medical expenses, something that’s covered with European travel insurance

As for injuries and accidents, most policies don’t cover incidents that occur while practicing extreme sports or risky activities. In the case of Heymondo , some adventure sports are included in the Premium plan. For other insurers, there is the option to add this type of coverage to your policy for an extra fee. So, if you’re a daredevil and plan on participating in some extreme sports during your trip, I recommend getting a policy with Heymondo.

Evacuation & repatriation

Evacuation and repatriation coverage are other must-haves when buying insurance for a European trip . If you have to return to your home country due to a medical emergency or death abroad, this coverage will take care of the associated expenses. Moreover, if a family member back home gets seriously sick or dies, or there is an accident at your home, the costs will fall under this category.

Unexpected delays can happen while traveling, be it a flight delay, weather problems, or an issue with the airline. This is why many European travel insurance companies include trip delay coverage. This covers expenses like meals and accommodation if your trip is delayed several hours or more.

Trip cancellation & interruption

As for trip cancellation , it’s often not included in European travel insurance . You usually must take out a trip cancellation policy or add this coverage to your plan.

With trip cancellation protection, you’ll be covered if you have to cancel your trip for health, legal, or work reasons. The amount varies depending on your policy, but you could recover up to 100% of the money you invested in the trip. Of course, you must provide documentation justifying the cancellation.

If you want the option of canceling your trip for any reason and getting reimbursed, look into Cancel For Any Reason (CFAR) insurance . Many companies offer this coverage as an add-on.

Moreover, trip cancellation coverage is especially useful if you’re visiting multiple countries in Europe. An unexpected incident may come up in the middle of your trip, such as a family member getting sick or a natural disaster back home. Instead of losing all the money you paid for the rest of your journey, you can get reimbursed with European travel insurance with trip cancellation/interruption benefits.

Baggage loss, theft, or damage

It’s not uncommon for luggage to get lost, stolen, or damaged during travel. For this reason, I consider this type of coverage essential for any European travel insurance plan .

Be sure to check the monetary amount for this benefit since some insurers don’t offer as much protection as others. I also suggest keeping your most valuable and expensive items with you in a backpack or carry-on so you don’t risk losing them in your checked baggage.

If you can’t store your things in a hotel, consider using a luggage storage service once you’ve arrived at your destination. This way, you’re not a walking target for pickpockets!

Electronic equipment

If you’re bringing electronic equipment like a camera or laptop, be aware that these items aren’t typically covered under the baggage loss benefit. An exception is Heymondo , which includes electronic equipment protection in its policies.

For most other European travel insurance plans , you’ll have to get this coverage as an add-on for an extra fee.

Adventure sports

This is another benefit that’s often available as an add-on. If you know you’ll be participating in some extreme activities, adding this type of coverage to your policy is a good idea. Adventure sports include things like bungee jumping, skydiving, scuba diving, and white-water rafting.

Heymondo is one of the few European travel insurance companies that include adventure sports protection in its policies.

Search and rescue

Another insurance benefit is search and rescue coverage. This covers the cost of an organized search and rescue effort should you get lost or reported missing during your trip.

Natural disaster evacuation

Finally, natural disaster coverage will pay for the transportation costs if you need to return to your home country due to a natural disaster at your destination. Examples of natural disasters include earthquakes, floods, landslides, tornadoes, tsunamis, volcanic eruptions, and wildfires.

Europe travel insurance with a discount

If you decide to get travel insurance for a Europe trip , remember that you can take advantage of our discount to save money on your policy.

In the case of Heymondo , you can get a cheaper European travel insurance policy for being a Capture the Atlas reader. Just click our link below to get a 5% discount on Heymondo insurance .

Also, be sure to read our guide on the best discounts for travel so you can save money on flights, hotels, rental cars, and more.

Is Europe travel insurance worth it?

Even if you aren’t required to get a Schengen visa (and thus European travel insurance ), getting coverage is still a good idea. We never travel without insurance, and I advise everyone to do the same. After all, you never know what could happen abroad, whether you get in an accident or fall ill.

Throughout the years, my friends and I have had many experiences that highlight the importance of having insurance.

For example, I was studying English in Ireland with my cousin when he had to have emergency surgery for appendicitis. Luckily, he had EU travel insurance, so the cost of his operation was covered. He would have been stuck paying thousands if he hadn’t had travel medical insurance for Europe .

Another time, I was taking a trip to Germany, and my luggage never arrived. I was stressed out about not having any clothes or toiletries, but fortunately, I had travel insurance, so the company covered the cost of all the clothes and necessities I had to repurchase.

While those two scenarios ended nicely, my family and I have had less-than-ideal situations that resulted from not having insurance coverage.

One of those was when I planned a trip to Ukraine years ago. I had to cancel it because of a family emergency, and since I didn’t have travel insurance for Europe , I lost all the money I had invested in flights and hotels.

Similarly, my mom didn’t bother to get insurance before traveling to London. Someone stole her bag in a pub, so she lost her cell phone, camera, and wallet (with her ID and credit cards). She could’ve been covered for these losses if she had purchased European holiday insurance . Unfortunately, she had to pay to replace everything herself.

As you can see from the examples above, all kinds of unexpected circumstances crop up while traveling. It’s always better to have the added security of trip insurance. Take it from me, and don’t learn your lesson the hard way!

Other things to plan for your trip to Europe

Once you get the best travel medical insurance for Europe , finish organizing your trip with these helpful tips:

- Get one of the best SIM cards for Europe to avoid paying for roaming while using internet in Europe . We always use the Holafly eSIM , and you can even purchase it if you’re already abroad.

- Get a travel credit card to avoid hefty fees when using foreign ATMs. There are even some great credit cards with no foreign transaction fees that you can take advantage of.

- Check the iVisa website to see if you need a Schengen visa for your trip. If you do, make sure you request it in advance so you have it in time for your trip.

Lastly, enjoy your trip to the fullest!

FAQs – Travel insurance for Europe

If you still have concerns about European trip insurance , these answers to commonly asked questions may help:

Do I need travel insurance for Europe?

Travel insurance for Europe is mandatory for citizens who are required to apply for a Schengen visa.

Do I need European travel insurance if I have a European Health Insurance Card (EHIC)?

No, you don’t need European travel insurance if you have an EHIC.

Do I need Europe travel insurance for a Schengen Visa?

Yes, those applying for a Schengen visa must have European travel health insurance .

Which countries are required to have travel insurance to Europe?

Travelers who are residents and hold passports from the following countries must have travel insurance for Europe : Afghanistan, Algeria, Angola, Armenia, Azerbaijan, Bahrain, Bangladesh, Belarus, Belize, Benin, Bhutan, Bolivia, Botswana, Burkina Faso, Burma/Myanmar, Burundi, Cambodia, Cameroon, Cape Verde, Central African Republic, Chad, China, Comoros, Congo, Cuba, Democratic Republic of the Congo, Djibouti, Dominican Republic, East Timor, Ecuador, Egypt, Equatorial Guinea, Eritrea, Eswatini, Ethiopia, Fiji, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Guyana, Haiti, India, Indonesia, Iran, Iraq, Ivory Coast, Jamaica, Jordan, Kazakhstan, Kenya, Kosovo, Kuwait, Kyrgyzstan, Laos, Lebanon, Lesotho, Liberia, Libya, Madagascar, Malawi, Maldives, Mali, Mauritania, Mongolia, Morocco, Mozambique, Namibia, Nepal, Niger, Nigeria, North Korea, Northern Mariana Islands, Oman, Pakistan, Palestinian National Authority, Papua New Guinea, Philippines, Qatar, Russia, Rwanda, Sao Tome and Principe, Saudi Arabia, Senegal, Sierra Leone, Somalia, South Africa, South Sudan, Sri Lanka, Sudan, Suriname, Syria, Tajikistan, Tanzania, Thailand, Togo, Tonga, Tunisia, Turkey, Turkmenistan, Uganda, Uzbekistan, Vietnam, Yemen, Zambia, and Zimbabwe.

What is the minimum medical coverage to get a tourist visa to Europe?

Individuals must have European travel insurance with a minimum of $30,000 in emergency medical coverage to get a tourist visa to Europe.

The best travel insurance for Europe should include emergency medical coverage, repatriation and evacuation, baggage protection, and trip delay protection. It’s also a good idea to include trip cancellation coverage in the policy.

What’s not covered by travel insurance for Europe?

Some European travel insurance plans don’t include trip cancellation benefits, but this may be available as an add-on. Other things that aren’t typically included are adventure sports, electronic equipment, and natural disasters.

What is the best travel insurance for Europe?

The best travel health insurance for Europe is Heymondo since it has an excellent price-to-coverage ratio and no deductible. Plus, it is the only company that pays your medical bills upfront, so you don’t have to pay out of pocket and file a claim for reimbursement.

How much is travel insurance to Europe?

The cost of Europe travel insurance can range from $2/day to $7/day or more.

Is travel insurance for Europe worth it?

Yes, European travel insurance is absolutely worth it , whether it’s mandatory for you or not. In addition to emergency medical coverage, you’ll have baggage, trip delay, and repatriation benefits that can save you thousands of dollars.

What happens if I get sick or have an accident in Europe and I don’t have travel insurance?

If you need medical assistance during your trip, you’ll have to pay out of pocket for any care you receive at the hospital or a doctor’s office. If you have a European Health Insurance Card, you can go to a public medical center. You’ll have to pay out of pocket, but you can file a claim for reimbursement once you return to your home country.

What should I do if I have travel insurance and get sick or have an accident in Europe?

If you get sick or injured while abroad, contact your insurer to find out which medical center or hospital to go to. You can go to the nearest public hospital or clinic if you have a European Health Insurance Card.

What is the age limit for getting travel insurance for Europe?

Some insurers have age limits on their policies, such as Heymondo and SafetyWing, which cover individuals up to 69 years old. Other companies have higher age limits or no limits at all.

Can I extend my travel insurance to Europe if I’m already traveling?

The ability to extend your coverage depends on the insurer. For example, SafetyWing policies automatically renew every 28 days until you select an end date. Heymondo allows you to take out a policy if you’re already traveling, but you’ll have to wait 72 hours after purchasing it for it to go into effect.

Does my travel insurance for Europe cover a flight canceled by the airline?

Generally, European travel insurance doesn’t cover flights that are canceled by the airline. If you want this type of coverage, look into Cancel For Any Reason insurance.

I hope this guide helps you find the best travel health insurance for Europe and that you feel better prepared for your trip. Remember, if you need a Schengen visa to enter the Schengen Area, you’ll need proof of insurance to get the visa.

However, even if you don’t need a Schengen visa, it’s still worth getting European travel insurance . It’s always safer to travel with insurance coverage. This way, you can enjoy your trip and have peace of mind knowing you won’t have to pay any medical bills and cancellation fees out of your own pocket.

Again, Heymondo is the best European holiday insurance , offering excellent coverage for a reasonable price and direct, upfront payments for medical expenses. If you decide to buy a policy, take advantage of our 5% Heymondo discount code below.

Stay safe, and have a wonderful time in Europe!

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

14 replies on “ 4 Best Travel Insurance for Europe in 2024 ”

Is there a Schengen insurance that covers the UK on the same trip?

Hi Supinda, Yes, with the companies above, you can find European travel insurance plans that cover Schengen countries and the UK.

I wish to travel multiple trips to Europe 4-5 days duration

4-5 trips per year Mostly with my kids

Then I recommend you annual multi-trip travel insurance instead.

Let me know if you have any questions, Ascen

We are a family of four and applying for long term resident visa for Spain. We need health insurance for the visa. What do you recommend?

How long are you planning to stay in Spain. I usually recommend Heymondo, but if you’re staying for long, maybe it’s better to get a health insurance instead of a Travel Insurance,

Thanks, Ascen

Great information. Thank you so much for the information. Amazing services are there. i am very glad to see this blog. in the Schengen visa Itinerary also, providing good services like Flight Itinerary, Hotel Reservation and Travel Insurance are there.

hi Nigeria passport holder want to attend 15 days course in amsterdam Netherland base in Dubai UAE which travel insurance do you recommend for me thanks

I would try this one.

Let me know what you think.

We are a family of five traveling to Italy from the US. We are planning to do some hikes there. Which insurance do you recommend?

If you are going to have any kind of hiking or adventure sport I would go with insuremytrip standard for sure. It is the best insurance for Europe if you plan up to 2000m.

Thanks for this great post! I found all the info I need to decide which is the best travel insurance for my trip to Europe. I hope don’t have to use it though

I am glad to read you! Let me know if you have any question and safe travels!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Schengen Visa Travel Insurance (2024 Guide)

Josh Lew is a travel journalist and writer based in the midwestern U.S. He has been active for the past decade, covering airlines, international destinations and ecotourism for sites like TravelPulse and TreeHugger. He currently contributes to content writing agency World Words.

Sabrina Lopez is an editor with over six years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she is not working on articles to help consumers make informed decisions, Sabrina enjoys creative writing and spending time with her family and their two parrots.

The Schengen area is an alliance of 27 European countries that allows border-free travel. It covers most of mainland Europe, including 23 European Union countries and four members of the European Free Trade Alliance.

Travel insurance is a requirement for the Schengen visa application process. You need at least €30,000 (US$32,800) in coverage in case you need medical attention during your stay in Europe, and you have to purchase coverage and obtain a certificate showing insurance to include with your visa application. Read on to learn more about the unique requirements of a Schengen visa and the role travel insurance plays in the application process.

Which Insurance Provider is Best for Schengen Visa?

Use the table below to compare the top recommended choice for travel insurance for a Schengen visa.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Is Insurance Required for a Schengen Visa?

With a few exceptions, travelers from the U.S. do not need a visa for the Schengen area if staying for 90 days or less. Americans visiting for over three months, permanent residents without citizenship and foreign nationals traveling from the U.S. will need a Schengen visa if they are citizens of a country without a visa-free arrangement with Schengen countries.

The countries in the Schengen area are: Austria , Belgium, Croatia, Czech Republic, Denmark , Estonia, Finland, France , Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovenia, Slovakia, Spain, Sweden and Switzerland. Bulgaria, Cyprus, Ireland and Romania are currently not Schengen countries.

Travelers from the U.S., Canada , and other visa-exempt countries only have to go through immigration and customs in the first country they visit in the Schengen zone. After that, they can travel to any other nation in the alliance without taking out their passport. For instance, you can fly, drive or take a train from Sweden all the way to Spain on the same visa.

Citizens from visa-exempt countries like the U.S. don’t need a visa or travel insurance to visit Europe. However, because of the high price of healthcare in Europe, travel insurance is still a good idea for visa-free travelers. But note that if you have to visit with a Schengen visa, you need to meet specific health insurance mandates.

Schengen visa holders must have comprehensive health insurance coverage. It should last for the length of their stay in the area (but does not need to cover the duration of the visa).

When you apply for a Schengen visa at the consulate or embassy of the country you plan to visit first or spend most of your time in, they will explain the specifics of the travel insurance requirements. You will need proof of a travel insurance plan for visa approval.

Schengen Visa Insurance Requirements

Schengen visa applicants need travel medical insurance . However, the policy must have specific features and minimum limits for medical coverage and medical evacuation.

Here is a closer look at the requirements for Schengen visa eligibility.

- Medical emergency insurance

- Repatriation coverage for death

- Medical evacuation insurance if you need long-term care in your home country

- Coverage limits of at least €30,000 (US$32,000)

- Coverage lasting for the entire length of your stay in the Schengen area

The purpose of these requirements is to ensure you can pay for medical treatment without requiring assistance from your host country’s healthcare system.

You need a document from your travel insurance company as proof that you have a visa-compliant policy. This insurance certificate shows that you have met the minimum requirements. It is a vital part of your visa application, and you won’t gain approval without it.

Types of Travel Insurance Policies

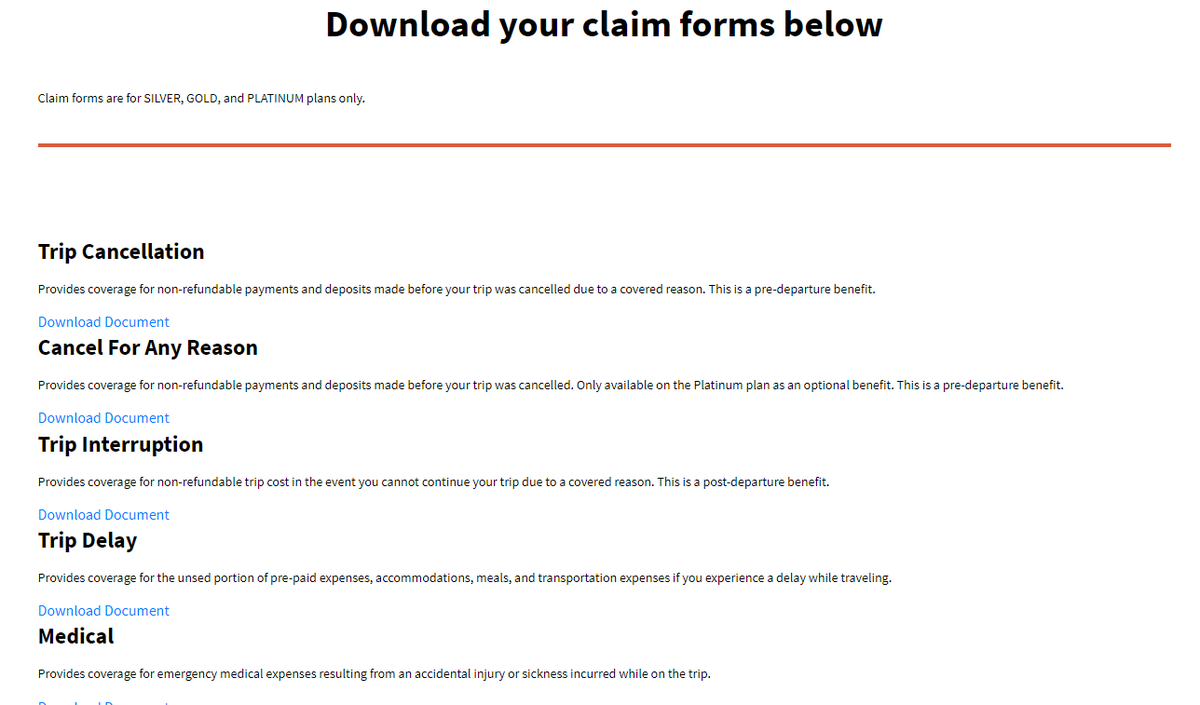

Schengen visa insurance plans focus on medical expenses, but travel policies can also offer other protections. Comprehensive travel insurance covers additional risks, including those related to cancellations and delays.

Here is a look at the different travel insurance coverages.

- Medical, evacuation and repatriation coverage is required for visa approval.

- Trip cancellation insurance provides reimbursement if your trip gets canceled due to covered reasons, such as an unexpected illness or injury or a crisis or disaster in your European destination.

- Trip delay and interruption coverages pay for expenses related to delays or incidents that cancel your journey earlier than planned.

- Baggage delay or loss reimburses you for missing items so that you can replace necessities and continue your travels.

- Add-ons to standard policies may include rental car insurance, pre-existing condition coverage and insurance for exclusions from standard insurance like scuba diving or climbing.

Schengen visa applicants can purchase travel insurance with comprehensive coverage to protect the non-medical aspects of their trip. International travel can be expensive, so cancellation insurance and other protections available through a complete travel policy can save you from frustration and financial loss.

Choosing the Right Schengen Visa Insurance

There are several factors to consider when selecting travel insurance.

- Coverage limits are the maximums that the insurer will pay for each claim type. Schengen visas require €30,000 (about $32,800) in medical emergency, evacuation, and repatriation insurance, but you can get a policy with higher limits if you wish.

- Pre-existing conditions are another important factor. Insurers may or may not cover them on a standard policy, but those that do not provide coverage directly may sell waivers that add coverage for your conditions.

- Deductibles are another factor to consider. This amount is an out-of-pocket payment you have to make before the insurer takes over payment. Some low-cost policies have high deductibles.

Finally, you should always get insurance with a reputable company that can provide the necessary documentation for your visa application.

Here are six reputable insurers to consider.

- Travelex offers budget and mid-range plans for international travelers. You can opt for both medical and trip cancellation coverage.

- Trawick International travel insurance offers stand-alone medical and cancellation policies, so you can opt for minimum requirements for your Schengen visa if you wish.

- AIG Travel Guard offers several tiers of travel insurance, all of which offer comprehensive coverage and provide optional add-ons.

- Seven Corners has customizable travel plans that include medical emergency, evacuation, and repatriation coverage necessary for a Schengen visa

- IMG offers stand-alone medical insurance policies and separate plans providing cancellation, lost baggage and delay benefits.

Use our insurance comparison tool to find the prices and coverage details for each of these insurance providers.

Applying for Schengen Visa with Travel Insurance

You apply for a Schengen visa at the consulate or embassy of the country you intend to travel to first or spend most of your time during your stay.

You must purchase a policy that covers the entire duration of your stay and is valid throughout the Schengen area, not just in the countries you plan to visit.

You need proof of insurance to include with the rest of application documents when applying for the visa. This means you need to purchase the insurance before submitting your application. You should only choose insurance companies able to provide the necessary documentation to include with your application.

Additional Expert Tips

There are some other considerations for Schengen visa insurance.

First, you should make copies of your insurance card, policy documents and other information and bring them with you on your trip.

Second, regulations require that you have coverage for the entire duration of your stay. If you have a multi-trip visa, you will need insurance that provides benefits for the entire stay. The best option in these cases is to get an annual or multi-trip policy that meets visa requirements for coverage types and limits.

Before leaving, you should perform a thorough policy review to ensure you have the appropriate coverage. You can consider the potential costs of medical care in your host countries and decide if the coverage you have is sufficient.

Frequently Asked Questions About Schengen Visa Insurance

Do you need travel insurance to visit schengen countries.

Travelers from visa-exempt countries can visit Europe without insurance, though they would not be protected from medical expenses or cancellations. However, those requiring a Schengen visa need €30,000 worth of medical coverage for approval.

Is Schengen travel insurance refundable?

You would be able to cancel your insurance if your visa application is not approved. Most companies will allow you to cancel the policy and get a full refund if you show evidence that your visa application was not approved.

Does travel insurance cover all of Europe?

Travel insurance for a Schengen visa must cover all 27 countries. However, some travel insurers may require that you specify all the countries you plan to visit to get comprehensive coverage.

What are the benefits of Schengen visa insurance?

In addition to being a requirement for the visa application process, Schengen insurance will cover medical costs if you get sick or suffer an injury during your Europe travel experiences. While travel health insurance is the only necessary policy component for the visa application, you can get additional benefits by purchasing a comprehensive policy.

If you have questions about this page, please reach out to our editors at [email protected] .

- International Travel Insurance Dubai

- Single Trip

- Schengen product

- Annual Multi-Trip

- Hajj & Umrah

- Inbound to UAE

- Sports Cover

- Policy Document

- Travel Tips

- Glossary of Terms

- Privacy Notice

- Health declaration & health exclusions

- Blogs & Newsletters

- BUY ALLIANZ TRAVEL

SCHENGEN TRAVEL INSURANCE

Our schengen travel insurance offers essential coverage for your trip, including the required insurance certificate for schengen visa applications, why is it crucial to have schengen insurance while travelling in europe.

Schengen Visa, which allows for travel within 26 European countries, comes with specific insurance requirements, as Schengen Visa Info outlines. Travellers must meet these requirements, which include coverage for emergency medical expenses, repatriation of remains, and a minimum coverage of €30,000.

Medical costs in some European countries can be excessive. For instance, according to the World Health Organization, a single day's hospitalisation in Switzerland can cost around US$1,000. Having Schengen insurance is a must to avoid unexpected financial burdens.

This insurance isn't limited to a particular demographic; it's designed to offer coverage for global travellers, including

- Senior citizens up to the age of 85

- Individuals traveling for work

- Children between the ages of 1-18 and

Not every traveller needs a Schengen Visa for Schengen Area visits, given that countries such as the U.S.A., Mexico, Brazil, and Canada maintain visa-free agreements with the Schengen Zone. Nevertheless, it is highly advisable to secure insurance since your medical expenses, or any potential costs arising from unexpected incidents during your journey, may lack coverage without proper travel insurance. Opting for travel insurance is particularly beneficial if you intend to explore multiple Schengen countries or desire flexibility in your itinerary, offering comprehensive coverage across most European nations.

Why Choose Allianz Schengen Travel Insurance?

Our Schengen travel insurance will help you get your Schengen visa and offer protection while travelling in Europe. You’ll receive the mandatory insurance certificate for your Schengen visa application.

Different benefits are available within this travel insurance product:

- Up to US$50,000 in emergency medical expenses in case of accident, sickness, illness or injury.

- Up to US$200 if your baggage is delayed.

- Up to US$2,000 in case of trip cancellation.

Insure your next European holiday, starting from AED 56 per person.

Schengen Product

Schengen travel visa insurance requirements – europe travel insurance.

Swipe to view more

Schengen Travel Insurance

Travel Schengen Single Trip

From 56 AED

Everything you need to know about Schengen Travel Insurance

What does a schengen insurance policy usually cover .

A Schengen insurance policy is a specific type of travel insurance designed to fulfil the visa requirements for individuals travelling to the Schengen Area. The Schengen Area comprises 26 European countries that have abolished passport control at their mutual borders, allowing for easier travel within the region. A Schengen insurance policy typically covers the following:

1. Medical expenses: Coverage for emergency medical expenses, including hospitalisation, surgery, and outpatient treatment. As Schengen visa regulations require, the policy usually covers a minimum amount, such as €30,000.

2. Emergency evacuation and repatriation : Coverage for the cost of emergency evacuation and repatriation to your home country in case of a medical emergency.